This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

South Carolina Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

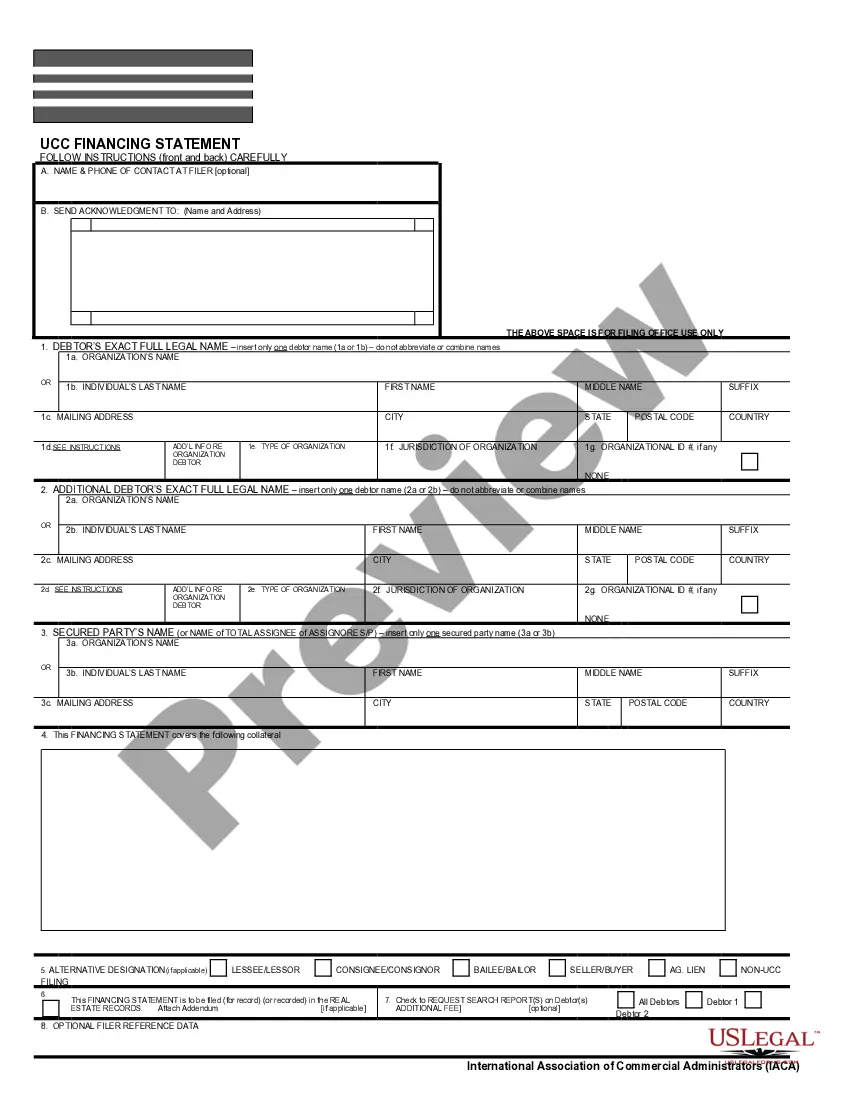

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

If you require thorough, acquire, or print valid document formats, utilize US Legal Forms, the largest assortment of legal templates, that is available on the internet.

Utilize the site’s straightforward and user-friendly search to find the documents you need.

A range of formats for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you obtain is yours indefinitely. You have access to every form you purchased within your account. Browse the My documents area and select a form to print or download again.

Stay competitive and download, and print the South Carolina Supplemental Needs Trust for a Third Party - Disabled Beneficiary with US Legal Forms. There are thousands of professional and state-specific templates you can use for your business or personal needs.

- Use US Legal Forms to obtain the South Carolina Supplemental Needs Trust for a Third Party - Disabled Beneficiary with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download option to access the South Carolina Supplemental Needs Trust for a Third Party - Disabled Beneficiary.

- You can also reach forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for the correct city/region.

- Step 2. Use the Review option to assess the form’s content. Remember to read the summary.

- Step 3. If you are dissatisfied with the template, use the Search field at the top of the screen to discover other types within the legal form catalog.

- Step 4. Once you find the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the South Carolina Supplemental Needs Trust for a Third Party - Disabled Beneficiary.

Form popularity

FAQ

A qualified disability trust is a special type of trust that allows individuals with disabilities to retain certain benefits while still having access to trust income. In South Carolina, this type of trust aims to help disabled beneficiaries manage their finances without losing crucial government support. The trust must meet specific IRS requirements for tax reporting purposes, making it essential to set it up properly. Consulting platforms like US Legal Forms can simplify the process by providing necessary documents and legal guidance.

Setting up a third-party special needs trust in South Carolina requires careful planning. First, choose a reliable trustee who will manage the trust and ensure that the assets benefit the disabled beneficiary. Next, you will need to draft the trust document, clearly stating the terms and conditions, and ensure compliance with state laws. Lastly, funding the trust with appropriate assets can provide financial support without jeopardizing the beneficiary's eligibility for government benefits.

To set up a trust fund for a disabled person, start by identifying the individual’s specific needs and potential expenses. Consult an attorney to draft an appropriate trust document that clearly outlines the terms and the designated trustee. Finally, ensure to fund the trust, possibly using assets, life insurance, or savings, to provide adequate support as necessary.

One major mistake parents make when setting up a trust fund for a disabled beneficiary is failing to adequately plan for future needs. This often includes not considering how living expenses or changing medical needs will affect the trust. It’s crucial to involve professionals who specialize in South Carolina Supplemental Needs Trust for Third Party - Disabled Beneficiary to avoid overlooking critical details.

Negatives of a special needs trust can include complexity in setup and funding, which may deter individuals from establishing one. Moreover, there can be strict regulations regarding asset distribution, limiting how the beneficiary can use the funds. Additionally, if the trust isn’t managed correctly, it might fail to meet the beneficiary's needs effectively.

Setting up a third party special needs trust for a disabled beneficiary involves several steps. First, consult with an attorney who specializes in trusts and estate planning. Next, you must draft the trust document, outlining terms, conditions, and beneficiaries, then fund the trust with assets to support the disabled individual’s needs.

Some disadvantages of a third party special needs trust for a disabled beneficiary include potential high setup costs and ongoing management fees. Additionally, if not properly funded or managed, it might not provide the desired financial support for your loved one. Furthermore, there can be limitations on how funds can be accessed, which might restrict the beneficiary's spending flexibility.

To set up a trust fund for a disabled person, begin by defining your goals for the trust and choosing a reliable trustee. Next, draft a legal document that outlines the terms of the trust. It’s beneficial to utilize the expertise of services like uslegalforms, where you can access templates and legal guidance tailored to establishing a South Carolina Supplemental Needs Trust for Third Party - Disabled Beneficiary, ensuring compliance and effectiveness.

The best trust for a disabled person is typically a special needs trust because it allows for the management of funds while preserving access to government benefits. A South Carolina Supplemental Needs Trust for Third Party - Disabled Beneficiary offers flexibility and protection, ensuring that the beneficiary receives financial support without compromising their eligibility. Consulting with legal experts can help you determine the most suitable option based on specific needs.

For a disabled beneficiary, a special needs trust is often the ideal choice. This trust is specifically designed to hold funds meant for the disabled individual's benefit while ensuring they retain eligibility for public assistance programs. The South Carolina Supplemental Needs Trust for Third Party - Disabled Beneficiary provides a comprehensive framework, allowing you to tailor the trust to the unique circumstances of the beneficiary.