South Carolina Change of Beneficiary

Description

How to fill out Change Of Beneficiary?

US Legal Forms - one of several biggest libraries of legitimate kinds in the United States - delivers a wide range of legitimate papers layouts you can acquire or print out. Utilizing the internet site, you can find thousands of kinds for enterprise and person purposes, sorted by categories, says, or key phrases.You can get the latest variations of kinds much like the South Carolina Change of Beneficiary within minutes.

If you currently have a monthly subscription, log in and acquire South Carolina Change of Beneficiary from your US Legal Forms catalogue. The Acquire key will show up on each and every develop you perspective. You have access to all previously delivered electronically kinds inside the My Forms tab of the accounts.

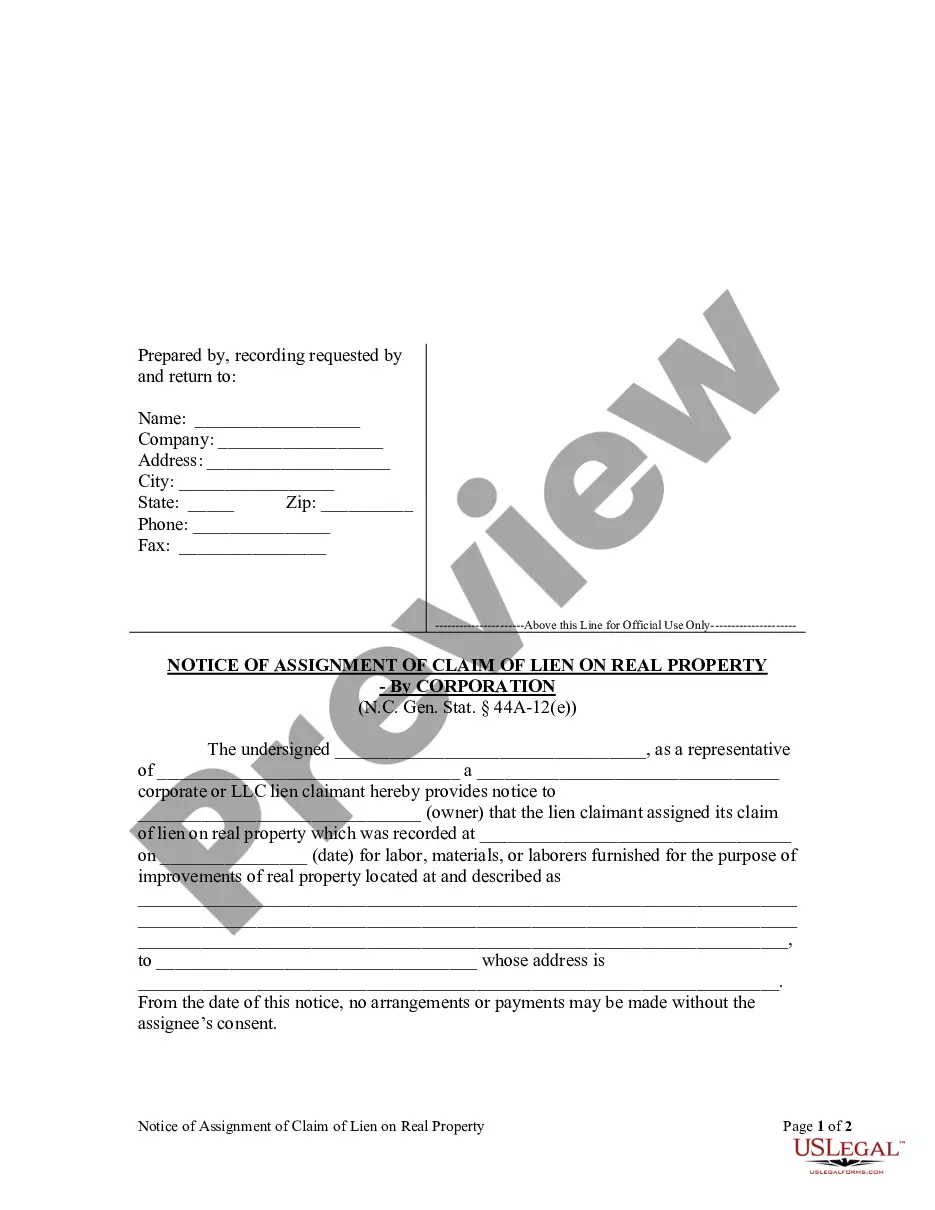

If you want to use US Legal Forms the first time, listed below are basic guidelines to get you started off:

- Make sure you have picked the correct develop for your city/state. Go through the Review key to analyze the form`s content. See the develop outline to ensure that you have selected the proper develop.

- In the event the develop does not match your requirements, make use of the Research area at the top of the display screen to discover the one who does.

- Should you be satisfied with the shape, validate your decision by simply clicking the Purchase now key. Then, select the costs strategy you favor and provide your credentials to sign up to have an accounts.

- Method the transaction. Utilize your Visa or Mastercard or PayPal accounts to complete the transaction.

- Choose the format and acquire the shape on your system.

- Make changes. Load, change and print out and sign the delivered electronically South Carolina Change of Beneficiary.

Each web template you included in your bank account lacks an expiry particular date and it is your own forever. So, if you would like acquire or print out an additional backup, just check out the My Forms section and click on on the develop you require.

Obtain access to the South Carolina Change of Beneficiary with US Legal Forms, the most comprehensive catalogue of legitimate papers layouts. Use thousands of specialist and state-certain layouts that meet your company or person demands and requirements.

Form popularity

FAQ

You can add or change a lump-sum beneficiary at any time. It's important to keep your beneficiary designation up to date.

It's important to name beneficiaries for life insurance policies and financial accounts to ensure that your assets pass quickly to your loved ones. It's even more important to review and update beneficiaries if you experience changes in your life to ensure that your assets end up in the right hands. ?

When you establish an IRA or 401(k), you complete a form to name your beneficiaries. Changes are made in the same way ? you complete a new beneficiary designation form. A will or trust does not override your beneficiary designation form. However, spouses may have special rights under federal or state law.

Can you change your beneficiary after you retire? That depends. If it's the beneficiary for your pension, in most cases the answer is no. If you choose a pension payment option that provides a lifetime benefit for a surviving beneficiary, you cannot change that beneficiary, even if they die before you do.

You can add or change a lump-sum beneficiary at any time. It's important to keep your beneficiary designation up to date.

Generally, you will need to fill out a change of beneficiary form which includes information such as the policyholder's name, the new beneficiary's name, and the reason for the change. You may also need to provide a copy of the policyholder's death certificate if the beneficiary is being changed due to their death.

The policy owner is the only person who can change the beneficiary designation in most cases. If you have an irrevocable beneficiary or live in a community property state you need approval to make policy changes. A power of attorney can give someone else the ability to change your beneficiaries.