Iowa Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

Are you presently in a circumstance where you frequently require documents for either business or personal matters every single day.

There are numerous legal document templates available online, but it is not easy to find trustworthy ones.

US Legal Forms provides thousands of form templates, including the Iowa Ratification or Confirmation of an Oral Amendment to a Partnership Agreement, which are designed to comply with state and federal regulations.

Once you find the right form, click Buy now.

Choose the payment plan you prefer, input the required information to create your account, and process the payment using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Iowa Ratification or Confirmation of an Oral Amendment to a Partnership Agreement template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it’s for the correct city/state.

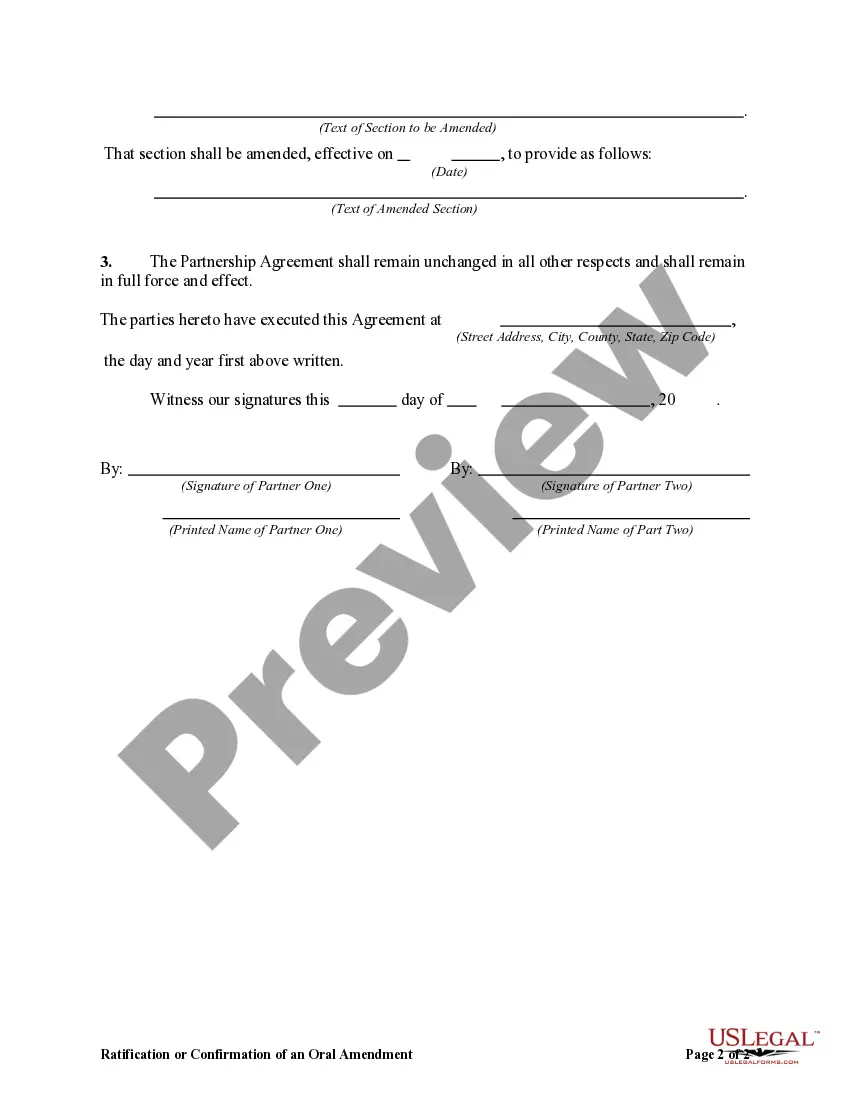

- Utilize the Preview button to review the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find a form that fits your needs and requirements.

Form popularity

FAQ

To form a partnership, you need a formal partnership agreement that outlines the terms and conditions of the partnership. This agreement should include details on the partnership's purpose, the roles of each partner, and how profits and losses will be shared. Additionally, you may need to register your partnership with state authorities depending on your business structure. With uslegalforms, you can gain access to essential templates and legal insights for a successful formation.

Forming a partnership in Iowa begins with selecting a suitable partnership structure, such as a general partnership or limited partnership. You will need to create a partnership agreement, detailing roles, responsibilities, and profit-sharing. Afterward, consider registering your partnership with the state, especially if you're considering amending it orally in the future. Consulting uslegalforms can help streamline this process.

The partnership tax form for Iowa is Form 1065, the U.S. Return of Partnership Income. Partnerships in Iowa must use this form to report income, deductions, and credits from partnership operations. To ensure compliance with Iowa tax regulations, it is crucial to accurately complete this form. If you need assistance with this process, consider utilizing the services provided by uslegalforms to simplify the steps.

Partnerships can be formed with a handshake--and often they are. In fact, partnerships are the only business entities that can be formed by oral agreement. Of course, as with any important legal relationship, oral agreements often lead to misunderstandings, which often lead to disputes.

Verbal agreements between two parties are just as enforceable as a written agreement, so long as they do not violate the Statute of Frauds. Like written contracts, oral ones just need to meet the requirements of a valid contract to be enforced in court.

Conclusion. A Partnership Deed acts as the spine of the Partnership firm. It can be modified and altered at any time according to the business requirements or partners' willingness. The most essential element to bring change in partnership deed is to obtain the consent of partners in form of their signature on the deed

The agreement can be either in written or oral form. The Partnership Act does not demand that the agreement has to be in writing. Wherever it is in the form of writing, the document, which comprises terms of the agreement is called 'Partnership Deed.

Partnerships are unique in that they can be legally formed with a verbal agreement and a handshake. However, disputes and questions often arise regarding financial responsibilities and expected activities. A written contract can reduce the chances of legal disputes.

Removing a partner from a general partnership is the act of removing someone from your business that operates as a partnership. It can happen in several different ways, but the most common option is through a clause in the partnership agreement itself.

As stated before, a partnership agreement can be oral or in writing.