South Carolina Software Sales Agreement

Description

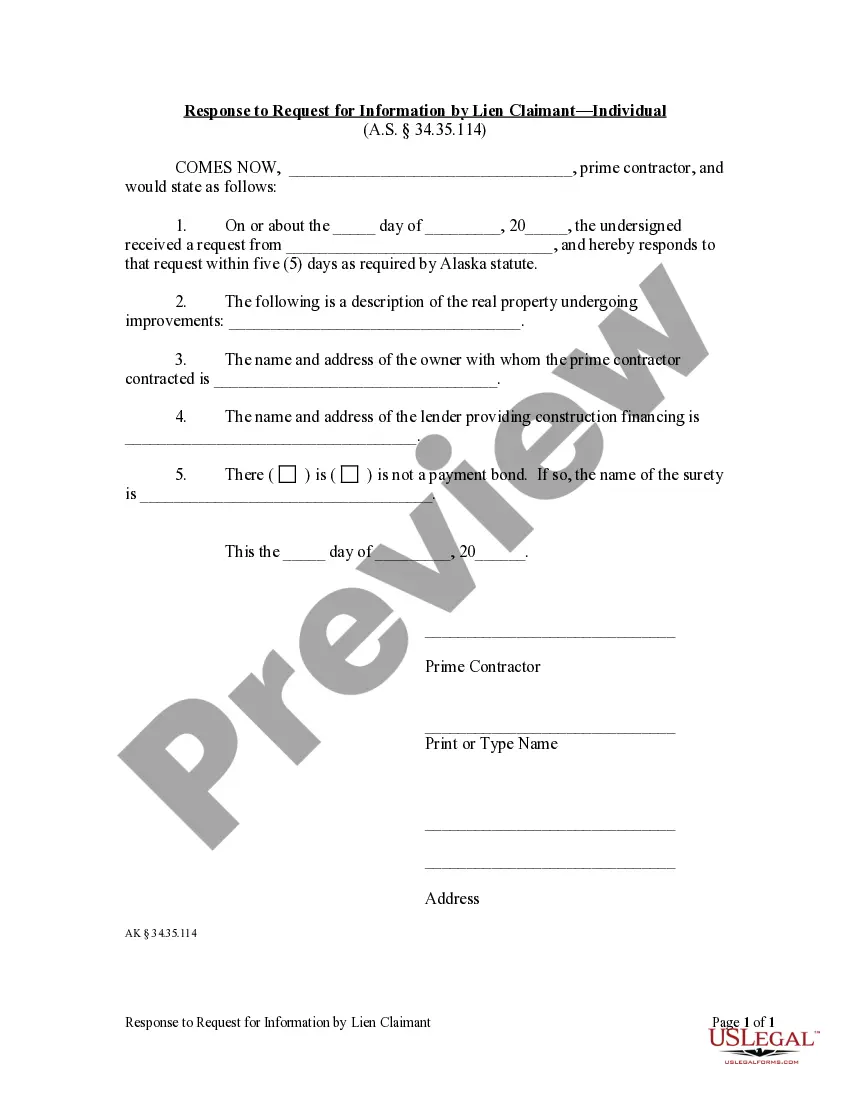

How to fill out Software Sales Agreement?

Are you presently in a situation where you require documents for business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a wide range of template options, including the South Carolina Software Sales Agreement, designed to comply with federal and state regulations.

Once you have found the correct form, click Get now.

Choose the pricing plan you want, fill in the required information to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Software Sales Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/region.

- Use the Review button to examine the document.

- Check the details to ensure you have selected the appropriate form.

- If the document isn't what you're looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

In summary, software sold and delivered to a purchaser by tangible means, such as by tape, diskette or flash drive, is a sale subject to the sales or use tax. Software sold and delivered to a purchaser electronically is not subject to the sales and use tax.

In the state of South Carolina, any modifications that are made to canned software that are prepared exclusively for a specific customer are considered to be taxable custom programs, not exempt. Sales of digital products are exempt from the sales tax in South Carolina.

South Carolina Digital products are not taxable in South Carolina. Digital products are not specifically included in the definition of tangible personal property.

Yes. Charges for maintenance agreements (whether optional or mandatory) that are made in conjunction with, or as part of the sale of, computer software sold and delivered by tangible means are includable in "gross proceeds of sales" or "sales price", and, therefore, subject to the tax.

Charges for renewals of warranty, maintenance or similar service contracts for tangible personal property are subject to the sales and use tax, unless otherwise exempt under the law.

Software sold and delivered to a purchaser electronically is not subject to the sales and use tax.

The Sales Tax is imposed on the sales at retail of tangible personal property and certain services. The Use Tax is imposed of the storage, use or consumption of tangible personal property and certain services when purchased at retail from outside the state for storage, use or consumption in South Carolina.

Additionally, software subscriptions services are considered tangible property and are subject to sales and use taxes.

Traditional Goods or Services Goods that are subject to sales tax in South Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription medicines, groceries, and gasoline are all tax-exempt.

In a recent private letter ruling, the South Carolina Department of Revenue held that software subscription services are tangible personal property subject to sales and use taxes.