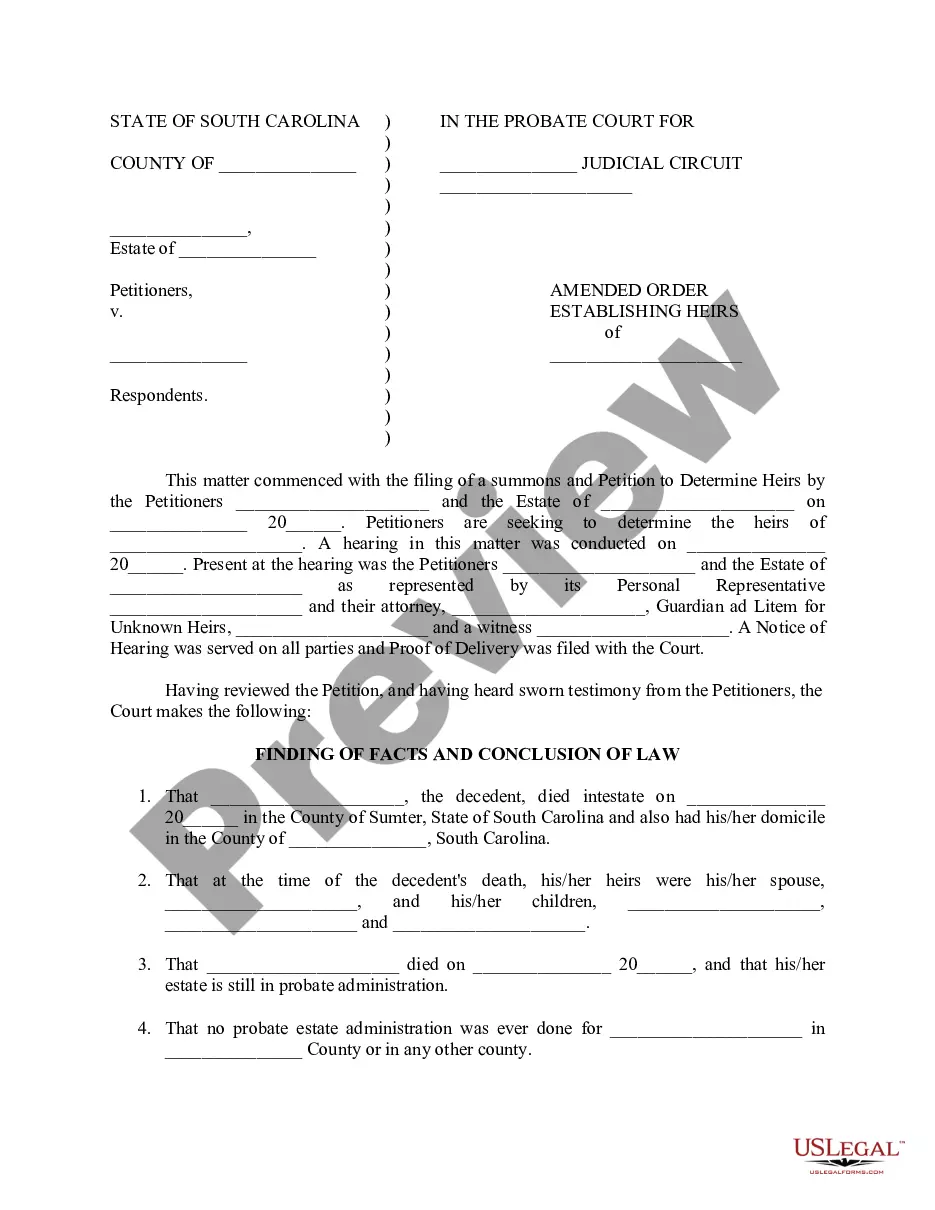

South Carolina Amended Order Establishing Heirs

Description

Get your form ready online

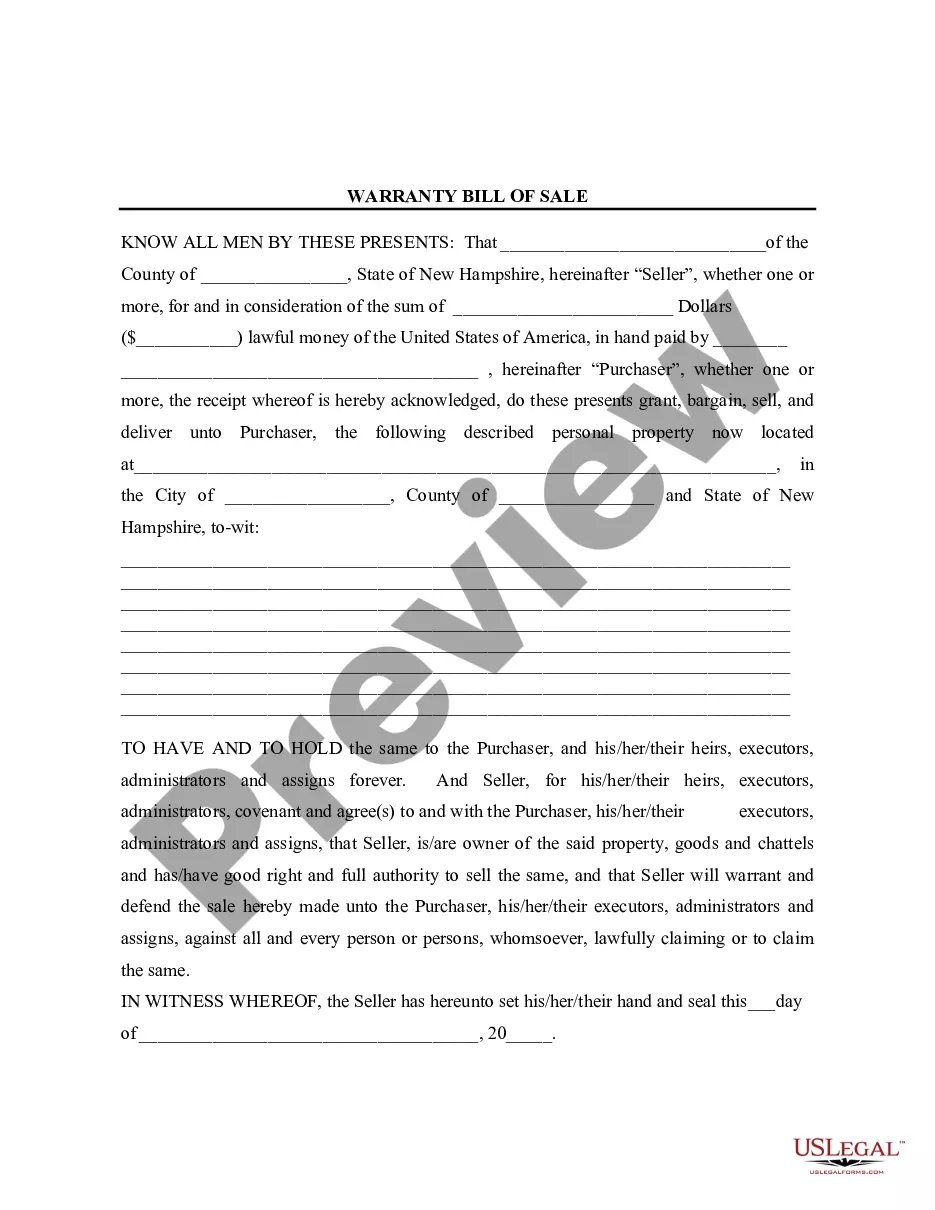

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

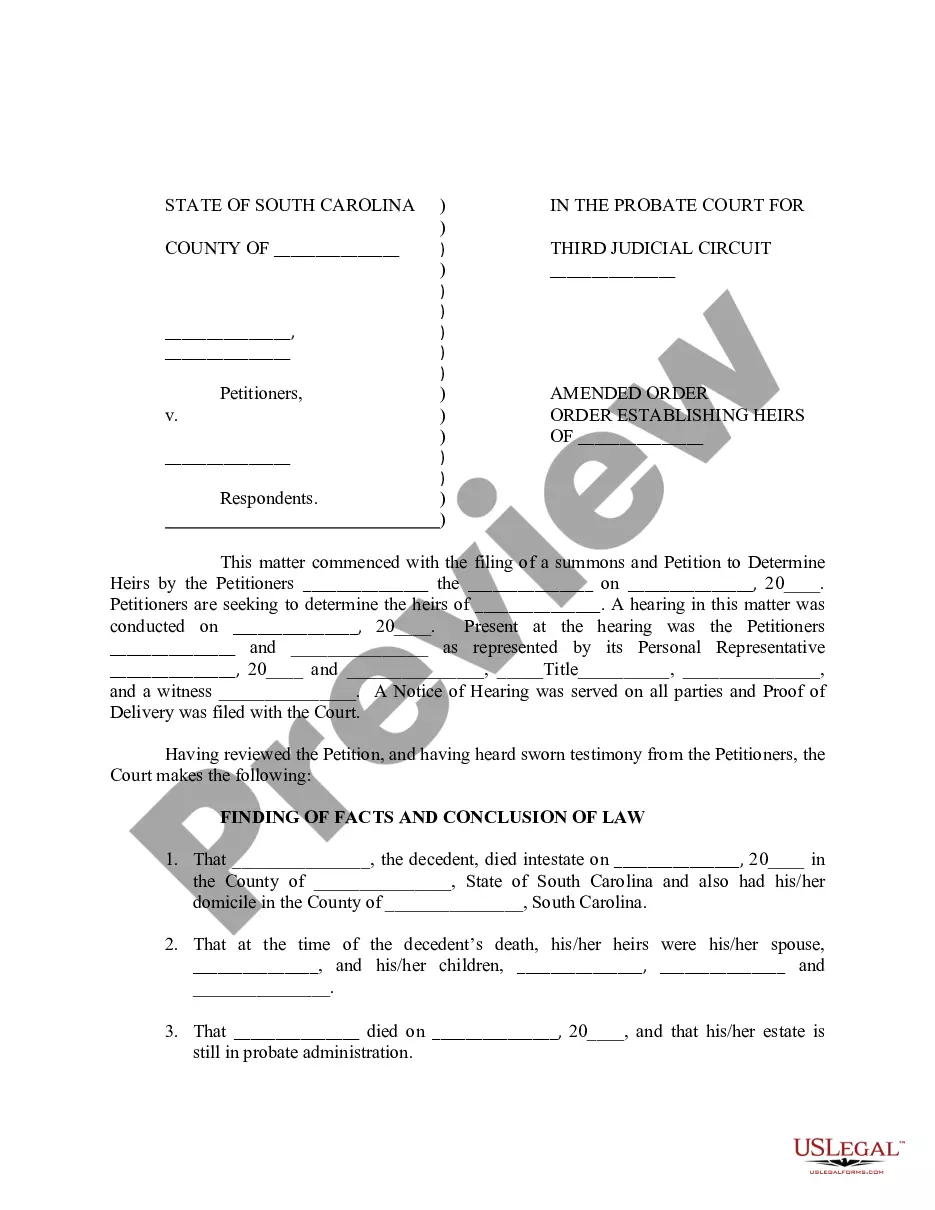

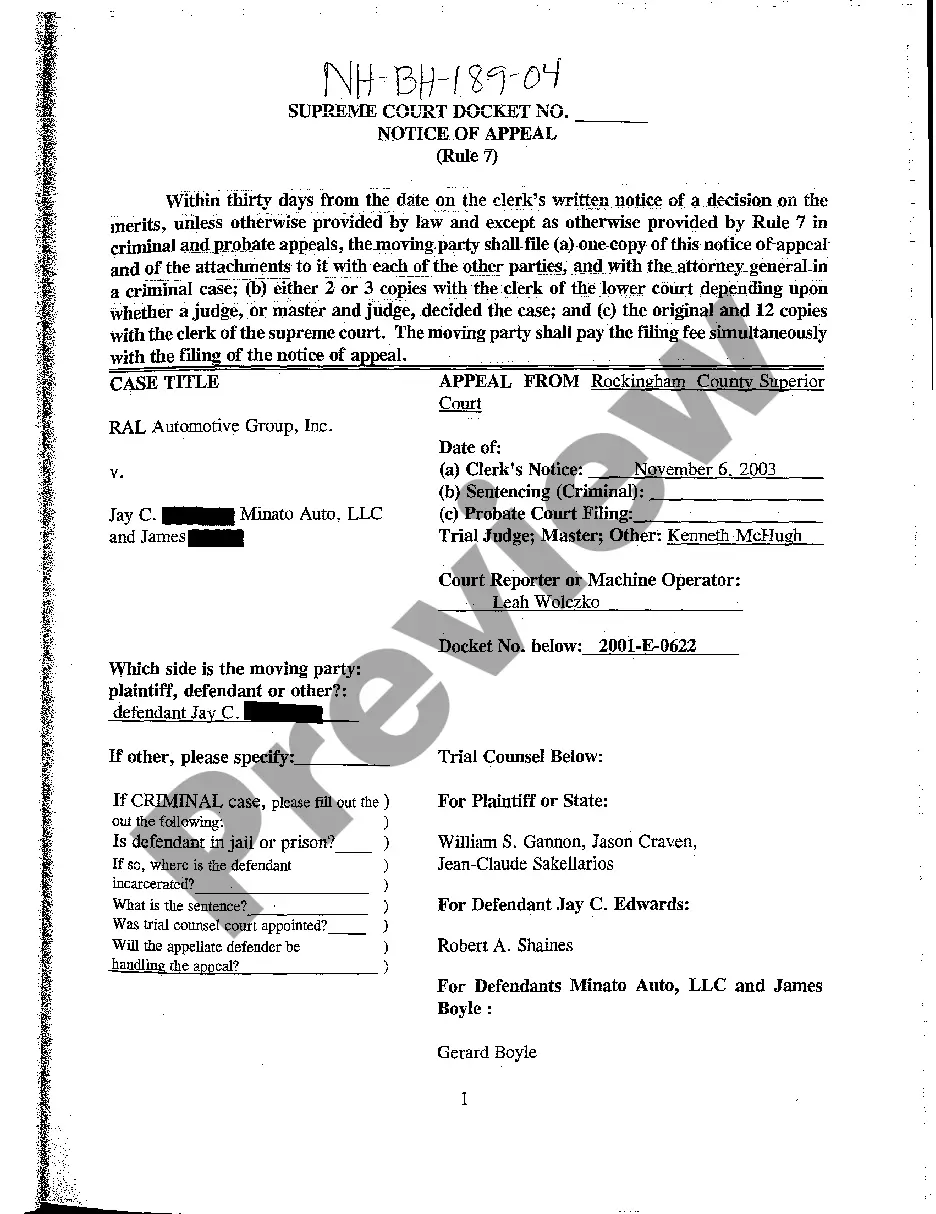

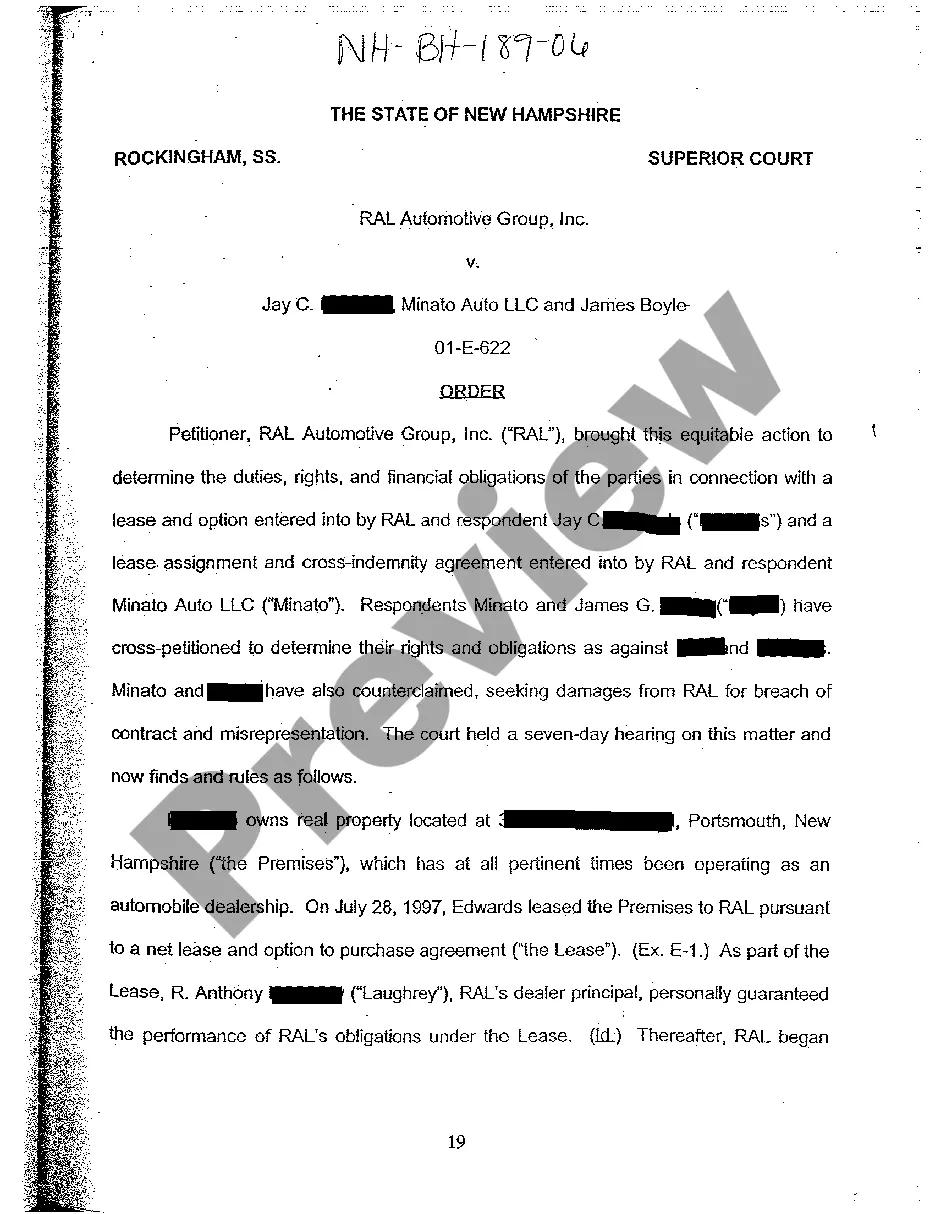

How to fill out South Carolina Amended Order Establishing Heirs?

The work with documents isn't the most straightforward task, especially for people who almost never work with legal paperwork. That's why we advise using accurate South Carolina Amended Order Establishing Heirs templates made by skilled lawyers. It gives you the ability to avoid difficulties when in court or working with formal institutions. Find the samples you need on our site for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will immediately appear on the template webpage. Right after getting the sample, it will be stored in the My Forms menu.

Users without an active subscription can easily create an account. Use this brief step-by-step help guide to get the South Carolina Amended Order Establishing Heirs:

- Be sure that file you found is eligible for use in the state it’s necessary in.

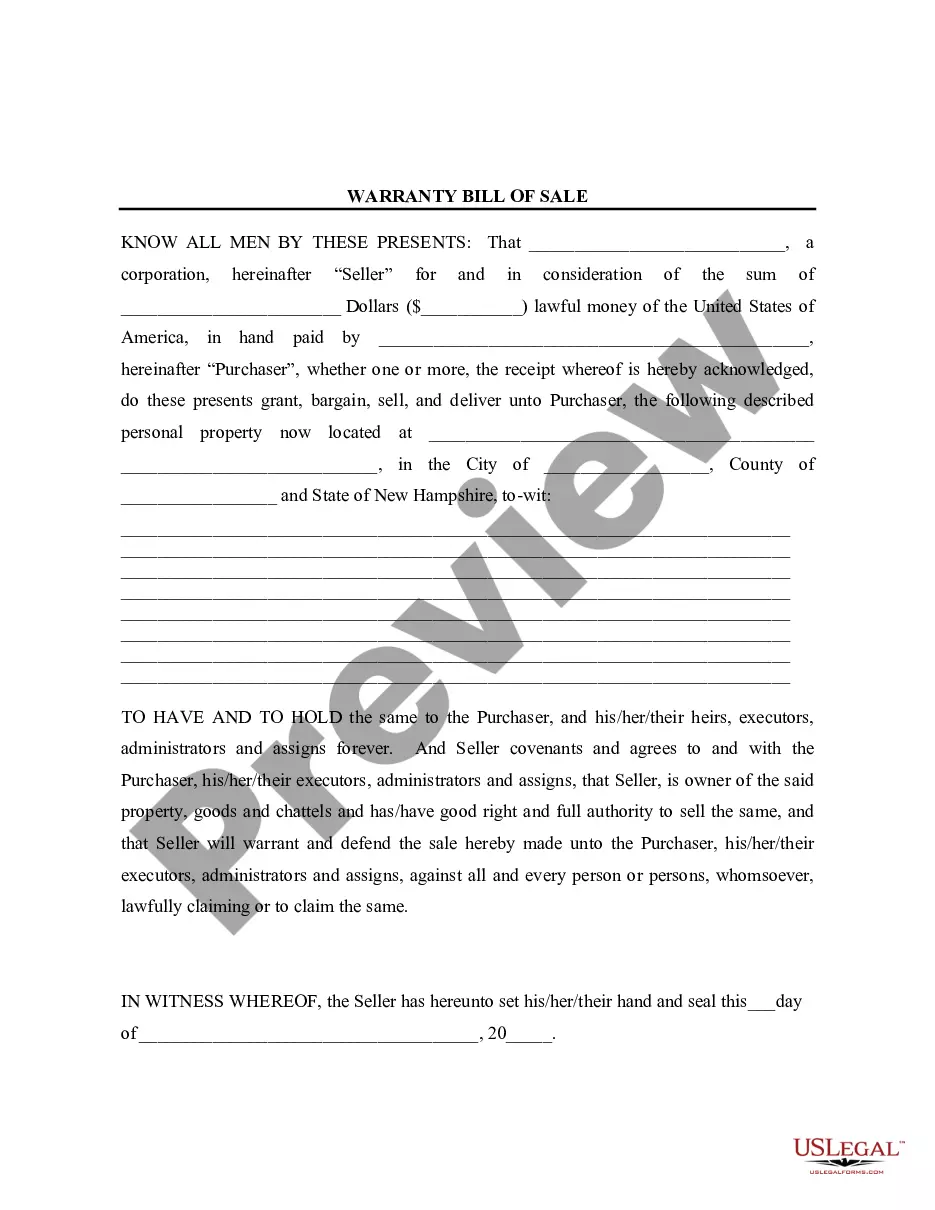

- Confirm the file. Utilize the Preview feature or read its description (if readily available).

- Click Buy Now if this sample is what you need or utilize the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these easy steps, you can complete the sample in an appropriate editor. Recheck filled in details and consider requesting a lawyer to examine your South Carolina Amended Order Establishing Heirs for correctness. With US Legal Forms, everything gets much simpler. Test it now!

Form popularity

FAQ

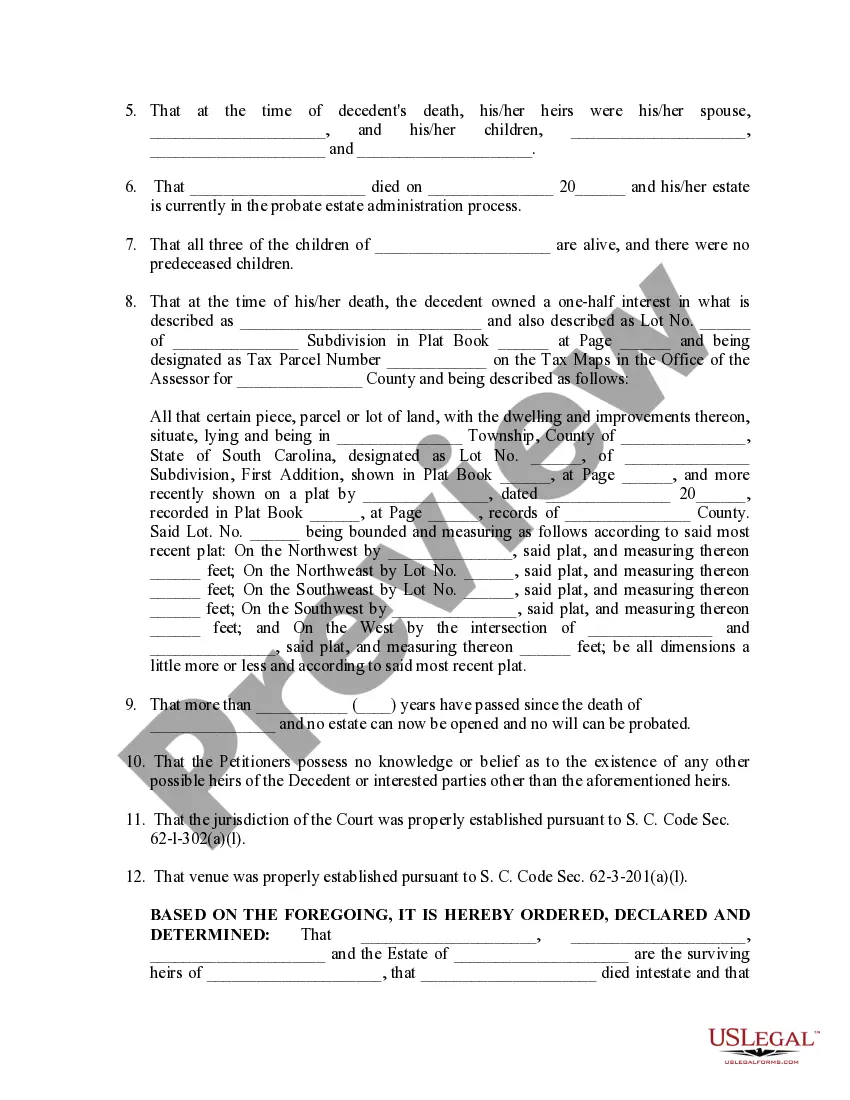

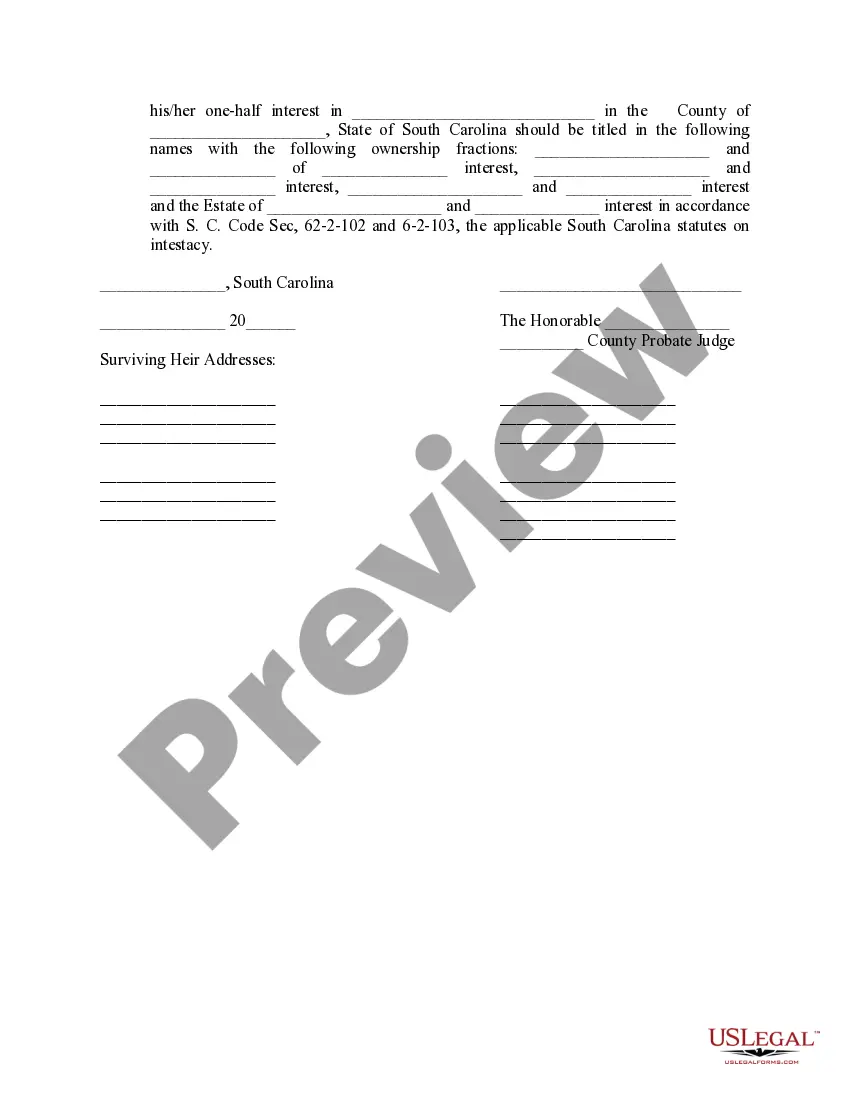

In most cases, a deceased person's heirs-at-law are determined by the intestacy laws of the state in which she lived at the time of her death. But the intestacy laws of another state might apply if she owned real estate or tangible personal property there.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

As an heir, you are entitled to a copy of the Will, whether you are named as a beneficiary or not. If there is a probate estate, then you should receive a copy of the Will. If you do not, you can always get it from the court. If there is no probate estate, then the Will is not going to do anything.

Heirs who inherit property are typically children, descendants, or other close relatives of the decedent. Spouses typically are not legally considered to be heirs, as they are instead entitled to properties via marital or community property laws.

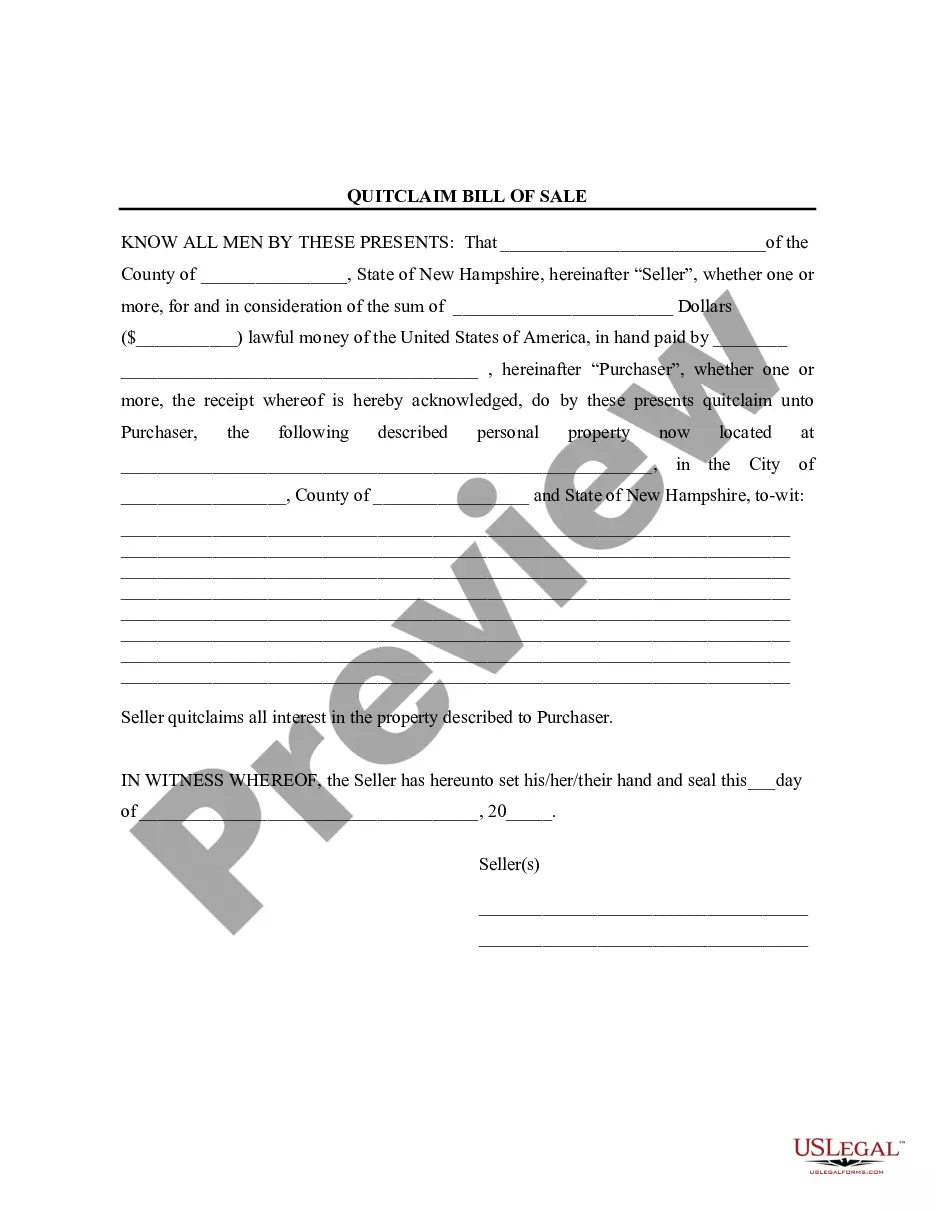

Quitclaim Deed. A quitclaim deed transfers an owner's interest in real property whatever that interest may be to the buyer. Forced Sale. Tax Sale. Suit to Quiet Title. Transfer by Agreement.