South Carolina Renunciation And Disclaimer of Property received by Intestate Succession

Overview of this form

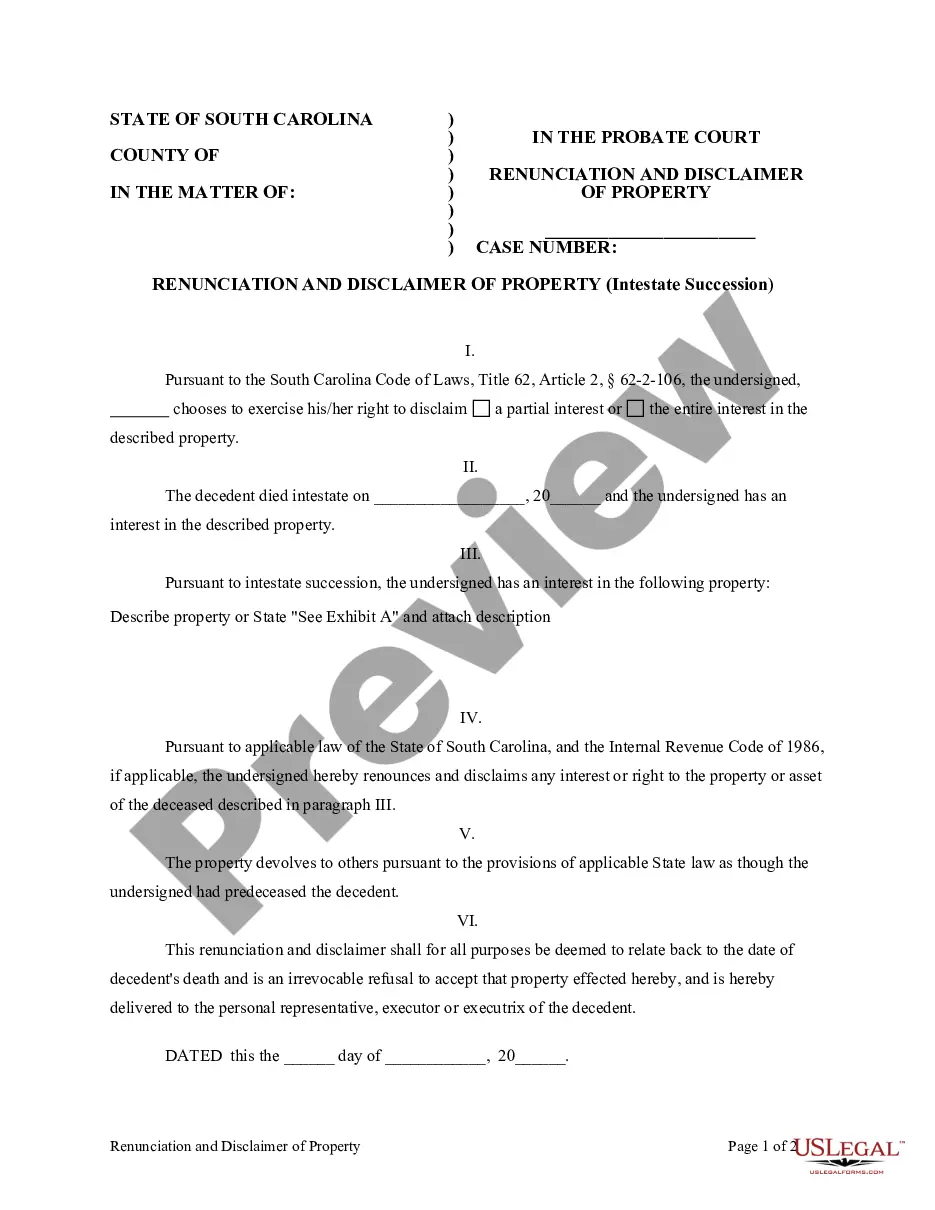

The Renunciation and Disclaimer of Property received by Intestate Succession is a legal document that allows a beneficiary to refuse or disclaim an interest in property inherited from a deceased individual who did not leave a valid will. This form is particularly relevant under South Carolina law, where such disclaimers relate back to the decedent's death, effectively treating the disclaimer as if the beneficiary predeceased the decedent. It differs from other inheritance forms as it signifies an intentional refusal to accept property rights.

What’s included in this form

- Decedent's details, including date of death

- Description of the property being disclaimed

- Statement of renunciation and disclaimer of interest

- Legal implications of the disclaimer under South Carolina law

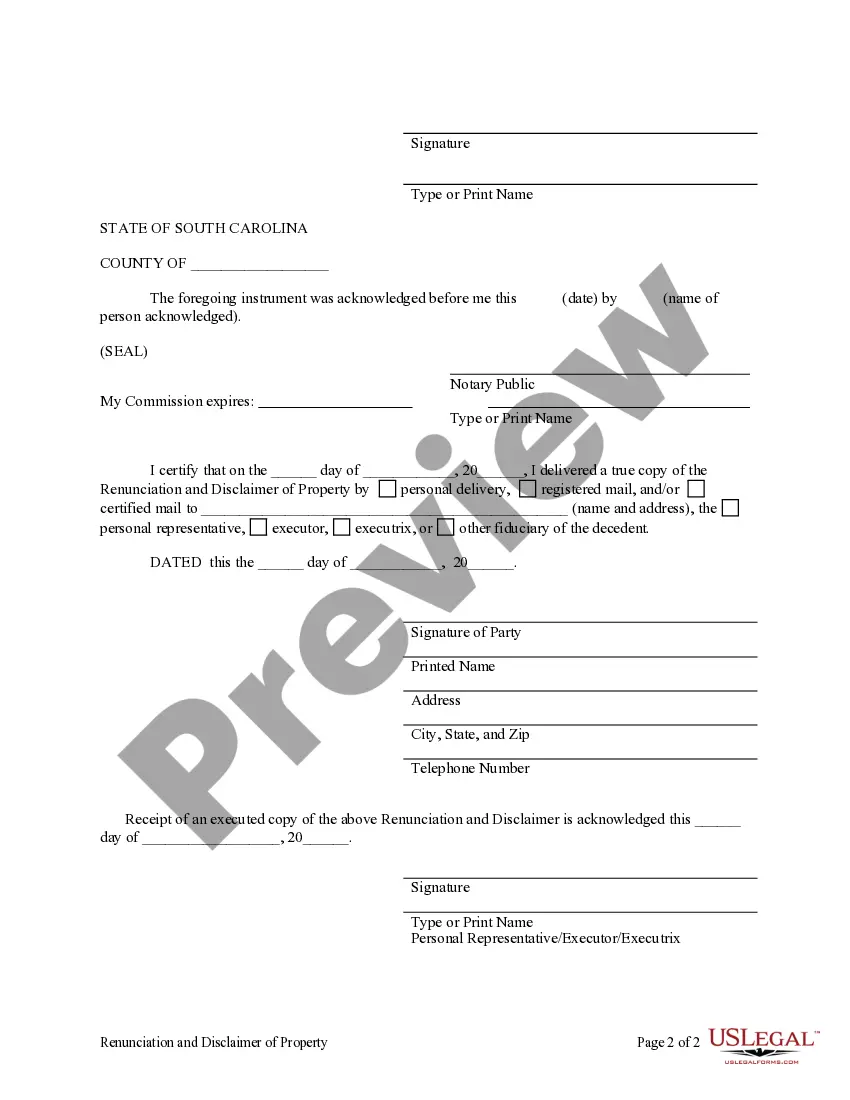

- Acknowledgment and certificate of delivery for the document

Jurisdiction-specific notes

This form aligns with the requirements set forth in the South Carolina Code of Laws, Title 62, Article 2, detailing the process for disclaiming interests in property following intestate succession.

Situations where this form applies

This form should be used when a beneficiary of an estate, who has received property through intestate succession, decides not to accept their inheritance. Common scenarios include situations where accepting the property may lead to tax liabilities, debts attached to the property, or when the beneficiary wishes to pass the inheritance onto other heirs.

Who can use this document

- Beneficiaries of an intestate estate in South Carolina

- Individuals seeking to avoid tax implications associated with inherited property

- Those who no longer wish to take responsibility for inherited assets or liabilities

Instructions for completing this form

- Enter the date of the decedent's death.

- Specify the property being renounced, referring to Exhibit A if necessary.

- State your intention to disclaim the property following South Carolina law.

- Sign and date the form to validate your disclaimer.

- Ensure that a certificate of delivery is included for verification purposes.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Avoid these common issues

- Failing to describe the property accurately.

- Not signing and dating the form correctly.

- Neglecting to attach necessary exhibits with property descriptions.

- Assuming that verbal disclaimers are sufficient; a written form is required.

Benefits of using this form online

- Convenient downloadable format allowing for immediate access.

- Editability ensures you can customize the form to meet your specific needs.

- Reliability from professionally drafted templates by licensed attorneys.

Key takeaways

- The form allows you to renounce an interest in inherited property under South Carolina law.

- Completing the form correctly is crucial to avoid legal complications.

- Be aware of the tax implications that may result from accepting an inheritance.

Form popularity

FAQ

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Disclaim Inheritance, DefinitionDisclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

Dying without a will is called intestacy, and each state has its own intestacy law.South Carolina's intestacy law says that if you die without a Will and have children and a spouse, your spouse will receive one-half of your intestate estate and your children will receive the other half.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

In South Carolina, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

If someone dies without a will, the money in his or her bank account will still pass to the named beneficiary or POD for the account.The executor has to use the funds in the account to pay any of the estate's creditors and then distributes the money according to local inheritance laws.