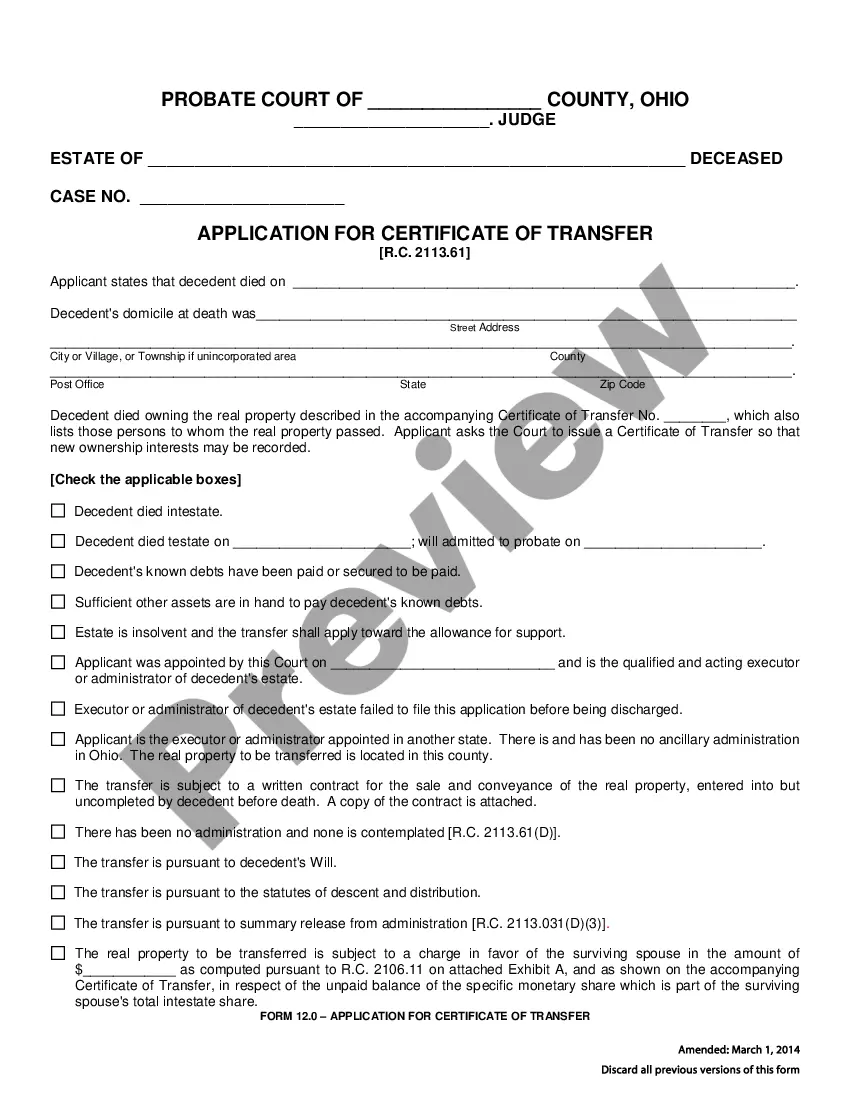

South Carolina Demand for Non-Probate Property Inventory is a legal document that is used to request an inventory of property that is not subject to probate. The Non-Probate Property Inventory is a list of assets that are not subject to administration through the probate process, such as joint bank accounts, trusts, life insurance policies, and real estate. The Demand for Non-Probate Property Inventory is used to determine a decedent's assets that are not subject to probate and to secure them for the beneficiaries. There are two different types of South Carolina Demand for Non-Probate Property Inventory: the Demand for Inventory and the Demand for Appraisal. The Demand for Inventory requires the holder of the estate to provide an inventory of the assets, and the Demand for Appraisal requests an appraisal of the estate's assets.

South Carolina Demand for Non-Probate Property Inventory

Description

Key Concepts & Definitions

When discussing the demand for non probate property inventory, it is essential to define both 'non probate property' and 'inventory'. Non probate property refers to assets that do not need to go through probate upon the owner's death, such as jointly owned assets, retirement accounts with designated beneficiaries, and trusts. An inventory in this context is a comprehensive list detailing each item of the non probate property, their estimated value, and detailed descriptions.

Step-by-Step Guide

- Identify the Non Probate Assets: Compile a list of all assets that do not require probate. This includes jointly owned properties, life insurance payouts, retirement accounts, etc.

- Assess the Value: Estimate the value of each asset using current market rates or appraisals.

- Document Details: Create detailed descriptions for each asset, including condition, location, and any other relevant information.

- Legal Review: Have a legal expert review the inventory to ensure compliance with state laws.

- Update Regularly: Reassess and update the inventory annually or as changes occur.

Risk Analysis

Inaccurate appraisal of assets can lead to disputes among beneficiaries, potential legal challenges, and financial discrepancies. Additionally, failure to regularly update the inventory can result in outdated information that does not accurately reflect the owner's current holdings, increasing the risk of oversight or mismanagement.

Key Takeaways

- Accuracy: Ensuring the accuracy of the non probate property inventory is critical for smooth asset transfer and minimizing conflicts.

- Legal Compliance: Compliance with state laws is crucial to avoid legal complications.

- Regular Updates: Keeping the inventory updated helps in making the wealth management process more efficient and less susceptible to errors.

FAQ

- What is non probate property? Non probate property includes assets that are immediately transferred to the designated beneficiaries upon the owner's death, bypassing probate.

- Why is it important to keep a non probate property inventory? Maintaining an inventory helps in the smooth transition of property ownership, facilitates financial planning, and ensures legal compliance.

- How often should the inventory be updated? It is advisable to update the non probate property inventory annually or as significant changes occur in the asset holdings.

Common Mistakes & How to Avoid Them

- Failing to Update the Inventory: Regular updates can prevent major discrepancies and conflicts. Schedule annual reviews of the inventory.

- Underestimating Values: Hire professional appraisers for accurate valuation of assets.

- Overlooking Digital Assets: Include digital assets such as online accounts and cryptocurrency holdings in your inventory.

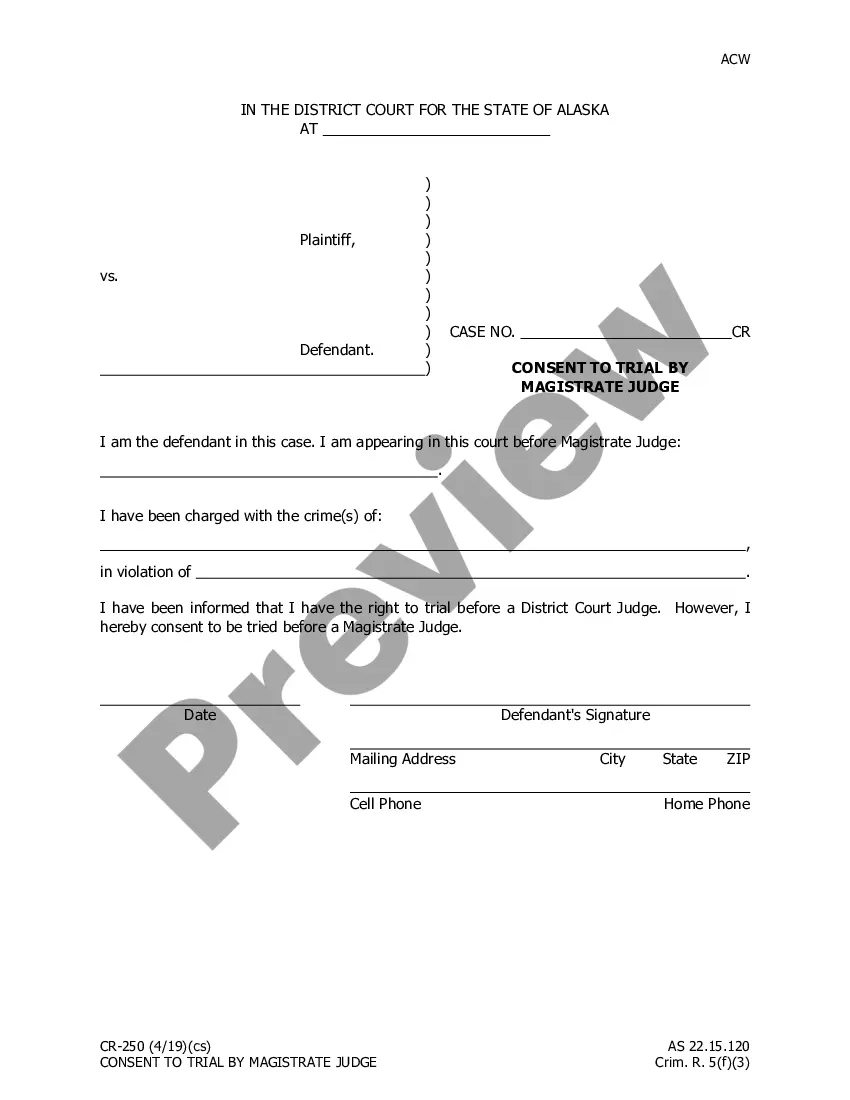

How to fill out South Carolina Demand For Non-Probate Property Inventory?

Coping with legal paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your South Carolina Demand for Non-Probate Property Inventory template from our service, you can be certain it complies with federal and state regulations.

Dealing with our service is straightforward and quick. To obtain the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your South Carolina Demand for Non-Probate Property Inventory within minutes:

- Remember to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the South Carolina Demand for Non-Probate Property Inventory in the format you prefer. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the South Carolina Demand for Non-Probate Property Inventory you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

The Inventory is basically a ?snapshot? of the decedent's probate assets at the time of death. The Inventory lists all assets and the value of each of those assets on the date of death: bank accounts not jointly owned, real estate, personal property, any investments, and other miscellaneous items.

Non-probate assets, by contrast, pass outside of the will. Accounts which are non-probate assets include insurance policies, 401(k) plans, pensions, funds held in trust, and Joint Tenants with Right of Survivorship (JTWROS) and Payable on Death (POD) bank accounts, to name a few.

In California, any form of property that is not individually owned by the deceased is considered a non-probate property by operation of California probate law. These assets are common. They can be anything from cars, belongings, life insurance policies, real property, and transfers on death accounts.

In California, any form of property that is not individually owned by the deceased is considered a non-probate property by operation of California probate law. These assets are common. They can be anything from cars, belongings, life insurance policies, real property, and transfers on death accounts.

In many cases, the best way to avoid probate is to establish a transfer-on-death, or TOD, on those bank accounts, brokerage accounts or real estate. That way, assets transfer to the person listed as the TOD beneficiary.

What are some examples of probate property? Real property owned in severalty or in tenancy in common life insurance proceeds payable to the estate, gain from the sale of a business, social security benefits.

In South Carolina, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In South Carolina, the following assets are subject to probate: Property only held in the deceased's name. Any real estate that the decedent held as a tenant in common. The deceased's interest in an LLC, corporation or a partnership.