South Carolina Rules and Regulations Attached to and part of Lease Agreement of Commercial Building

Description

How to fill out Rules And Regulations Attached To And Part Of Lease Agreement Of Commercial Building?

You can dedicate hours online trying to find the appropriate legal document format that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that have been reviewed by professionals.

You can easily obtain or create the South Carolina Rules and Regulations Connected to and part of Lease Agreement for Commercial Building from this service.

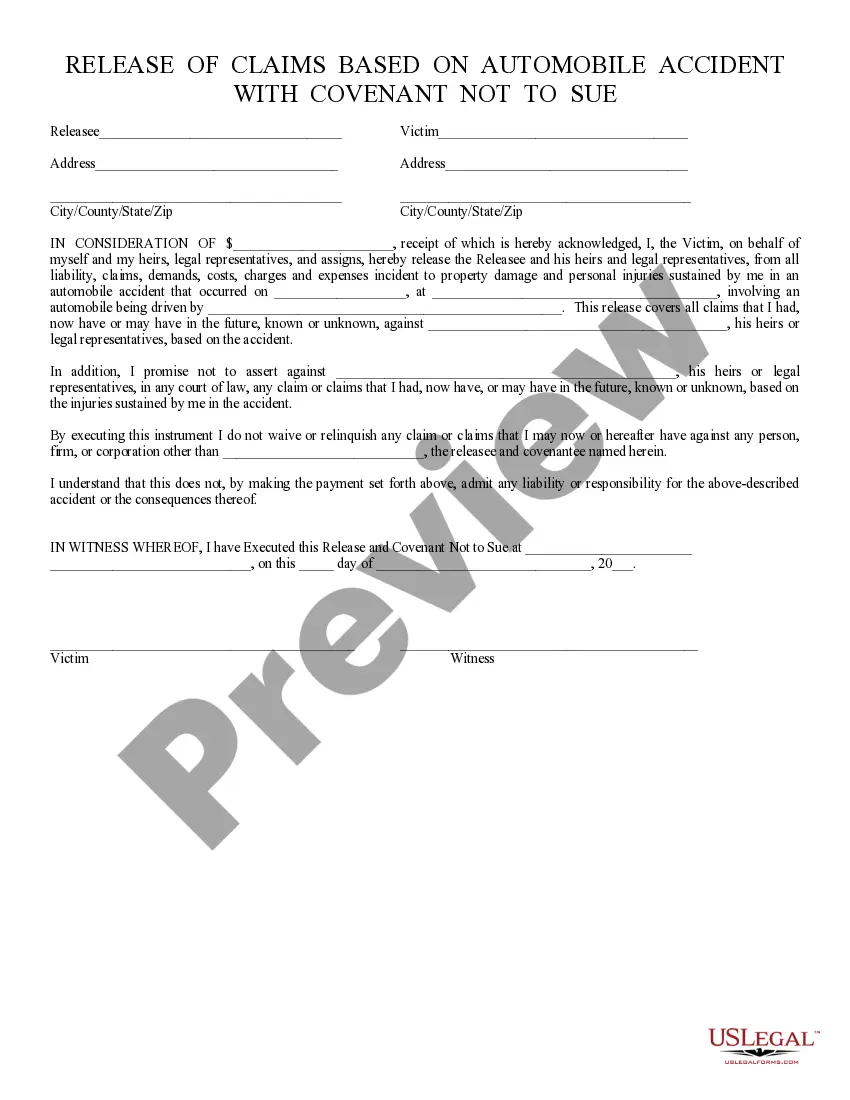

If available, use the Preview button to look through the document template at the same time.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the South Carolina Rules and Regulations Connected to and part of Lease Agreement for Commercial Building.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the location/area of your choice.

- Review the document description to confirm you have chosen the right form.

Form popularity

FAQ

In South Carolina, certain types of property enjoy exemptions from judgment to protect tenants and property owners alike. For instance, essential household goods and certain business equipment may escape judgment, ensuring that individuals can maintain a standard of living or continue their business operations. Understanding these exemptions is crucial for navigating the legal intricacies within the South Carolina Rules and Regulations Attached to and part of Lease Agreement of Commercial Building.

3 Types of Commercial Real Estate LeasesGross Lease/Full Service Lease. In a gross lease, the tenant's rent covers all property operating expenses.Net Lease. The net lease is a highly adjustable commercial real estate lease.Modified Gross Lease/Modified Net Lease.

Renting a House? 10 Laws That Every Tenant & Owner in India Must KnowA written agreement.Maintenance of the property.Uninhabitable conditions.Damage of property after tenancy commences.The landlord or landlady cannot entire the premises without prior notice.Essential supplies.Eviction of tenants.Death of the tenant.More items...?

At a minimum, the lease agreement should include the property address , amount of rent , and duration of the lease with an effective start date. It should also include any other costs that the tenant and landlord will be responsible for. Leases need to be signed by both the landlord and the tenant.

Essential Lease Clauses In Your California Rental AgreementRental Agreement vs. Lease.Ownership of Inhabitancy.Mode of Communication.Description of Rental Property.Rent.Deposits & Fees.Repairs and Maintenance.Restricting tenant's illegal activities.More items...?

The responsibilities of landlord and tenant will be clearly set out in the lease. Normally commercial landlords are responsible for any structural repairs such as foundations, flooring, roof and exterior walls, and tenants are responsible for non-structural repairs such as air conditioning or plumbing.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

Here are 10 key financial commercial lease clauses that you should keep a close eye on throughout your lease term.Rent And Default.Rent Increase Steps/Percentages.Profit-Sharing Or Revenue-Based Rent.Options.Operating Expenses.Rent Incentives And Reimbursements.Janitorial Services.Electricity.More items...?

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.