This office lease guaranty states that the guarantor unconditionally guarantees to the landlord the full and timely performance and observance of all of the terms, covenants, and conditions of the lease.

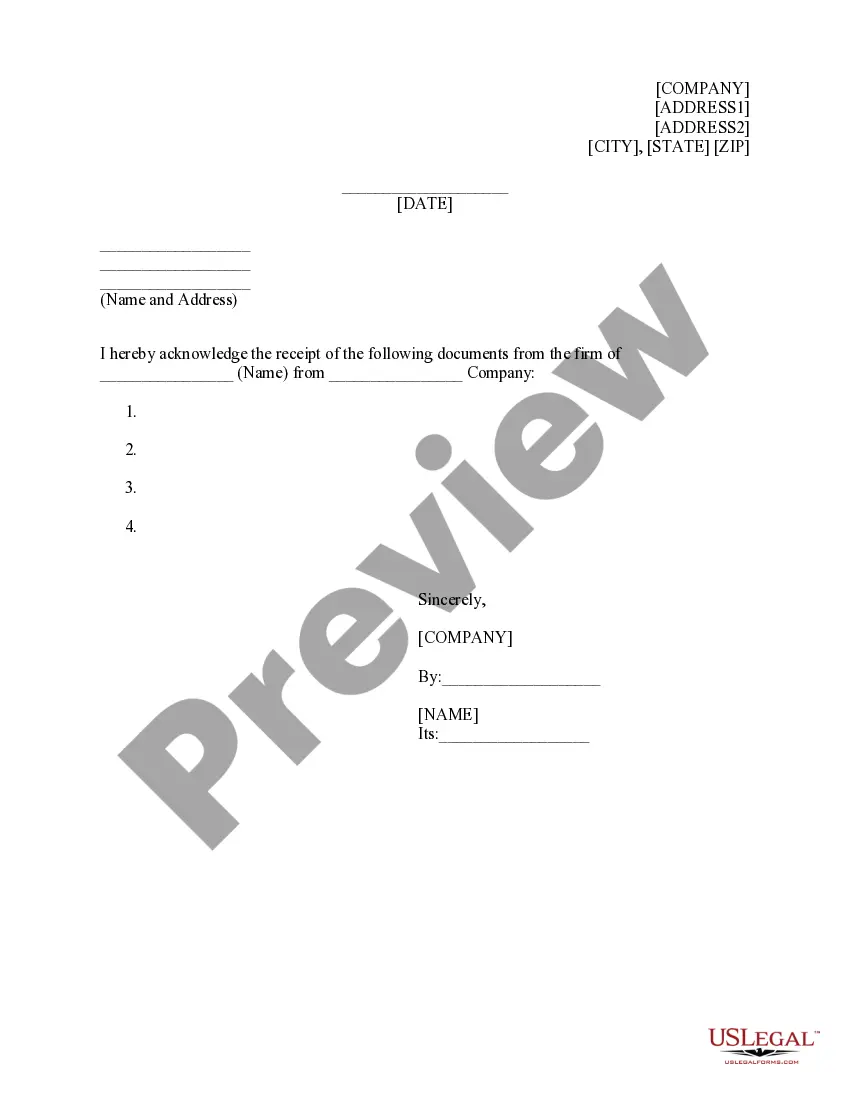

Rhode Island Full Guaranty

Description

How to fill out Full Guaranty?

Choosing the right authorized file template can be quite a struggle. Naturally, there are a variety of layouts available on the net, but how will you obtain the authorized type you need? Take advantage of the US Legal Forms internet site. The assistance delivers 1000s of layouts, such as the Rhode Island Full Guaranty, that can be used for organization and private requirements. Every one of the varieties are checked by professionals and meet state and federal requirements.

When you are presently listed, log in for your accounts and click the Download switch to have the Rhode Island Full Guaranty. Make use of your accounts to search with the authorized varieties you might have acquired earlier. Check out the My Forms tab of your respective accounts and have another duplicate in the file you need.

When you are a new user of US Legal Forms, listed here are simple guidelines for you to stick to:

- Initially, be sure you have chosen the correct type for your area/state. You are able to check out the form using the Review switch and study the form explanation to make certain this is basically the best for you.

- In the event the type is not going to meet your needs, make use of the Seach field to get the correct type.

- When you are sure that the form is suitable, click the Acquire now switch to have the type.

- Pick the rates program you would like and type in the essential details. Make your accounts and pay money for an order utilizing your PayPal accounts or Visa or Mastercard.

- Select the submit formatting and obtain the authorized file template for your device.

- Full, revise and print out and indicator the received Rhode Island Full Guaranty.

US Legal Forms is definitely the biggest local library of authorized varieties that you can find a variety of file layouts. Take advantage of the company to obtain skillfully-manufactured files that stick to condition requirements.

Form popularity

FAQ

What is the difference between state guaranty associations and FDIC insurance? The FDIC is an independent federal agency that provides deposit insurance for bank deposits. State guaranty associations are nonprofit organizations that operate at the state level to protect insurance policyholders.

A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.

Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

The maximum total amount the Guarantee Association will provide for any one individual for life insurance and annuity coverage is $300,000, even if that individual is covered by multiple life insurance policies and annuities.

The health insurance protection for which the Guarantee Association may become liable shall be the contractual obligations for which the insurer is liable or would have been liable if it were not an insolvent insurer, up to a maximum benefit of $200,000.

As a basic example, if you have an annuity providing for $300,000 in present value of annuity benefits and the benefit level in your state is $250,000, you are limited to $250,000 in benefits from your state's guaranty association. The remaining $50,000 may become a claim against the estate of the insolvent company.

Although there is no maximum for workers compensation claims, the maximum amount WAGA can pay on other claims is $300,000. You may file a claim against the assets of the insurance company estate for amounts over that cap that are still within the limits of the applicable policy.

The maximum total amount the Guarantee Association will provide for any one individual for life insurance and annuity coverage is $300,000, even if that individual is covered by multiple life insurance policies and annuities. Is my claim against the insolvent insurer affected by the Guarantee Association? Yes.