South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

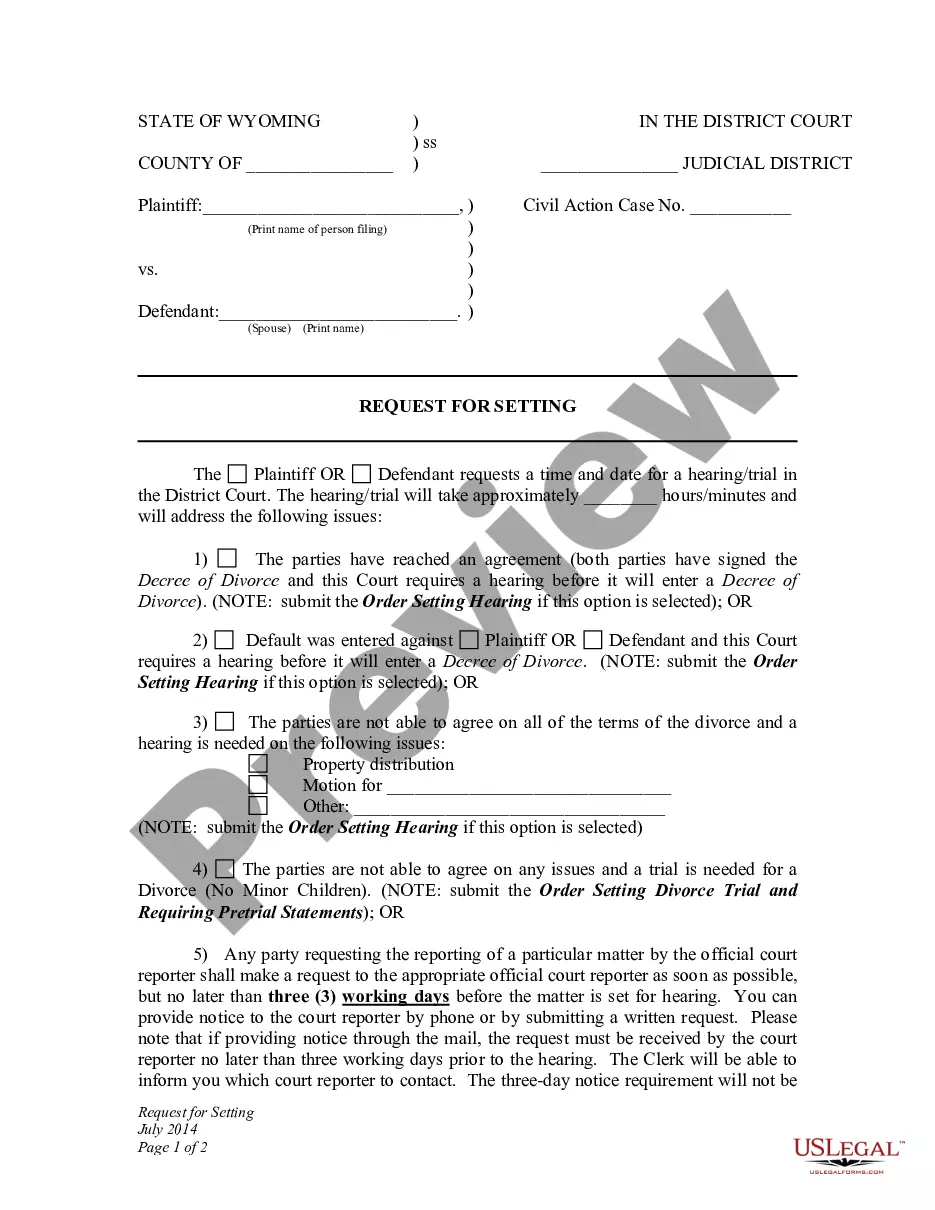

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

If you want to download, obtain, or print authentic document templates, use US Legal Forms, the largest assortment of legal forms available online.

Utilize the site's straightforward and user-friendly search feature to locate the documents you require.

Different templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find different versions of the legal form template.

Step 4. Once you have identified the form you need, select the Purchase now button. Choose your preferred payment plan and enter your details to register for an account.

- Use US Legal Forms to locate the South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to acquire the South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's contents. Be sure to read the summary.

Form popularity

FAQ

The percentage breakpoint is a predetermined sales figure that establishes when additional percentage rent payments begin. This figure helps both tenants and landlords understand the point at which contributions beyond base rent are necessary. Effectively managing the percentage breakpoint is essential for parties engaged in South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, fostering transparency and aligning expectations between landlords and tenants.

To avoid capital gains tax on real estate in South Carolina, consider utilizing exclusions like the primary residence exemption, which allows homeowners to potentially exclude a certain amount of gain when they sell their home. Additionally, 1031 exchanges allow you to defer taxes by reinvesting proceeds from a sale into similar, qualified properties. Understanding these strategies is vital when dealing with South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, as they can significantly influence a property's financial outcomes.

To calculate the break-even point for percentage rent, you need to identify your fixed costs, including the base rent and other expenses. Next, determine the percentage rent clause and calculate the total sales needed to cover these costs. This essential step ensures that tenants can plan their business strategies effectively within the South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate framework.

Occupancy tax, also known as lodging tax, applies to temporary lodging accommodations in South Carolina. This tax is imposed on guests staying in hotels, motels, or vacation rentals. If you are entering a South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate for a property offering such accommodations, you should account for this tax in your financial planning. Utilizing platforms like uslegalforms can help streamline your knowledge of occupancy taxes and related legalities.

In South Carolina, rental payments for tangible personal property are generally subject to sales tax. However, real property leases are typically not taxable. When engaging in a South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it's essential to clarify whether you're dealing with personal or real property, as it impacts tax obligations. Always consider seeking legal advice to ensure compliance with local regulations.

In South Carolina, certain items are exempt from sales tax, including food for home consumption, prescription drugs, and some services. When dealing with a South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it's crucial to understand which products your lease may cover. Consulting with a tax professional can help clarify any specific exemptions related to your business operations. Understanding these exemptions can lead to significant savings for your retail venture.

While it's difficult to completely avoid property tax in South Carolina, homeowners can leverage exemptions and appeals to reduce their tax burden. Staying informed about local regulations can help you identify strategies to lower your assessment. Consider using resources like USLegalForms to navigate the complexities of your South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, ensuring you're on the right path to managing your taxes effectively.

To obtain the 4% property tax assessment in South Carolina, a property must qualify as a legal residence. Homeowners should file an application to be granted this reduced tax rate. If you are considering leasing or owning a retail store, understanding eligibility for this reduction can optimize your costs associated with your South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Yes, in South Carolina, certain rental activities may be subject to sales tax. This can include leases of tangible personal property, but does not typically apply to real estate rentals. To ensure compliance and avoid unexpected costs related to your South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it's advisable to consult with a tax professional.

Property tax on rental properties in South Carolina is generally assessed at a different rate compared to primary residences. The current rate tends to vary by county, making it essential to check local regulations. Understanding these rates is vital for managing your expenses associated with a South Carolina Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.