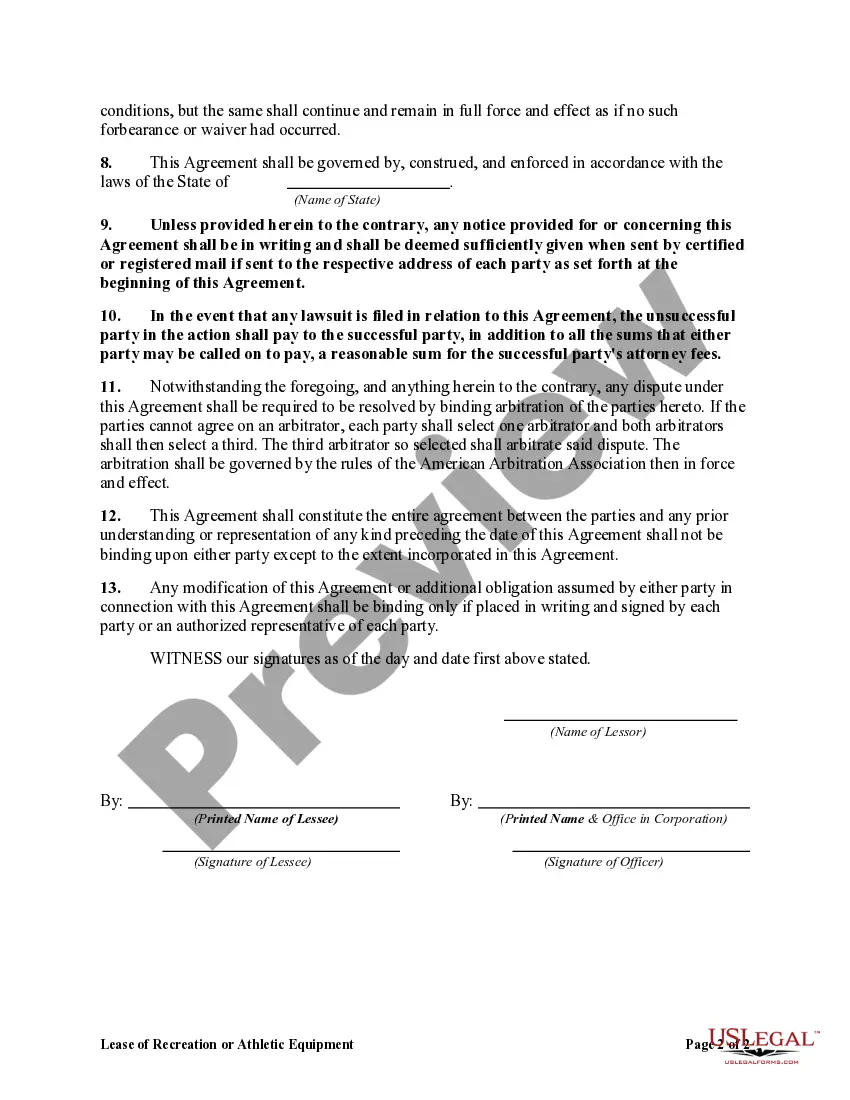

South Carolina Lease of Recreation or Athletic Equipment

Description

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

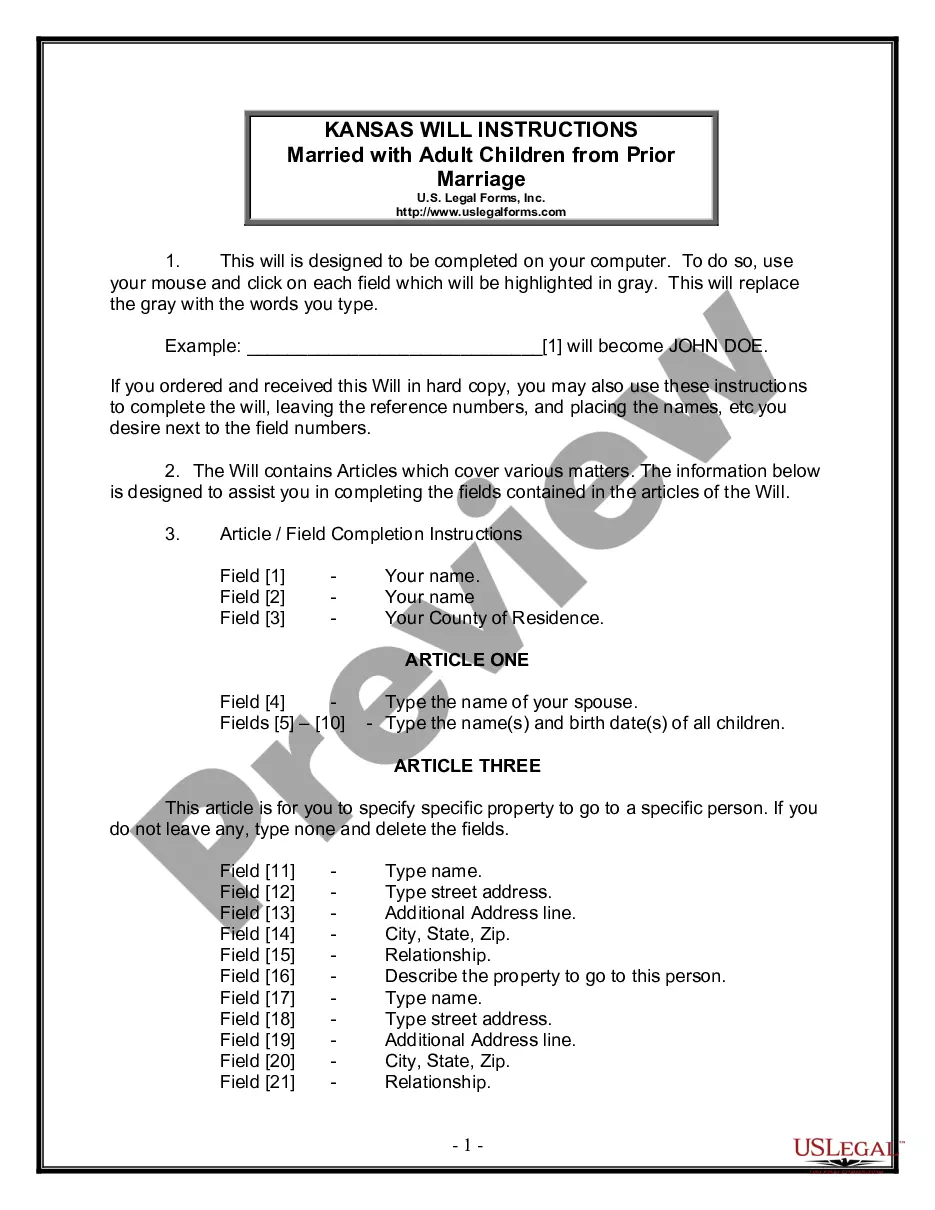

How to fill out Lease Of Recreation Or Athletic Equipment?

Selecting the optimal legal document template can be quite challenging. Naturally, there are numerous options available online, but how will you locate the exact legal form you require? Utilize the US Legal Forms website.

The platform offers a vast selection of templates, including the South Carolina Lease of Recreation or Athletic Equipment, that you can utilize for business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to acquire the South Carolina Lease of Recreation or Athletic Equipment. Use your account to search for the legal forms you may have previously purchased. Navigate to the My documents tab of your account to obtain another copy of the document you require.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired South Carolina Lease of Recreation or Athletic Equipment. US Legal Forms is the largest collection of legal templates where you can find a variety of document templates. Utilize the service to acquire professionally crafted paperwork that conforms to state regulations.

- Firstly, ensure you have selected the correct form for your jurisdiction/region.

- You can review the form using the Preview button and read the form details to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the right form.

- Once you are certain the form is appropriate, click the Buy now button to obtain the form.

- Choose the pricing plan you desire and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

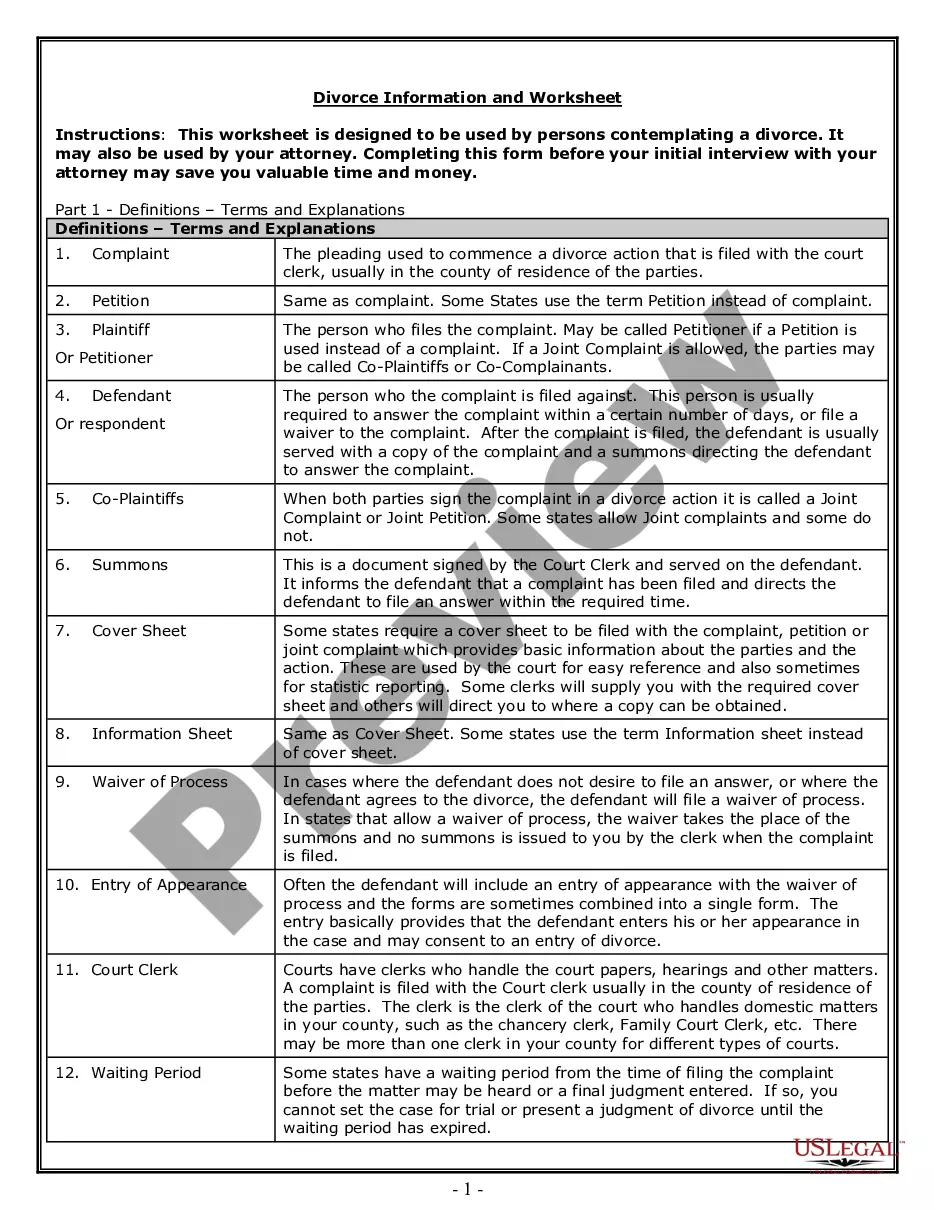

FAQ

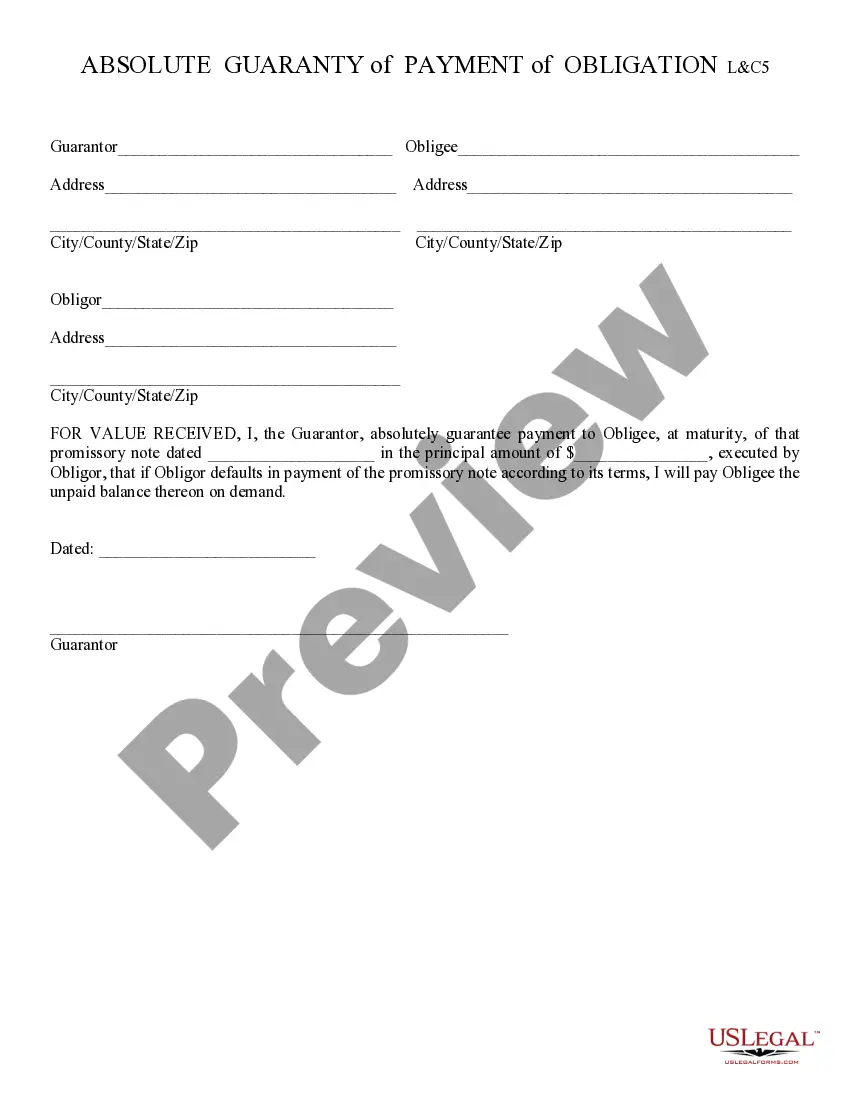

In South Carolina, a variety of items are subject to sales tax, including tangible personal property, food, and certain types of equipment, including those leased under the South Carolina Lease of Recreation or Athletic Equipment. Tax regulations can change, so it’s important to stay informed about what is taxed. Understanding your obligations ensures you remain compliant. Our platform provides up-to-date information on taxation that you can rely on.

The St. 9 form in South Carolina is an application used to claim a sales tax exemption. Organizations that qualify for exemptions, such as those leasing recreation or athletic equipment, must complete this form to avoid paying sales tax. Proper use of the St. 9 form can streamline your leasing transactions, creating more savings. You can find templates and detailed guidance on how to fill it out at uslegalforms.

In South Carolina, some business equipment may be tax-exempt, particularly if used for exempt purposes. For instance, equipment leased for educational or charitable activities might fall under this category. Understanding the rules governing tax exemption for business equipment, including recreation and athletic leases, is crucial. The uslegalforms platform can assist you with the necessary documentation and guidelines.

In South Carolina, the sales tax on equipment typically ranges around 6% to 9%, depending on the locality. This includes sports and recreational equipment, which falls under the South Carolina Lease of Recreation or Athletic Equipment. Knowing the precise sales tax can help you budget your expenses effectively. For additional guidance, our platform offers resources that clarify these specifics.

The code 12 36 120 in South Carolina pertains to the lease of recreation or athletic equipment. This code defines the tax implications and exemptions related to such leases. Understanding this code can help you navigate your obligations when leasing equipment for recreational purposes. By utilizing the information from uslegalforms, you can ensure compliance and avoid potential issues.

Yes, property taxes often decrease after an individual turns 65 in South Carolina due to available exemptions. These benefits can reduce the amount owed, making it easier for senior residents to maintain their properties. If you are leasing recreation or athletic equipment, being aware of these tax benefits could ease your financial obligations.

The SC PT 100 is required to be filed by property owners who are leasing or renting equipment, including recreation or athletic gear. This form helps ensure compliance with South Carolina tax regulations. If you're renting recreational equipment, understanding this requirement is crucial to avoid penalties.

In South Carolina, individuals usually stop paying property taxes when they turn 65, provided they meet certain criteria. There are specific exemptions available for seniors that can lessen their tax burden. If you are looking into a South Carolina Lease of Recreation or Athletic Equipment, be sure to understand how these tax exemptions can influence your overall costs.

Several groups may qualify for property tax exemptions in South Carolina. This includes individuals over 65, disabled veterans, and those who receive certain income-related benefits. If you are leasing recreation or athletic equipment, recognizing these exemptions can assist in financial planning.

Yes, rental equipment is typically subject to sales tax in South Carolina. This includes equipment that is leased for recreational or athletic use. If you are considering entering into a South Carolina Lease of Recreation or Athletic Equipment, you should factor in applicable taxes when assessing your total costs.