South Carolina Sample Letter for Purchase of Loan

Description

How to fill out Sample Letter For Purchase Of Loan?

Are you in a placement in which you will need files for possibly business or specific purposes just about every working day? There are a variety of authorized papers themes accessible on the Internet, but getting types you can trust isn`t effortless. US Legal Forms provides a large number of kind themes, such as the South Carolina Sample Letter for Purchase of Loan, which are composed to meet state and federal demands.

In case you are currently familiar with US Legal Forms website and also have a free account, just log in. After that, you may obtain the South Carolina Sample Letter for Purchase of Loan format.

Should you not provide an bank account and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you want and make sure it is for your proper area/area.

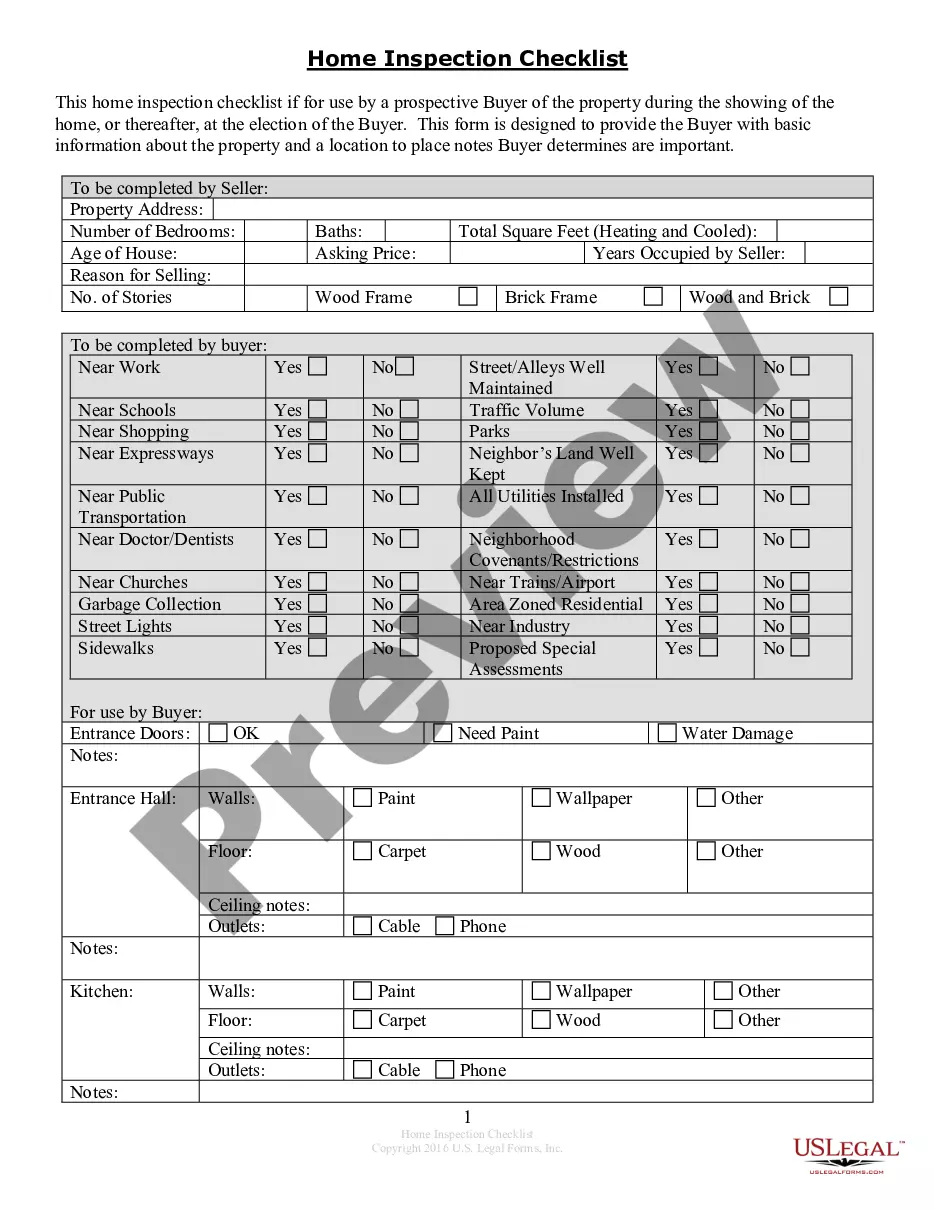

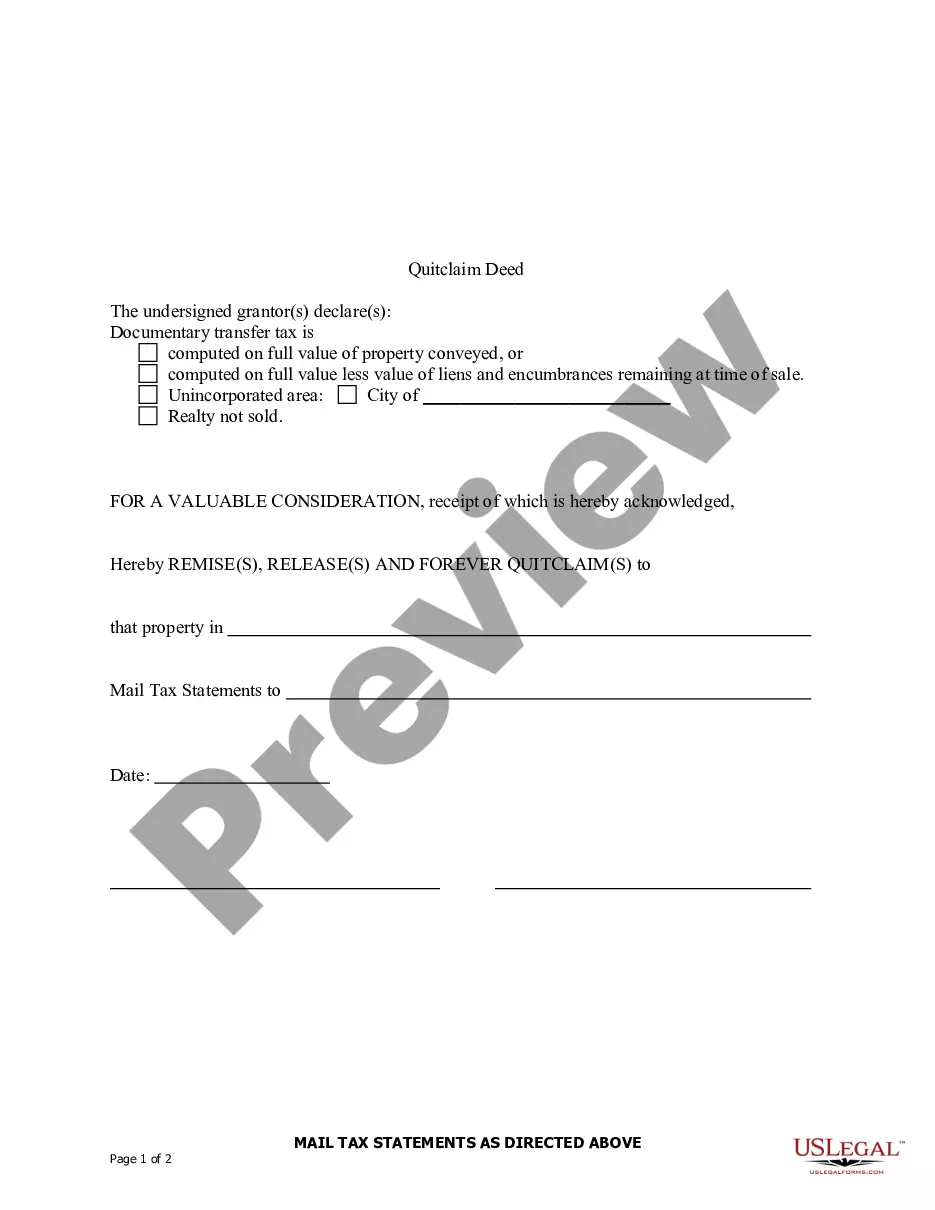

- Make use of the Preview key to analyze the form.

- See the explanation to ensure that you have selected the correct kind.

- In the event the kind isn`t what you`re trying to find, use the Lookup industry to get the kind that meets your requirements and demands.

- Once you find the proper kind, just click Purchase now.

- Opt for the rates plan you would like, fill in the desired details to generate your bank account, and buy the order utilizing your PayPal or credit card.

- Decide on a practical data file file format and obtain your backup.

Find all the papers themes you may have bought in the My Forms menu. You can aquire a further backup of South Carolina Sample Letter for Purchase of Loan anytime, if required. Just select the needed kind to obtain or printing the papers format.

Use US Legal Forms, probably the most considerable selection of authorized varieties, in order to save time as well as prevent mistakes. The support provides skillfully made authorized papers themes which you can use for an array of purposes. Produce a free account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

How to write a letter of explanationThe date you're writing the letter.The lender's name, mailing address, and phone number.Your full legal name and loan application number.Your explanation, with references to any supporting documents you're including.Your mailing address and phone number.01-Mar-2022

Begin the letter with the date, a salutation, and an introduction of the incident or issue. Provide a short but detailed description without having to add unnecessary terms and phrases. Provide an explanation of the steps you've taken to rectify the error or to complete the missing information.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?15-Apr-2021

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation. An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

There are gaps in the borrower's employment history. The borrower's income has been declining. The borrower has recently changed jobs. The borrower has negative items on their credit report.