South Carolina General Form of Inter Vivos Irrevocable Trust Agreement

Description

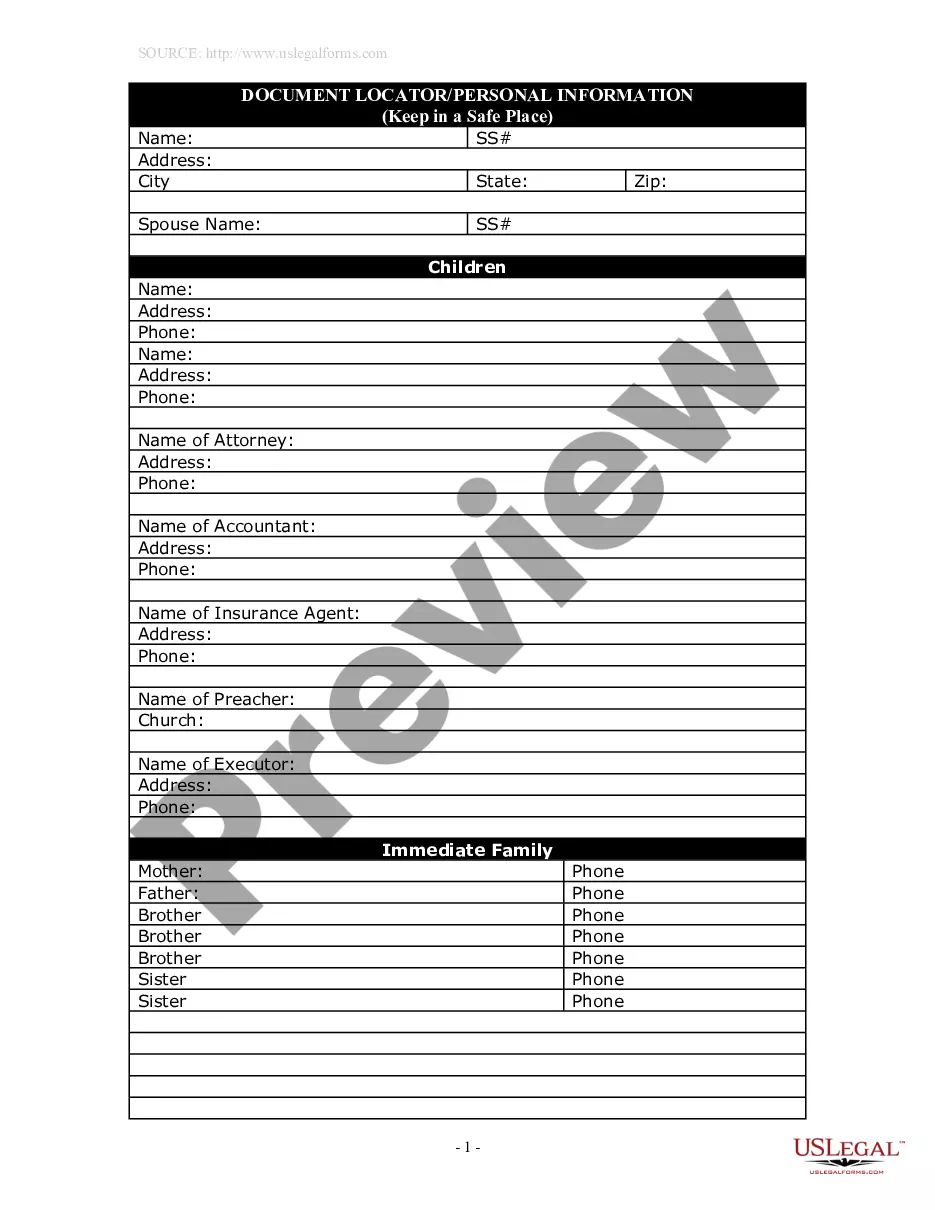

How to fill out General Form Of Inter Vivos Irrevocable Trust Agreement?

If you wish to finish, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Take advantage of the website's user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form design.

Step 4. Once you have found the form you require, click on the Download now button. Select the pricing plan you prefer and enter your credentials to register for an account.

- Utilize US Legal Forms to acquire the South Carolina General Form of Inter Vivos Irrevocable Trust Agreement in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Acquire button to obtain the South Carolina General Form of Inter Vivos Irrevocable Trust Agreement.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's contents. Be sure to read the description.

Form popularity

FAQ

The three common types of irrevocable trusts include irrevocable life insurance trusts, charitable remainder trusts, and special needs trusts. Each serves distinct purposes, such as minimizing estate taxes, supporting charitable causes, or safeguarding assets for dependents with disabilities. When considering a South Carolina General Form of Inter Vivos Irrevocable Trust Agreement, it's beneficial to explore how these trust types align with your financial goals.

An irrevocable trust can certainly be classified as an inter vivos trust. This type of arrangement establishes a trust during the owner's lifetime, ensuring assets cannot be changed or withdrawn later. The South Carolina General Form of Inter Vivos Irrevocable Trust Agreement is designed specifically to meet such needs, providing security and structure for your estate planning.

Yes, an irrevocable trust can indeed be an inter vivos trust. This means it is created while the grantor is alive and cannot be altered or revoked once established. The South Carolina General Form of Inter Vivos Irrevocable Trust Agreement exemplifies this type of trust, offering significant tax and estate benefits to the grantor and beneficiaries.

Inter vivos trusts are created during the lifetime of the grantor and can take several forms, including revocable trusts and irrevocable trusts. Examples include living trusts, charitable trusts, and special needs trusts. Choosing the right type of inter vivos trust, like the South Carolina General Form of Inter Vivos Irrevocable Trust Agreement, can provide unique benefits based on individual needs.

SC code 62 7 701 refers to specific legal statutes in South Carolina governing trusts. This code outlines the requirements and regulations for establishing trusts, including inter vivos trusts. Familiarizing yourself with SC code 62 7 701 ensures you design a compliant South Carolina General Form of Inter Vivos Irrevocable Trust Agreement.

There are two primary types of inter vivos trusts: revocable and irrevocable trusts. A revocable trust allows the grantor to modify or terminate the trust during their lifetime, while an irrevocable trust, such as the South Carolina General Form of Inter Vivos Irrevocable Trust Agreement, cannot be changed after it is established. Understanding these differences is key to effective estate planning.

To establish a trust in South Carolina, you need to create a legal document that outlines your intentions. The South Carolina General Form of Inter Vivos Irrevocable Trust Agreement serves as an excellent template for this purpose. You will specify the assets you wish to place in the trust and designate a trustee to manage those assets on behalf of the beneficiaries. Additionally, consider using resources from USLegalForms to ensure you have a comprehensive and compliant trust agreement tailored to your needs.

For an irrevocable trust, you primarily need Form 1041. This form captures income, deductions, and any distributions made to beneficiaries. When you create a South Carolina General Form of Inter Vivos Irrevocable Trust Agreement, using Form 1041 helps keep your tax responsibilities clear and organized. You can rely on UsLegalForms for resources related to this.

You should file your irrevocable trust forms with the IRS, typically sending Form 1041 to the address specified in the form's instructions. Additionally, if your trust is subject to state taxes, you might need to file in South Carolina. It is crucial to follow guidelines for the South Carolina General Form of Inter Vivos Irrevocable Trust Agreement to ensure compliance. Platforms like UsLegalForms can help you identify the correct filing locations.

Form 1041 is used for reporting income for an irrevocable trust, while Form 706 is for estate tax purposes. They serve different functions, with 1041 focusing on annual income generated and 706 dealing with the estate of the deceased. If you are exploring a South Carolina General Form of Inter Vivos Irrevocable Trust Agreement, understanding these differences can assist in proper tax planning.