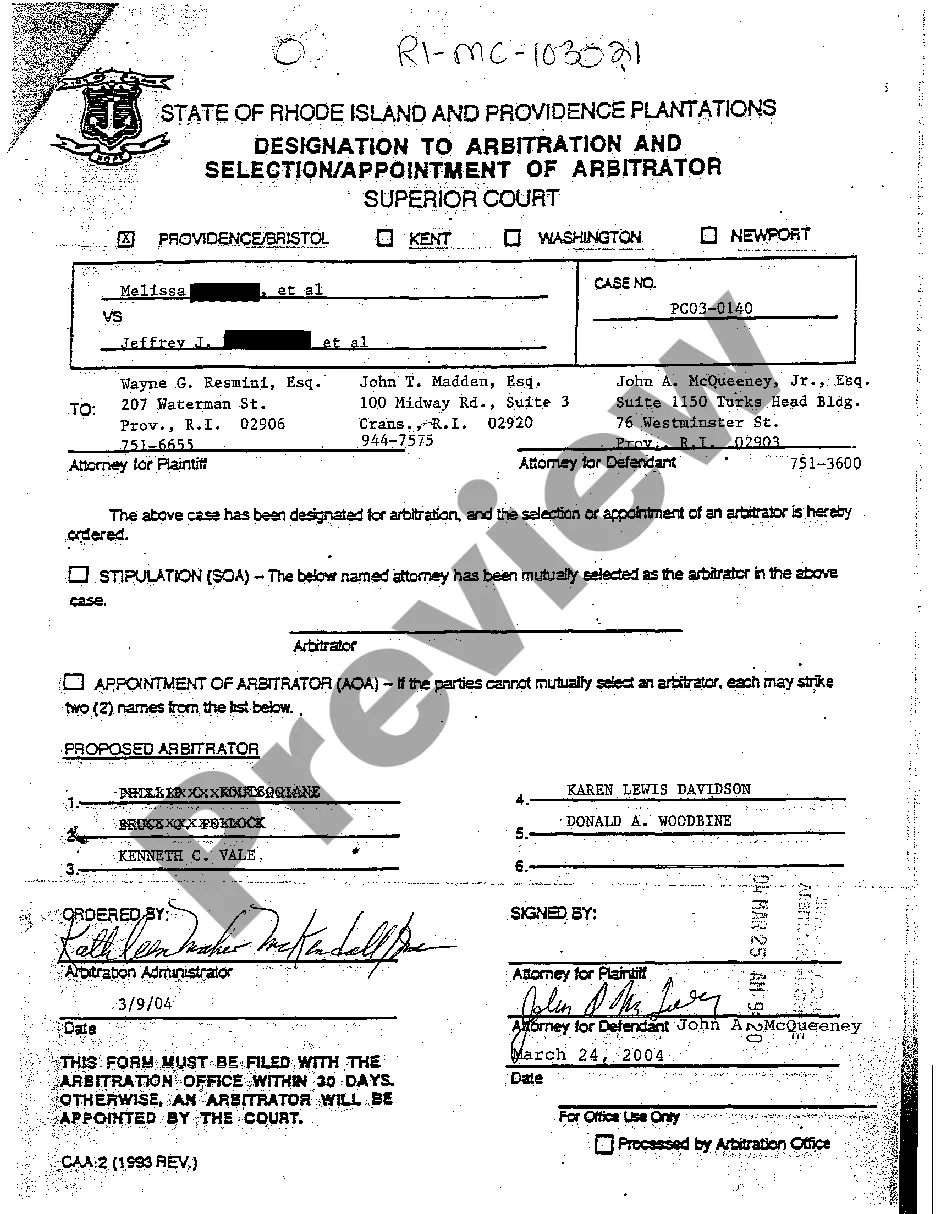

This office lease form describes the language to be used by a landlord seeking to charge the tenant for operating and maintaining the garage without offsetting the expense with income.

Rhode Island Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income

Description

How to fill out Language Charging For Operating And Maintenance Of A Garage Without Offsetting The Expense With Income?

Are you currently in the position that you need documents for both business or individual purposes virtually every day time? There are a variety of lawful record templates available on the Internet, but discovering kinds you can trust isn`t effortless. US Legal Forms provides a huge number of kind templates, like the Rhode Island Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income, that happen to be created to meet federal and state requirements.

Should you be previously acquainted with US Legal Forms internet site and possess a merchant account, just log in. Next, it is possible to download the Rhode Island Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income template.

If you do not provide an account and need to start using US Legal Forms, follow these steps:

- Obtain the kind you require and make sure it is for your proper city/area.

- Take advantage of the Preview option to check the shape.

- Look at the outline to ensure that you have chosen the correct kind.

- If the kind isn`t what you`re looking for, take advantage of the Research discipline to get the kind that fits your needs and requirements.

- When you obtain the proper kind, click on Purchase now.

- Select the rates program you want, complete the desired information to create your bank account, and purchase the transaction utilizing your PayPal or bank card.

- Choose a hassle-free file structure and download your version.

Find each of the record templates you might have purchased in the My Forms menus. You can obtain a additional version of Rhode Island Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income whenever, if necessary. Just go through the essential kind to download or print the record template.

Use US Legal Forms, the most extensive assortment of lawful varieties, in order to save time and prevent blunders. The support provides skillfully made lawful record templates which you can use for a range of purposes. Produce a merchant account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

The Bureau of Indian Affairs may carry out the operation of Indian programs by direct expenditure, contracts, cooperative agreements, compacts and grants, either directly or in cooperation with States and other organizations. Public Law 108-7 - U.S. Department of the Interior doi.gov ? sites ? doi.gov ? files doi.gov ? sites ? doi.gov ? files

Public Law 107-67, Sec. 630, permits Federal agencies, at their discretion, to use appropriated funds normally available for salaries to assist their lower income employees with child care costs. Department X has chosen to establish this program for its lower income employees.

For example, both the War in Afghanistan and the Iraq War were funded with a variety of supplemental appropriations. Supplemental appropriations bills also provide funding for recovering from unexpected natural disasters like Hurricane Sandy (the Disaster Relief Appropriations Act, 2013).

Appropriation: A law of Congress that provides an agency with budget authority. An appropriation allows the agency to incur obligations and to make payments from the U.S. Treasury for specified purposes. Appropriations are definite (a specific sum of money) or indefinite (an amount for "such sums as may be necessary").

An act to authorize appropriations for fiscal year 2005 for military activities of the Department of Defense, for military construction, and for defense activities of the Department of Energy, to prescribe personnel strengths for such fiscal year for the Armed Forces, and for other purposes.

Service revenue is the income a company generates from providing a service. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a company's total revenue during a specific time period. Is Service Revenue an Asset? Breaking down the Income Statement freshbooks.com ? hub ? accounting ? is-ser... freshbooks.com ? hub ? accounting ? is-ser...