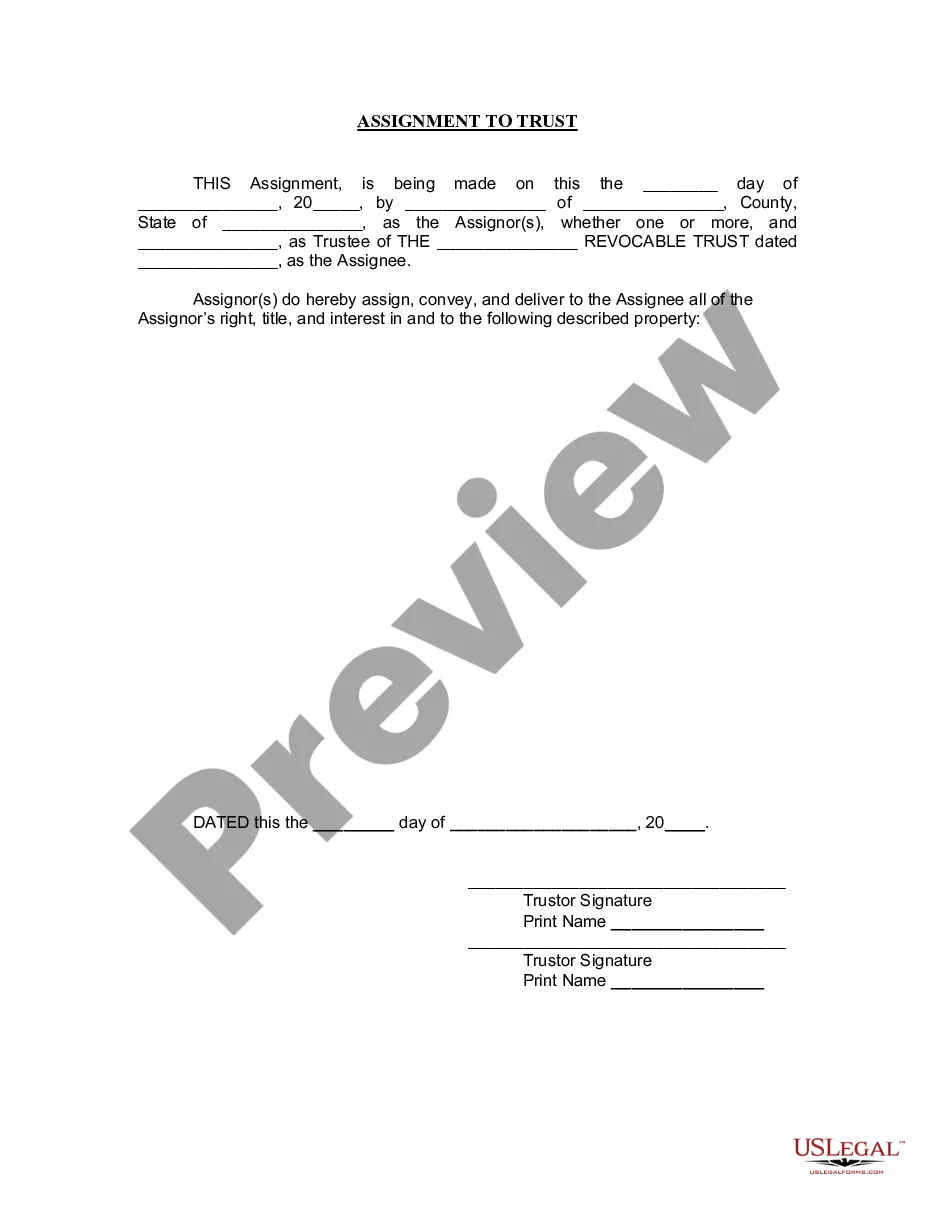

South Carolina Pro of Delivery of Non-Probate Property Inventory is a form used in the state of South Carolina to transfer ownership of non-probate property, such as real estate, from an estate to its rightful beneficiaries. This form can be used to transfer ownership without going through the probate process. It includes a detailed inventory of all the non-probate property in the estate, including any real estate owned and any tangible personal property (such as cars, jewelry, furniture, etc.). The form also requires the executor of the estate to certify that all the information provided is accurate and that the beneficiaries listed on the form are the rightful owners of the non-probate property. There are two types of South Carolina Pro of Delivery of Non-Probate Property Inventory: Form SCDPO-1 for transferring ownership of real estate, and Form SCDPO-2 for transferring ownership of tangible personal property.

South Carolina Pro of of Delivery of Non-Probate Property Inventory

Description

How to fill out South Carolina Pro Of Of Delivery Of Non-Probate Property Inventory?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state laws and are verified by our specialists. So if you need to complete South Carolina Pro of of Delivery of Non-Probate Property Inventory, our service is the best place to download it.

Getting your South Carolina Pro of of Delivery of Non-Probate Property Inventory from our catalog is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the proper template. Afterwards, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance verification. You should carefully examine the content of the form you want and check whether it satisfies your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your South Carolina Pro of of Delivery of Non-Probate Property Inventory and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Is Probate Required in South Carolina? In most cases, the answer is ?yes.? Probate will be a necessary step in distributing he assets of the estate. The court monitors this process to ensure the decedent's wishes are followed as indicated in the will.

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann. 12-24-70(A)(1)).

South Carolina does not recognize transfer-on-death deeds for real estate property. For a beneficiary to receive real estate property upon a person's death, they must have jointly owned the property under the state's joint tenancy laws.

In South Carolina, the following assets are subject to probate: Property only held in the deceased's name. Any real estate that the decedent held as a tenant in common. The deceased's interest in an LLC, corporation or a partnership.

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

Any executor, devisee, legatee, guardian, attorney, or other person who fails to deliver to the judge of the probate court having jurisdiction to admit it to probate any last will and testament, including any codicil or codicils thereto, upon conviction must be punished as for a misdemeanor.

South Carolina does not recognize transfer-on-death (TOD) deeds. TOD deeds?where recognized?serve a purpose similar to life estate deeds without restricting the owner's property rights during life.

In California, any form of property that is not individually owned by the deceased is considered a non-probate property by operation of California probate law. These assets are common. They can be anything from cars, belongings, life insurance policies, real property, and transfers on death accounts.