Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

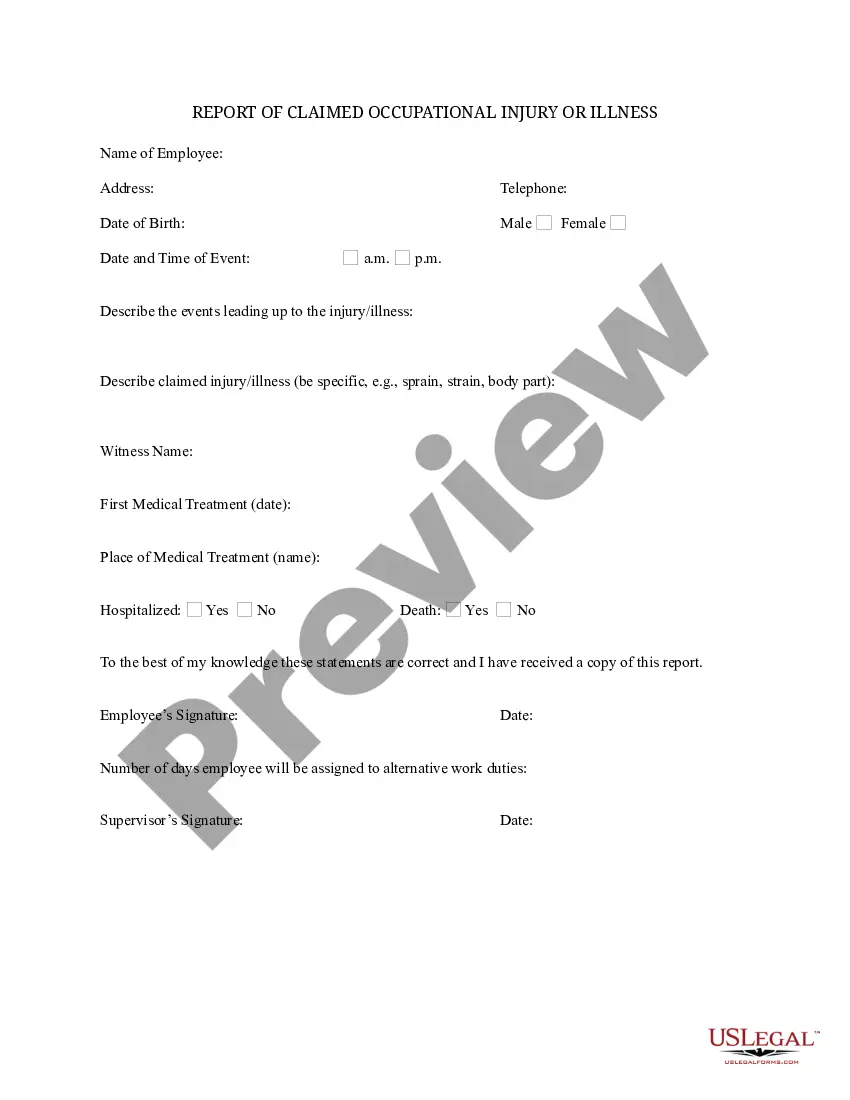

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

You might dedicate countless hours online trying to discover the legal document format that meets the local and national regulations you require.

US Legal Forms offers thousands of legal templates that are reviewed by professionals.

You can download or print the Rhode Island Personal Guaranty - Assurance of Contract for the Lease and Acquisition of Real Property from our services.

Select the pricing plan you prefer, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of your document and download it to your device. Make adjustments to the document if possible. You may complete, modify, sign, and print the Rhode Island Personal Guaranty - Assurance of Contract for the Lease and Acquisition of Real Property. Access and print thousands of document templates using the US Legal Forms website, which provides the widest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and hit the Obtain button.

- After that, you can complete, modify, print, or sign the Rhode Island Personal Guaranty - Assurance of Contract for the Lease and Acquisition of Real Property.

- Every legal document format you purchase is yours for a long time.

- To obtain another copy of any purchased form, click the My documents tab and select the related button.

- If it's your first time using the US Legal Forms site, follow the straightforward instructions below.

- First, ensure you've selected the correct document format for your area/region of choice.

- Review the form description to confirm you've chosen the right document.

- If available, use the Review button to browse through the document format as well.

- If you wish to find another version of the form, utilize the Lookup field to discover the format that meets your needs and requirements.

- Once you have identified the format you want, click Purchase now to proceed.

Form popularity

FAQ

A lease is a legal agreement between a property owner and a tenant, outlining the terms under which the tenant can use the property. In contrast, a guaranty supports that lease by adding a personal guarantee, ensuring that obligations, like rent payments, will be met by a third party if the tenant fails to do so. Understanding this distinction is vital for anyone navigating the Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

A personal guarantee form is a legal document that an individual completes to affirm their commitment to support a contract's obligations. It outlines the responsibilities that the guarantor will undertake, ensuring creditors that they will cover debts in the event of default. This form is essential when dealing with the Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, as it adds an extra layer of security for all parties involved.

A personal guarantee on a contract is a financial commitment made by an individual to ensure the fulfillment of another party's contractual obligations. This is particularly relevant in the context of a Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, where the guarantor agrees to cover costs if the primary party defaults. It provides a layer of security for the other party, making it a common element in lease and purchase agreements.

The enforceability of a personal guarantee largely depends on how well it is drafted and its compliance with state laws. In Rhode Island, personal guaranties are generally enforceable, provided they meet legal standards and are signed by the guarantor. To ensure that your personal guarantee holds up in court, consider consulting with uslegalforms to create a solid agreement reflecting the Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Creating a personal guarantee involves drafting a legal document that outlines the obligations of the guarantor and the specifics of the underlying contract. To ensure its validity, include essential details such as the parties involved, the exact terms of the guarantee, and the specific obligations it covers in relation to the Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. Engaging with legal forms available on platforms like uslegalforms can simplify this process and help protect your interests.

A guarantee is a general commitment to fulfill a contract or obligation should the primary party fail to do so. In contrast, a personal guaranty specifically involves an individual who agrees to take responsibility for someone's financial obligations, particularly in situations like the Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. This means the personal guarantor’s assets may be at risk if the obligation is not met, offering an additional layer of security for landlords or lenders.

To fill out a personal guarantee, start by writing your personal details, including your full name and contact information. Clearly express your commitment to guarantee the lease and include specific terms outlined in the lease agreement. For precision, consider using uslegalforms, as they offer templates tailored to the Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

For a guarantee to be legally enforceable, it must contain clear terms, be signed by the guarantor, and ideally be in writing. The agreement should identify the parties involved and specify the obligations being guaranteed. Understanding the legal framework surrounding the Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can strengthen the enforceability of such agreements.

Filling out a personal guaranty involves providing your personal information and clearly stating that you intend to guarantee the lease obligations. You must accurately reflect the terms outlined in the main lease agreement. For assistance, you can utilize platforms like uslegalforms to ensure your documents meet the requirements of Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Generally, a personal guarantee does not need to be notarized to be legally valid, but notarization can provide an additional layer of security and authenticity. It’s prudent to consult legal practices specific to the Rhode Island Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, as different states may have varied requirements. Always consider getting legal advice if you're unsure about the necessity of notarization.