Rhode Island Declaration of Dissolution of Unit

Description

How to fill out Declaration Of Dissolution Of Unit?

Have you been in a position the place you require files for sometimes organization or specific purposes almost every working day? There are tons of legitimate papers themes available on the Internet, but locating ones you can rely isn`t simple. US Legal Forms provides a large number of type themes, much like the Rhode Island Declaration of Dissolution of Unit, that happen to be written in order to meet state and federal needs.

In case you are previously familiar with US Legal Forms site and also have a merchant account, merely log in. After that, you may obtain the Rhode Island Declaration of Dissolution of Unit format.

Should you not offer an account and wish to begin using US Legal Forms, adopt these measures:

- Obtain the type you will need and ensure it is for the proper metropolis/area.

- Utilize the Review key to analyze the form.

- Browse the outline to actually have chosen the right type.

- If the type isn`t what you are looking for, take advantage of the Research industry to find the type that meets your requirements and needs.

- Whenever you find the proper type, click on Acquire now.

- Opt for the prices prepare you want, fill in the desired details to create your money, and pay for your order with your PayPal or Visa or Mastercard.

- Choose a convenient document structure and obtain your copy.

Locate each of the papers themes you have bought in the My Forms menu. You can get a additional copy of Rhode Island Declaration of Dissolution of Unit any time, if required. Just click the essential type to obtain or print the papers format.

Use US Legal Forms, probably the most considerable collection of legitimate varieties, in order to save efforts and steer clear of blunders. The service provides skillfully made legitimate papers themes which can be used for a selection of purposes. Make a merchant account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

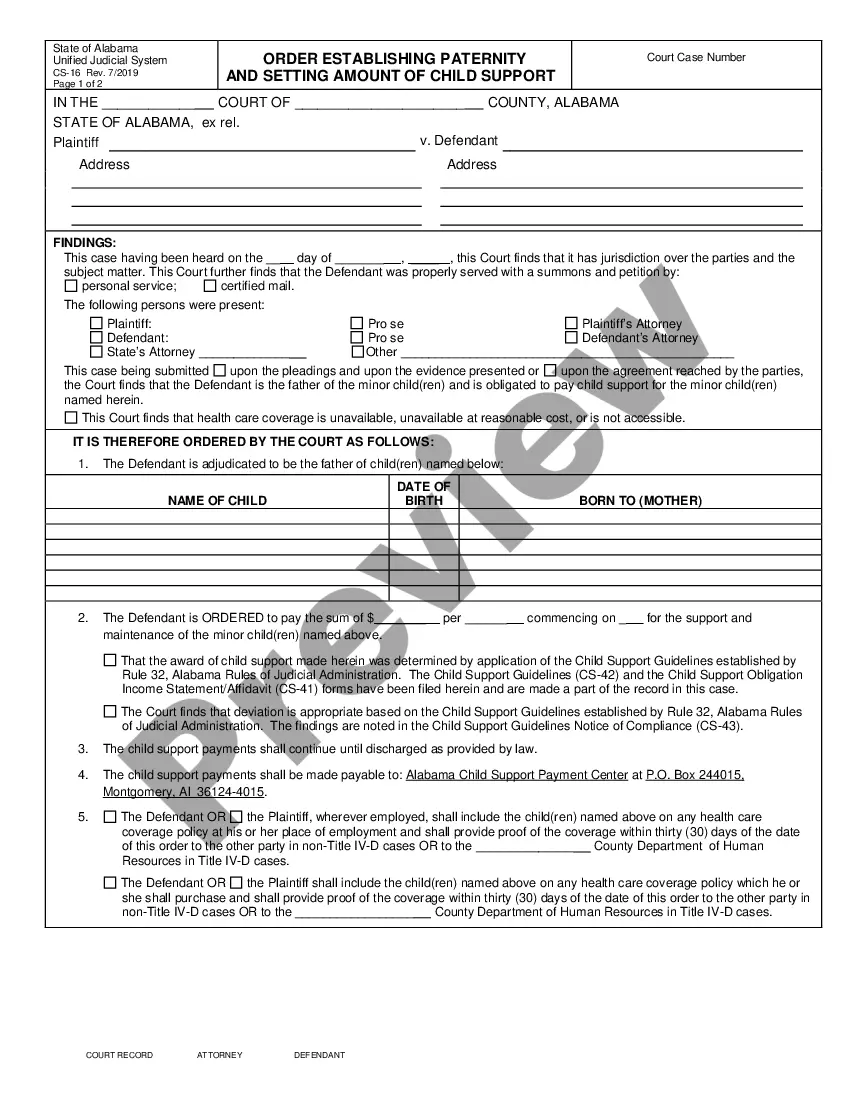

Dissolution is a legal process that terminates a business entity's existence. If a corporation or LLC is not properly dissolved, it continues to exist as a legal entity under state law. This means that it still faces corporate or LLC filing requirements, such as annual reports and franchise taxes.

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

Articles of dissolution are the reverse of organization or incorporation articles ? they end your business entity's existence.

Dissolving a Church or Nonprofit in Pennsylvania Take an Official Vote of the Board of Directors/Members. ... Obtain Tax Certificates. ... Obtain Attorney General Approval. ... Obtain Court Approval to Sell Real Estate. ... Ensure that Money Left Over is Transferred to a Similar Nonprofit.

This is accomplished through the filing of a Certificate of Dissolution, which must be signed by at least one member of the partnership and must specify information regarding the distribution of assets and the management of obligations and debts.

To withdraw a foreign Rhode Island corporation, you will need to submit an Application for Certificate of Withdrawal of a Foreign Business Corporation to the SOS. Once you have submitted all the required documents, the Certificate of Withdrawal or Cancellation is issued electronically by SOS.

To close your business in Rhode Island, you must satisfy all filing obligations with both the RI Division of Taxation and the RI Department of State. To dissolve your business, it must be active and up to date with all filings with the RI Department of State. To verify your status, email corporations@sos.ri.gov.

Pennsylvania doesn't administratively dissolve LLCs. However, if you fail to file your decennial report, your LLC's name will no longer be reserved for your use. To reinstate your LLC's name, you can file your late decennial report.