South Carolina Sales Representative Agreement for Software Developer

Description

How to fill out Sales Representative Agreement For Software Developer?

If you require thorough, acquire, or generate sanctioned document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by groups and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to create an account.

Step 5. Process the transaction. You can use your Visa, MasterCard, or PayPal account to complete the payment.

- Use US Legal Forms to retrieve the South Carolina Sales Representative Agreement for Software Developer with just a few clicks.

- If you are an existing user of US Legal Forms, Log In to your account and then click the Download button to access the South Carolina Sales Representative Agreement for Software Developer.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

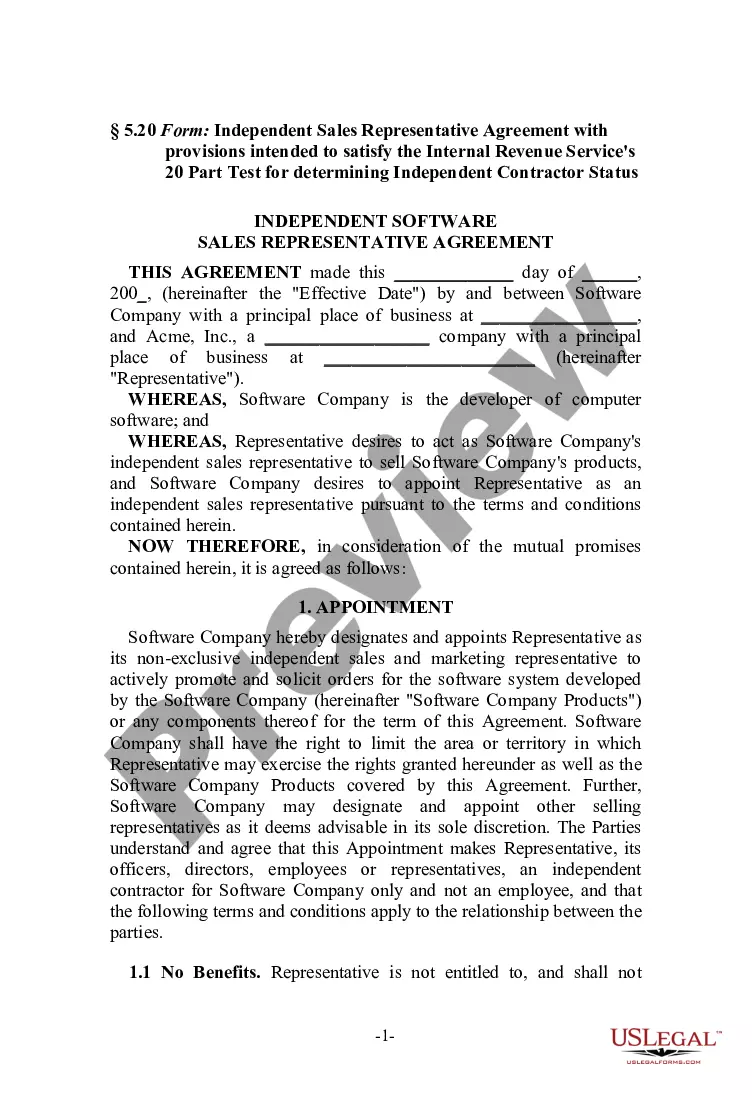

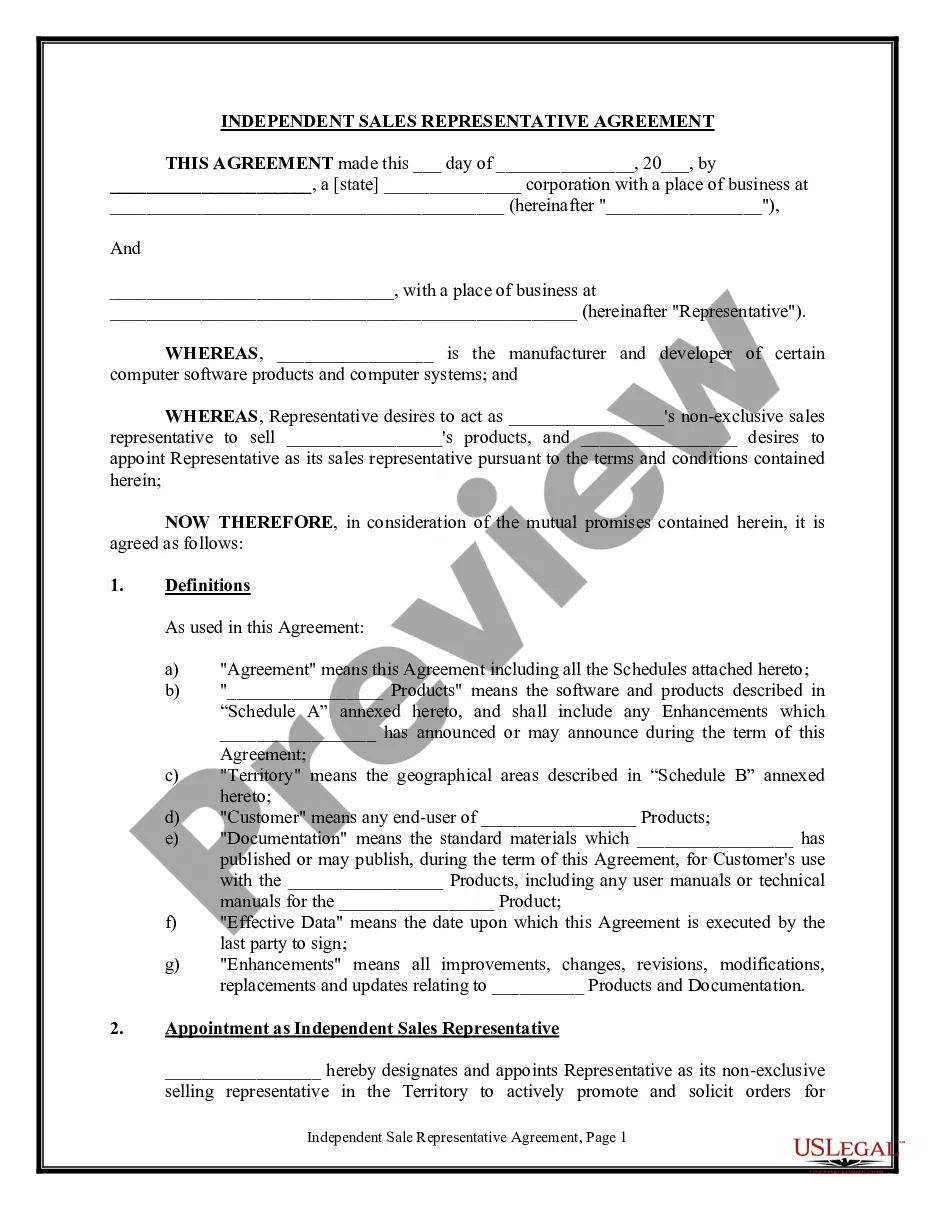

- Step 2. Utilize the Preview feature to review the contents of the form. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

If the true object of a contract is to acquire tangible personal property (e.g. software updates provided by tangible means), the total charges for the contract are taxable, even though certain services are also provided.

In the state of South Carolina, any modifications that are made to canned software that are prepared exclusively for a specific customer are considered to be taxable custom programs, not exempt. Sales of digital products are exempt from the sales tax in South Carolina.

Yes, the sale or renewal of a warranty, maintenance or similar service contract for tangible personal property that is subject to the maximum tax provisions under Code Section 12-36-2110 is subject to the sales and use tax, unless otherwise exempt under the law.

The majority of states which have addressed the issue and have concluded that software (at least unbundled software) is not tangible personal property for ad valorem tax purposes and therefore is generally not taxable.

In the state of South Carolina, any modifications that are made to canned software that are prepared exclusively for a specific customer are considered to be taxable custom programs, not exempt. Sales of digital products are exempt from the sales tax in South Carolina.

Software-as-a-service is taxed in 17 states, partially taxed in 2 states and taxed only if the provider has a server in that state in 8 states. Digital movies are tax-exempt in 23 states and charged at 1% in Connecticut. Digital photography is tax-exempt in 23 states. Digital games are taxed in 26 states.

Service fees for the installation of software are subject to sales tax. Moreover, charges for software maintenance services including delivery of updates for prewritten software are generally taxable. However, maintenance contracts that only provide support services for canned software are not taxable.

Prescription medicines, groceries, and gasoline are all tax-exempt. Some services in South Carolina are subject to sales tax.

In a recent private letter ruling, the South Carolina Department of Revenue held that software subscription services are tangible personal property subject to sales and use taxes.