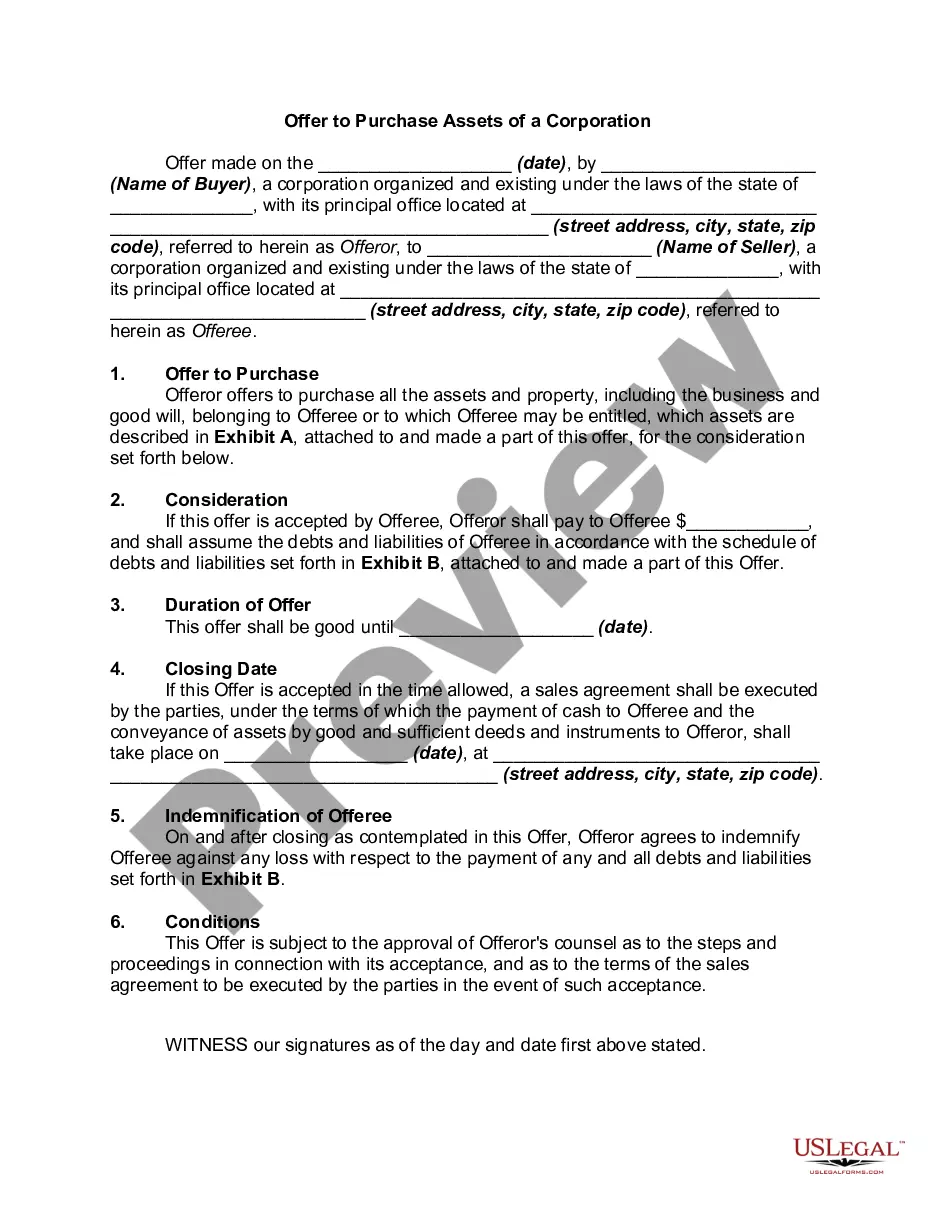

South Carolina Offer to Purchase Assets of a Corporation

Description

Pursuant the Model Business Corporation Act, a sale of all of the assets of a corporation requires approval of the corporation's shareholders if the disposition would leave the corporation without a significant continuing business activity.

How to fill out Offer To Purchase Assets Of A Corporation?

It is possible to spend hours on the Internet searching for the lawful file design that meets the state and federal demands you will need. US Legal Forms provides thousands of lawful varieties which can be analyzed by professionals. It is simple to down load or print out the South Carolina Offer to Purchase Assets of a Corporation from the support.

If you already have a US Legal Forms profile, you may log in and click the Down load button. Next, you may full, revise, print out, or indicator the South Carolina Offer to Purchase Assets of a Corporation. Each lawful file design you purchase is the one you have eternally. To obtain one more duplicate for any bought develop, proceed to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms site initially, stick to the simple recommendations under:

- Initial, make sure that you have selected the best file design to the area/city of your choosing. Browse the develop information to ensure you have picked out the right develop. If offered, take advantage of the Review button to appear from the file design also.

- If you wish to find one more version in the develop, take advantage of the Lookup area to discover the design that fits your needs and demands.

- After you have found the design you want, just click Acquire now to proceed.

- Select the pricing strategy you want, enter your credentials, and register for a free account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal profile to purchase the lawful develop.

- Select the formatting in the file and down load it in your system.

- Make adjustments in your file if needed. It is possible to full, revise and indicator and print out South Carolina Offer to Purchase Assets of a Corporation.

Down load and print out thousands of file web templates using the US Legal Forms web site, that offers the biggest selection of lawful varieties. Use professional and state-specific web templates to handle your small business or individual demands.

Form popularity

FAQ

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Asset Sale ? Capital Gains Tax You'll pay tax on the capital gain or loss on the assets sold. Here's a quick equation: Sale price ? purchase price = net proceeds. Net proceeds x 50% = taxable amount.

Key Takeaways. In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

What is a sale of assets? A sale of assets is when a company sells one or more of its financial assets. Selling assets provides the company making the sale with cash while the purchasing company gains profit by purchasing the assets for less value than they provide.

There are two core methods to buy or sell a business: an asset purchase or a share purchase. An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

A statutory close corporation is a special election that corporations with fewer than 50 shareholders may select. The designation allows for more flexibility than typically allowed with a ??regular? corporation.