Rhode Island Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

Selecting the correct valid document format can be challenging. Of course, there are numerous templates available online, but how can you locate the valid template you seek? Utilize the US Legal Forms website.

This service offers thousands of templates, such as the Rhode Island Social Worker Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal purposes. All documents are vetted by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to find the Rhode Island Social Worker Agreement - Self-Employed Independent Contractor. Use your account to view the legal documents you have previously purchased. Visit the My documents tab in your account to retrieve another copy of the document you need.

Complete, modify, print, and sign the downloaded Rhode Island Social Worker Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal documents where you can find various document templates. Use this service to obtain professionally crafted papers that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

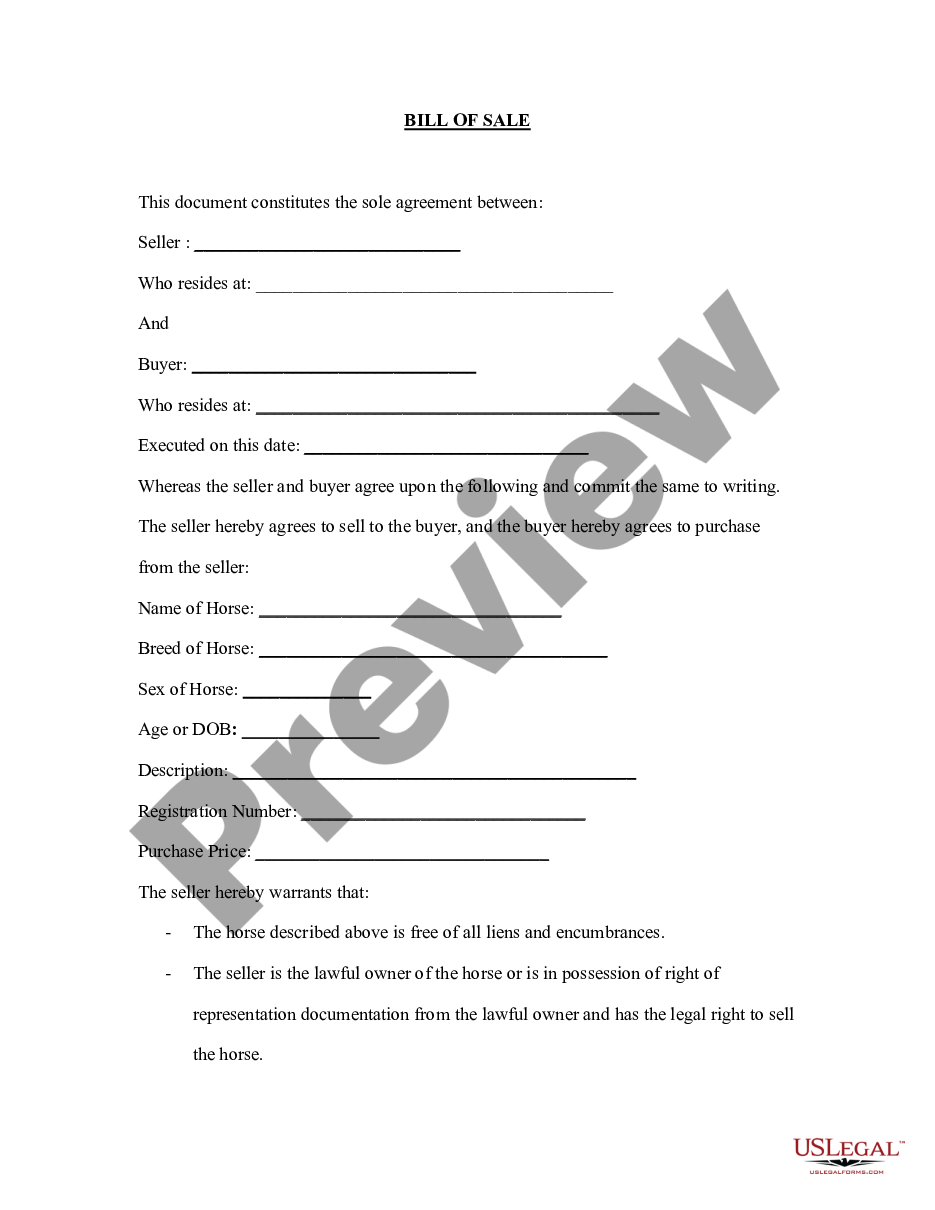

- First, ensure you have selected the correct template for your location/region. You can preview the form using the Review button and read the form description to ensure it’s suitable for you.

- If the template does not fulfill your requirements, use the Search field to find the appropriate document.

- Once you are confident that the form is acceptable, click the Purchase now button to get the document.

- Choose the pricing plan you prefer and enter the necessary details. Create your account and process the payment using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Yes, receiving a 1099 form typically indicates that you are self-employed. This form is used to report income earned as an independent contractor, which aligns with the definition of a Rhode Island Social Worker Agreement - Self-Employed Independent Contractor. If you receive a 1099, it’s important to track your income and expenses, as you will be responsible for your taxes.

While both terms are often used interchangeably, 'independent contractor' can offer more clarity in professional contexts. When referring to a Rhode Island Social Worker Agreement - Self-Employed Independent Contractor, using the specific title helps communicate the professional arrangement. Ultimately, it depends on the audience and context, but clarity should always be your priority.

employed individual typically earns income through their business rather than a standard job. This includes any situation where a person offers services or goods independently, such as in a Rhode Island Social Worker Agreement SelfEmployed Independent Contractor. To qualify, one must actively manage their business operations and be responsible for their taxes and income.

Yes, an independent contractor is classified as self-employed. This status means they work for themselves rather than a traditional employer. In the context of a Rhode Island Social Worker Agreement - Self-Employed Independent Contractor, this arrangement allows social workers to operate independently while providing their services. This can lead to greater flexibility and the potential for higher earnings.

An independent contractor typically fills out a Rhode Island Social Worker Agreement - Self-Employed Independent Contractor and may also need to complete tax forms like the W-9. Additional paperwork might include insurance documentation or confidentiality agreements, depending on the project requirements. Using resources from uslegalforms can guide you through necessary documentation and ensure all paperwork is properly managed.

Yes, non-disclosure agreements (NDAs) can apply to independent contractors, including those working under a Rhode Island Social Worker Agreement - Self-Employed Independent Contractor. NDAs help protect sensitive information shared during the contract period. Make sure to include an NDA clause in your agreement if confidentiality is important to your business. This adds a layer of security to your professional relationship.

To write a Rhode Island Social Worker Agreement - Self-Employed Independent Contractor, begin by defining the scope of work and each party's responsibilities. Include essential elements like payment details, duration, and termination conditions. Use clear and direct language to avoid misunderstandings. Consider using templates available on platforms like uslegalforms to simplify the writing process and ensure compliance with state laws.

Filling out a Rhode Island Social Worker Agreement - Self-Employed Independent Contractor is straightforward. Start by entering your information and the contractor’s details, including their name and address. Next, clearly outline the services to be provided, payment terms, and deadlines. Review the agreement for accuracy, ensuring all terms align with your understanding before signing.

Yes, independent contractors file as self-employed when they prepare their tax returns. This means you report your income and expenses on Schedule C of your tax return. Utilizing the Rhode Island Social Worker Agreement - Self-Employed Independent Contractor can simplify this process by providing clear guidelines on your income and what can be deducted. Adopting good financial practices now will make tax time much easier for you.

To prove you are an independent contractor under the Rhode Island Social Worker Agreement - Self-Employed Independent Contractor, you need to gather specific documentation. Start with a written contract that outlines your services, payment terms, and project scope. Additionally, keep records of your invoices and communications with clients to demonstrate your independent status. Using a platform like USLegalForms can help you create the necessary paperwork to establish your status clearly.