South Carolina Seller's Affidavit of Nonforeign Status

Description

How to fill out Seller's Affidavit Of Nonforeign Status?

US Legal Forms - one of the most significant libraries of legal kinds in the United States - provides a wide range of legal record layouts you may obtain or print out. Using the internet site, you will get a large number of kinds for enterprise and personal uses, categorized by types, claims, or search phrases.You will find the latest versions of kinds like the South Carolina Seller's Affidavit of Nonforeign Status in seconds.

If you already have a membership, log in and obtain South Carolina Seller's Affidavit of Nonforeign Status in the US Legal Forms catalogue. The Download key can look on every kind you view. You have accessibility to all formerly acquired kinds within the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, listed below are simple guidelines to obtain began:

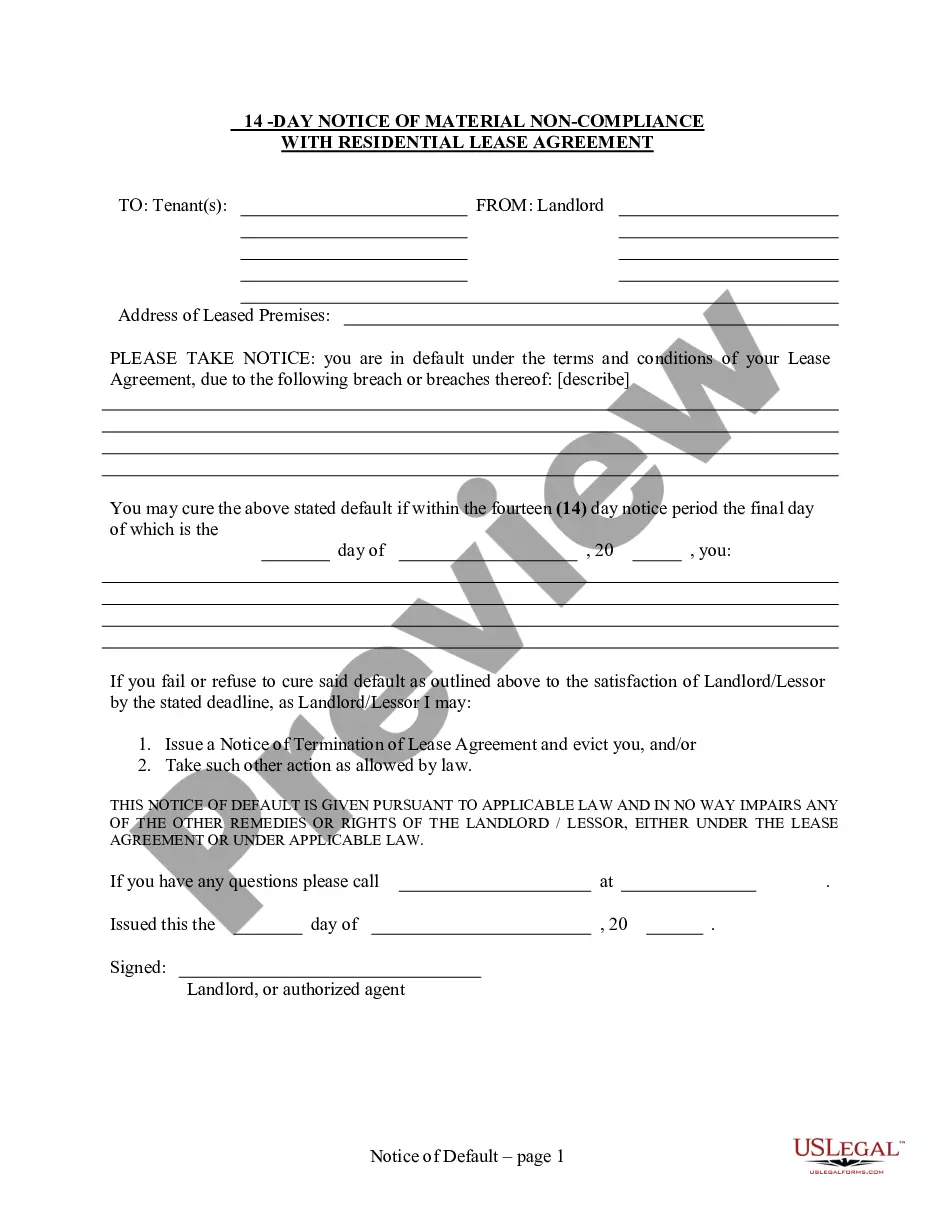

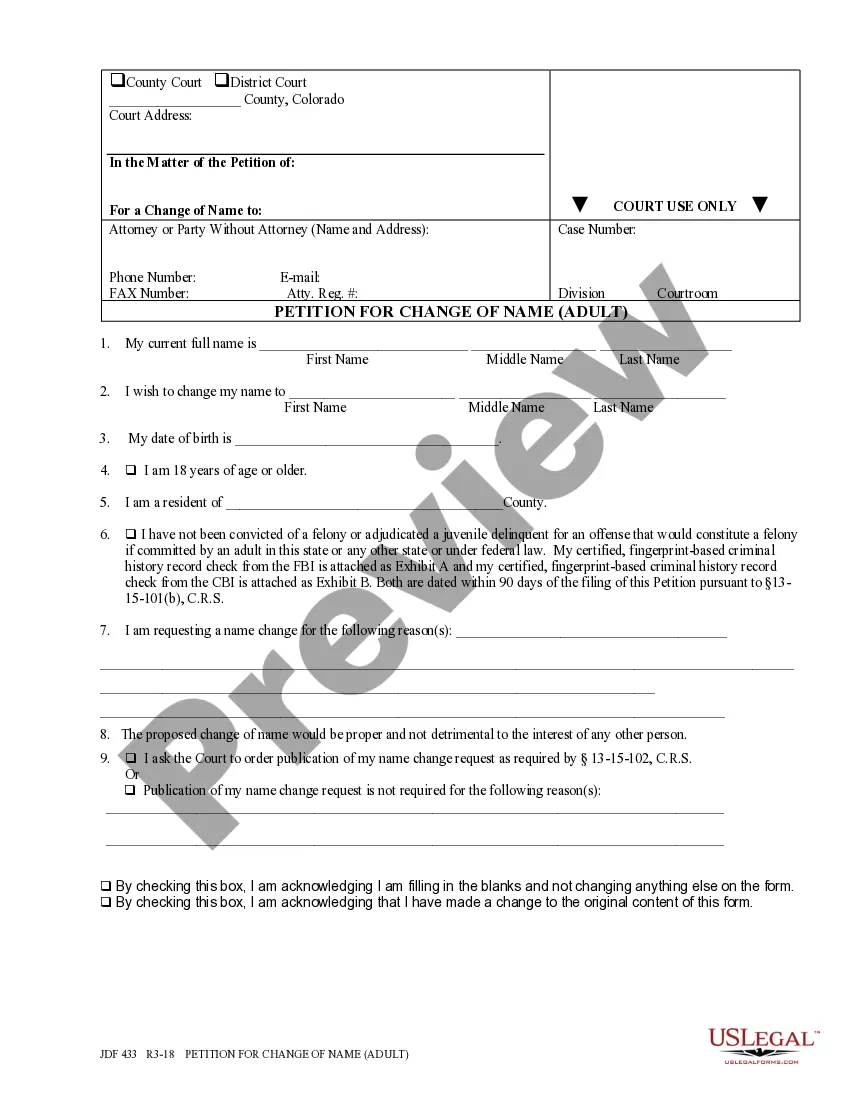

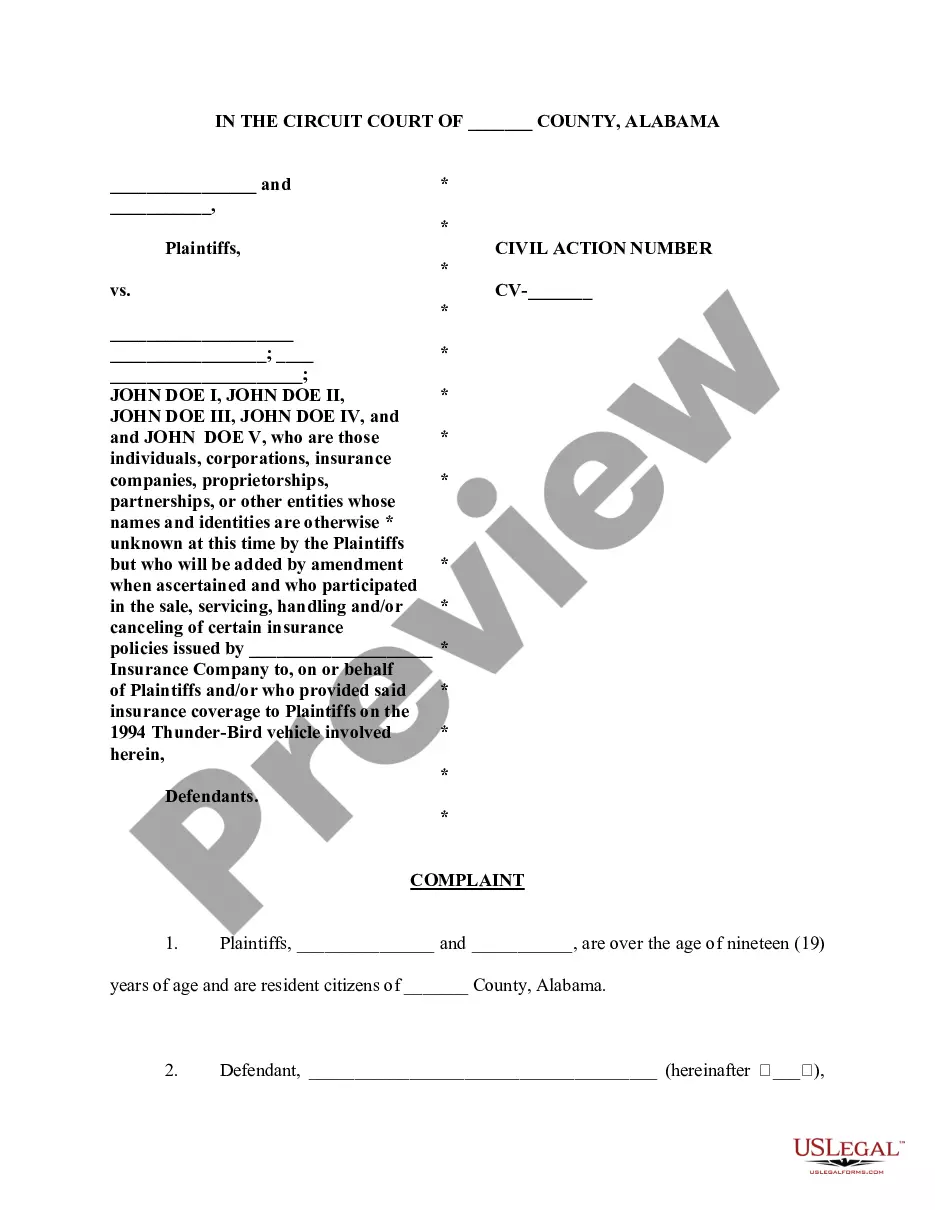

- Be sure to have picked the proper kind for your personal area/state. Select the Review key to examine the form`s information. Look at the kind explanation to actually have chosen the correct kind.

- In the event the kind doesn`t satisfy your requirements, use the Research discipline towards the top of the display to get the one that does.

- In case you are happy with the shape, verify your decision by clicking on the Get now key. Then, select the rates strategy you favor and provide your accreditations to sign up for the accounts.

- Method the deal. Use your charge card or PayPal accounts to perform the deal.

- Choose the file format and obtain the shape on your gadget.

- Make adjustments. Fill out, change and print out and indicator the acquired South Carolina Seller's Affidavit of Nonforeign Status.

Every single format you put into your bank account does not have an expiration particular date and is also your own for a long time. So, if you would like obtain or print out one more backup, just go to the My Forms section and then click in the kind you need.

Obtain access to the South Carolina Seller's Affidavit of Nonforeign Status with US Legal Forms, by far the most considerable catalogue of legal record layouts. Use a large number of professional and condition-certain layouts that meet up with your organization or personal demands and requirements.

Form popularity

FAQ

The Seller's Affidavit of Non-Foreign Status ( AS-14) is used to document the exemption if the Seller is not a NRA. This can be signed by a: US citizen; US green card holder; or. Non-citizen who meets the substantial presence test (based on the number of days actually present in the US).

The affidavit is used by a nonresident shareholder or partner to request an exemption from the withholding required pursuant to SC Code Section 12-8-590. Shareholders or partners who will be included in a composite Individual Income Tax return do not need to complete this affidavit.

S Corporations are required to withhold 5% of the South Carolina taxable income of shareholders who are nonresidents of South Carolina. To avoid penalty and interest, file the SC1120S-WH and submit your Withholding Tax payment by the 15th day of the third month following the S Corporation's taxable year end.

If the seller gives the buyer a ?Seller's Affidavit? stating that, for South Carolina income tax purposes, he will elect out of installment sales treatment, as defined by Internal Revenue Code §453, then the buyer will remit the entire amount of withholding tax in one payment.

A person is not required to withhold taxes for a nonresident taxpayer who submits an affidavit (Form I-312) certifying that they are registered with either the South Carolina Secretary of State or the South Carolina Department of Revenue.

The transferee can obtain from the transferor a ?Transferor Affidavit.? The purpose of this affidavit is to protect the transferee who is not receiving business assets or where the transferor is not transferring a majority of the assets of a business in this and other related or planned transfers from a tax lien that ...

Partnership taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically. To file by paper, use the SC 1065 Partnership Return.