South Carolina Direct Deposit Form for Stimulus Check

Description

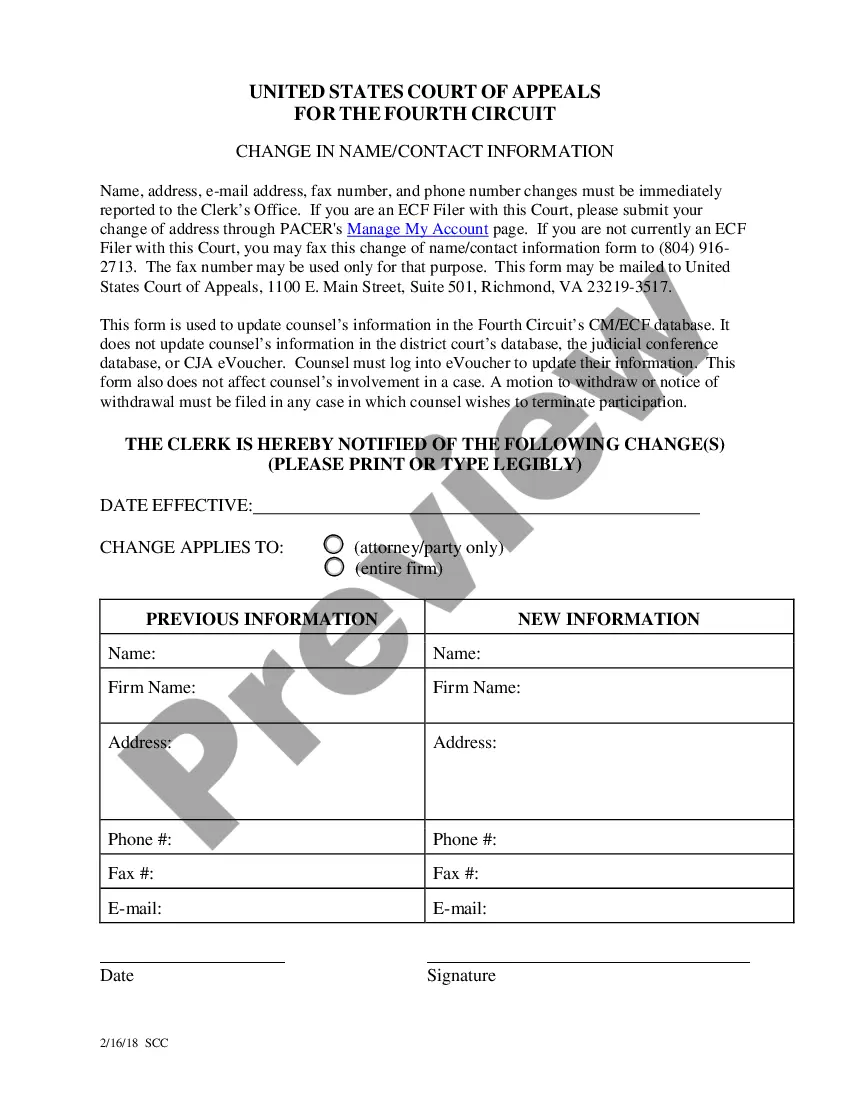

How to fill out Direct Deposit Form For Stimulus Check?

Finding the appropriate legal document format can be a challenge.

Certainly, there are numerous templates available online, but how will you locate the legal form you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, such as the South Carolina Direct Deposit Form for Stimulus Payment, suitable for both business and private purposes.

You can browse the form using the Preview button and read the form description to verify this is indeed the right option for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to secure the South Carolina Direct Deposit Form for Stimulus Payment.

- Use your account to view the legal forms you have acquired previously.

- Proceed to the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

To claim an IRS stimulus check, you usually need to provide your tax information when filing your federal tax return. If you've missed a previous payment, you can request it through the Recovery Rebate Credit section of your return. To receive future payments directly, complete the South Carolina Direct Deposit Form for Stimulus Check to ensure timely delivery.

To claim the stimulus check in 2025, file your tax return according to the guidelines provided by the IRS for that year. This may involve including information on any dependent claims and income details. Make the process easier for yourself by using the South Carolina Direct Deposit Form for Stimulus Check for a seamless direct deposit of your payment.

Qualifying for the 2025 stimulus check will depend on your income, filing status, and any recent updates to tax legislation at that time. It's essential to stay informed about eligibility criteria as they can change. Utilizing the South Carolina Direct Deposit Form for Stimulus Check can help ensure your future payments are processed smoothly.

To receive your $1400 stimulus check, you typically need to file your tax return accurately for the relevant year. If you've already filed, ensure your banking information is current through the South Carolina Direct Deposit Form for Stimulus Check to receive the amount directly into your account.

Yes, you can still claim your $1400 stimulus check if you were eligible but did not receive it. The IRS allows you to claim this through your tax return by filing the Recovery Rebate Credit. To facilitate getting your funds faster, consider completing the South Carolina Direct Deposit Form for Stimulus Check for direct deposits.

To determine your eligibility for a stimulus check, check your income level and filing status for the specified tax year. Generally, individuals with adjusted gross incomes below a certain threshold qualify for the checks. You can streamline this process by using the South Carolina Direct Deposit Form for Stimulus Check to ensure that you receive the funds directly.

The $800 tax rebate in South Carolina is a one-time payment provided to eligible residents as part of a support initiative. This rebate is designed to help residents weather economic challenges, offering financial relief. If you're looking to receive your rebate via direct deposit, you will need to fill out the South Carolina Direct Deposit Form for Stimulus Check.

You should file your SC1040 form with the South Carolina Department of Revenue. This form is crucial for reporting your income and may involve listing information related to your South Carolina Direct Deposit Form for Stimulus Check. Ensure you file it by the deadline to avoid any penalties or delays.

If you never received your stimulus check, you should first verify your eligibility and payment status on the IRS website. If there are issues, filing Form 3911 will allow you to request information on your South Carolina Direct Deposit Form for Stimulus Check. You may also want to consult tax professionals or use uslegalforms for assistance in navigating the process.

Filling out Form 3911 requires basic personal information, such as your name, address, and Social Security number. Make sure to clearly indicate that you are inquiring about the South Carolina Direct Deposit Form for Stimulus Check. Double-check all entries for accuracy to avoid processing delays.