South Carolina Agreement for Web Design Maintenance Services

Description

How to fill out Agreement For Web Design Maintenance Services?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a wide array of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal uses, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the South Carolina Agreement for Web Design Maintenance Services within moments.

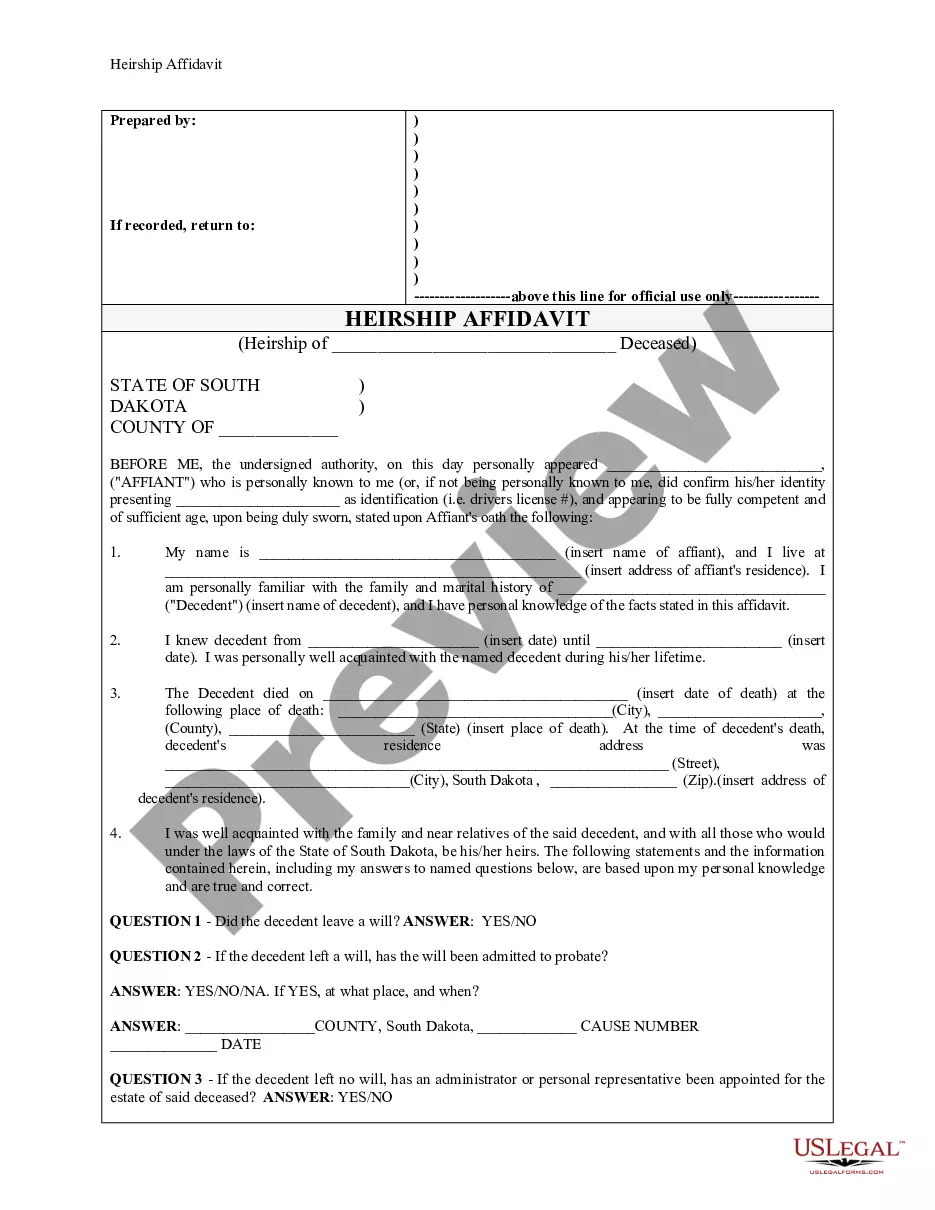

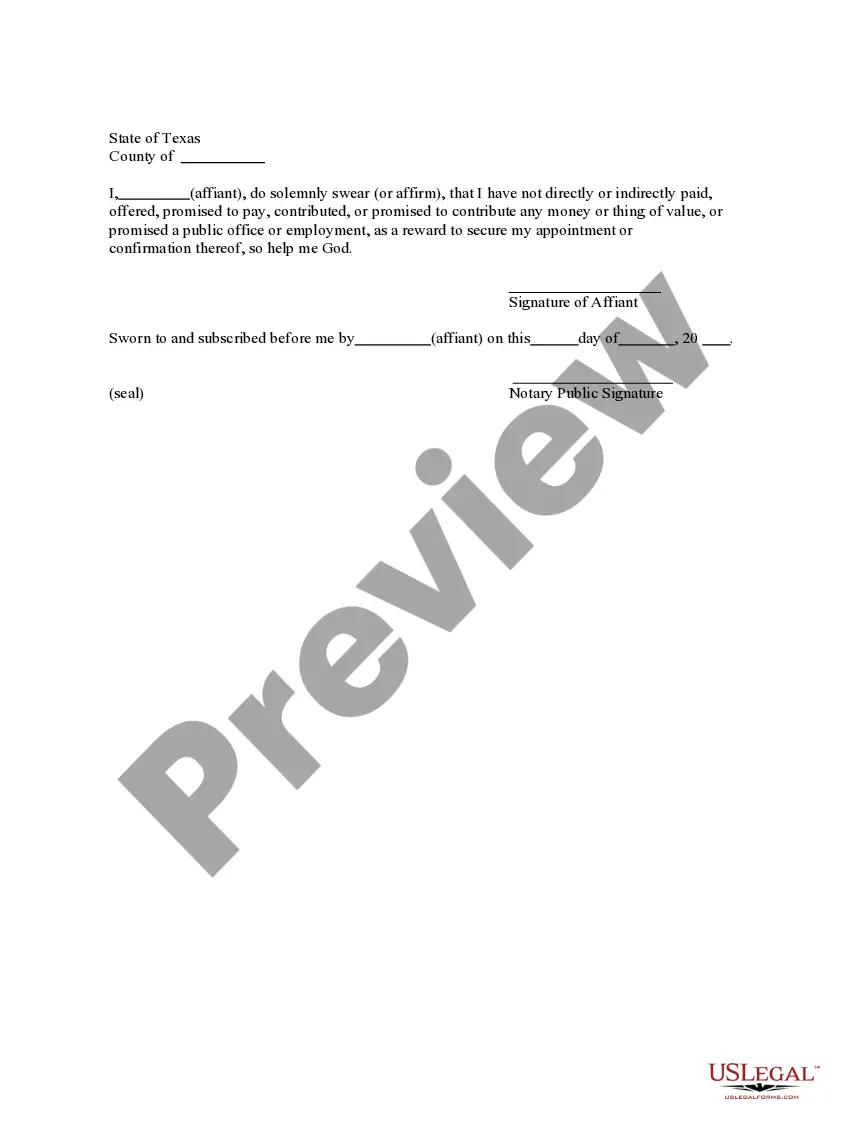

Click the Review button to examine the form's details.

Check the form information to ensure you have selected the correct one.

- If you are a registered user, Log In to download the South Carolina Agreement for Web Design Maintenance Services from the US Legal Forms library.

- The Acquire button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Make sure you have selected the correct form for your city/county.

Form popularity

FAQ

Website maintenance consists of six areas that need attention on a regular basis. They are: Security, Content, Design, Technical SEO, Functionality and Performance. Here is a brief description of the maintenance required for each of these areas.

Website maintenance is the process of checking to see whether your website is healthy and performing well. It's about keeping up with security updates, fresh content, encouraging traffic growth, and making sure your website visitors are happy.

Website maintenance is the act of regularly checking your website for issues and mistakes and keeping it updated and relevant. This should be done on a consistent basis in order to keep your website healthy, encourage continued traffic growth, and strengthen your SEO and Google rankings.

Yes. Charges for maintenance agreements (whether optional or mandatory) that are made in conjunction with, or as part of the sale of, computer software sold and delivered by tangible means are includable in "gross proceeds of sales" or "sales price", and, therefore, subject to the tax.

Charges for renewals of warranty, maintenance or similar service contracts for tangible personal property are subject to the sales and use tax, unless otherwise exempt under the law.

Your 10-Step Guide to Website MaintenanceThoroughly review and test the entire website (annually or after any updates).Test your website forms/checkout process (quarterly or after any updates).Review your KPIs, SEO and analytics reports (monthly).Security updates and bug fixes (monthly or as patches are released).More items...

Service fees for the installation of software are subject to sales tax. Moreover, charges for software maintenance services including delivery of updates for prewritten software are generally taxable. However, maintenance contracts that only provide support services for canned software are not taxable.

In the state of South Carolina, any modifications that are made to canned software that are prepared exclusively for a specific customer are considered to be taxable custom programs, not exempt. Sales of digital products are exempt from the sales tax in South Carolina.

Traditional Goods or Services Goods that are subject to sales tax in South Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription medicines, groceries, and gasoline are all tax-exempt.

Elements of a Website Maintenance Plan This usually includes ongoing or monthly security updates, installation of the most up-to-date software, and optimizations to enhance web performance and speed.