South Carolina Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

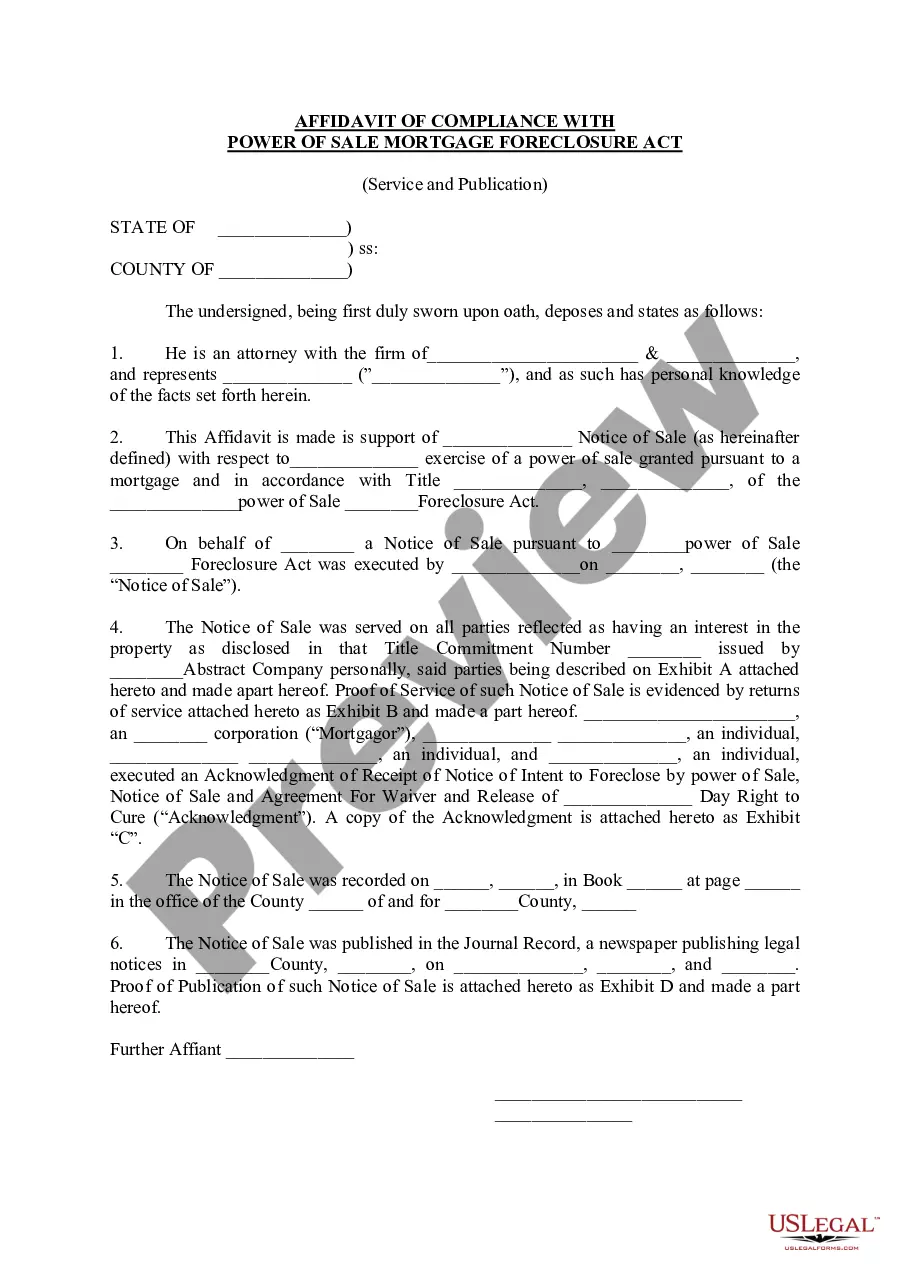

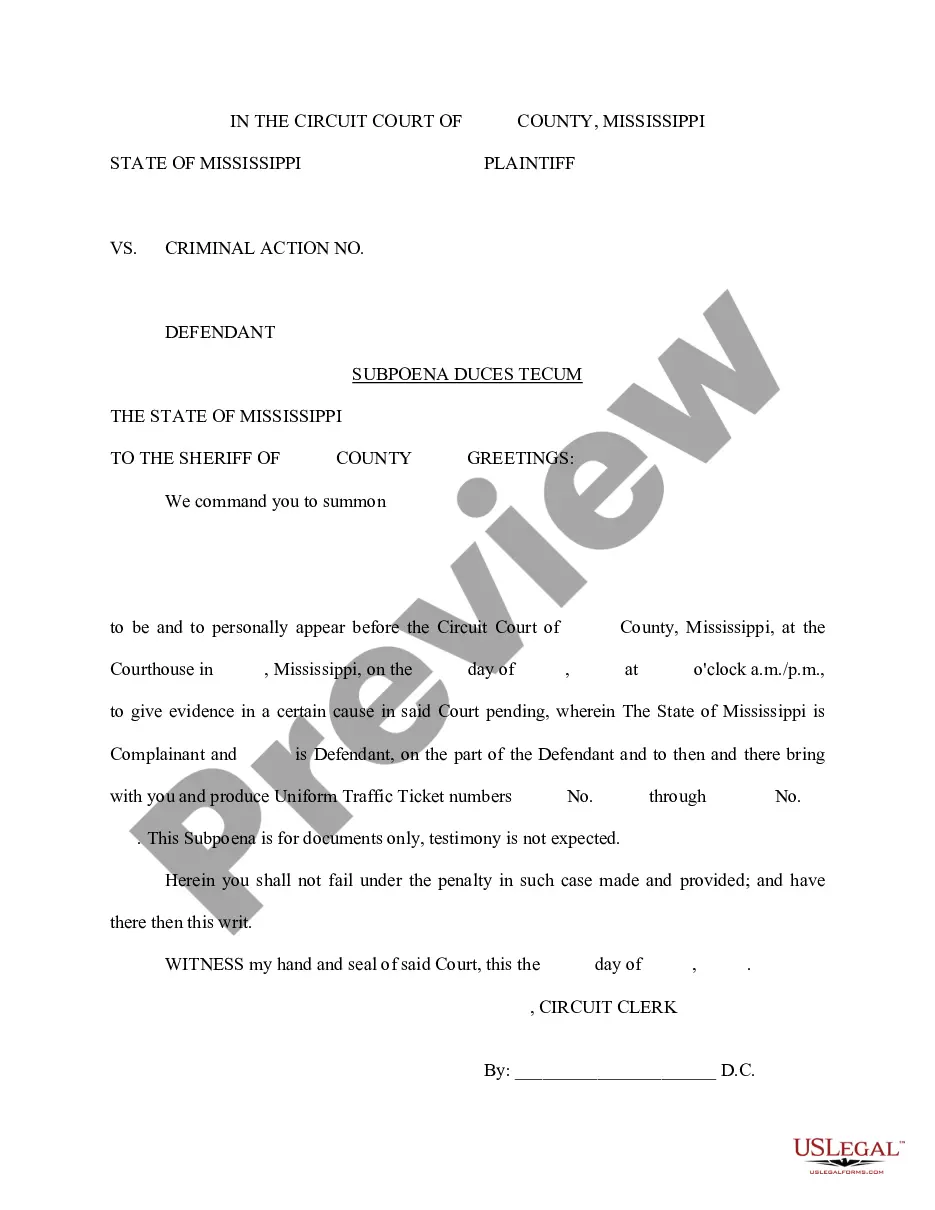

How to fill out Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

Are you currently in a location where you require documents for either business or personal purposes nearly every day.

There are numerous legitimate form templates available online, but finding ones you can trust isn't simple.

US Legal Forms provides thousands of document templates, including the South Carolina Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners, which is drafted to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the South Carolina Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners anytime, if needed. Just select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have your account, just Log In.

- After that, you can download the South Carolina Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview feature to inspect the form.

- Review the description to ensure you have chosen the right form.

- If the form isn't what you are looking for, use the Search field to locate the form that fits your needs and requirements.

- Once you obtain the appropriate form, click Buy now.

- Select the pricing plan you require, provide the necessary information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Is there a filing fee to dissolve or cancel a South Carolina LLC? There is a $10 filing fee to dissolve an LLC or corporation. Your South Carolina registered agent service may be able to help you terminate your LLC.

Closing a business or accountTo close SC Dept. of Revenue accounts online, go to MyDORWAY.dor.sc.gov.To close SC Dept. of Revenue accounts by paper use the form C-278 Account Closing Form.To close your Alcohol and Tobacco account use the L-1278 Form.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

South Carolina requires business owners to submit their Articles of Termination by mail. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.