South Carolina Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions

Description

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

Are you presently in a position that requires documentation for organizational or personal activities almost all the time.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers thousands of form templates, such as the South Carolina Shareholders Buy Sell Agreement of Stock in a Close Corporation with Spousal Agreement and Stock Transfer Limitations, designed to comply with federal and state regulations.

Select a convenient document format and download your version.

Access all the document templates you have purchased from the My documents section. You can retrieve an additional copy of the South Carolina Shareholders Buy Sell Agreement of Stock in a Close Corporation with Spousal Agreement and Stock Transfer Limitations at any time if needed. Simply click on the required form to download or print the document template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and prevent errors. The service offers professionally drafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and commence simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the South Carolina Shareholders Buy Sell Agreement of Stock in a Close Corporation with Spousal Agreement and Stock Transfer Limitations template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it pertains to the correct area/county.

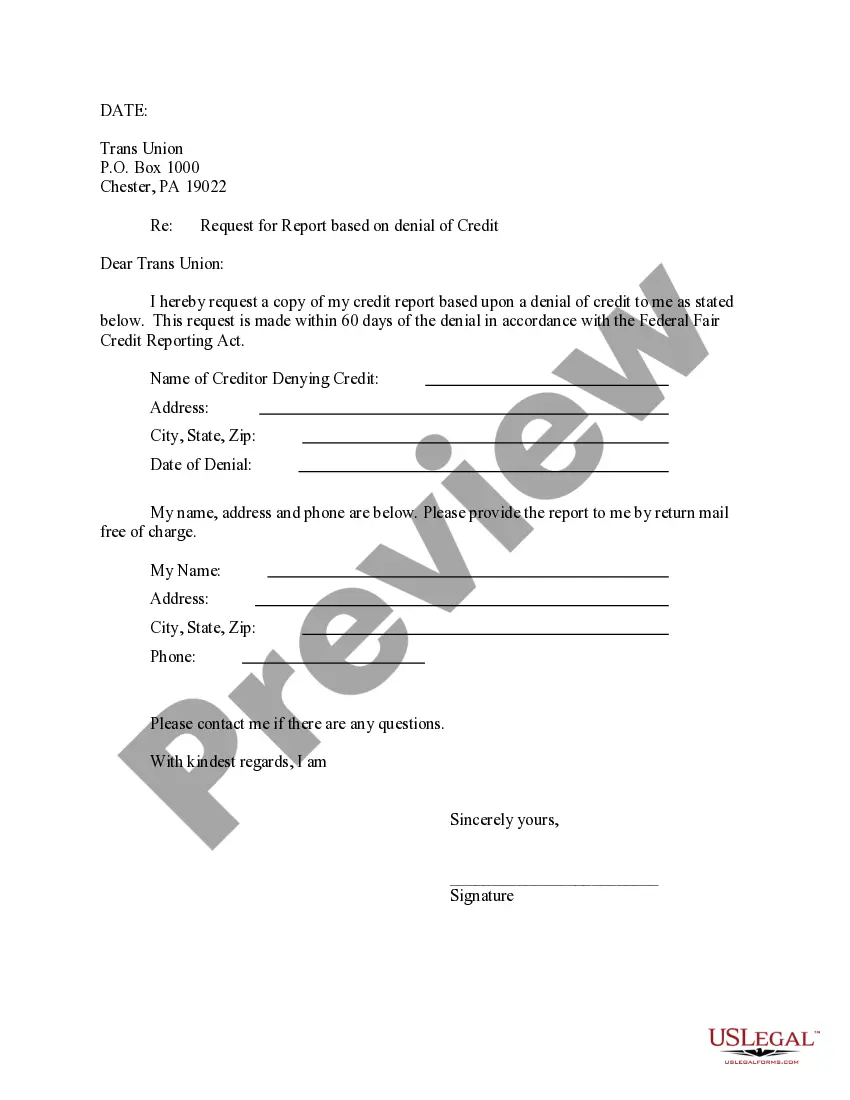

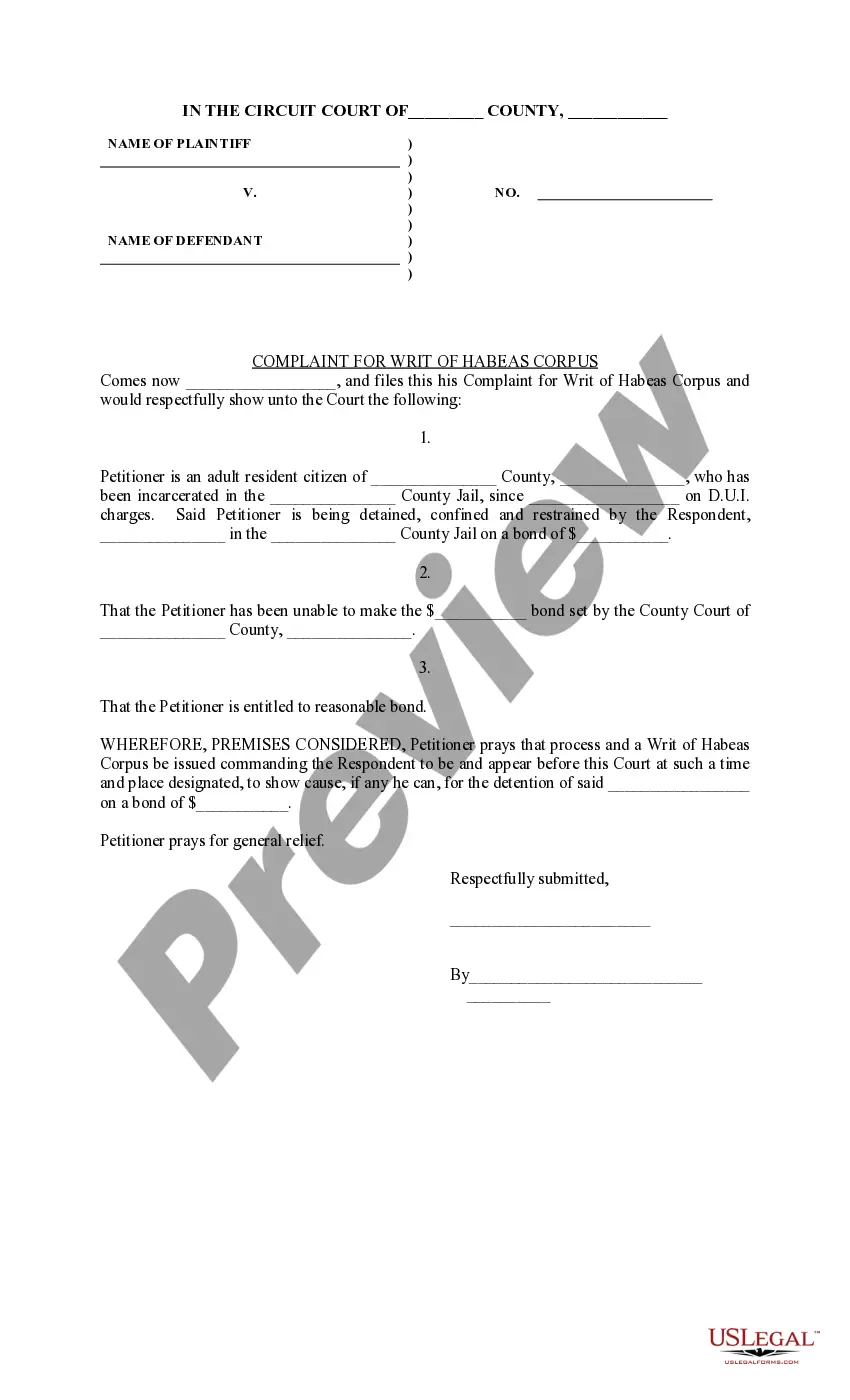

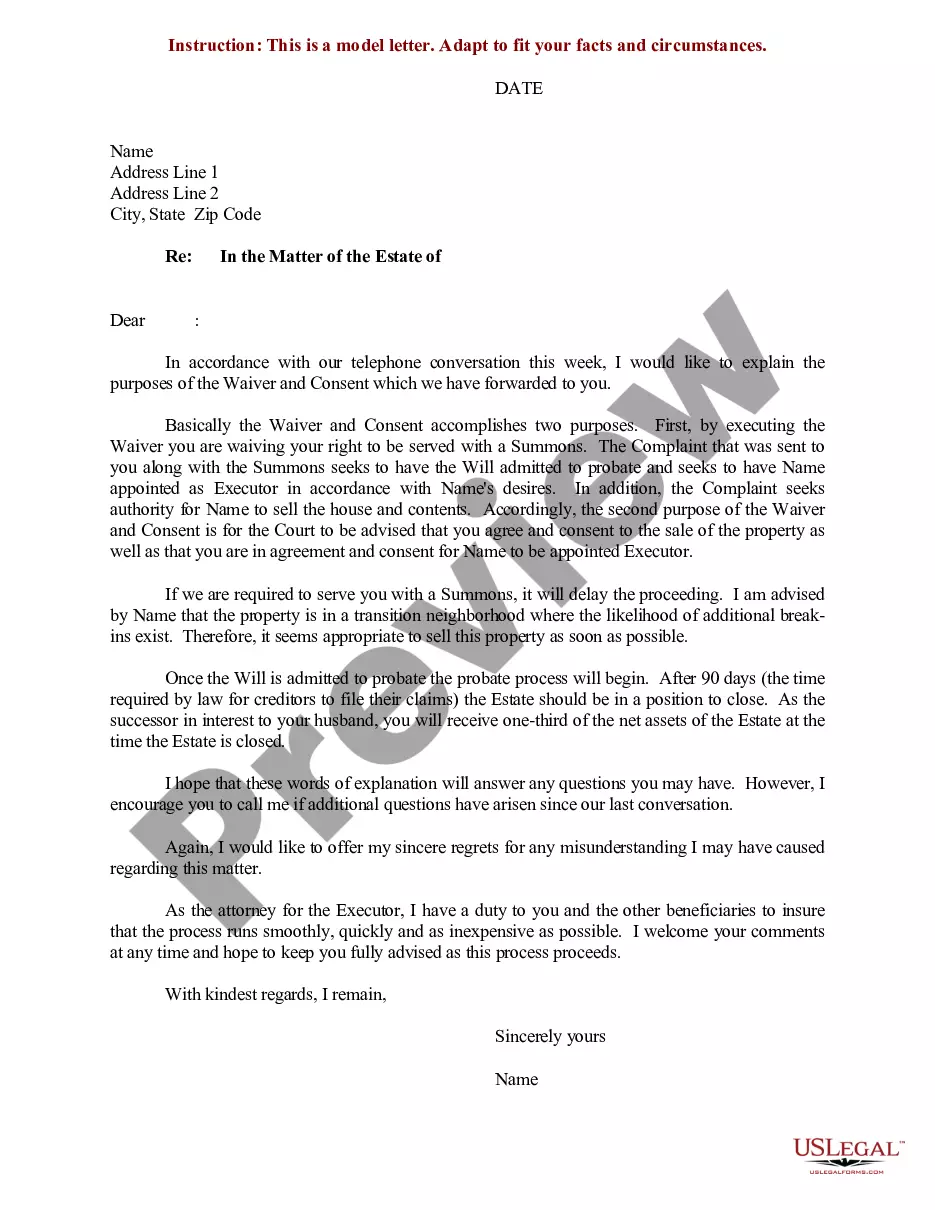

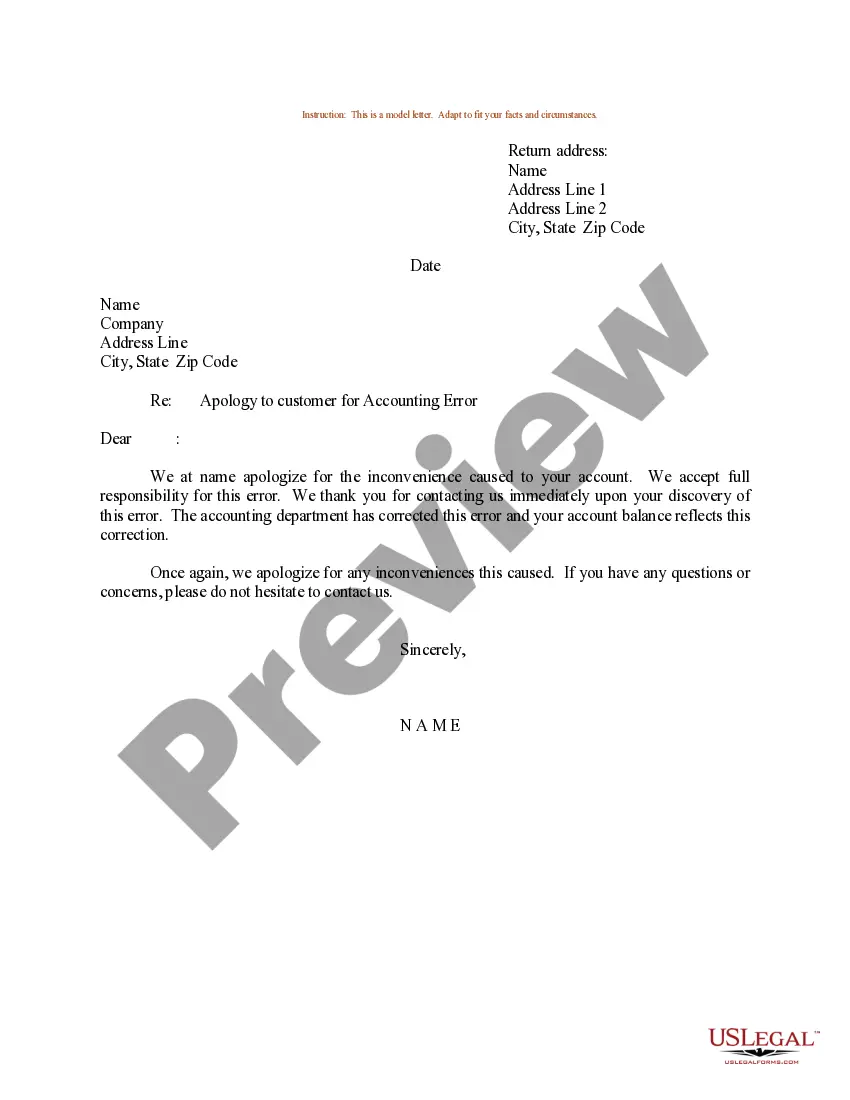

- Use the Preview button to examine the document.

- Review the description to confirm that you have selected the right form.

- If the form does not meet your requirements, utilize the Lookup field to find the appropriate form.

- Once you find the correct form, click on Purchase now.

- Choose your preferred pricing plan, complete the necessary details to create your account, and settle the transaction using PayPal or a Visa or Mastercard.

Form popularity

FAQ

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

What is a Buy-Sell Agreement? Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

Entity-purchase agreement Under an entity-purchase plan, the business purchases an owner's entire interest at an agreed-upon price if and when a triggering event occurs. If the business is a corporation, the plan is referred to as a stock redemption agreement.

Transferring one partner's shares to another for an agreed-upon price should include the use of a written stock purchase agreement that details the terms of the sale. Once the agreement is executed and the payment exchanged, the stock transfer should be recorded in the S corporation's stock ledger.

In a cross-purchase agreement, one or more of the remaining shareholders agrees to purchase the stock from the estate of a deceased shareholder or from the departing shareholder.

The sale of the shares may be accomplished in two very different ways. First, each shareholder can agree to purchase, pro rata or otherwise, all the stock being sold. This is called a "cross purchase" of stock.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.