South Carolina Complaint for Impropriety Involving Loan Application

Description

How to fill out Complaint For Impropriety Involving Loan Application?

You are able to commit time online attempting to find the lawful document template that suits the federal and state needs you require. US Legal Forms supplies thousands of lawful types which are analyzed by pros. You can actually download or produce the South Carolina Complaint for Impropriety Involving Loan Application from your service.

If you already possess a US Legal Forms bank account, you may log in and then click the Acquire option. Afterward, you may total, revise, produce, or indicator the South Carolina Complaint for Impropriety Involving Loan Application. Each and every lawful document template you buy is yours for a long time. To obtain an additional backup of any obtained develop, visit the My Forms tab and then click the related option.

If you are using the US Legal Forms internet site the very first time, keep to the straightforward guidelines beneath:

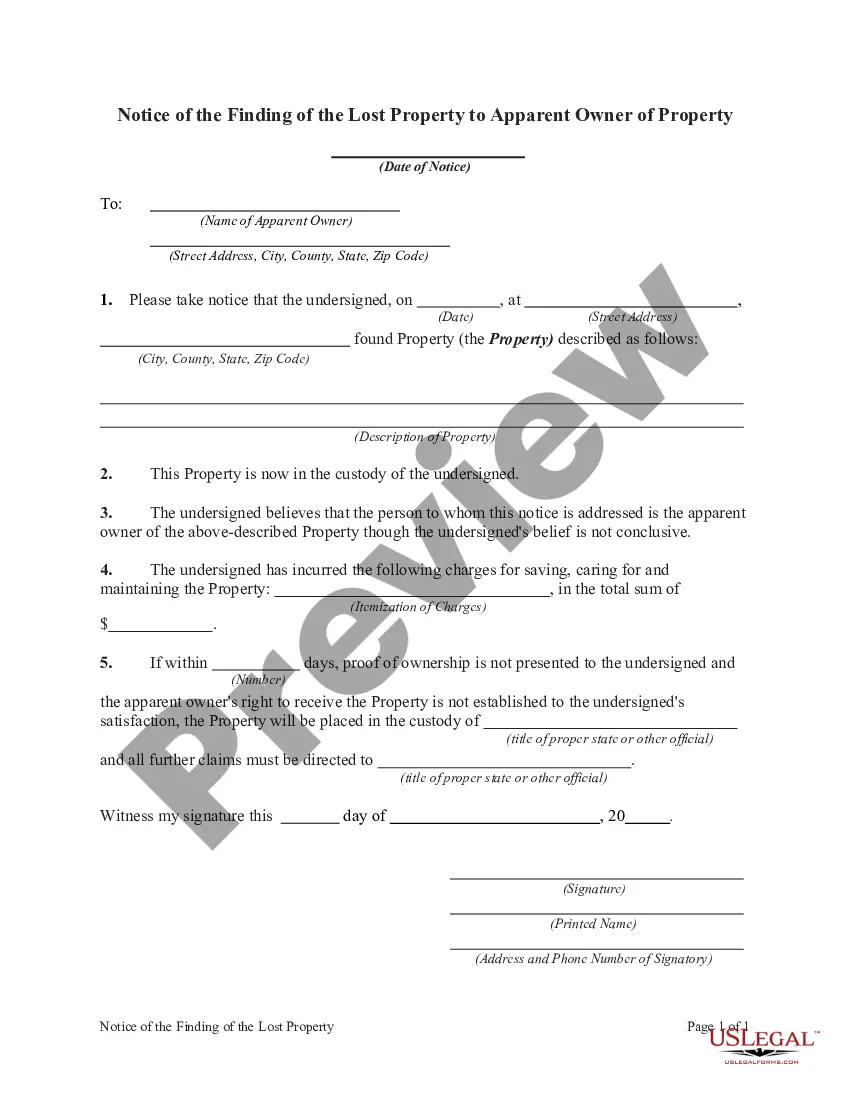

- Very first, ensure that you have chosen the correct document template for the state/metropolis of your choosing. Look at the develop description to ensure you have picked the correct develop. If readily available, take advantage of the Review option to check through the document template too.

- If you wish to find an additional version from the develop, take advantage of the Research discipline to discover the template that suits you and needs.

- Upon having identified the template you desire, click on Get now to carry on.

- Find the prices strategy you desire, key in your qualifications, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You can use your charge card or PayPal bank account to pay for the lawful develop.

- Find the file format from the document and download it for your system.

- Make changes for your document if required. You are able to total, revise and indicator and produce South Carolina Complaint for Impropriety Involving Loan Application.

Acquire and produce thousands of document web templates using the US Legal Forms web site, that provides the biggest collection of lawful types. Use professional and express-certain web templates to take on your business or specific requirements.

Form popularity

FAQ

Section 37-22-210 - Commissioner's records; segregated escrow funds; licensee ceasing business activities. (A) The commissioner shall keep a list of all applicants for licensure pursuant to this chapter which includes the date of application, name, and place of residence and whether the license was granted or refused.

(D) At the time of application for a mortgage loan, the mortgage broker, originator, or employee shall provide the borrower with a document specifying the agency designated to receive complaints or inquiries about the origination and making of the loan, with the telephone number and address of the agency.

In a criminal case, a person may be fined up to ten thousand ($10,000.00) dollars and imprisoned for up to one year. In a private lawsuit, a person may be liable to the person charged for the settlement services in an amount equal to three times the amount of the charge paid for the service.

SECTION 37-22-120. Licensing requirements. (2) circulate or use advertising, including electronic means, make a representation or give information to a person which indicates or reasonably implies activity within the scope of this chapter.

No mortgage or deed having the effect of a mortgage or other lien shall constitute a lien upon any real estate after the lapse of twenty years from the date for the maturity of the lien.

Chapter 23 - High-cost And Consumer Home Loans. Section 37-23-70. Prohibited acts; complaints; penalties; statute of limitations; enforcement; costs. (A) A lender may not engage knowingly or intentionally in the unfair act or practice of "flipping" a consumer home loan.

SECTION 37-3-105. First mortgage real estate loans. (1) Except as otherwise provided in subsection (2), unless the loan is made subject to this title by agreement (Section 37-3-601), "consumer loan" does not include a loan secured by a first lien or equivalent security interest in real estate.