South Carolina Employment Application for Sole Trader

Description

How to fill out Employment Application For Sole Trader?

If you require to sum up, obtain, or print authentic document formats, utilize US Legal Forms, the premier assortment of legal forms available online.

Take advantage of the site’s user-friendly and efficient search feature to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have identified the form you desire, click on the Buy Now button. Choose the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to find the South Carolina Employment Application for Sole Trader with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the South Carolina Employment Application for Sole Trader.

- You can also access forms you previously stored in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the suitable city/state.

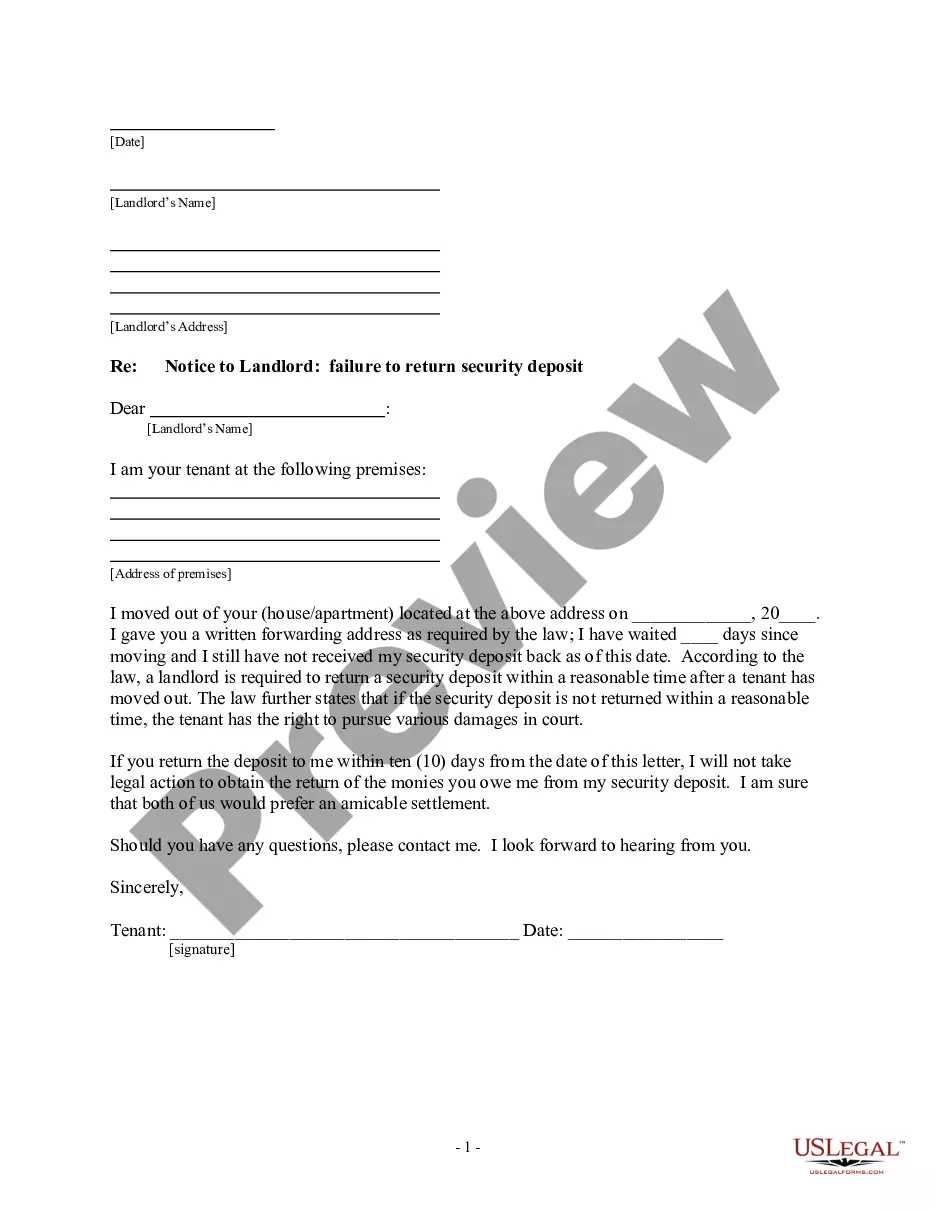

- Step 2. Use the Preview option to review the content of the form. Remember to go over the summary.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the page to find alternative forms from the legal template catalog.

Form popularity

FAQ

When you need a DBA Generally speaking, South Carolina does not require the registration of a DBA.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.

Applying for an EIN for your LLC is free ($0) Applying for an EIN for your South Carolina LLC is completely free. The IRS doesn't charge anything for applying for an EIN.

The Federal Employer Identification Number (FEIN) is obtained from the Internal Revenue Service (IRS). You can register for one online, or by completing an SS-4 and mailing it in. The IRS requires a business to have an FEIN if the business: Already has employees.

While the sole proprietor is such a simple business classification that South Carolina doesn't even require a business registration process or any type of fees, depending on how you use your sole proprietorship and what industry you operate in, you still might have some important steps that need to be taken.

Sole Proprietorship Registration can be done in 3 ways: Register under the Shop and Establishment Act. Get a Udyog Aadhaar under the Ministry of MSME. Get a GST registration.

Apply for an EIN with the IRS assistance tool. It will guide you through questions and ask for your name, social security number, address, and your "doing business as" (DBA) name. Your nine-digit federal tax ID becomes available immediately upon verification.

Sole proprietors must register with the Department of Trade & Industry (DTI) while corporations and partnerships are registered with the Securities & Exchange Commission (SEC).

The Federal Employer Identification Number (FEIN) is obtained from the Internal Revenue Service (IRS). You can register for one online, or by completing an SS-4 and mailing it in. The IRS requires a business to have an FEIN if the business: Already has employees.

A Sole Proprietorship form of business organisation is where a business is managed by a single person. Generally, it does not require any registration as such. Any individual who wants to start a business with less investment can choose this type of business form.