South Carolina Product Sales Order Form

Description

How to fill out Product Sales Order Form?

If you want to finish, obtain, or print legal document templates, use US Legal Forms, the largest library of legal forms available online.

Utilize the site's straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are organized by types and categories, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Use US Legal Forms to locate the South Carolina Product Sales Order Form in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the South Carolina Product Sales Order Form.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the form for your specific city/state.

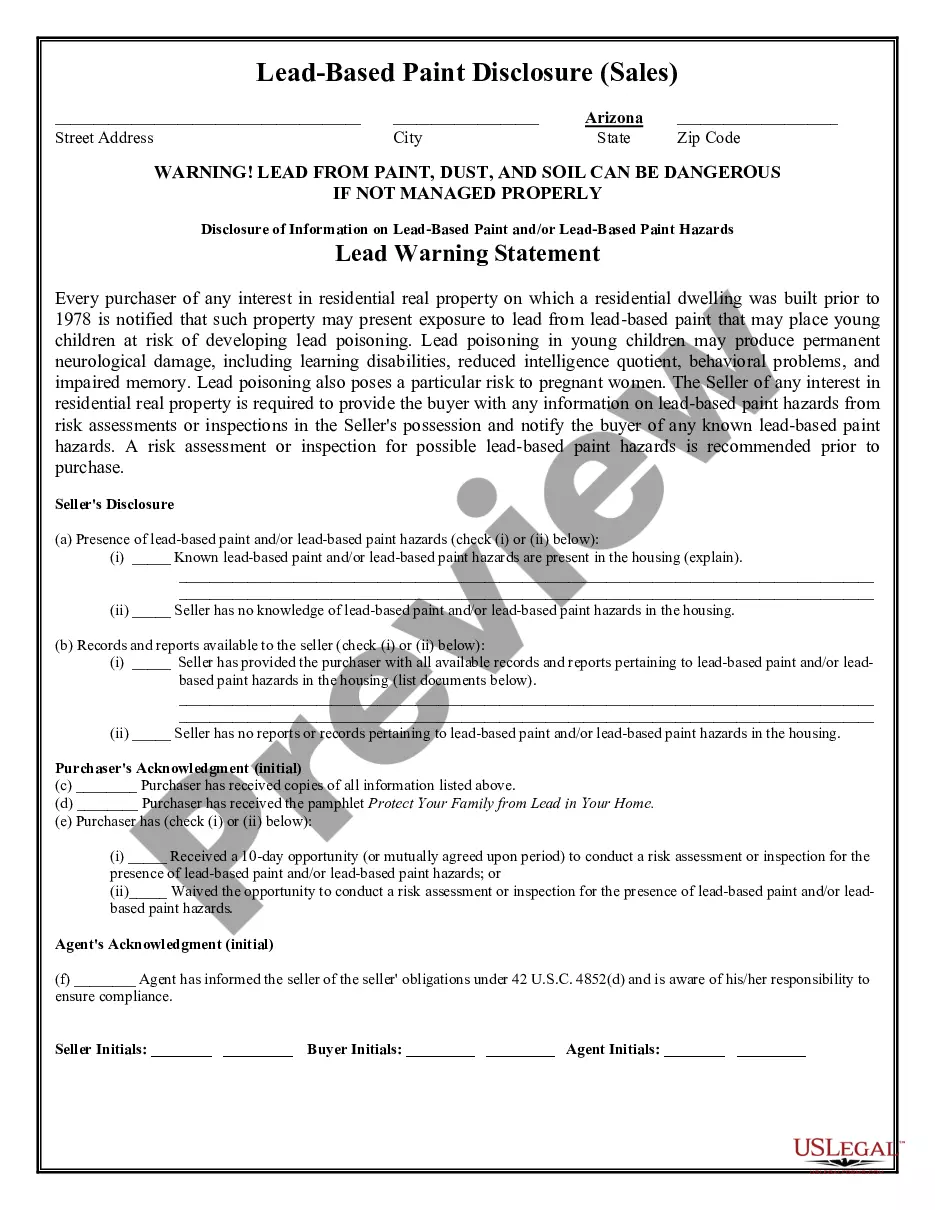

- Step 2. Use the Review option to check the form's content. Don't forget to read the explanation.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

To fill out the South Carolina W-4 form, start by providing your personal information, including your name and social security number. Next, indicate your filing status and the number of allowances you wish to claim. For accuracy and to ensure you are withholding the right amount, consider referencing the South Carolina Product Sales Order Form, which can guide you through any relevant financial obligations.

Instructions - 2020 SC1040 - South Carolina Individual Income Tax Return. Line p-4 through line p-6: Military retirement deduction. An individual with military retirement income included in their South Carolina taxable income may take a deduction up to the amount of military retirement income.

200bSummary: Every person who engages in business in this state as a retailer must obtain a retail license before making any sales. This includes sales made online and persons who make infrequent sales in this state.

According to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages.

How to Get a Retail License. Apply for the retail license online using MyDORWAY or by paper with the SCDOR-111, Business Tax Registration Form. The fee for each permanent retail license is $50. If an outstanding debt exists for state taxes, the retail license will not be issued until the taxes are paid.

Child deductions: South Carolina offers a deduction of $4,260 for each dependent child and an additional deduction of $4,260 for each child under 6 years of age. Almost a million returns claimed these deductions for tax year 2019.

How to Get a Retail License. Apply for the retail license online using MyDORWAY or by paper with the SCDOR-111, Business Tax Registration Form. The fee for each permanent retail license is $50. If an outstanding debt exists for state taxes, the retail license will not be issued until the taxes are paid.

Do I need to file a South Carolina return? If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.

Form NameRemote Seller Sales and Use Tax Registration. Form NumberSCDOR-111 RS. Form NameApplication for Exemption Certificate. Form NumberST-10. Form NameApplication for Exemption from Local Tax for Construction Contractors.

If you elect to file as a full-year resident, file SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. You must complete SC1040TC and attach a copy of the other state's income tax return.