If you have to complete, acquire, or produce authorized document themes, use US Legal Forms, the greatest variety of authorized kinds, that can be found on-line. Utilize the site`s simple and handy research to find the papers you will need. Numerous themes for business and personal uses are categorized by classes and suggests, or search phrases. Use US Legal Forms to find the South Carolina Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act in a number of mouse clicks.

If you are previously a US Legal Forms customer, log in to the accounts and click on the Acquire button to have the South Carolina Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act. You can also accessibility kinds you earlier acquired from the My Forms tab of your accounts.

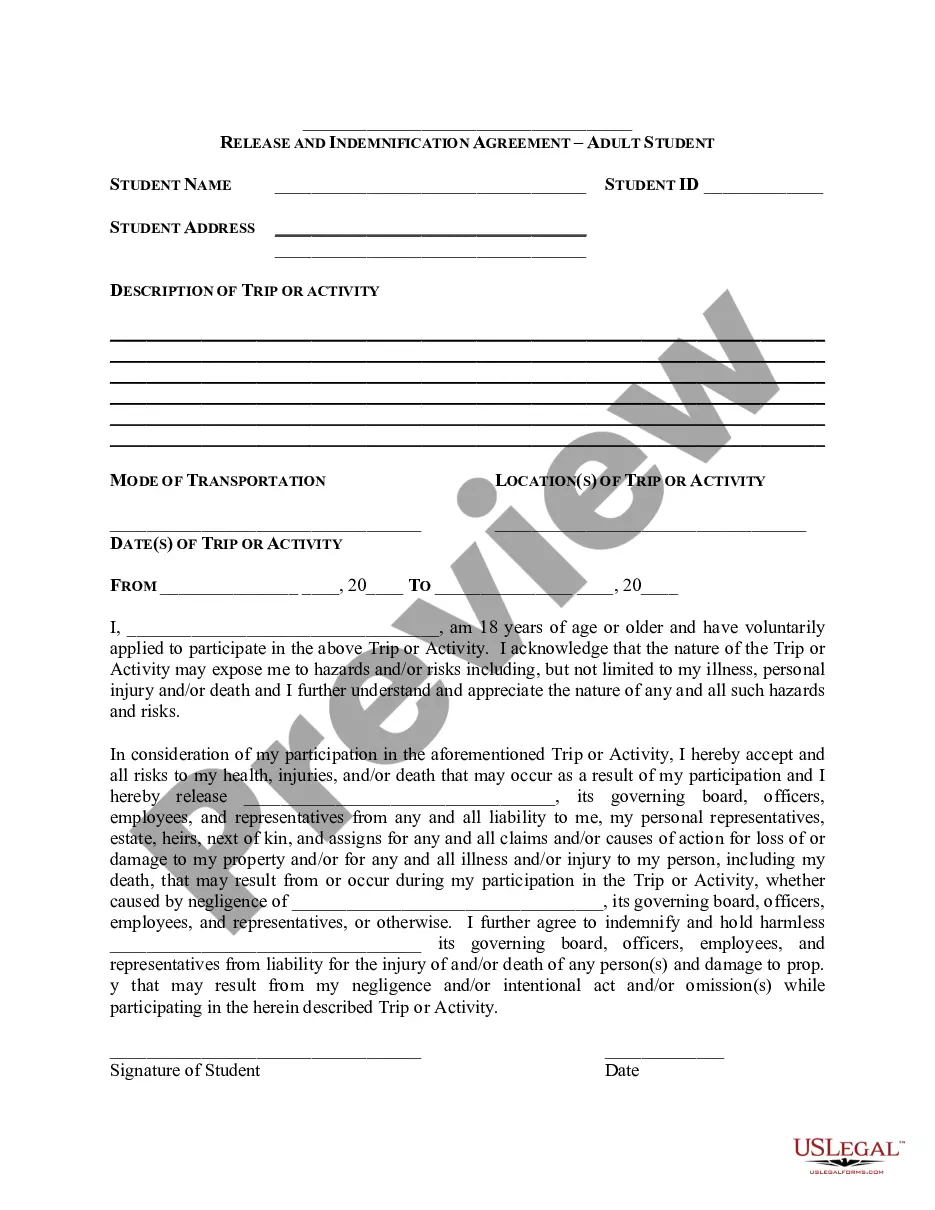

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape for your right metropolis/nation.

- Step 2. Take advantage of the Preview method to look over the form`s articles. Never forget to learn the description.

- Step 3. If you are unsatisfied with the develop, use the Look for industry towards the top of the display screen to discover other versions of the authorized develop template.

- Step 4. Once you have found the shape you will need, select the Buy now button. Select the costs program you choose and add your qualifications to register to have an accounts.

- Step 5. Process the deal. You may use your Мisa or Ьastercard or PayPal accounts to finish the deal.

- Step 6. Find the file format of the authorized develop and acquire it in your product.

- Step 7. Comprehensive, modify and produce or signal the South Carolina Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act.

Each authorized document template you get is yours for a long time. You may have acces to every develop you acquired inside your acccount. Select the My Forms section and choose a develop to produce or acquire yet again.

Compete and acquire, and produce the South Carolina Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act with US Legal Forms. There are thousands of specialist and state-distinct kinds you can use to your business or personal demands.