South Carolina Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

It is possible to devote hrs on the Internet looking for the legal file format that suits the state and federal requirements you want. US Legal Forms gives thousands of legal types that happen to be reviewed by professionals. It is possible to down load or produce the South Carolina Letter to Creditors Notifying Them of Identity Theft for New Accounts from the support.

If you already possess a US Legal Forms profile, you are able to log in and then click the Obtain button. Next, you are able to comprehensive, change, produce, or indicator the South Carolina Letter to Creditors Notifying Them of Identity Theft for New Accounts. Each and every legal file format you get is the one you have permanently. To get yet another version of the bought develop, visit the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms web site initially, stick to the simple directions listed below:

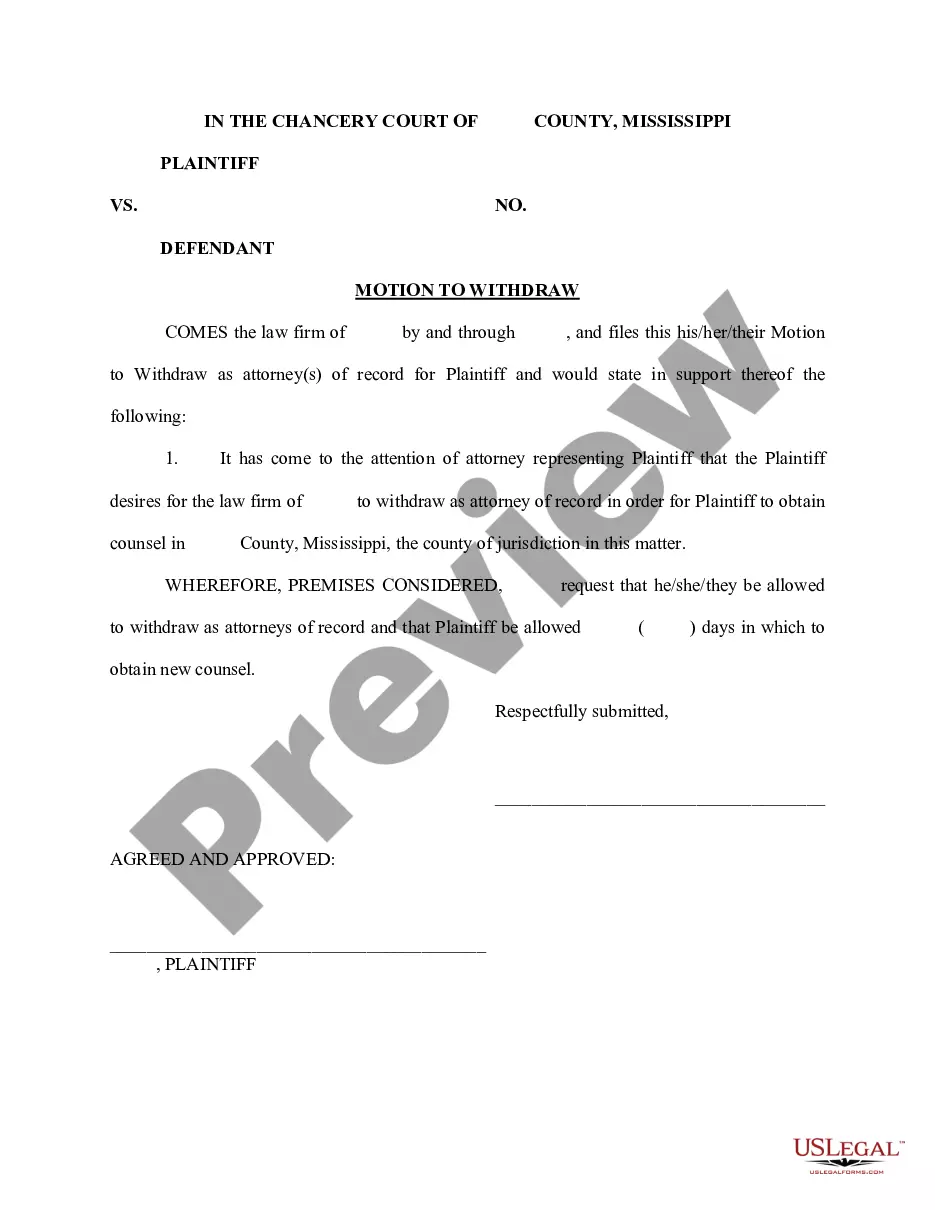

- Initial, be sure that you have chosen the best file format for the state/metropolis that you pick. See the develop information to make sure you have chosen the right develop. If readily available, use the Preview button to appear through the file format as well.

- If you wish to find yet another variation in the develop, use the Look for field to obtain the format that fits your needs and requirements.

- Once you have identified the format you need, just click Get now to move forward.

- Choose the prices plan you need, enter your references, and sign up for a free account on US Legal Forms.

- Complete the deal. You should use your bank card or PayPal profile to fund the legal develop.

- Choose the formatting in the file and down load it to the gadget.

- Make alterations to the file if possible. It is possible to comprehensive, change and indicator and produce South Carolina Letter to Creditors Notifying Them of Identity Theft for New Accounts.

Obtain and produce thousands of file web templates using the US Legal Forms website, which provides the biggest selection of legal types. Use professional and status-certain web templates to deal with your company or specific needs.

Form popularity

FAQ

An Identity Theft Affidavit is a document used by victims of identity theft to prove to businesses that their personal information was used to open a fraudulent account.

Identity theft is when one person uses the identifying information of another for financial gain, and the more we use our private identifying information in public ways, the more prevalent identity theft scams become. Under South Carolina law, identity theft is a felony punishable by up to 10 years in prison.

Could it hurt my credit scores? Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name -- and fail to pay the bills.

To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt. Taking action quickly is important, so don't delay. Create a personalized recovery plan at IdentityTheft.gov that walks you through each step of the process.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

You may receive a debt collection letter, to which you can respond by notifying the debt collector of the identity theft and providing it with proof of the theft, such as your Identity Theft Report. You should also contact the business that reported the debt to the collection agency and tell it to stop.

Identity theft has profound consequences for its victims. They can have their bank accounts wiped out, credit histories ruined, and jobs and valuable possessions taken away.

If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law). The longer you leave it, the more that financial liability falls on your shoulders.