South Carolina Revocable Trust for Married Couple

Description

How to fill out Revocable Trust For Married Couple?

It is feasible to spend numerous hours online attempting to locate the valid documents template that meets the state and federal requirements you need.

US Legal Forms offers thousands of valid forms that are assessed by experts.

You can download or print the South Carolina Revocable Trust for Married Couple from their service.

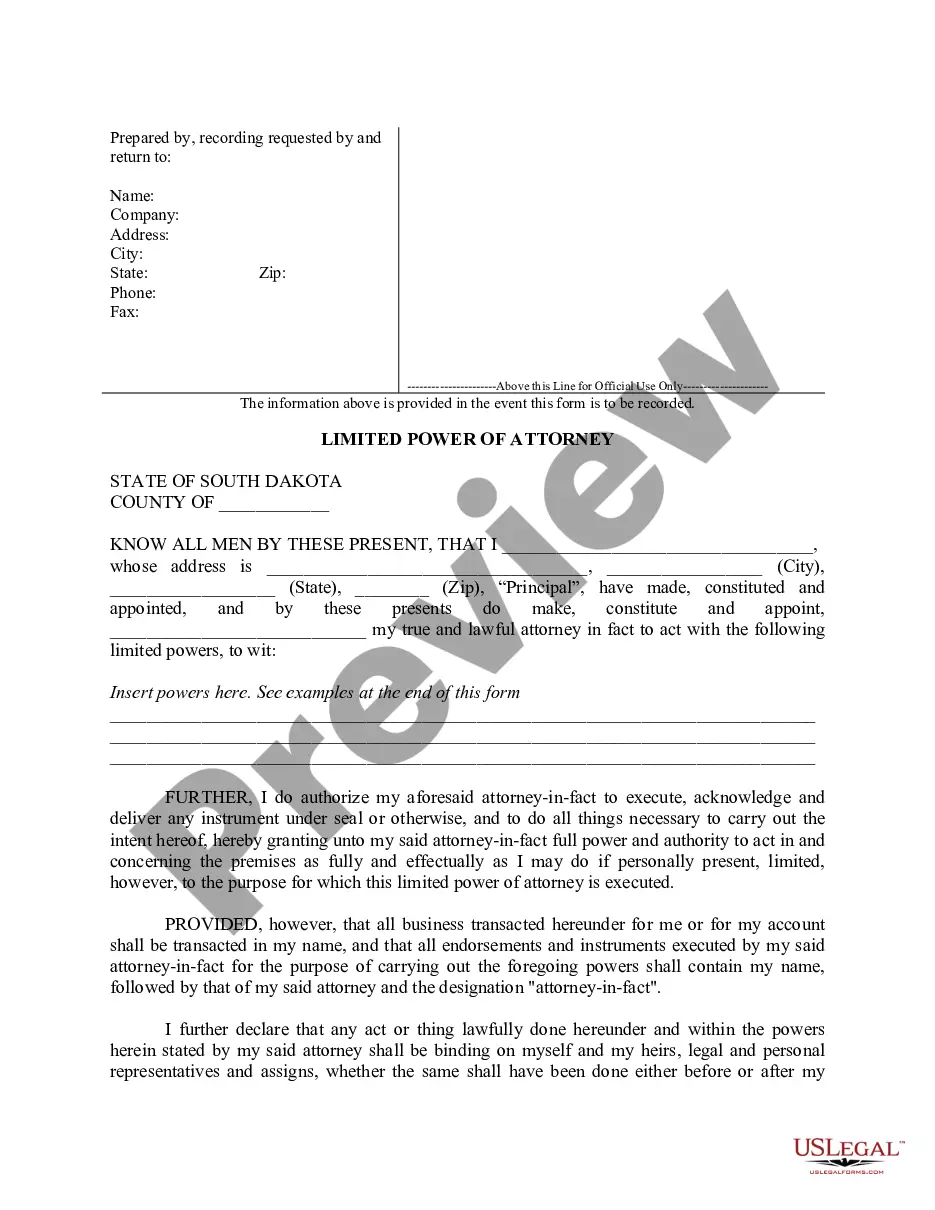

If available, utilize the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Get button.

- After that, you can fill out, modify, print, or sign the South Carolina Revocable Trust for Married Couple.

- Each valid document template you purchase is yours permanently.

- To obtain another copy of an acquired form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, please follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/region of your choice.

- Check the document description to make sure you have chosen the right form.

Form popularity

FAQ

Remarried couples may benefit from a special type of trust called a revocable living trust. This type allows flexibility and can be tailored to address the needs of each spouse's children from previous marriages. A South Carolina Revocable Trust for Married Couple can help in protecting assets while ensuring that all family members are considered in estate planning. It's beneficial to seek guidance from an estate planning professional to create a trust that meets everyone's needs.

The most popular form of marital trust is often the Qualified Terminable Interest Property (QTIP) trust. This trust allows one spouse to receive income from the trust during their lifetime, while ensuring that the remaining assets ultimately pass to designated beneficiaries after their death. For married couples, utilizing a South Carolina Revocable Trust for Married Couple can also incorporate the benefits of a QTIP trust, enabling effective estate planning.

The best trust for a married couple often depends on their unique financial situation and estate planning goals. A South Carolina Revocable Trust for Married Couple is frequently recommended due to its flexibility, ease of management, and ability to change as life circumstances evolve. This type of trust allows couples to maintain control over their assets while planning for eventual transfer to heirs. Consulting with a professional can help ensure this choice aligns with your intentions.

Putting your house in a trust can provide significant benefits, including avoiding probate and ensuring a smooth transfer of your assets. For married couples in South Carolina, a revocable trust often allows greater control over estate distribution. However, it's important to consult with a legal expert to ensure it fits your specific needs and circumstances. A South Carolina Revocable Trust for Married Couple can help streamline this process.

A joint trust can limit flexibility, as both spouses typically need to agree on any changes. This requirement can complicate decisions, particularly in times of disagreement. In addition, using a joint trust may create complexities if one spouse needs to make decisions independently due to health or other reasons. When considering a South Carolina Revocable Trust for Married Couple, it's essential to understand these potential limitations.

While it's not legally required to hire a lawyer to set up a trust in South Carolina, having legal guidance can be beneficial. A knowledgeable attorney can ensure that your South Carolina revocable trust for married couple meets all legal requirements and aligns with your wishes. However, if you are comfortable navigating the process, tools from uslegalforms can help you create a valid trust without legal representation.

One of the biggest mistakes parents often make when setting up a trust fund is not clearly defining their goals and intentions. Without a well-structured plan, beneficiaries may face confusion about asset distribution. To avoid this, ensure your trust reflects your specific objectives and consult experts, which uslegalforms can help guide you through.

For married couples, a South Carolina revocable trust for married couple is often the best choice due to its flexibility and ease of management. This type of trust allows both partners to retain control over their assets during their lifetime. Additionally, it offers significant benefits in estate planning, making it easier to facilitate the transfer of assets upon death.

To set up a revocable living trust in South Carolina, first define your assets and decide how you want to manage them. You will need to draft a trust document clearly stating your wishes, naming a trustee, and outlining successor beneficiaries. Utilizing resources like uslegalforms can simplify this process, providing handy templates tailored for creating a South Carolina revocable trust for married couples.

When one spouse in a South Carolina revocable trust for married couple passes away, the trust typically continues to operate. The surviving spouse usually retains control over the trust assets, and the trust may become irrevocable. This means that the trust's terms cannot be easily changed, ensuring the deceased spouse's wishes are honored.