South Carolina Contract for Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Carolina Contract For Deed?

Creating papers isn't the most straightforward task, especially for people who rarely deal with legal paperwork. That's why we recommend using correct South Carolina Contract for Deed templates made by professional attorneys. It gives you the ability to stay away from difficulties when in court or dealing with official institutions. Find the files you need on our site for top-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the file webpage. After downloading the sample, it’ll be stored in the My Forms menu.

Users without an activated subscription can quickly create an account. Make use of this short step-by-step guide to get your South Carolina Contract for Deed:

- Be sure that file you found is eligible for use in the state it is necessary in.

- Confirm the file. Make use of the Preview option or read its description (if readily available).

- Buy Now if this template is what you need or utilize the Search field to find another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After doing these straightforward actions, you can fill out the sample in an appropriate editor. Recheck completed data and consider asking a lawyer to examine your South Carolina Contract for Deed for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

Con: Buyer Depends On Seller Unless the seller owns the property outright, he is still making payments to a lending institution. If, for any reason, the seller does not make regular payments, the property can be foreclosed upon, leaving the buyer with a worthless contract and no home.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

The disadvantages are that a preprinted contract may not adequately fit a given A contract for deed allows buyers to purchase a home that's financed by the seller. The seller keeps the deed to the property, and therefore the property's ownership, until the contract is fulfilled.

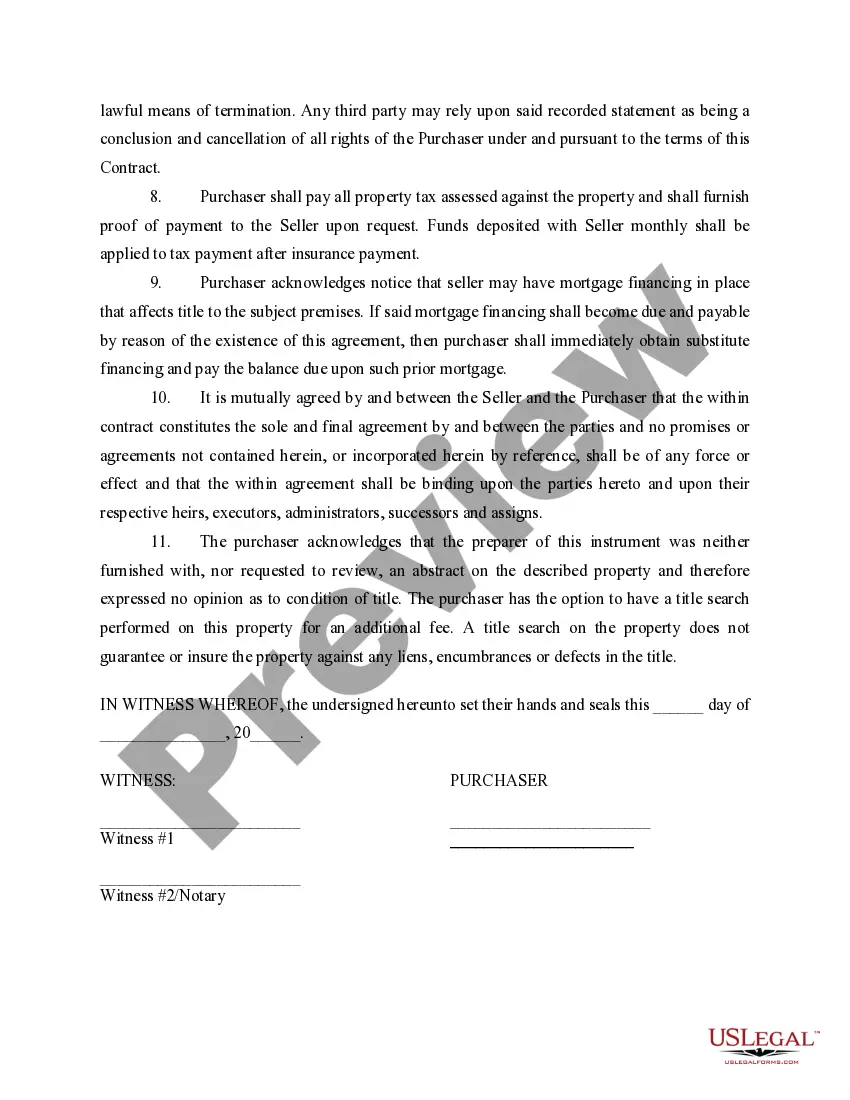

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

Usually the contract requires the buyer to make payments over time with interest payable on the unpaid balance. Once a buyer pays all of the payments called for under the contract, the owner transfers to the buyer a deed to the property.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

Loss of Service Control. A major disadvantage of contract management is that the organization gives up a considerable amount of control over the services that will be provided to customers. Potential Time Delays. Loss of Business Flexibility. Loss of Product Quality. Compliance and Legal Issues.

A seller using a contract for deed doesn?t have that option, unless you agree to include that clause in your contract. Other benefits include: no loan qualifying, low or flexible down payment, favorable interest rates and flexible terms, and a quicker settlement.