South Carolina Account Stated for Construction Work

Description

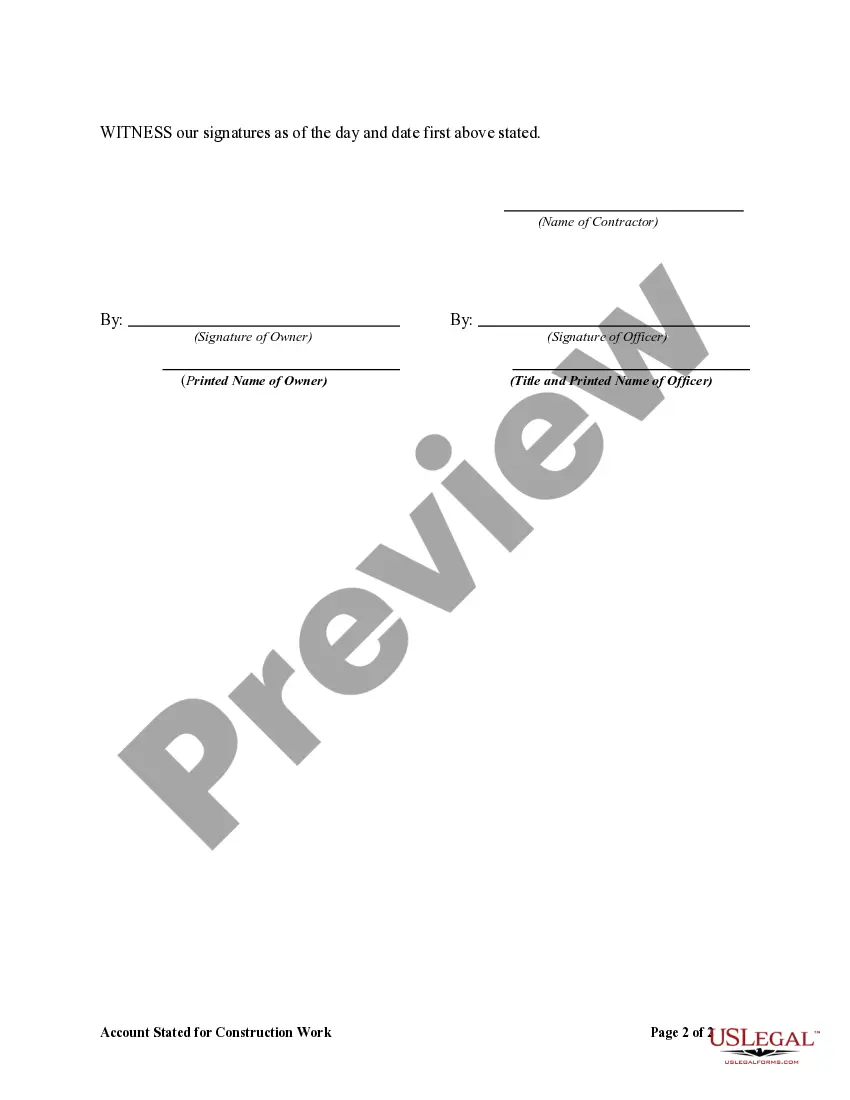

How to fill out Account Stated For Construction Work?

You can spend time online searching for the legal document template that meets the federal and state regulations you will need.

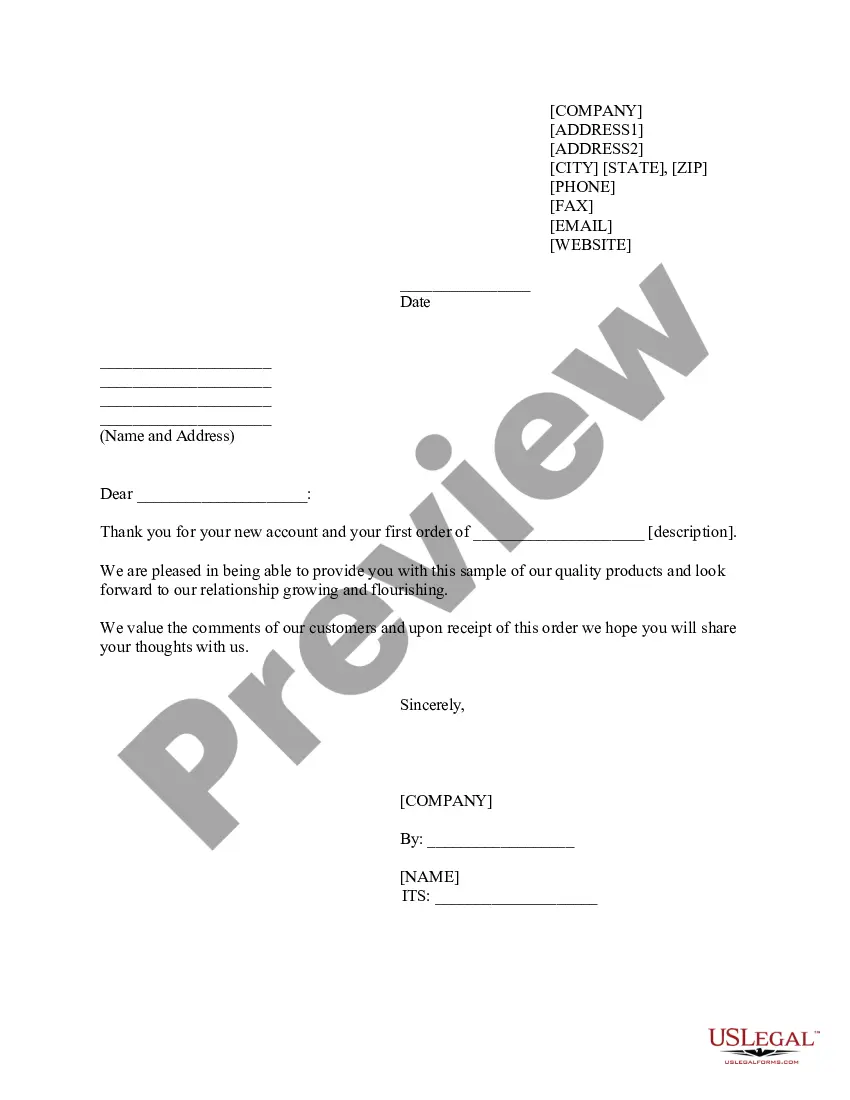

US Legal Forms provides a vast array of legal forms that are reviewed by professionals.

It is easy to obtain or create the South Carolina Account Stated for Construction Work from your service.

If available, use the Preview button to review the document template as well. If you wish to obtain another version of the form, use the Search field to find the template that suits your needs and specifications. Once you have found the template you want, click Buy now to proceed. Choose the pricing plan you prefer, enter your details, and create your account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Select the format of the file and download it to your device. Make adjustments to your document if necessary. You can complete, edit, sign, and print the South Carolina Account Stated for Construction Work. Access and print numerous document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and jurisdiction-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, edit, print, or sign the South Carolina Account Stated for Construction Work.

- Each legal document template you purchase is yours permanently.

- To get another copy of any purchased form, go to the My documents section and click the relevant button.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Section 29-5-10 of the Statute provides, in relevant part, that ?[a] person to whom a debt is due for labor performed or furnished or for materials furnished and actually used in the ?of a [structure] upon real estate?by virtue of an agreement with?the owner?or person having authority from, or rightfully acting ...

Services in South Carolina are generally not taxable. However ? if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Most tangible personal property is taxable in South Carolina, with a few exceptions.

Many sellers believe there is a general exemption from sales tax for labor charges. However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers.

Charges for sales or renewals of warranty, maintenance, or similar service contracts (whether optional or mandatory) for tangible personal property are subject to the sales and use tax.

With regard to training, South Carolina does not specifically include training services in its list of taxable services.

In South Carolina, the general rule is that you have 8 years from the last date on which work was performed on your home. After 8 years, the law (the ?statute of repose?) limits the claims an owner can bring.

??Sales Tax Sales Tax is imposed on the sale of goods and certain services in South Carolina. The statewide Sales &? Use Tax rate is six percent (6%). Counties may impose an additional one percent (1%) local sales tax if voters in that county approve the tax. Generally, all retail sales are subject to the Sales Tax.

7. SC Code § 29-6-50 permits a contractor to assess interest in the amount of one percent per month of the unpaid undisputed amount of a periodic or final pay request not paid within 21 days of receipt of the pay request, providing notice is given as required by the law.