South Carolina Articles of Association of Unincorporated Charitable Association

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

You can spend time online searching for the valid document template that meets the federal and state criteria you need.

US Legal Forms offers thousands of valid templates that are reviewed by professionals.

You can easily acquire or generate the South Carolina Articles of Association for Unincorporated Charitable Associations from our service.

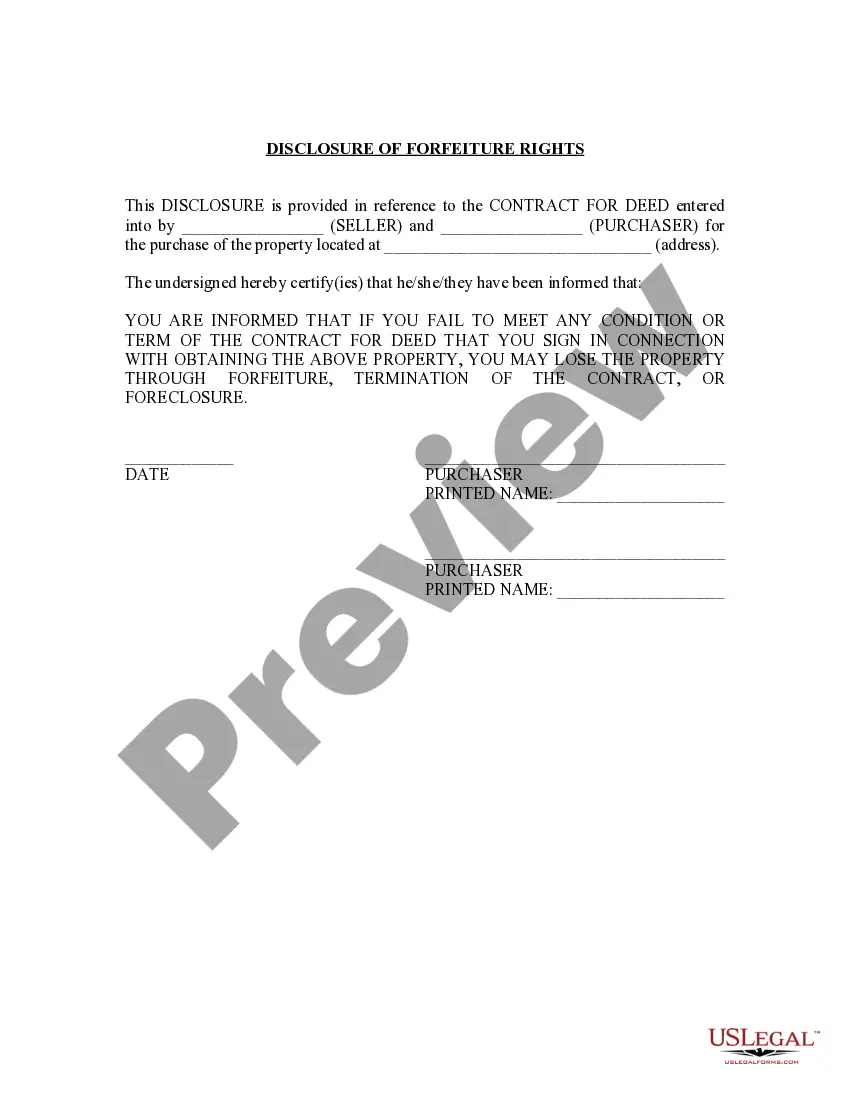

First, ensure you have chosen the correct document template for the county/city you select. Review the template description to confirm you have selected the right form. If available, use the Preview button to look at the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, modify, print, or sign the South Carolina Articles of Association for Unincorporated Charitable Associations.

- Every valid document template you purchase is yours indefinitely.

- To get another copy of any acquired form, go to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

To register a nonprofit organization in South Carolina, start by drafting your South Carolina Articles of Association of Unincorporated Charitable Association. Once your articles are complete, submit them along with any additional required forms, such as the CL-1, to the South Carolina Secretary of State. Platforms like uslegalforms offer comprehensive resources to assist you in completing these steps efficiently, thereby enhancing your nonprofit's chances of success.

The articles of association are foundational documents that outline the governance structure and purpose of a nonprofit organization. They typically detail membership, board structure, and operational procedures. In the case of a South Carolina Articles of Association of Unincorporated Charitable Association, these documents help define how the association functions and complies with state laws. Having a clear set of articles can guide decision-making and increase transparency.

3. An unincorporated association is defined as an association of two or more persons formed for some religious, educational, charitable, social or other non-commercial purpose. Accounts of a sole proprietorship or a DBA are not insured under this account category.

An unincorporated association is not a legal entity. It is an organisation of two or more persons, who are the members of the association. The membership may change from time to time. The members agree, usually in a written constitution, to co-operate in furthering a common purpose.

No. Sole proprietorshipsindividual or spousaland unincorporated associations are not legal entity customers as defined by the Rule, even though such businesses may file with the Secretary of State in order to register a trade name or establish a tax account.

Clubs and charities are often constituted as unincorporated associations. The members of a management committee of a charity that is formed as an unincorporated association are likely to be charity trustees.

A nonprofit corporation is able to contract directly with suppliers, financial institutions, and other organizations or individuals. With an unincorporated association, one or more of the association's members must personally enter into such contracts.

An unincorporated association is defined as an association of two or more persons formed for some religious, educational, charitable, social or other non-commercial purpose. Accounts of a sole proprietorship or a DBA are not insured under this account category.

The most common and traditional unincorporated entities are sole traders, partnerships, and trustees of trusts, and the more modern unincorporated entities include limited partnerships (LPs) (but not incorporated limited partnerships), limited liability partnerships (LLPs) (but not UK Limited Liability Partnerships

An unincorporated association is an organisation that arises when two or more people come together for a particular purpose, but decide not to use a formal structure like a company. Most clubs, societies, groups, and some syndicates are unincorporated, as are most voluntary organisations.