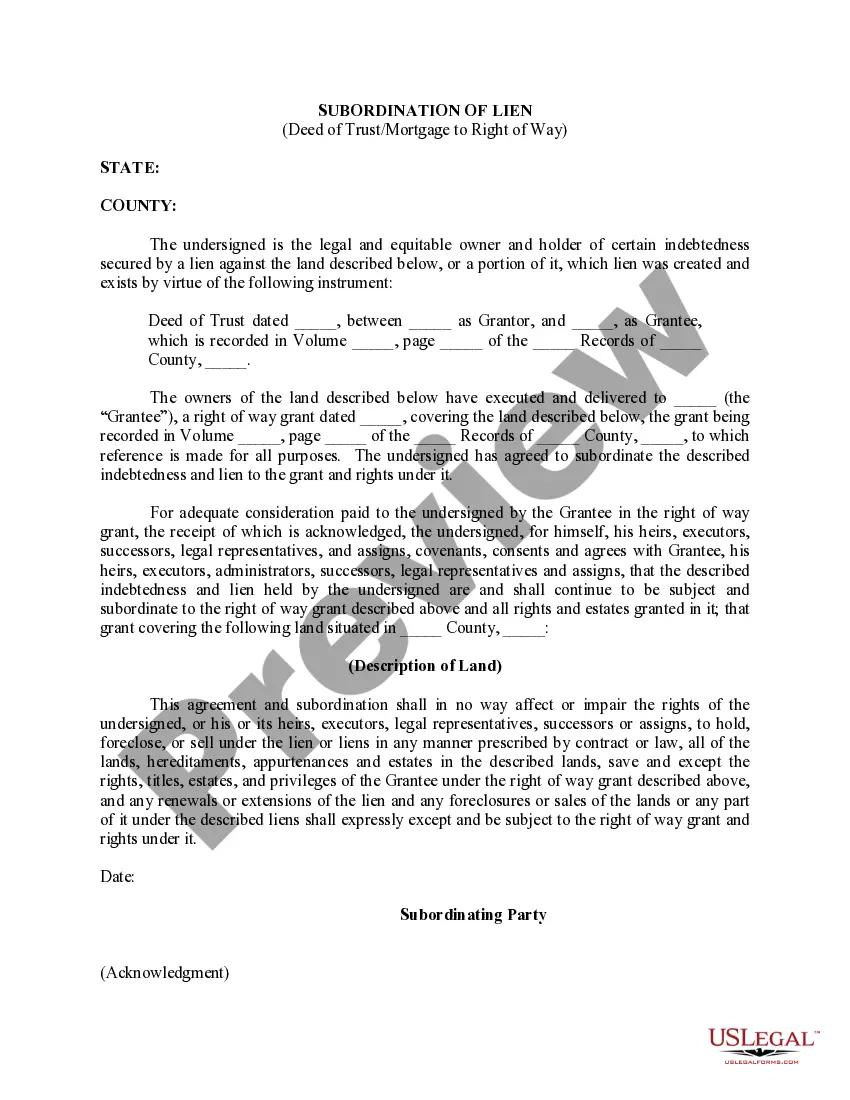

Rhode Island Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage)?

If you wish to complete, acquire, or print lawful papers themes, use US Legal Forms, the greatest variety of lawful forms, which can be found on-line. Utilize the site`s basic and hassle-free search to get the documents you want. Different themes for business and individual uses are sorted by types and claims, or search phrases. Use US Legal Forms to get the Rhode Island Subordination of Lien (Deed of Trust/Mortgage) in a few mouse clicks.

When you are currently a US Legal Forms buyer, log in to the profile and then click the Down load option to get the Rhode Island Subordination of Lien (Deed of Trust/Mortgage). Also you can entry forms you in the past acquired from the My Forms tab of your own profile.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for the proper town/land.

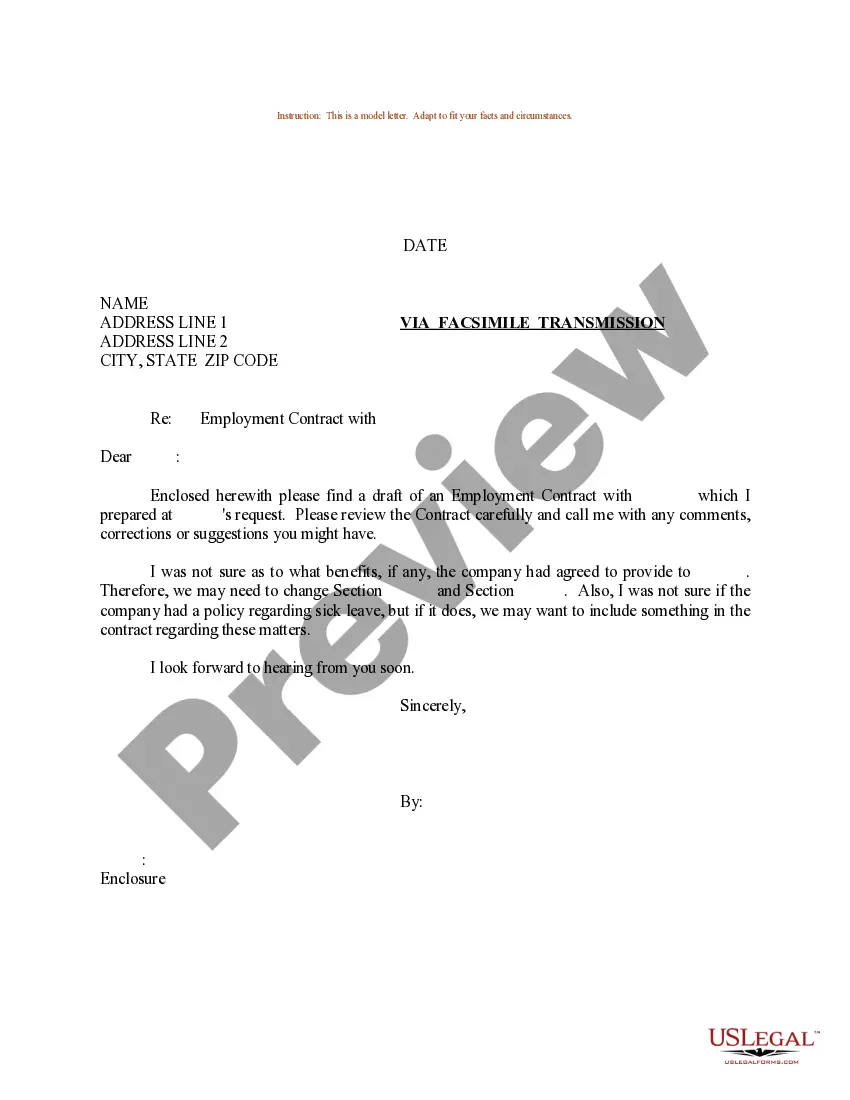

- Step 2. Make use of the Review option to look through the form`s articles. Don`t overlook to read through the description.

- Step 3. When you are not happy with all the develop, make use of the Search field towards the top of the screen to discover other versions of your lawful develop design.

- Step 4. Once you have discovered the form you want, select the Get now option. Select the prices strategy you favor and add your credentials to sign up to have an profile.

- Step 5. Method the deal. You can use your bank card or PayPal profile to complete the deal.

- Step 6. Find the format of your lawful develop and acquire it in your product.

- Step 7. Complete, revise and print or signal the Rhode Island Subordination of Lien (Deed of Trust/Mortgage).

Every lawful papers design you purchase is the one you have forever. You possess acces to every develop you acquired in your acccount. Click the My Forms portion and select a develop to print or acquire once more.

Compete and acquire, and print the Rhode Island Subordination of Lien (Deed of Trust/Mortgage) with US Legal Forms. There are many expert and state-distinct forms you can utilize for the business or individual requirements.

Form popularity

FAQ

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

A subordinated loan is debt that's only paid off after all primary loans are paid off, if there's any money left. It's also known as subordinated debt, junior debt or a junior security, while primary loans are also known as senior or unsubordinated debt.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

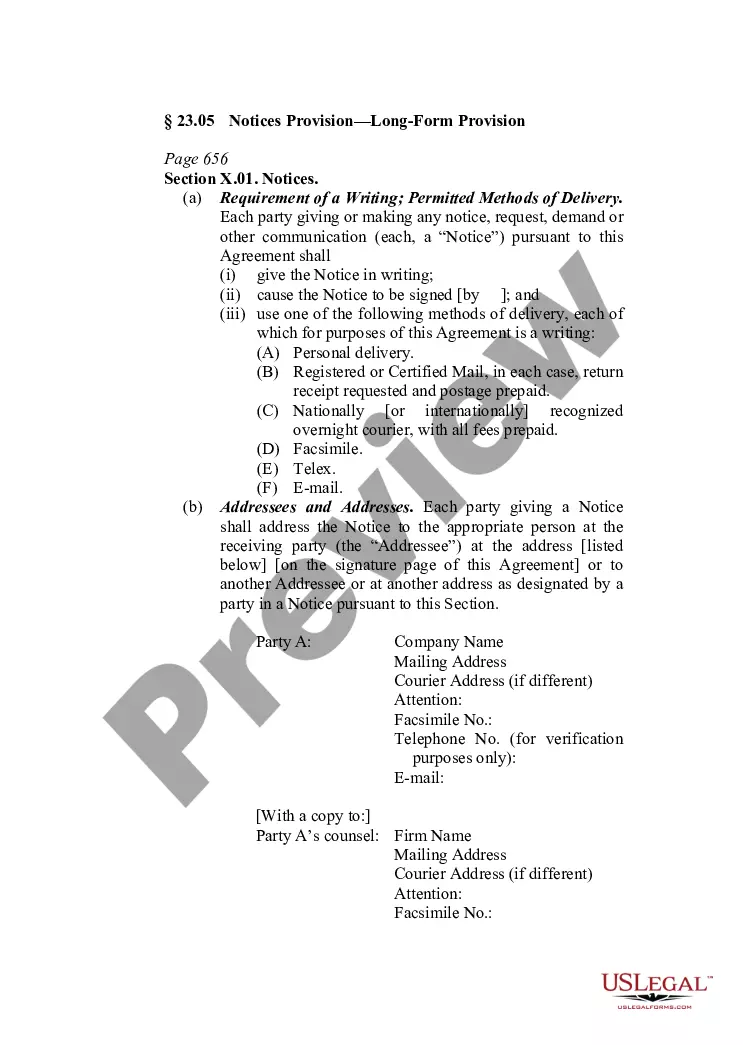

Subordination agreements may be included in existing deeds of trust or may be outlined in an independent contract. In situations where two deeds of trust are being recorded concurrently, the lien priority is typically handled by instructing the title company as to which security instrument will be recorded first.

Lien subordination refers to the order in which claims on collateral are prioritized. This takes place most often among senior secured lenders and does not imply that one tranche of senior debt has payment preference over another.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

A subordinated loan is also known as subordinated debt, subordinated debenture, and junior debt. Subordinated debt holders receive payment after the senior debt has been fully settled in the event of a liquidation. High yield bonds and mezzanine debt are two examples of subordinated loans.

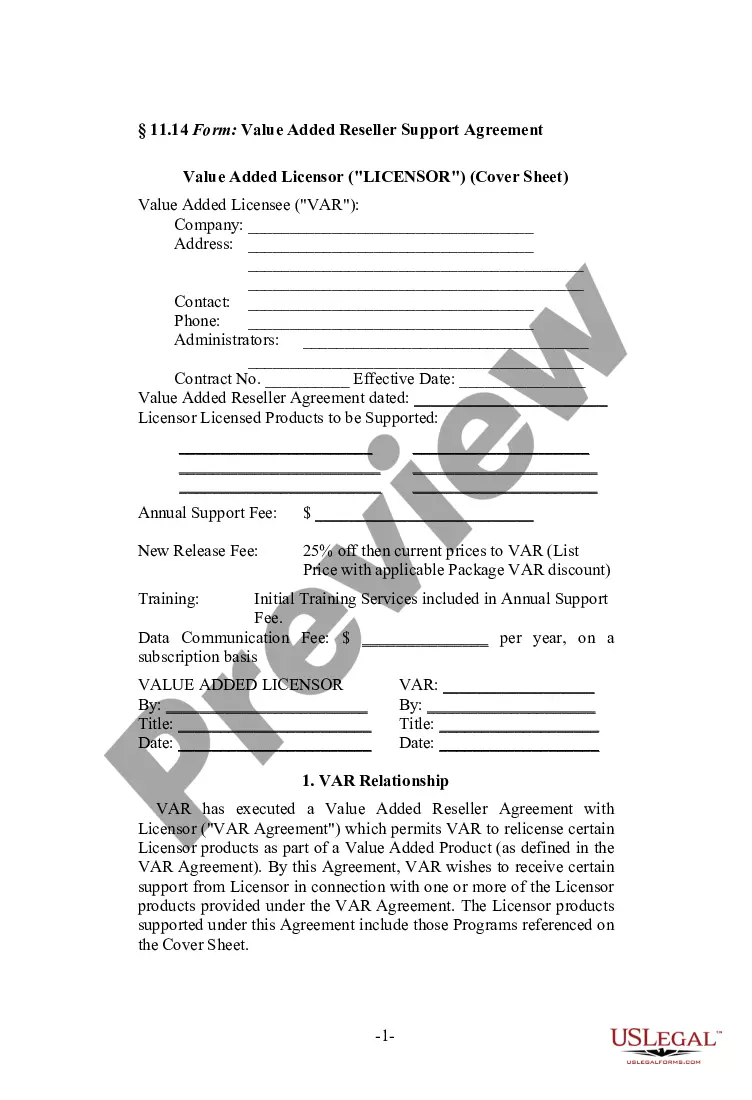

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.