South Carolina Solar Installation Agreement

Description

How to fill out Solar Installation Agreement?

You might spend numerous hours on the web searching for the appropriate legal document template that meets the requirements of state and federal regulations you seek.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You can conveniently obtain or print the South Carolina Solar Installation Agreement from my service.

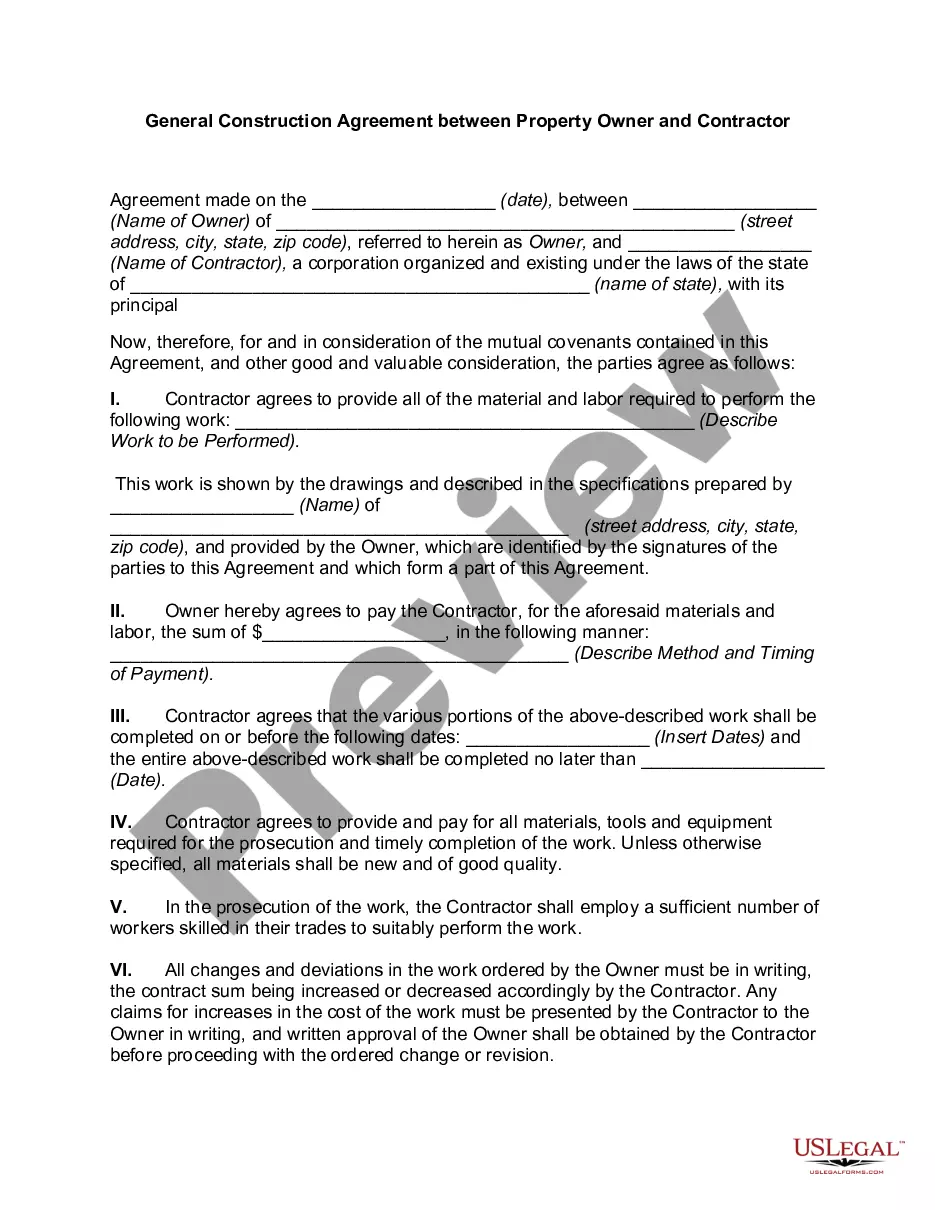

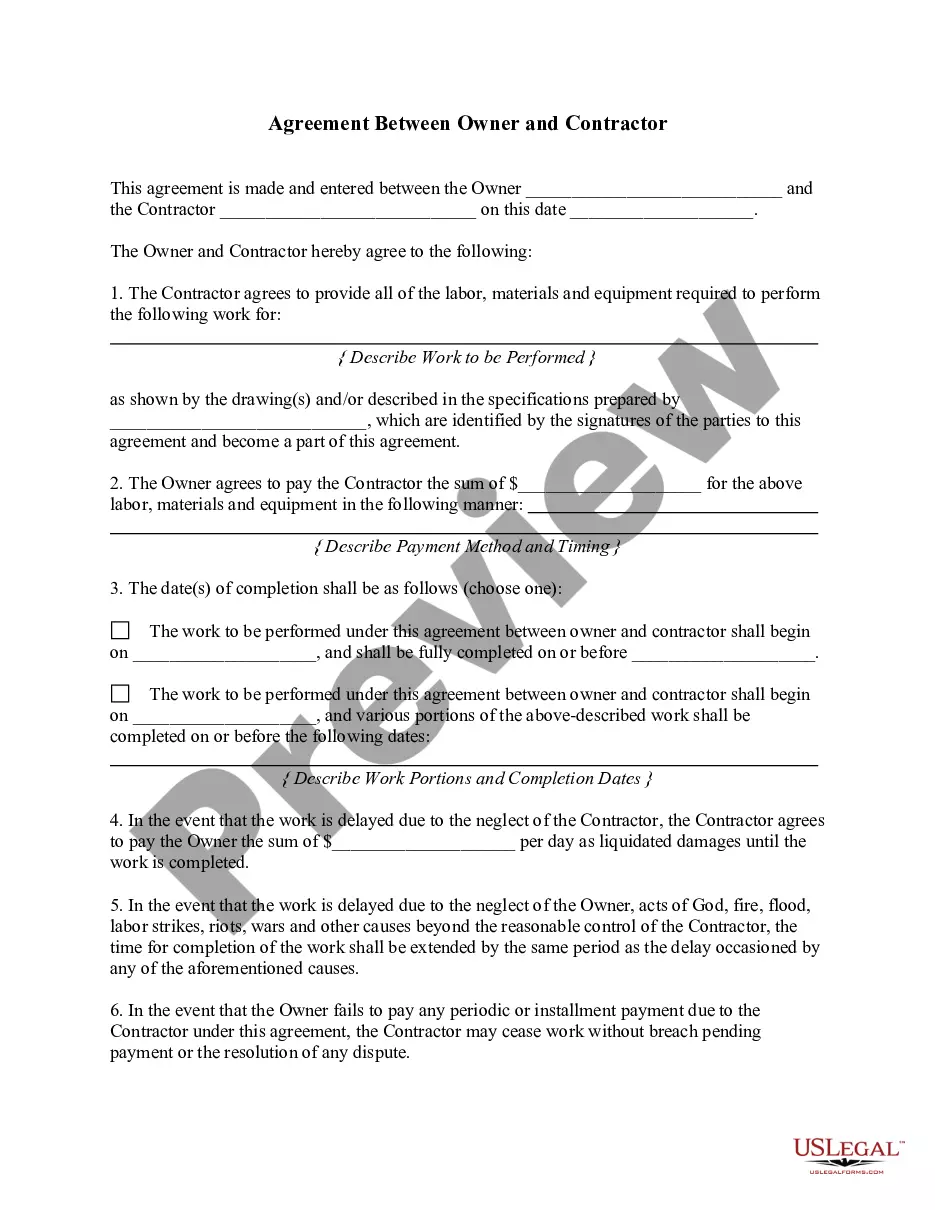

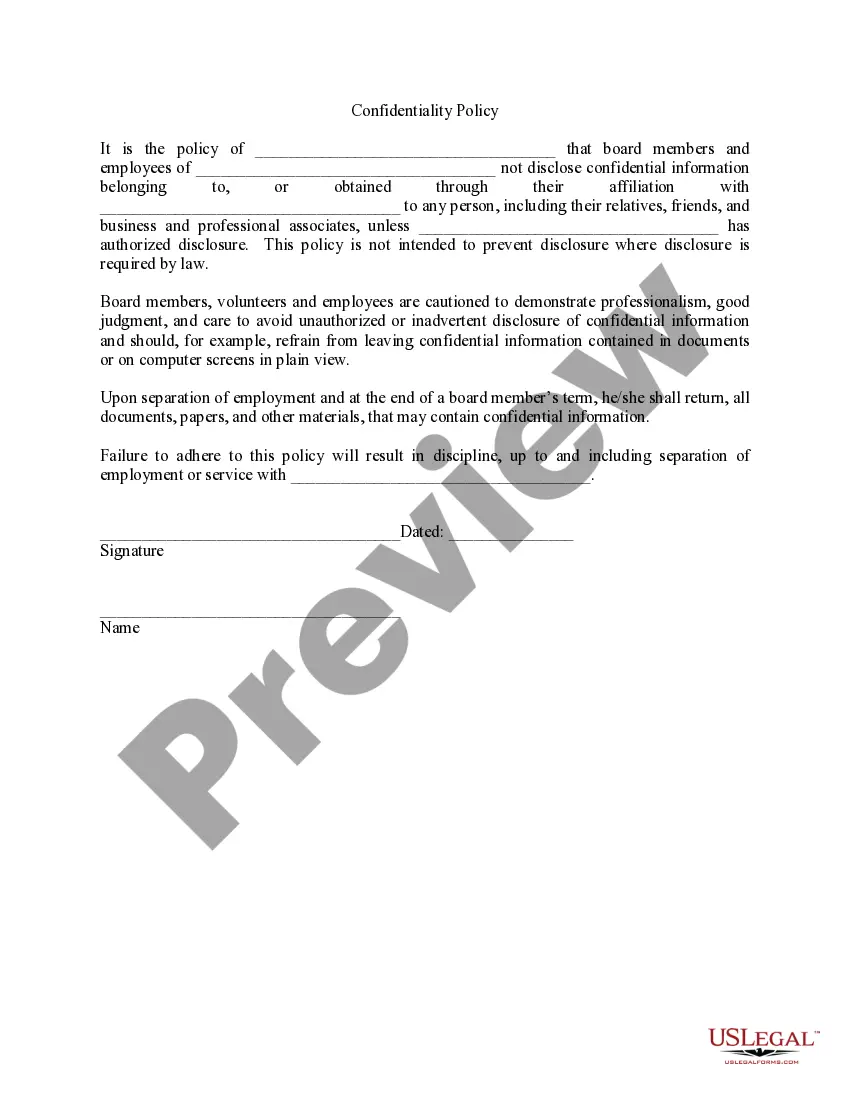

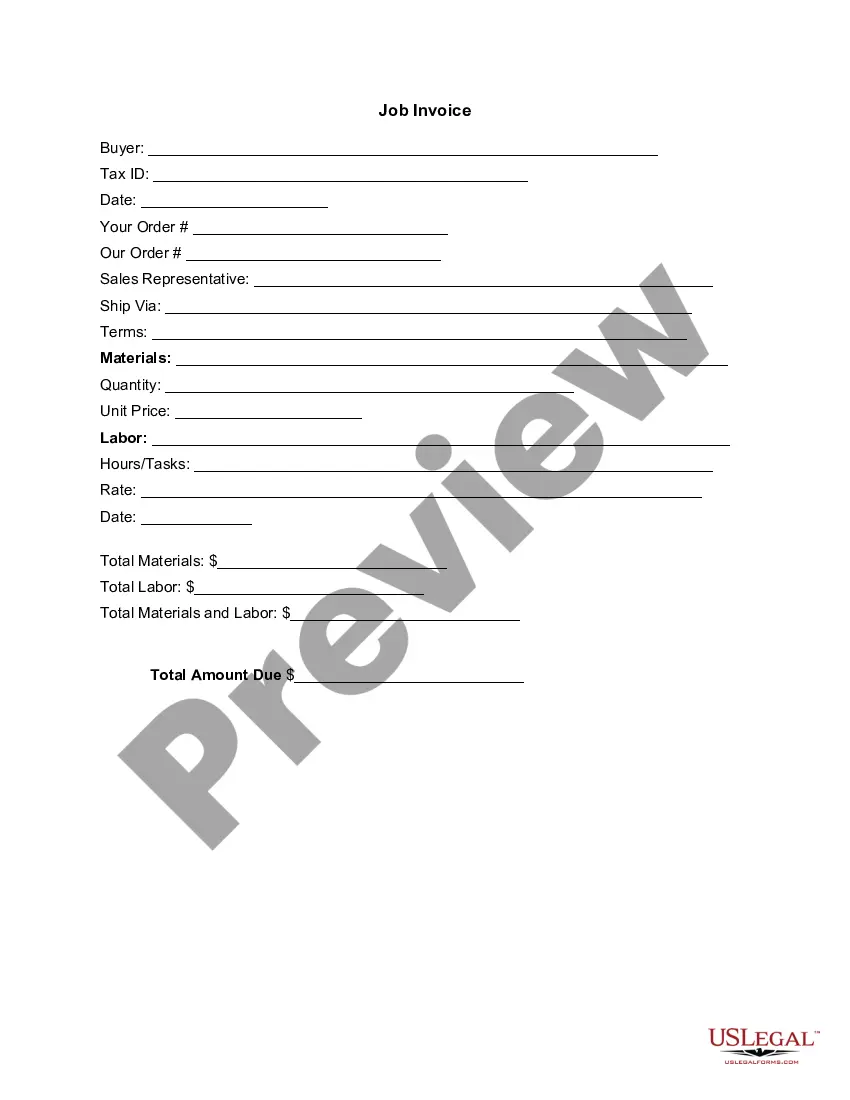

If available, utilize the Preview option to browse through the document format as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Following that, you can complete, edit, print, or sign the South Carolina Solar Installation Agreement.

- Every legal document template you purchase is yours permanently.

- To acquire another copy of the purchased form, navigate to the My documents tab and click the corresponding option.

- If this is your first time using the US Legal Forms website, adhere to the simple instructions provided below.

- First, confirm that you have selected the correct document format for the county/city of your choice.

- Review the form description to ensure you have chosen the correct form.

Form popularity

FAQ

To claim the South Carolina tax credit for solar, you must file Form SC1040TC as part of your state tax return. The corresponding code is 038 SOLAR ENERGY OR SMALL HYDROPOWER SYSTEM CREDIT: For installing a solar energy system or small hydropower system in a South Carolina facility (TC-38).

In South Carolina, homeowners' associations are allowed to restrict the placement of solar panels, so if you are part of a community governed by a homeowners' association, check before signing a contract. Homeowners will need to obtain any building or other local permits required before installation.

The state now sits in the top 15 states for solar power generation. Policies like the state's solar tax credit and net metering have made solar power more attractive, making it easy for residents to invest. If you live in South Carolina, you could save money on energy by installing solar panels on your home.

The South Carolina solar tax credit is worth 25% of the total cost including installation. The maximum incentive for the S.C. state solar tax credits is $35,000, or 50% of taxpayer's tax liability for that taxable year, whichever is less. The maximum amount that will be paid out each year is $3,500.

Yes, the whole range of pay-nothing-now options have been available in South Carolina since 2014from loans to leases to power purchase agreements (PPAs).

A solar service agreement is an agreement with an independent company who agrees to provide cheaper power than that offered by a local centralized utility. They can be structured as a lease, power purchase agreement (PPA), or a levelized PPA.

H. 3354 (now Act 68) exempts residential solar panels from property taxes. It was passed nearly unanimously in the House and in the Senate and was signed into law by Gov. Henry McMaster in May.

For a database of tax credits and incentives for solar, visit EnergySaver.SC.GOV. Important note about tax credits: Tax credits can reduce a consumer's tax liability, but the credits are non-refundable meaning that they only apply if a consumer owes enough in taxes to balance the credit.

The South Carolina Electric & Gas (SCE&G) net metering program allows customers with solar panels to cover their monthly electricity bills with the solar power they generate. Any energy generated beyond what you use in a month is carried over as a credit on your next month's bill.

South Carolina Solar Tax CreditEligible residents can get a 25% tax credit from the final cost of a new renewable energy system in South Carolina. The state tax credit can only take $3,500 or 50% of your tax liability per year for up to 10 years. (Max. solar installation cost: $35,000.)