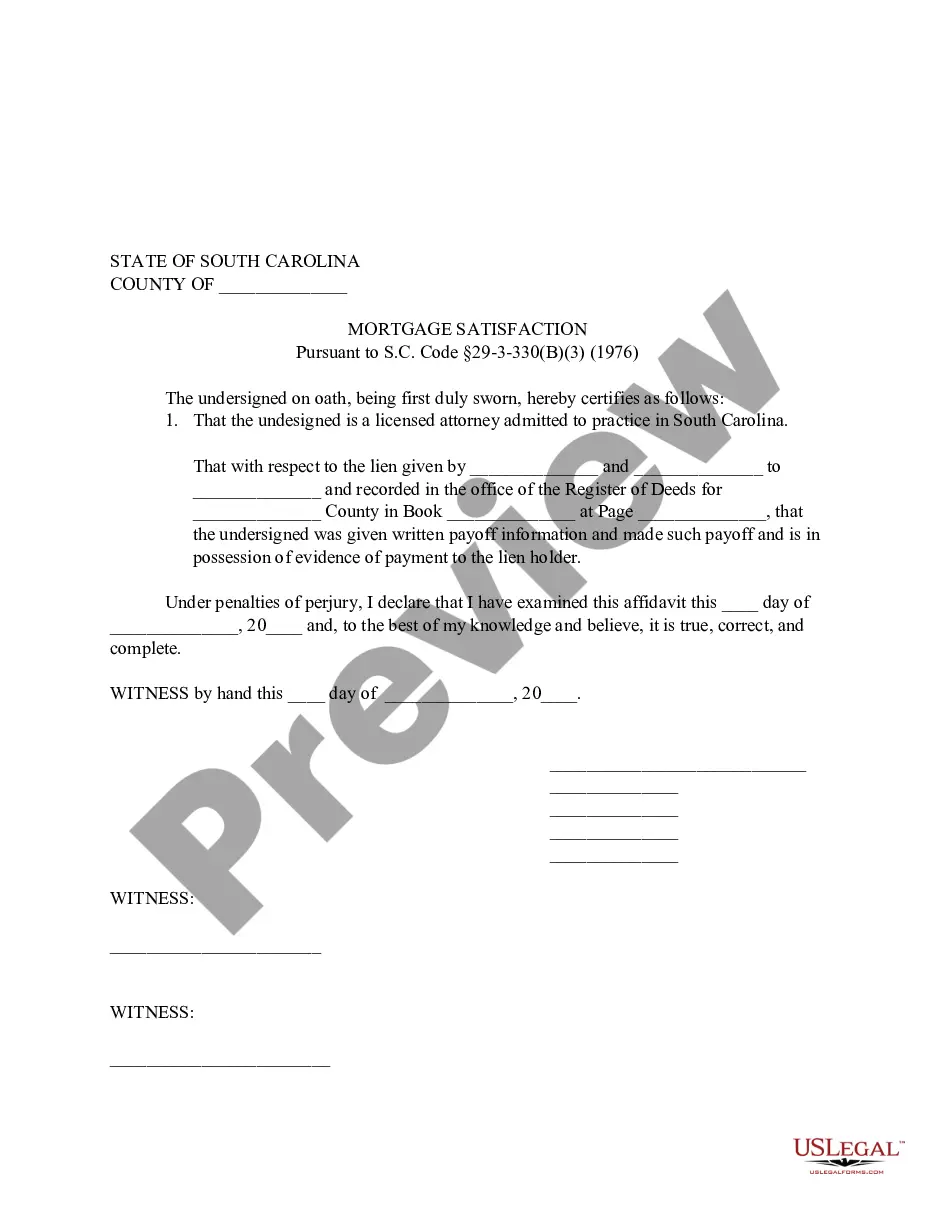

South Carolina Mortgage Satisfaction

Description

How to fill out South Carolina Mortgage Satisfaction?

The work with papers isn't the most simple job, especially for people who almost never work with legal paperwork. That's why we advise making use of correct South Carolina Mortgage Satisfaction samples made by skilled lawyers. It gives you the ability to eliminate difficulties when in court or handling official institutions. Find the samples you need on our site for top-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will automatically appear on the template webpage. Soon after getting the sample, it’ll be stored in the My Forms menu.

Customers without an activated subscription can quickly create an account. Use this simple step-by-step guide to get the South Carolina Mortgage Satisfaction:

- Be sure that the form you found is eligible for use in the state it is needed in.

- Verify the file. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this template is the thing you need or utilize the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after doing these simple actions, you can fill out the form in a preferred editor. Check the filled in data and consider requesting an attorney to examine your South Carolina Mortgage Satisfaction for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

A deed conveys ownership; a deed of trust secures a loan.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

Deed: This is the document that proves ownership of a property. It transfers ownership of the property to the grantee, also known as the buyer.Mortgage: This is the document that gives the lender a security interest in the property until the Note is paid in full.

South Carolina is a race-notice jurisdiction. In 1958 the recording statute was amended to require a subsequent lien creditor without notice to file the instrument evidencing his lien in order to claim under the statute.

A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

The following states use Deed of Trusts: Alaska, Arizona, California, District of Columbia, Georgia, Mississippi, Missouri, Nevada, North Carolina, and Virginia.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.