South Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance

Description

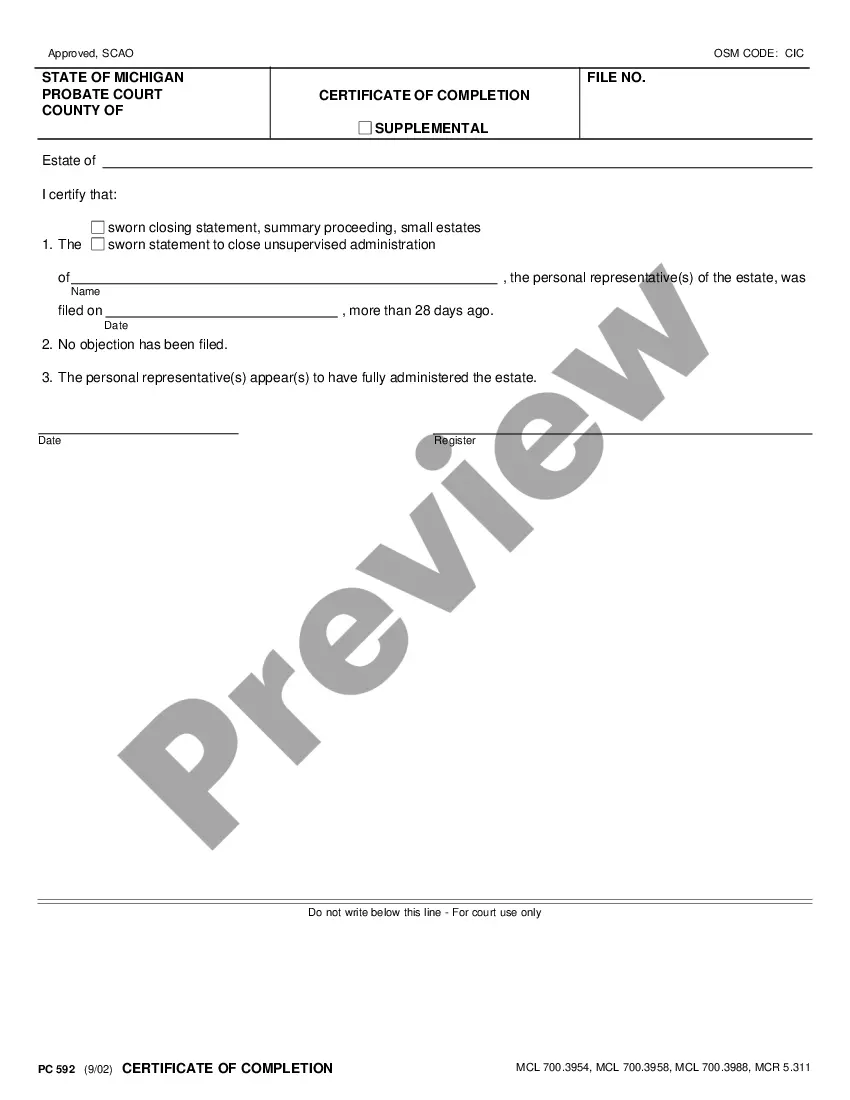

How to fill out Notice To Lessee By Lessor Of Intention To Restore Damaged Premises Covered By Insurance?

Are you currently in a circumstance where you require documents for either business or personal activities almost every day.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the South Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance, which are created to comply with state and federal regulations.

If you find the correct form, click Buy now.

Choose the subscription plan you want, fill in the necessary details to set up your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms platform and have an account, simply Log In.

- Then, you can download the South Carolina Notice to Lessee by Lessor of Intention to Restore Damaged Premises Covered by Insurance template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review option to examine the form.

- Check the outline to ensure you have selected the right form.

- If the form is not what you're looking for, utilize the Lookup field to find the form that suits your needs and requirements.

Form popularity

FAQ

It says landlords should fix major problems within two weeks if they pose a threat to a tenant's health and security, such as a broken boiler in the depths of winter.

A lessor is the owner of an asset that is leased, or rented, to another party, known as the lessee. Lessors and lessees enter into a binding contract, known as the lease agreement, that spells out the terms of their arrangement.

Where a mold condition in the dwelling unit materially affects the health or safety of any tenant or authorized occupant, the landlord may require the tenant to temporarily vacate the dwelling unit in order for the landlord to perform mold remediation in accordance with professional standards for a period not to exceed

An owner of real property, who allows another to take temporary possession through a lease. landlord & tenant. property & real estate law.

In the event of any assignment of a Leasehold Mortgage or in the event of a change of address of a Leasehold Mortgagee or of an assignee of a Leasehold Mortgage, notice of the new name and address shall be provided to Lessor. See All (23) Notice to Lessor.

Your landlord is always responsible for repairs to: the property's structure and exterior. basins, sinks, baths and other sanitary fittings including pipes and drains. heating and hot water.

In most cases, a landlord has fourteen (14) days to repair a problem, but if the problem affects health or safety, the landlord must make the repair as soon as possible.

Tenant Rights to Withhold Rent in South CarolinaTenants may withhold rent or exercise the right to "repair and deduct" if a landlord fails to take care of important repairs, such as a broken heater.

Landlords are required to make and pay for repairs for items under their responsibility. They must do so within 14 days after receiving a written request from tenants (read more).

Tenant Rights to Withhold Rent in South CarolinaTenants may withhold rent or exercise the right to "repair and deduct" if a landlord fails to take care of important repairs, such as a broken heater. For specifics, see South Carolina Tenant Rights to Withhold Rent or "Repair and Deduct".