South Carolina Independent Sales Representative Agreement

Description

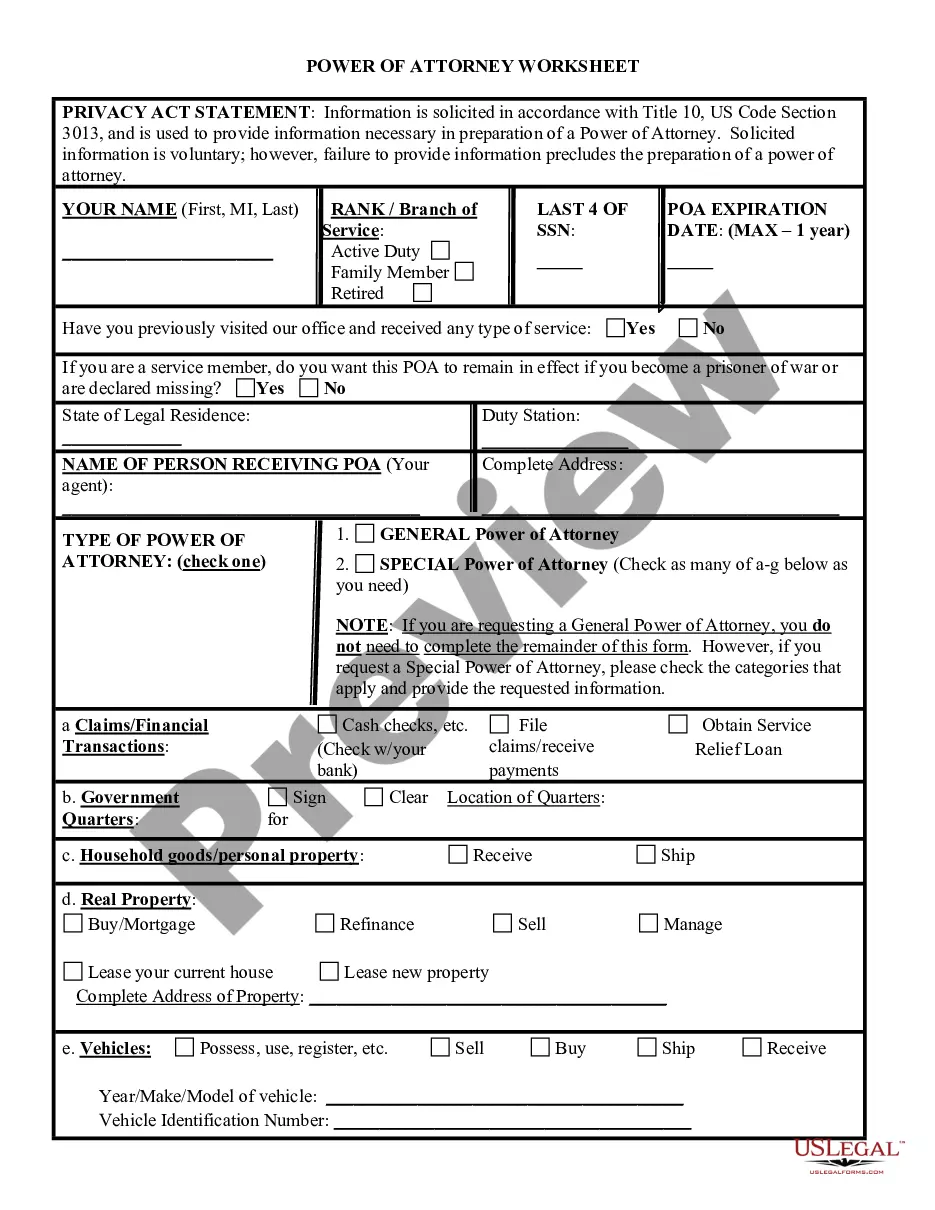

How to fill out Independent Sales Representative Agreement?

US Legal Forms - one of many greatest libraries of legitimate forms in the United States - gives an array of legitimate record layouts you can download or produce. Using the internet site, you can find a huge number of forms for organization and person uses, categorized by groups, suggests, or keywords and phrases.You can find the most recent variations of forms such as the South Carolina Independent Sales Representative Agreement within minutes.

If you already possess a monthly subscription, log in and download South Carolina Independent Sales Representative Agreement in the US Legal Forms library. The Obtain key will show up on each and every type you view. You get access to all formerly delivered electronically forms from the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, listed here are basic guidelines to get you started out:

- Be sure you have selected the best type to your area/county. Select the Review key to examine the form`s information. Browse the type explanation to actually have selected the proper type.

- If the type doesn`t satisfy your requirements, utilize the Look for area on top of the display screen to discover the the one that does.

- When you are happy with the shape, verify your selection by visiting the Buy now key. Then, choose the costs strategy you like and supply your accreditations to sign up for the bank account.

- Process the deal. Use your credit card or PayPal bank account to finish the deal.

- Choose the file format and download the shape on your own system.

- Make changes. Fill up, modify and produce and sign the delivered electronically South Carolina Independent Sales Representative Agreement.

Every single design you added to your money does not have an expiry time and is also your own property permanently. So, in order to download or produce yet another duplicate, just check out the My Forms segment and click about the type you want.

Get access to the South Carolina Independent Sales Representative Agreement with US Legal Forms, probably the most substantial library of legitimate record layouts. Use a huge number of specialist and state-particular layouts that satisfy your small business or person demands and requirements.

Form popularity

FAQ

What is a 1099 commission-only role? A 1099 commission-only role refers to a position where an individual, classified as an independent contractor, is compensated solely based on the commissions from sales or deals closed without a base salary.

Ing to the folks at ZenBusiness, independent sales reps ?typically [earn] 5 to 15 percent of net sales. However, in some businesses, independent representatives are paid on a ledger basis? ? earn a commission on every sale made in their territory, regardless of direct communication.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Salespeople can be independent contractors or they can be employees. For many, the advantages of becoming an independent sales representative far outweigh the disadvantages of working as a W-2, salaried sales rep.

A salesperson is an individual engaged in the selling of merchandise or services. The salesperson can be a common law employee, an independent contractor, an employee by specific statute, or an excluded employee by specific statute.

A 1099 commission sales representative is a professional who works as a freelancer, independent contractor or as a self-employed professional. They're often hired by employers to complete a specific, temporary task. Employers typically don't pay these representatives a salary since they're hired as a contractor.

Independent sales reps, also known as commission-only reps, are independent contractors who are paid sales commissions to sell yours products (or services) and represent your company. Keep in mind that commission-only reps are independent business owners.

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.