South Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

Definition and meaning

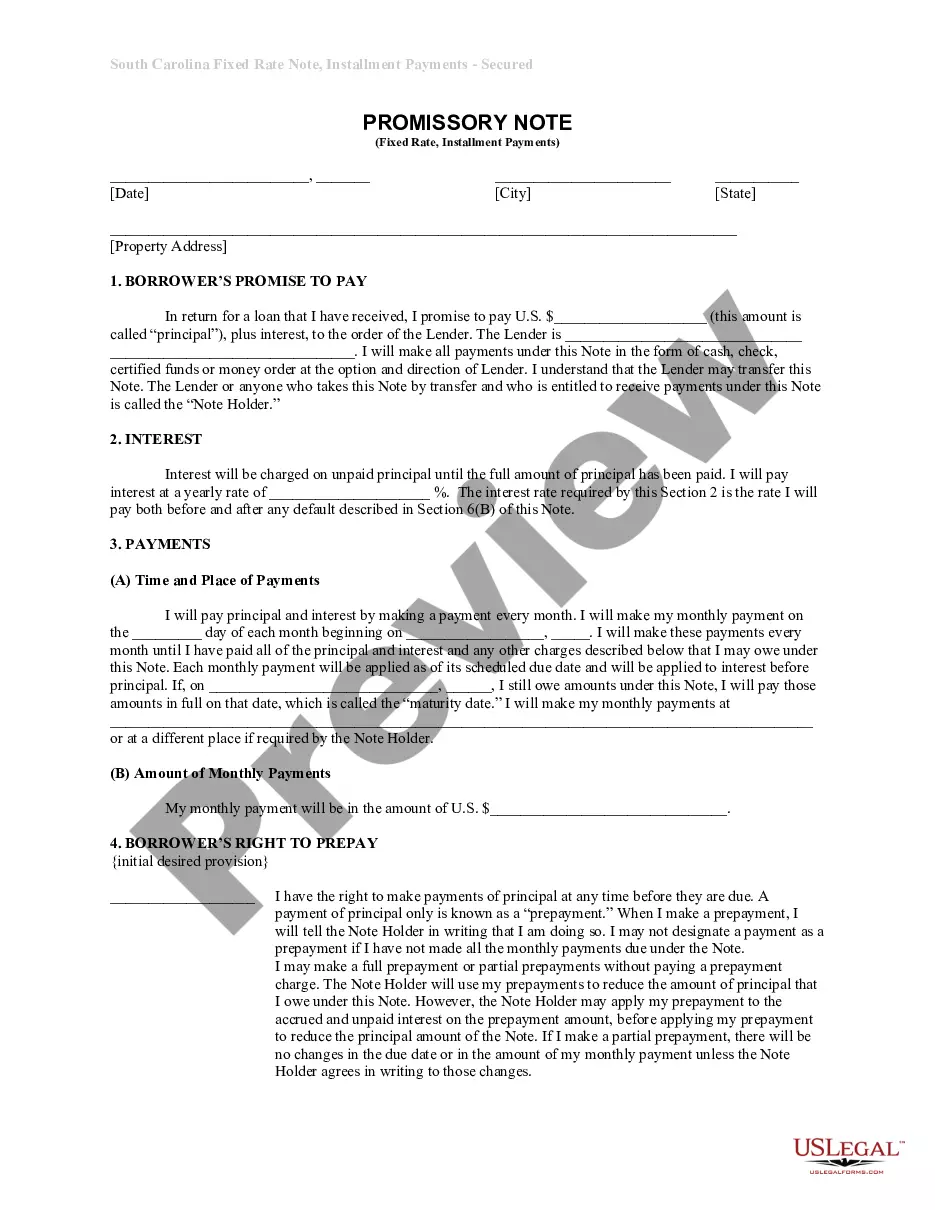

The South Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document in which a borrower promises to repay a specified amount of money, known as the principal, to a lender. This note establishes a fixed interest rate and outlines the conditions for repayment, including installment payments scheduled over time. It is secured against residential real estate, meaning in case of default, the lender has the right to claim the property.

Key components of the form

This form includes several critical components that define the agreement between the borrower and lender. These components are:

- Borrower's Promise to Pay: Details the amount of principal and the obligation to make timely payments.

- Interest Rate: Specifies the annual interest rate charged on the unpaid principal.

- Payment Schedule: Outlines when monthly payments are due, the payment amount, and the total repayment period.

- Borrower’s Right to Prepay: Indicates the conditions under which the borrower may pay off the loan early.

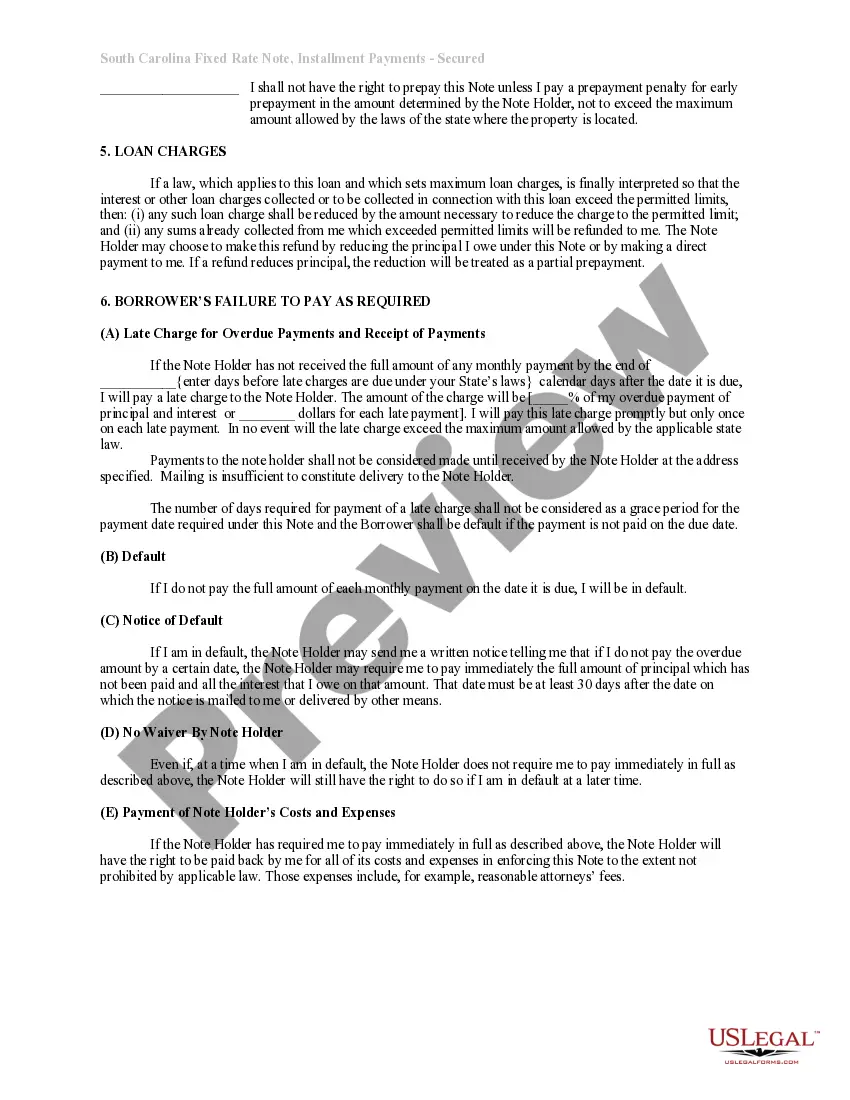

- Default Conditions: Describes what constitutes a default and the consequences thereof.

Who should use this form

This form is suitable for individuals or entities in South Carolina who are borrowing money that is secured by their residential property. It is ideal for homeowners seeking to finance a significant expense or consolidate debt while using their home as collateral. Additionally, lenders who require a formal agreement documenting the terms of the loan should utilize this form to ensure clarity and legal protection.

Common mistakes to avoid when using this form

When completing the South Carolina Installments Fixed Rate Promissory Note, users should be aware of some common pitfalls:

- Incorrect Interest Rate: Ensure that the interest rate is accurately stated and complies with state laws.

- Failure to Specify Payment Schedule: It is crucial to clearly outline the dates and amounts of payments to avoid confusion.

- Omitting Borrower’s Rights: Clearly stating the right to prepay can help avoid disputes in future financial planning.

- Not Notarizing: Depending on local laws, failing to notarize the document can affect its enforceability.

Legal use and context

The South Carolina Installments Fixed Rate Promissory Note is a legally binding document that serves as evidence of a debt obligation. It is primarily used in real estate transactions where a borrower seeks financing secured by residential property. This form is regulated by South Carolina state law, which dictates the terms and conditions under which such notes are valid, including maximum interest rates and disclosure requirements.

How to fill out South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

The work with papers isn't the most uncomplicated job, especially for people who almost never deal with legal papers. That's why we recommend utilizing accurate South Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate templates made by skilled attorneys. It allows you to prevent troubles when in court or dealing with official organizations. Find the samples you want on our site for high-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template web page. After downloading the sample, it will be saved in the My Forms menu.

Users with no an active subscription can easily get an account. Use this simple step-by-step guide to get your South Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate:

- Make certain that the document you found is eligible for use in the state it is needed in.

- Verify the file. Use the Preview feature or read its description (if readily available).

- Click Buy Now if this template is what you need or utilize the Search field to find another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After finishing these easy steps, it is possible to fill out the form in an appropriate editor. Recheck filled in information and consider requesting a legal representative to examine your South Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

No. California promissory notes do not need to be notarized or witnessed for validity.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied. When the loan is paid off, the trustee automatically records a deed of reconveyance at the county recorder's office for safekeeping.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.