South Carolina Termination of Trust by Trustee

Description

Form popularity

FAQ

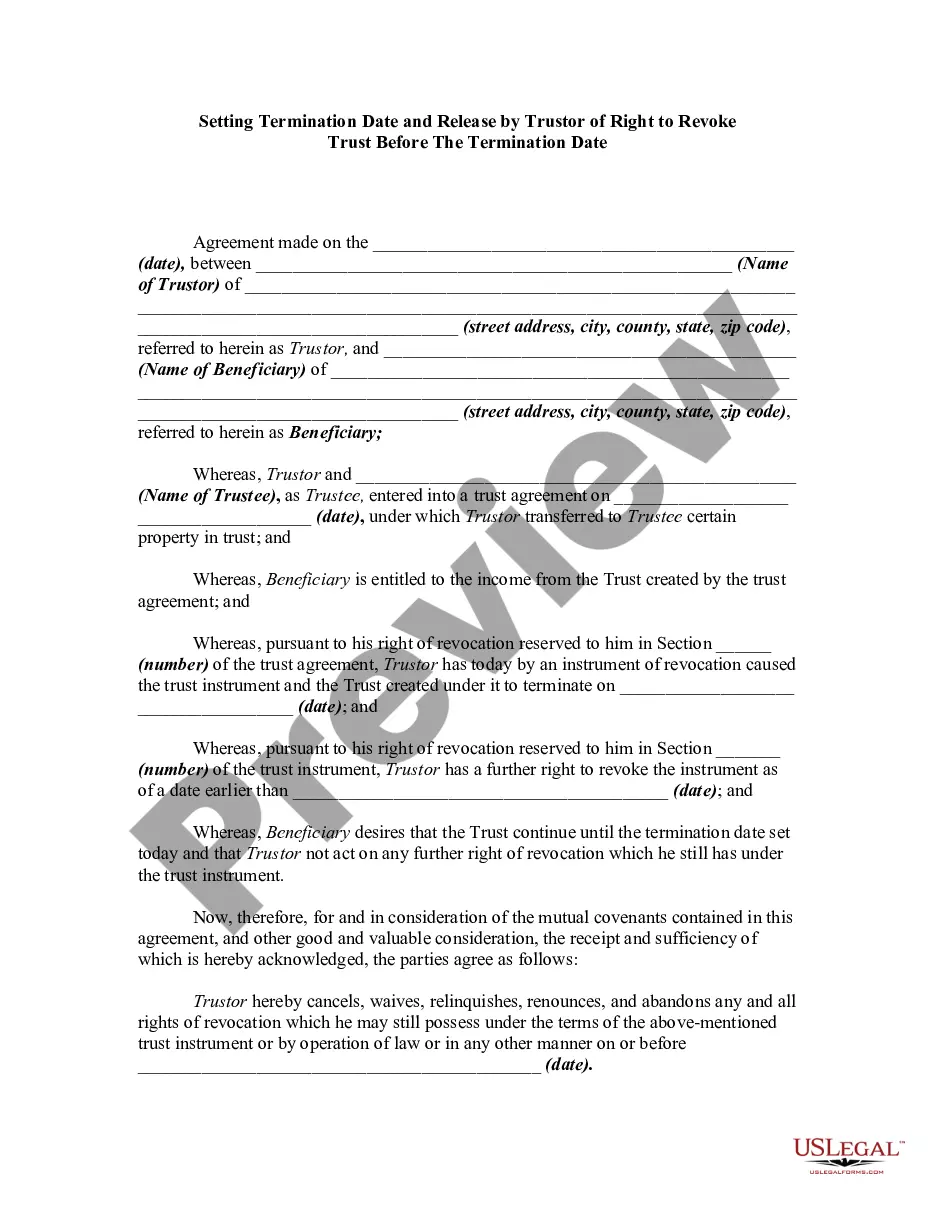

On the termination of the trust the trustees are under a duty to distribute the trust assets to the right beneficiaries. Failure to distribute to the correct beneficiary can subject the trustees to liability for breach of trust. See Practice Note: Termination of trustsbeneficiaries.

The irrevocable trust will automatically dissolve if its intent has been fulfilled. You might also contend that: The purpose of the trust has become illegal, impossible, wasteful or impractical to fulfill; Compliance with trust terms preclude accomplishing a material purpose of the trust; and.

Yes, a trustee can be one of the beneficiaries of a trust. However, it is important to note that a trustee cannot be the sole beneficiary of a trust.

(a) A noncharitable irrevocable trust may be modified or terminated with court approval upon consent of the settlor and all beneficiaries, even if the modification or termination is inconsistent with a material purpose of the trust.

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

A trust can be terminated for the following reasons: The trust assets have been fully distributed, making it uneconomical to continue with the trust. The money remaining in the trust makes it uneconomical to continue with the trust. The trust has served its purpose in terms of its stated objective.

Ways a Trust Can EndIf the trust property was cash or stocks, this can happen when all of the money, plus interest, gets paid to beneficiary. If the property was some other asset, like a house, then the trust may end when the house is destroyed or the trust itself comes to an end.

Trust can be damaged or destroyed in many ways. Trust is damaged when laughing at, not with, the other person, talking behind each other's backs, gossiping or openly moralizing about another person's behavior. Trust is damaged through expressions of disinterest or disrespect, and the refusal to reciprocate openness.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

How do you dissolve an irrevocable trust after death? While, in general, irrevocable trusts cannot be changed, they can be modified or dissolved after the grantor dies in certain situations as authorized by the California Probate Code.