South Carolina Deed Conveying Property to Charity with Reservation of Life Estate

Description

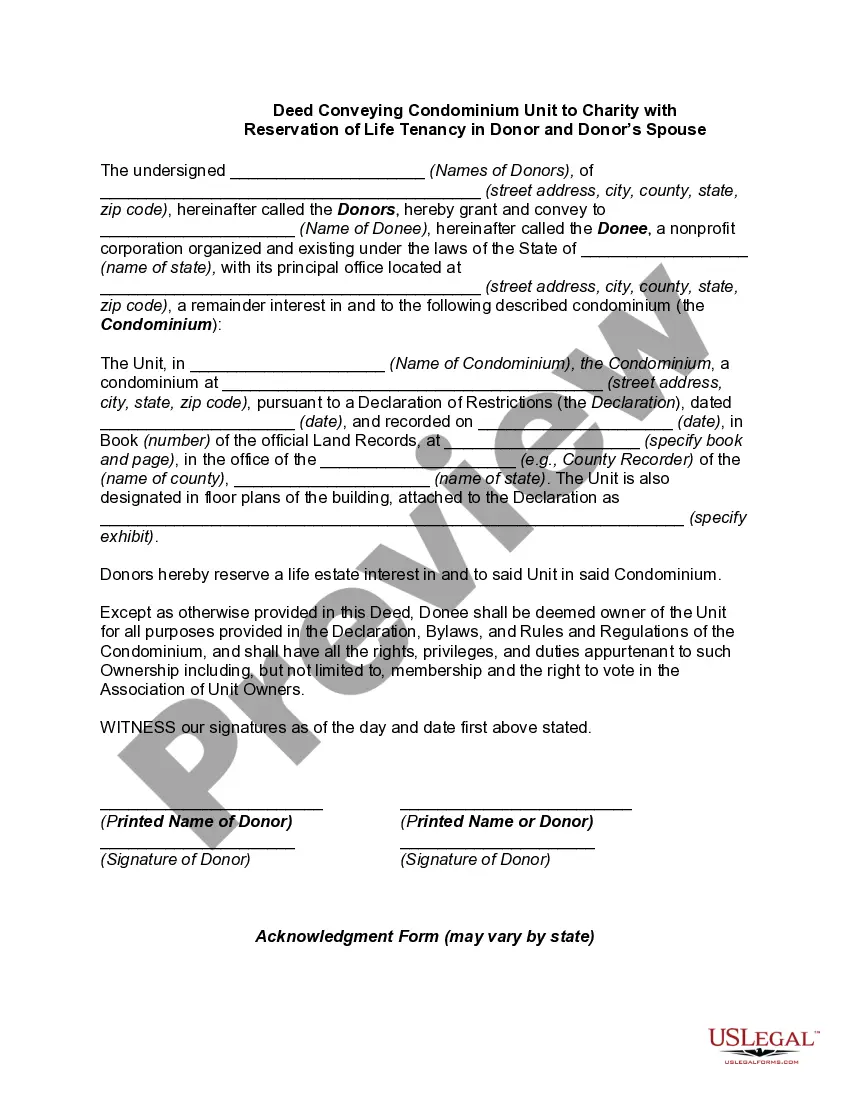

How to fill out Deed Conveying Property To Charity With Reservation Of Life Estate?

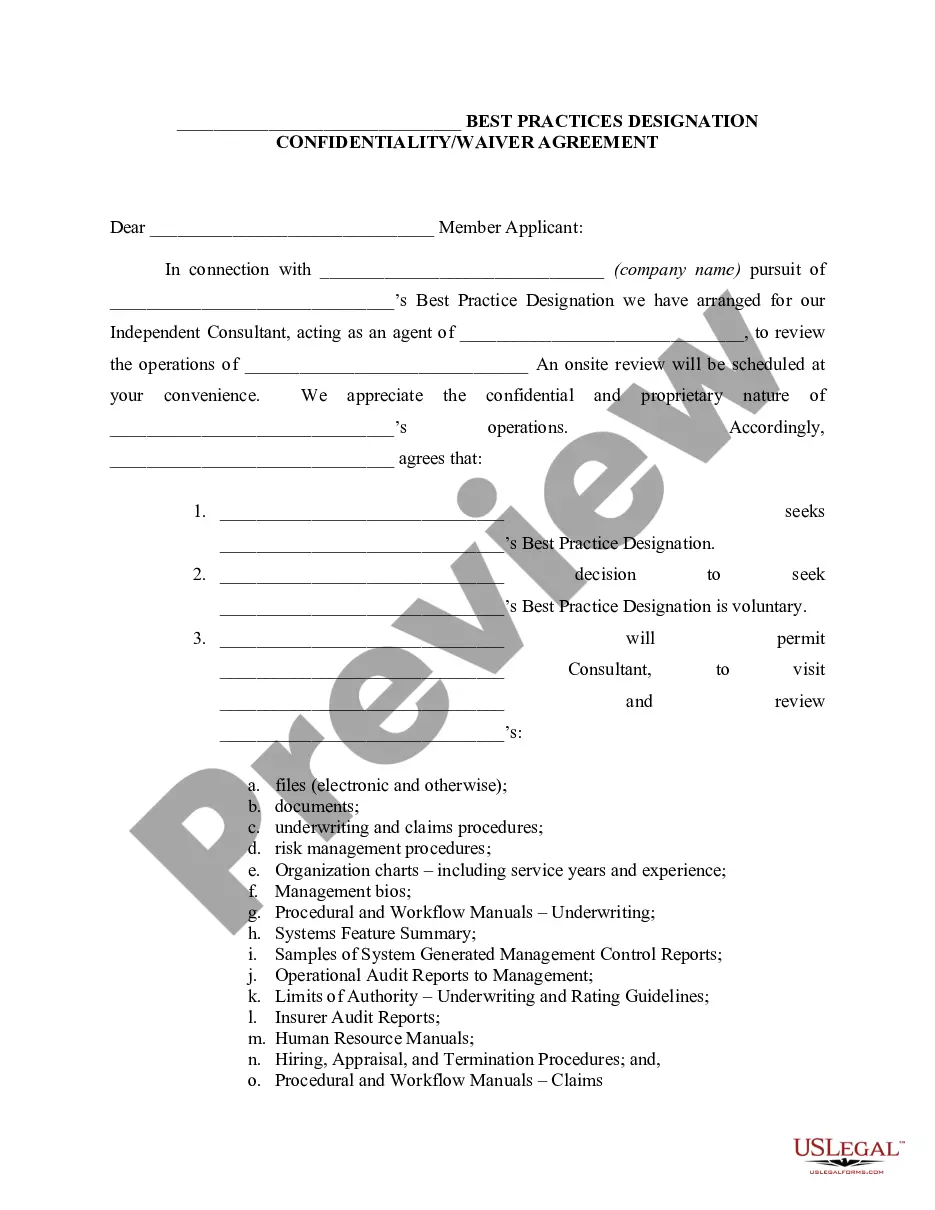

US Legal Forms - one of the most significant libraries of authorized kinds in America - delivers an array of authorized record layouts it is possible to down load or print out. Utilizing the web site, you can get 1000s of kinds for company and personal uses, categorized by types, suggests, or keywords.You will find the newest models of kinds such as the South Carolina Deed Conveying Property to Charity with Reservation of Life Estate within minutes.

If you have a monthly subscription, log in and down load South Carolina Deed Conveying Property to Charity with Reservation of Life Estate from your US Legal Forms catalogue. The Down load switch can look on each type you perspective. You have accessibility to all previously downloaded kinds in the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, listed below are easy instructions to help you get started out:

- Be sure to have picked the best type for your metropolis/region. Click the Review switch to check the form`s articles. See the type description to actually have chosen the right type.

- When the type doesn`t fit your demands, take advantage of the Search area at the top of the display to find the the one that does.

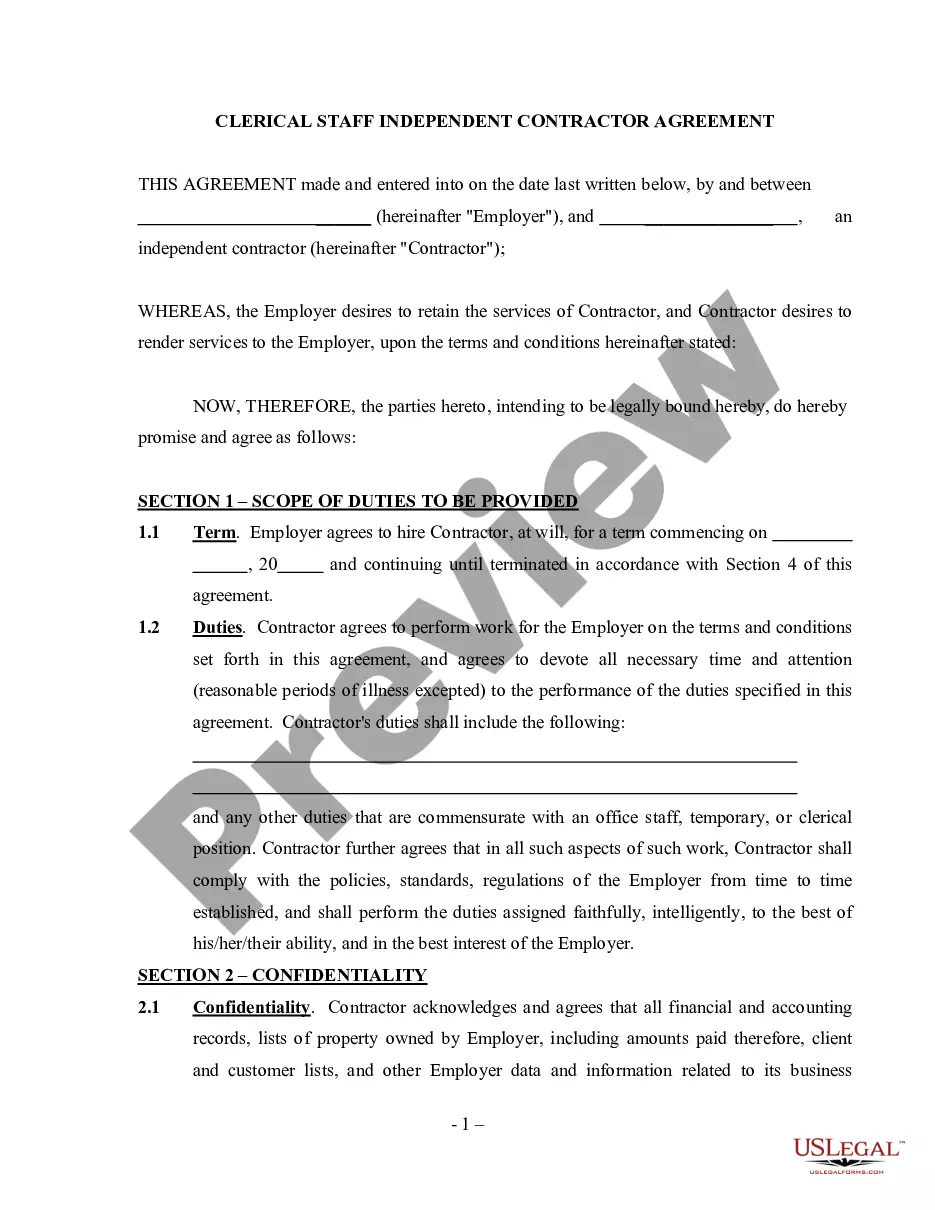

- In case you are satisfied with the form, confirm your selection by clicking on the Get now switch. Then, select the prices strategy you want and give your accreditations to register for the profile.

- Approach the financial transaction. Make use of your credit card or PayPal profile to accomplish the financial transaction.

- Find the structure and down load the form on your own gadget.

- Make modifications. Fill out, change and print out and signal the downloaded South Carolina Deed Conveying Property to Charity with Reservation of Life Estate.

Every single format you put into your bank account lacks an expiry day which is your own property forever. So, in order to down load or print out an additional backup, just proceed to the My Forms segment and then click on the type you want.

Obtain access to the South Carolina Deed Conveying Property to Charity with Reservation of Life Estate with US Legal Forms, one of the most extensive catalogue of authorized record layouts. Use 1000s of expert and express-certain layouts that fulfill your business or personal demands and demands.

Form popularity

FAQ

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

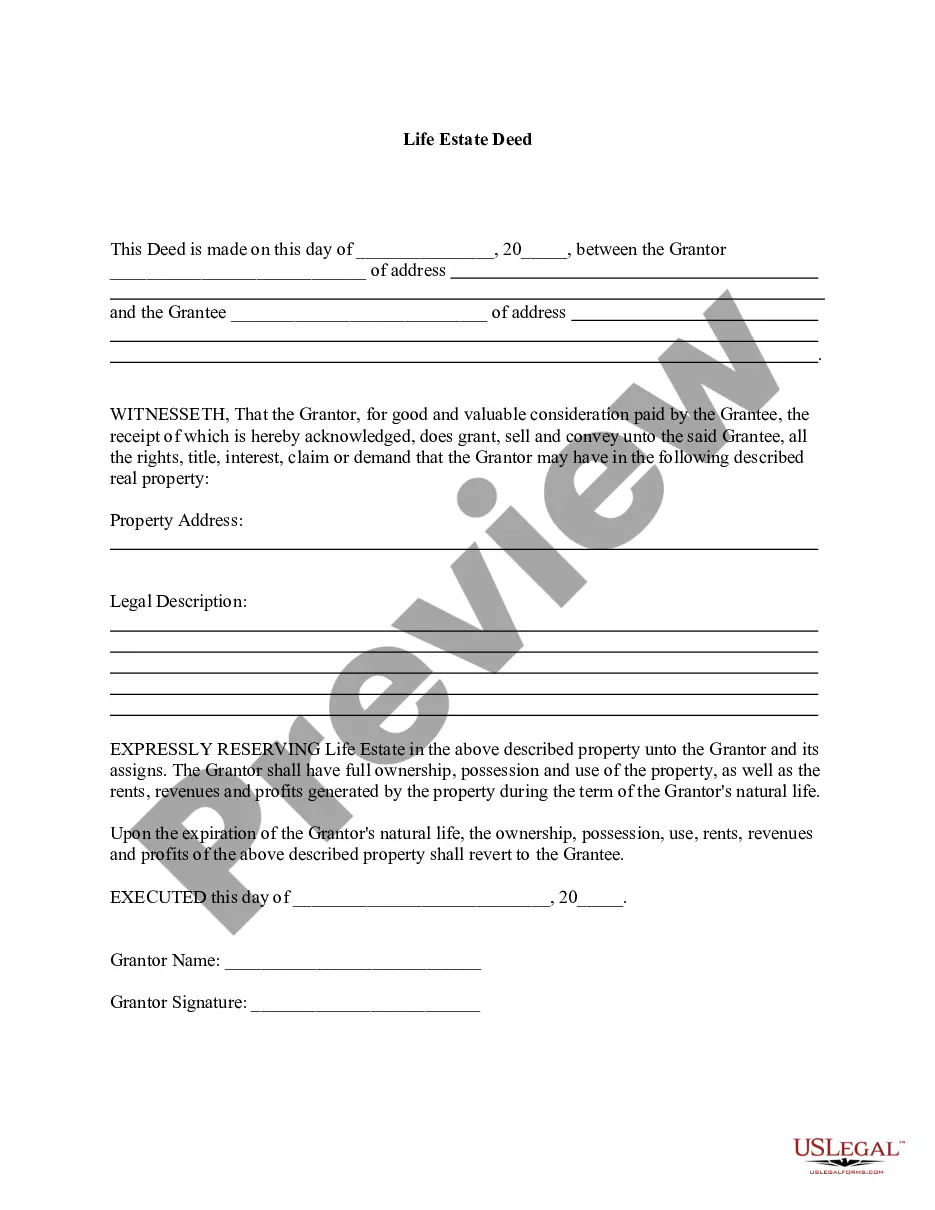

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

The life tenant is the property owner for life and is responsible for costs such as property taxes, insurance, and maintenance. Additionally, the life tenant also retains any tax benefits of homeownership.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

The Validity of Lady Bird Deeds in South Carolina Lady Bird deeds, or enhanced life estate deeds, are not recognized in South Carolina. Instead, individuals looking to retain control of their property during their lifetime while designating a beneficiary upon their death may need to consider options like living trusts.

The person with the right to use the property is a life tenant. The individual with a future right is called the remainderman. Once the life tenant passes away, the remainderman owns the property outright.