Rhode Island Interest Verification

Description

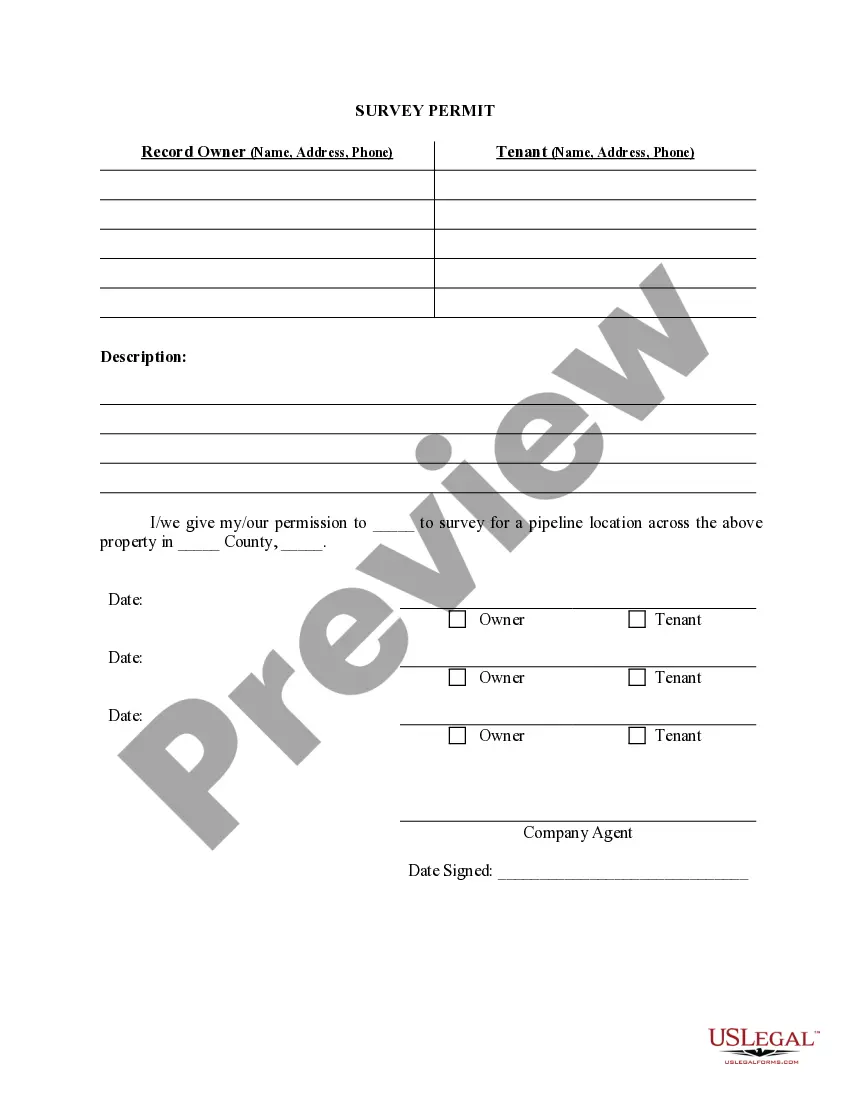

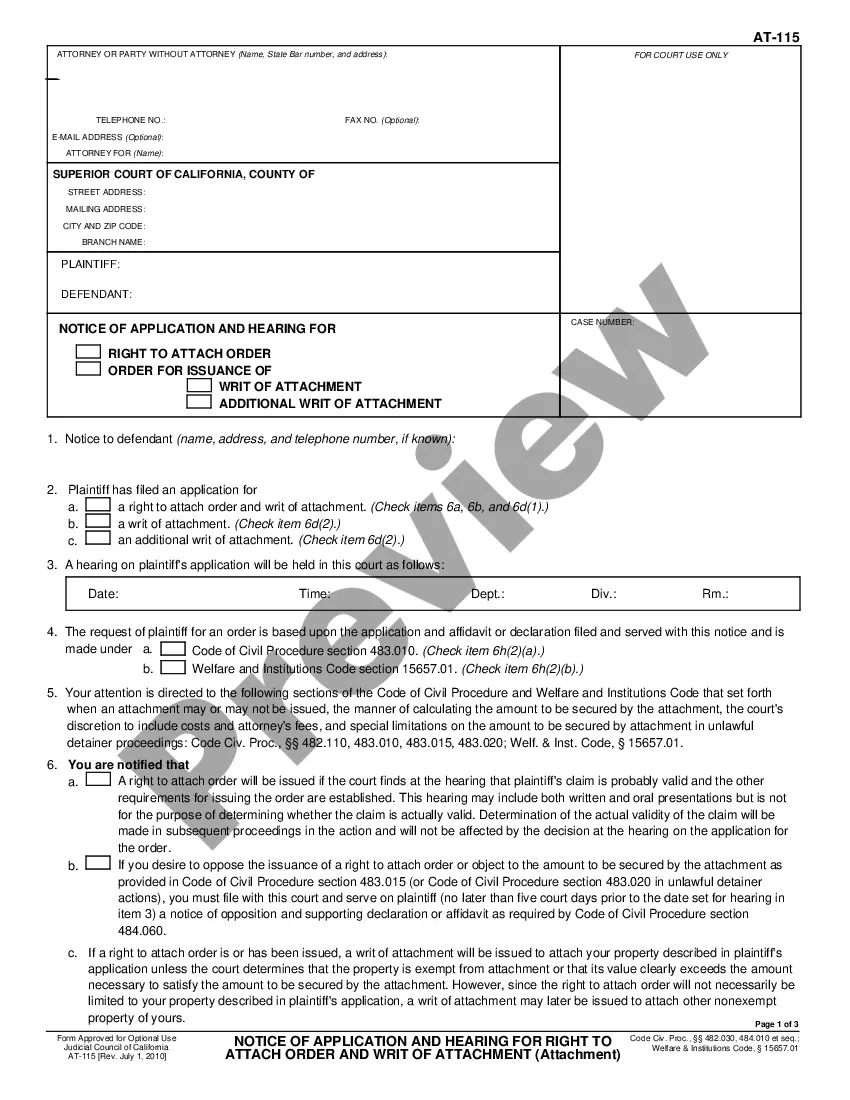

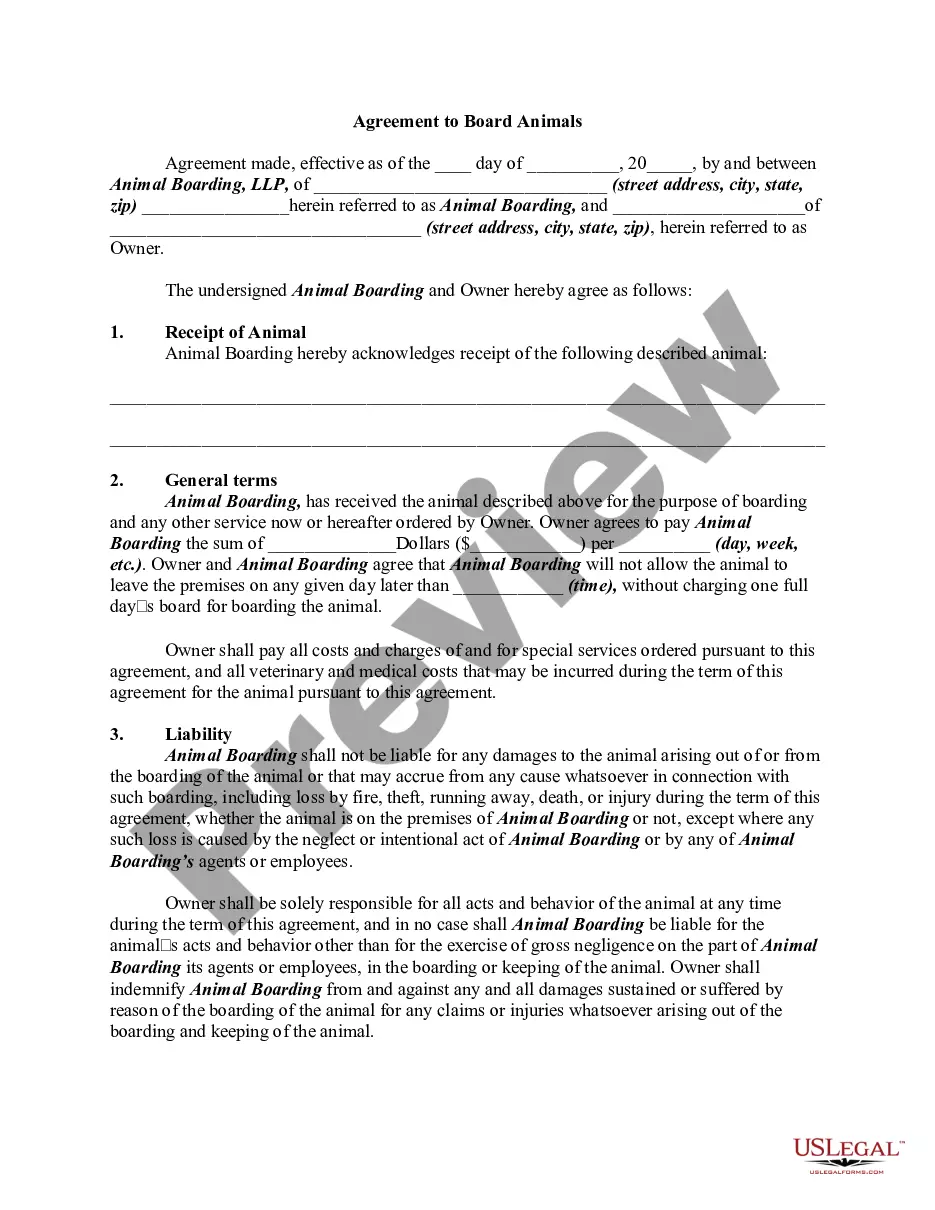

How to fill out Interest Verification?

Choosing the best lawful papers format could be a struggle. Of course, there are plenty of layouts available online, but how will you get the lawful type you will need? Make use of the US Legal Forms site. The services offers 1000s of layouts, such as the Rhode Island Interest Verification, that can be used for enterprise and personal requirements. All the types are inspected by specialists and fulfill state and federal needs.

In case you are currently listed, log in to the accounts and click the Acquire option to have the Rhode Island Interest Verification. Utilize your accounts to look with the lawful types you might have purchased previously. Proceed to the My Forms tab of the accounts and get one more version in the papers you will need.

In case you are a brand new user of US Legal Forms, allow me to share basic recommendations for you to comply with:

- Very first, make sure you have selected the correct type for your personal area/state. You are able to check out the form while using Preview option and browse the form information to ensure it is the right one for you.

- In the event the type fails to fulfill your expectations, make use of the Seach industry to find the appropriate type.

- Once you are positive that the form is suitable, select the Get now option to have the type.

- Choose the pricing plan you need and enter in the necessary info. Make your accounts and pay money for your order using your PayPal accounts or credit card.

- Choose the submit formatting and obtain the lawful papers format to the product.

- Comprehensive, edit and print out and sign the acquired Rhode Island Interest Verification.

US Legal Forms may be the most significant local library of lawful types that you can see various papers layouts. Make use of the company to obtain skillfully-manufactured paperwork that comply with condition needs.

Form popularity

FAQ

Withholding Tax on Gambling Winnings: If a must withhold for federal purposes, RI must withhold federal tax withheld multiplied by the Rhode Island personal income tax withholding rate in effect on the date of the payment.

If you are an alien individual, file Form 8843 to explain the basis of your claim that you can exclude days present in the United States for purposes of the substantial presence test because you: Were an exempt individual. Were unable to leave the United States because of a medical condition or medical problem.

What If Form 8843 Is Not Filed? There is no monetary penalty for not filing Form 8843. However, days of presence that are excluded must be properly recorded by filing Form 8843. Not doing so could affect the taxability of income or treaty benefits.

Schedule 1 is where you report all your income that wasn't from bank interest, investment dividends, or wages reported on a W-2 from your employer. The ?adjustments to income? section helps you find your AGI, which determines eligibility for other deductions.

IRS Form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the U.S. and help determine tax responsibility. All F-1/J-1 foreign national (and their F-2/J-2 dependents) who are non-residents for tax purposes are required to file Form 8843.

Even if you have dependents, everyone must submit their own 8843 in a separate envelope.

Line 10 of Form 1040, U.S. Individual Income Tax Return, is in the Income section of the 1040. Line 10 is: Taxable refunds, credits, or offsets of state and local income taxes.

All nonresident aliens present in the U.S. under F-1, F-2, J-1, or J-2 nonimmigrant status must file Form 8843 ?Statement for Exempt Individuals and Individuals With a Medical Condition??even if they received NO income during the tax filing year.