Rhode Island Ratification of Royalty Commingling Agreement

Description

How to fill out Ratification Of Royalty Commingling Agreement?

US Legal Forms - one of the most significant libraries of authorized varieties in the United States - provides a wide range of authorized papers web templates it is possible to obtain or print. Utilizing the website, you will get a large number of varieties for organization and individual reasons, categorized by categories, states, or keywords.You can find the most recent types of varieties such as the Rhode Island Ratification of Royalty Commingling Agreement within minutes.

If you already possess a registration, log in and obtain Rhode Island Ratification of Royalty Commingling Agreement from the US Legal Forms collection. The Download option will appear on every single form you view. You have accessibility to all previously acquired varieties from the My Forms tab of your own bank account.

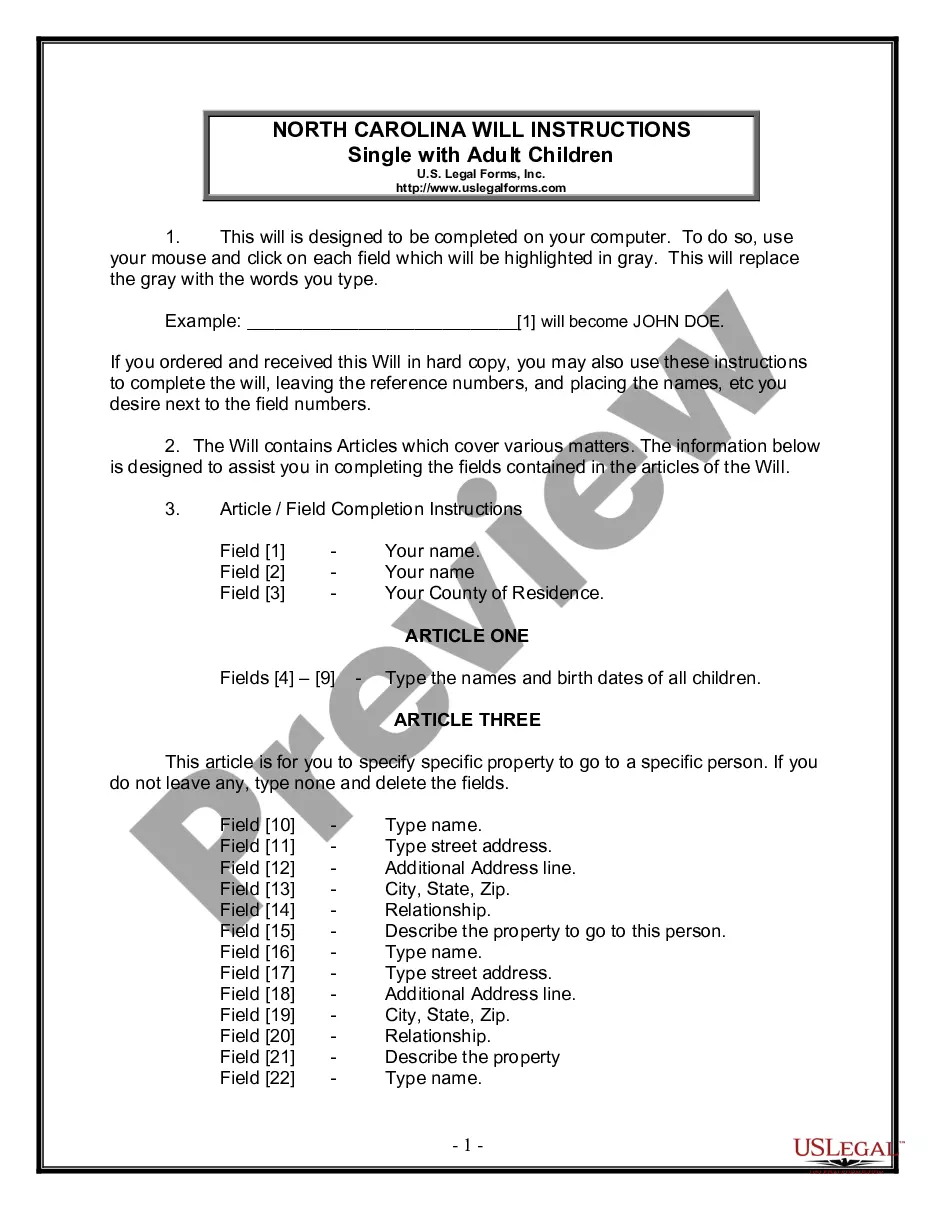

In order to use US Legal Forms for the first time, here are simple instructions to get you began:

- Make sure you have picked the correct form for the town/area. Go through the Preview option to review the form`s content. See the form information to ensure that you have selected the proper form.

- When the form does not suit your requirements, utilize the Look for industry on top of the display to get the one that does.

- When you are satisfied with the form, affirm your choice by clicking the Acquire now option. Then, pick the pricing strategy you want and offer your references to sign up for the bank account.

- Process the purchase. Make use of your Visa or Mastercard or PayPal bank account to finish the purchase.

- Find the formatting and obtain the form on the gadget.

- Make alterations. Fill up, modify and print and indicator the acquired Rhode Island Ratification of Royalty Commingling Agreement.

Every single template you put into your money lacks an expiry date and is also yours permanently. So, in order to obtain or print yet another backup, just go to the My Forms portion and then click about the form you want.

Obtain access to the Rhode Island Ratification of Royalty Commingling Agreement with US Legal Forms, the most considerable collection of authorized papers web templates. Use a large number of professional and express-certain web templates that meet up with your organization or individual requires and requirements.