Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

Louisiana Declaration of Cash Gift with Condition

Description

How to fill out Declaration Of Cash Gift With Condition?

If you are looking for comprehensive, obtain, or printing valid document templates, utilize US Legal Forms, the largest collection of valid documents available on the Internet.

Take advantage of the site's user-friendly and efficient search feature to locate the documentation you require. Numerous templates for business and personal purposes are categorized by categories and states, or keywords.

Use US Legal Forms to acquire the Louisiana Declaration of Cash Gift with Condition with just a few clicks.

Each legal document template you purchase is yours indefinitely. You will have access to every form you obtained within your account. Click the My documents section and choose a form to print or download again.

Complete and acquire, and print the Louisiana Declaration of Cash Gift with Condition with US Legal Forms. There are numerous professional and state-specific forms available for your personal business or individual needs.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to find the Louisiana Declaration of Cash Gift with Condition.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

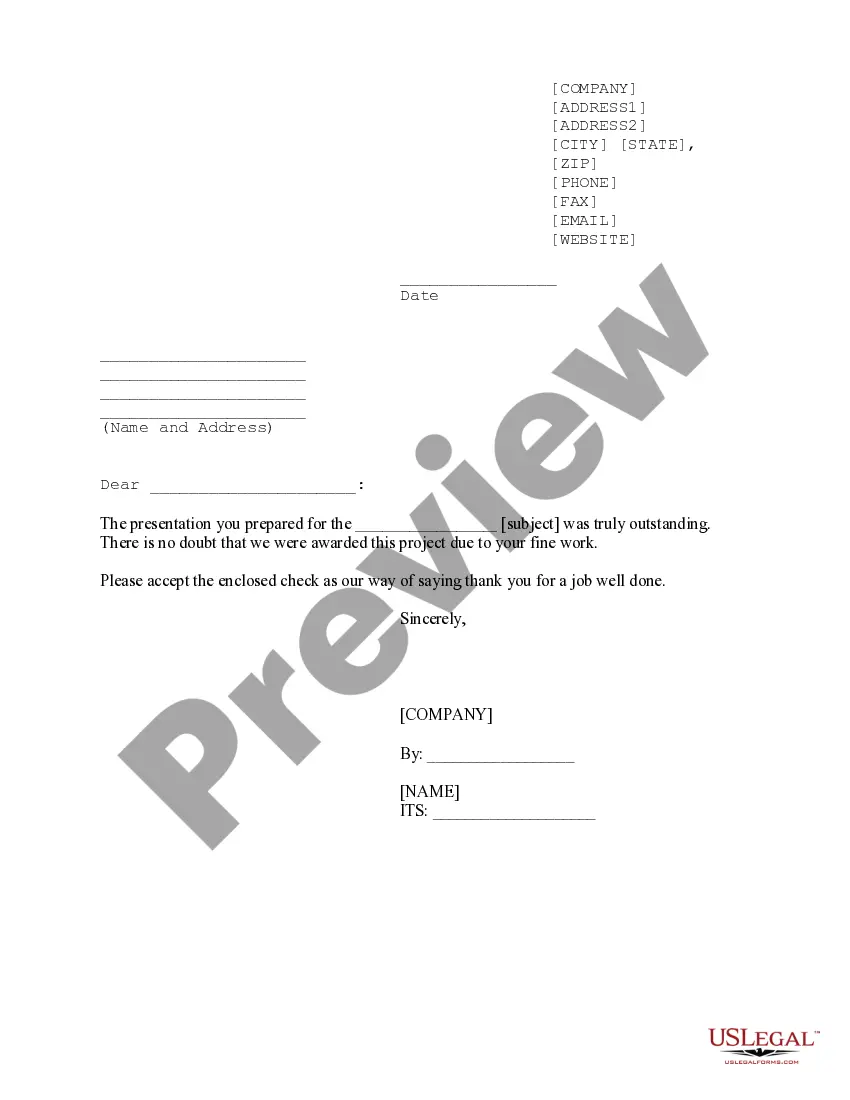

- Step 2. Use the Review option to view the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of your legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to register for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Finalize, modify, and print or sign the Louisiana Declaration of Cash Gift with Condition.

Form popularity

FAQ

Certain transactions may not qualify as gifts, even if they resemble one. For example, anything exchanged for value, such as a service or a product, does not fall under the category of a gift. Additionally, loans or transfers with the expectation of return also lack the characteristics of a true gift. Knowledge of these distinctions can prevent misunderstandings.

For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. The CARES Act eliminated the 60% limit for cash donations to public charities.

If you gift a car, you may be responsible for paying gift tax on it. While the requirements differ every year, for 2019, a gift tax is necessary if the fair market value of the car is more than $15,000 for a single person or $30,000 for a married couple. The gift tax can be anywhere from 18% to 40%.

At this point, you'll want to know how much does it cost to transfer a car title. Currently, the OMV charges a $68.50 title fee, along with an $8 handling fee.

Generally, if you receive a gifted car in Louisiana, you are not required to pay a sales tax on it. However, if the value of the car exceeds $15,000 the recipient may be responsible for up to 4% to 9% of your vehicle's assessed value.

Generally, the answer to do I have to pay taxes on a gift? is this: the person receiving a gift typically does not have to pay gift tax. The giver, however, will generally file a gift tax return when the gift exceeds the annual gift tax exclusion amount, which is $15,000 per recipient for 2019.

Although there are no taxes on donations received, there are taxes on any money you receive for raising it. If, for example, an organization pays you $200 to man a fundraising booth for them at a local fair, you must report it to the IRS as earned income.

Complete a vehicle application. Complete an odometer disclosure statement (if applicable) Submit the above documentation with all applicable payments to the Louisiana Office of Motor Vehicles (OMV) The seller needs to submit a Notice of Transfer or report the sale transaction online.

In the field where it asks for the sales price, you may simply fill in gift. In Louisiana, you will also need to:Get a lien release (if necessary)Get the gifter's signature on the title notarized.Complete a Vehicle Application form.Complete and notarize an Act of Donation of a Movable form.More items...?

Louisiana Inheritance and Gift Tax:There is no gift tax in Louisiana either. The federal gift tax exemption is $15,000 per year for each gift recipient.