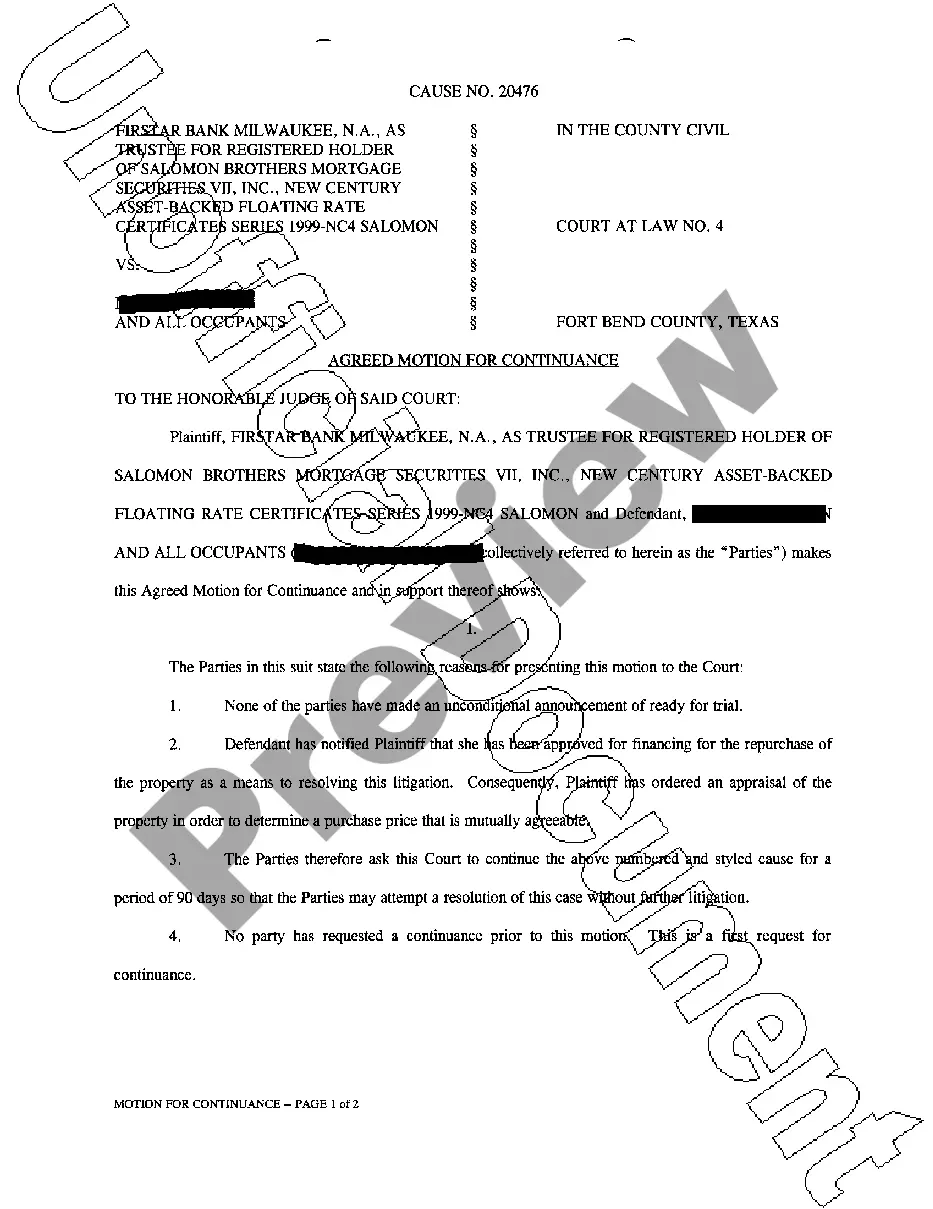

South Carolina Building Loan Agreement between Lender and Borrower

Description

How to fill out Building Loan Agreement Between Lender And Borrower?

US Legal Forms - one of several biggest libraries of authorized types in America - provides a wide array of authorized papers templates you are able to acquire or printing. While using web site, you will get a large number of types for enterprise and individual uses, categorized by groups, says, or key phrases.You will find the newest variations of types like the South Carolina Building Loan Agreement between Lender and Borrower within minutes.

If you currently have a monthly subscription, log in and acquire South Carolina Building Loan Agreement between Lender and Borrower in the US Legal Forms local library. The Acquire button can look on every single develop you look at. You get access to all in the past acquired types from the My Forms tab of your own profile.

In order to use US Legal Forms the very first time, here are basic instructions to obtain started:

- Make sure you have chosen the correct develop for your personal city/state. Click on the Preview button to review the form`s information. Look at the develop outline to actually have chosen the right develop.

- If the develop does not fit your requirements, utilize the Research discipline towards the top of the display screen to get the one that does.

- If you are satisfied with the form, affirm your option by simply clicking the Purchase now button. Then, pick the pricing plan you prefer and offer your references to sign up on an profile.

- Procedure the financial transaction. Utilize your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Choose the formatting and acquire the form on the product.

- Make alterations. Fill up, edit and printing and sign the acquired South Carolina Building Loan Agreement between Lender and Borrower.

Each web template you included with your money does not have an expiration date which is your own property eternally. So, if you want to acquire or printing one more version, just go to the My Forms section and then click around the develop you want.

Obtain access to the South Carolina Building Loan Agreement between Lender and Borrower with US Legal Forms, one of the most comprehensive local library of authorized papers templates. Use a large number of specialist and status-certain templates that fulfill your business or individual requires and requirements.

Form popularity

FAQ

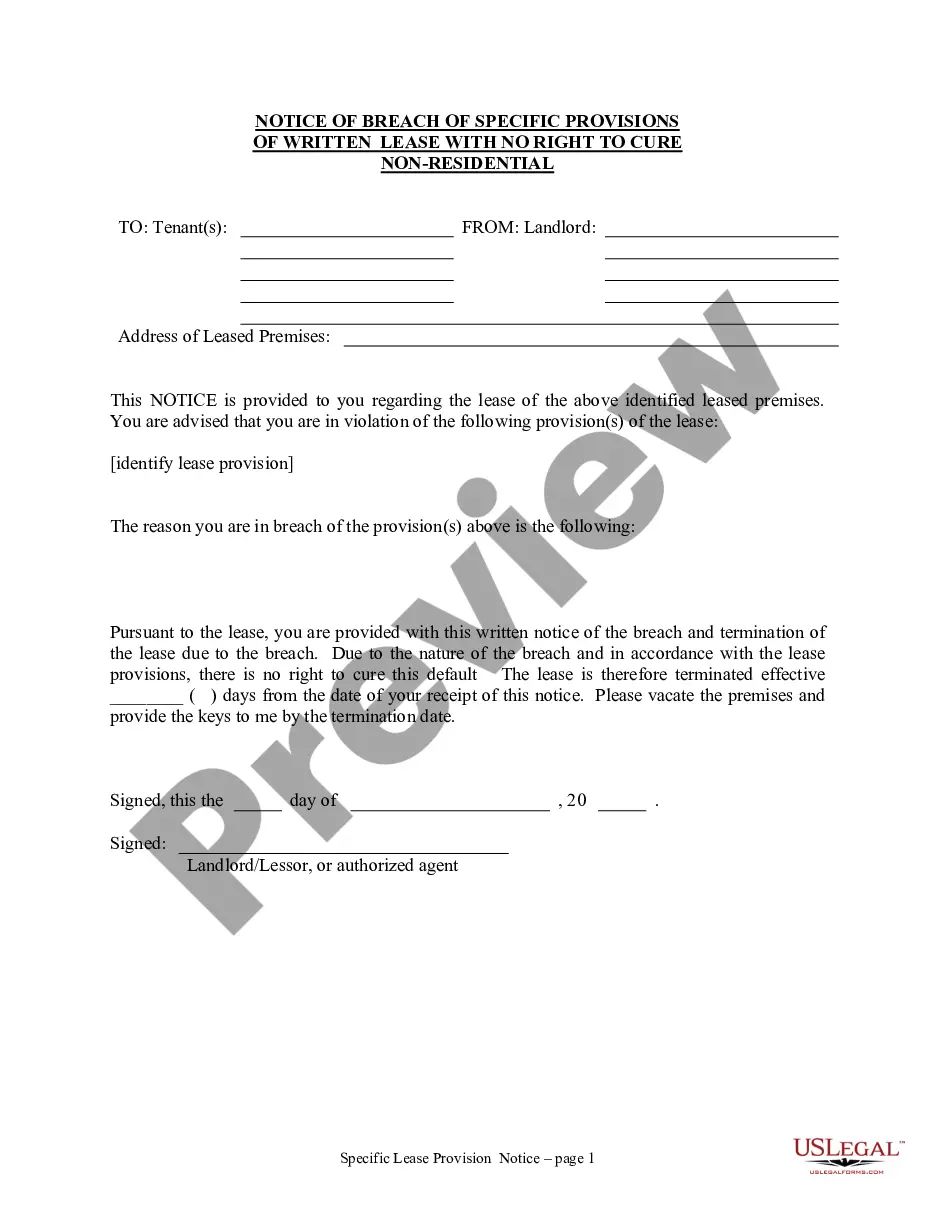

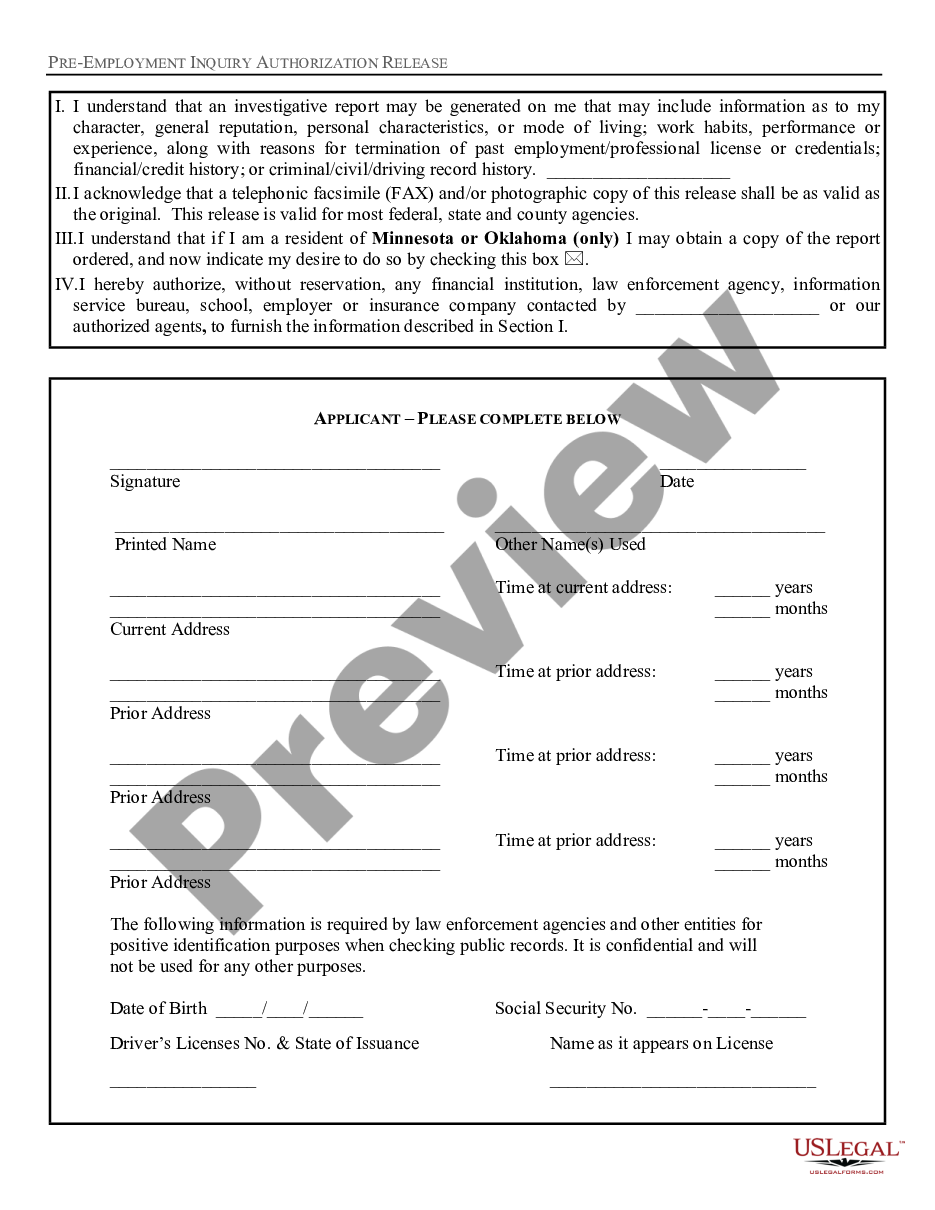

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.

Credit is a contractual agreement in which a borrower receives something of value now and agrees to repay the lenderat a later date. It allows you to buy now with the promise of paying later. By understanding how each type of credit works, you will learn to manage credit successfully.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

Loan agreement - Typically refers to a written agreement between a lender and borrower stipulating the terms and conditions associated with a financing transaction and in addition to those included to accompanying note, security agreement and other loan documents.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Ing to the Corporate Finance Institute (CFI), an ICA can also be called an intercreditor deed. Thus, as per CFI, an Intercreditor Agreement is a legal document between two or more creditors.

Credit is a relationship between a borrower and a lender. The borrower borrows money from the lendor. The borrower pays back the money at a later date along with interest. Most people still think of credit as an agreement to buy something or get a service with the promise to pay for it later.