South Carolina Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants

Description

How to fill out South Carolina Warranty Deed To Separate Property Of One Spouse To Both Spouses As Joint Tenants?

Among numerous paid and free examples that you get online, you can't be sure about their accuracy. For example, who created them or if they are skilled enough to take care of what you need them to. Keep relaxed and utilize US Legal Forms! Find South Carolina Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants samples created by professional lawyers and avoid the costly and time-consuming procedure of looking for an lawyer or attorney and after that paying them to write a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you are looking for. You'll also be able to access all your previously saved samples in the My Forms menu.

If you are utilizing our service the very first time, follow the guidelines below to get your South Carolina Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants easily:

- Make sure that the document you discover applies in the state where you live.

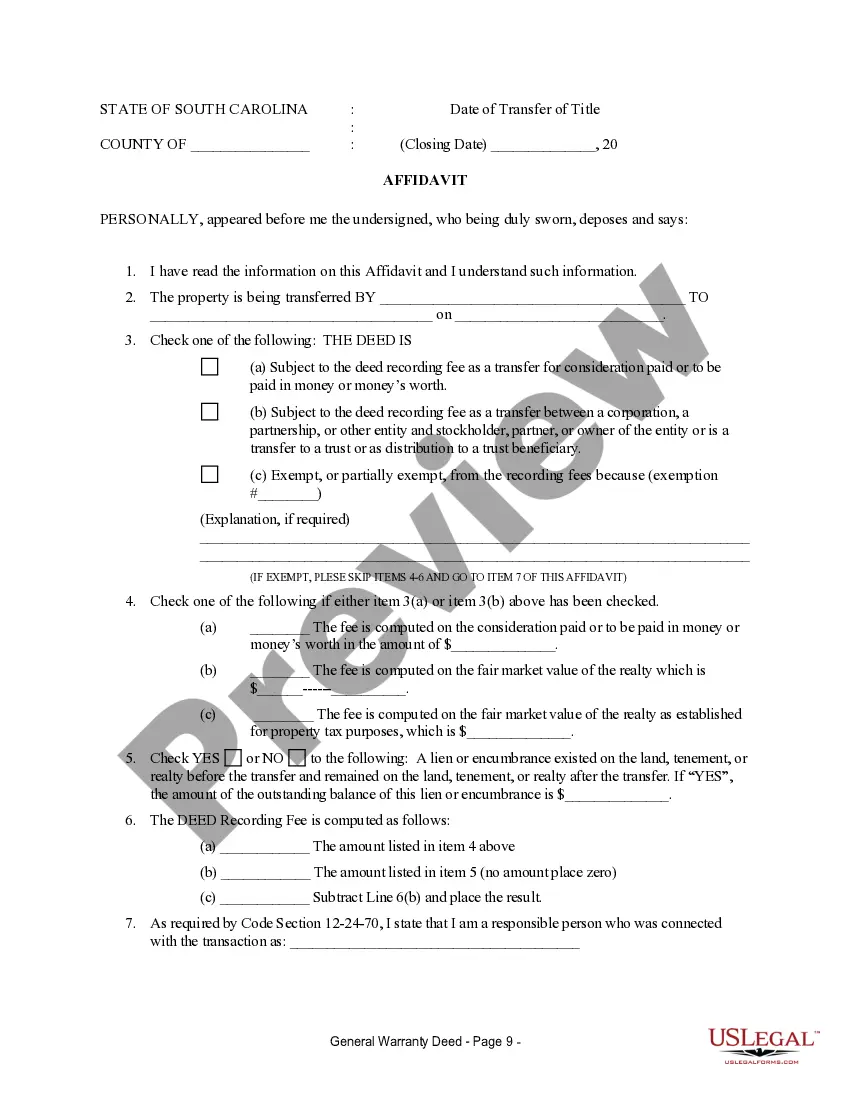

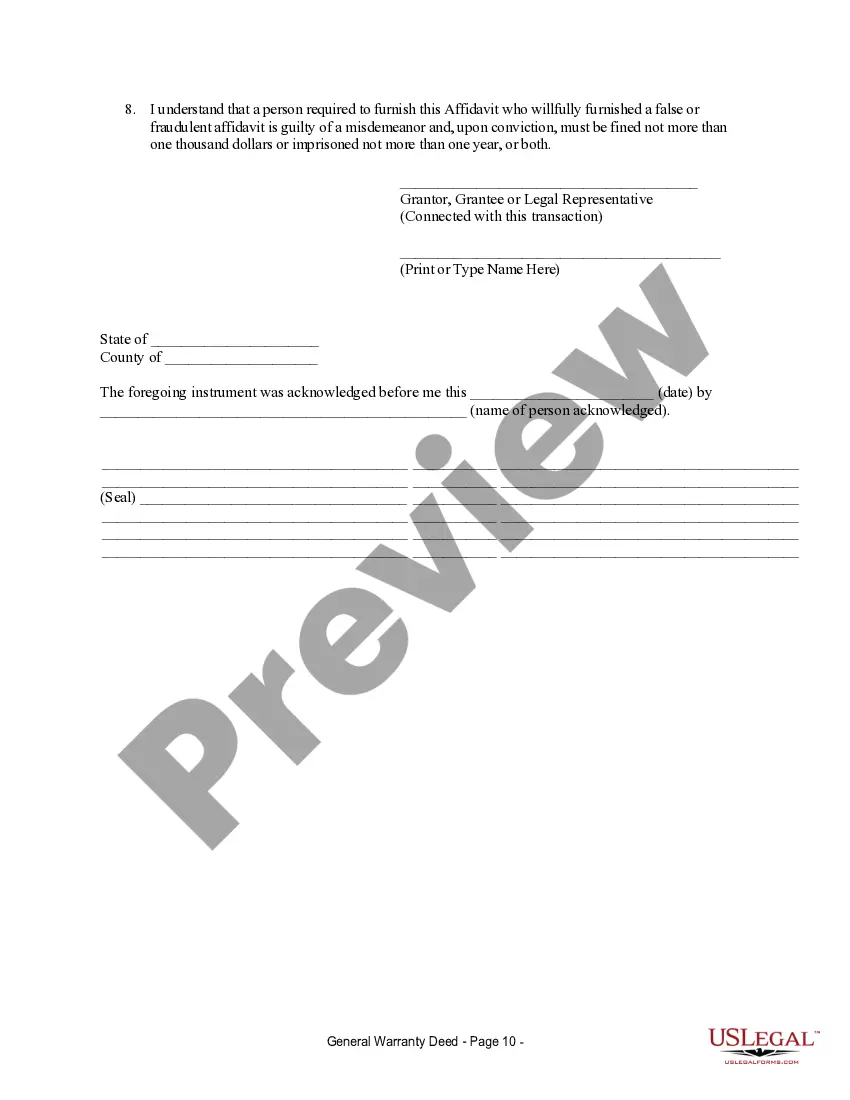

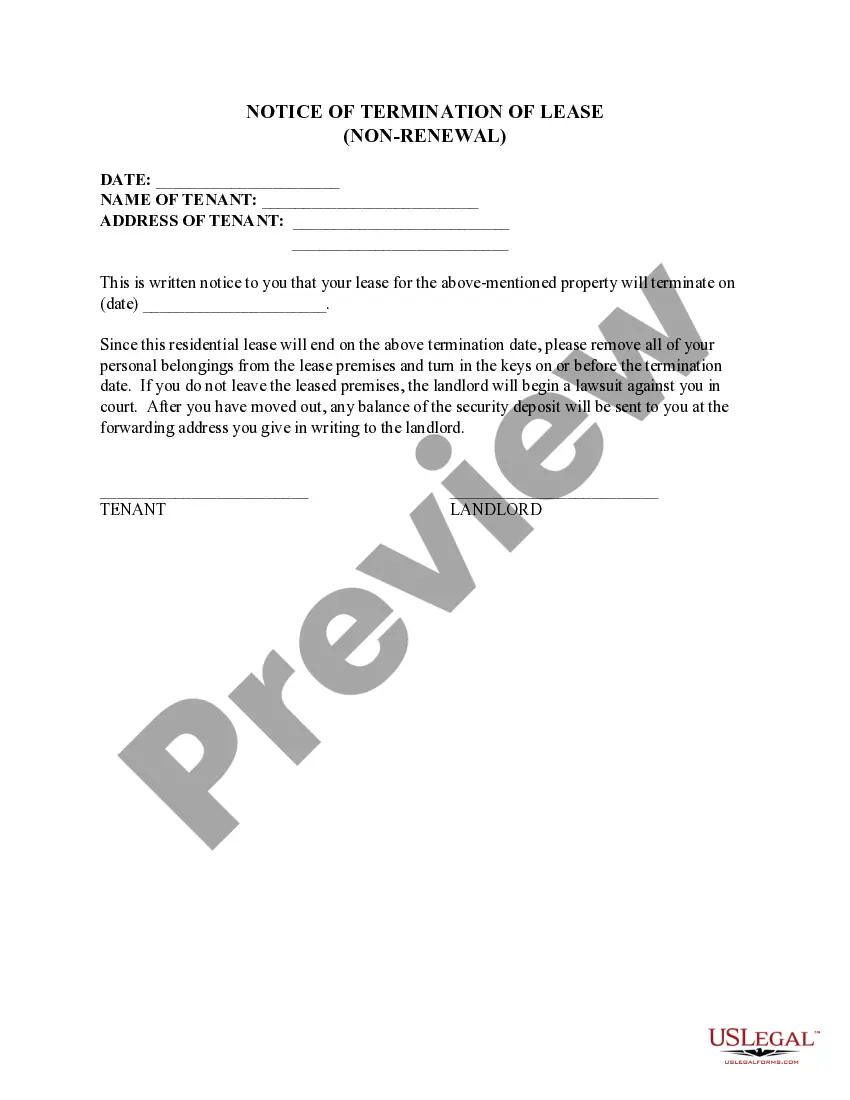

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another sample utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you’ve signed up and purchased your subscription, you may use your South Carolina Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants as often as you need or for as long as it stays active where you live. Revise it in your favored offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

In California, most married couples hold real property (such as land and buildings) as joint tenants with right of survivorship.For instance, many married couples share real property as joint tenants. This way, upon the death of a spouse, the surviving spouse will own 100% share of the property.

Buying a home while legally married but separated from your former spouse is certainly possible, but there's some extra documentation needed and things to be aware of. First, your lender is going to require your legal separation agreement. If you have a property settlement agreement, they'll need that as well.

You can buy a house under one name, and most of the time couples do this because one partner's credit is bad. However, there are advantages to joint mortgages. You should carefully consider the pros and cons of buying a house under only one partner's name.

With a Survivorship Deed in place, when one of the parties in a joint tenancy dies, the other party (or parties) takes over the deceased party's interest in the property instead of it passing to the deceased's heirs or beneficiaries.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

If you're married do you have to get a joint mortgage? The simple answer is 'no'. Generally, most lenders want both applicants to be on the mortgage, but it's possible to get a single mortgage when you're married and still get the best interest rate available.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Married couples buying a house or refinancing their current home do not have to include both spouses on the mortgage.For example, one spouse's low credit score could make it harder to qualify or raise your interest rate. In those cases, it's better to leave one spouse off the home loan.

In a common-law state, you can apply for a mortgage without your spouse. Your lender won't be able to consider your spouse's financial circumstances or credit while determining your eligibility.If you and your partner were to split up, the home would be yours alone; you wouldn't have to split it with your spouse.