Rhode Island Engineering Agreement - Self-Employed Independent Contractor

Description

How to fill out Engineering Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of authentic documents in the USA - provides a broad selection of lawful document templates you can obtain or print.

By utilizing the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can retrieve the latest forms such as the Rhode Island Engineering Agreement - Self-Employed Independent Contractor in moments.

If you already have a subscription, Log In and access the Rhode Island Engineering Agreement - Self-Employed Independent Contractor within the US Legal Forms library. The Acquire button will be visible on every form you encounter. You gain entry to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Rhode Island Engineering Agreement - Self-Employed Independent Contractor. Each template you saved in your account does not expire and belongs to you permanently. Therefore, to obtain or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Rhode Island Engineering Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of lawful document templates. Utilize thousands of professional and state-specific templates that meet your business or personal demands and criteria.

- Ensure you have selected the correct form for your specific city/state.

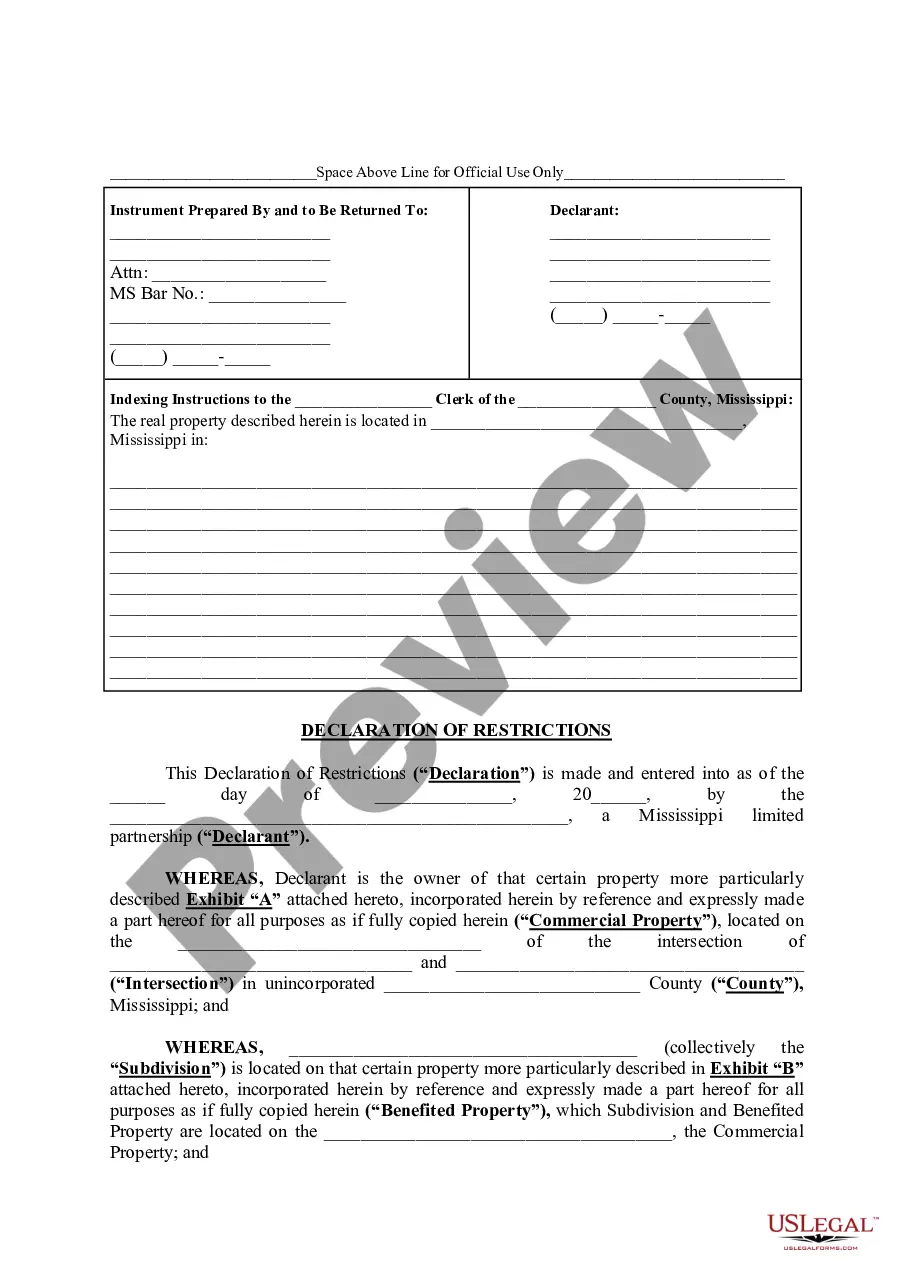

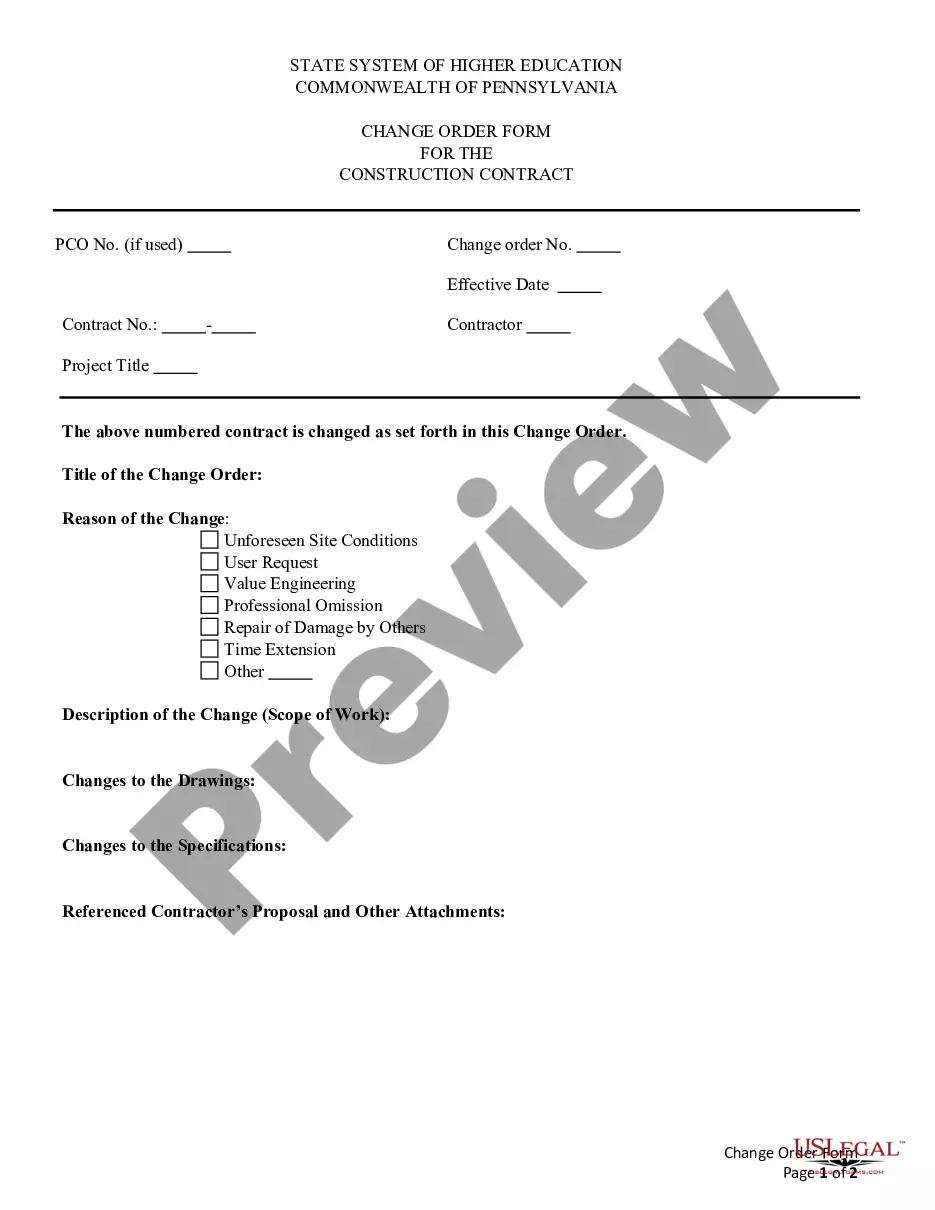

- Click the Preview button to review the content of the form.

- Examine the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Filling out an independent contractor agreement involves entering essential details such as the parties' names, contact information, and the scope of work. Specify payment terms and deadlines for deliverables to avoid any misunderstandings. Using a comprehensive Rhode Island Engineering Agreement - Self-Employed Independent Contractor template from UsLegalForms can simplify this process and help you craft an effective agreement.

To write an independent contractor agreement, clearly outline the services to be performed, payment rates, and project duration. Include confidentiality and liability clauses to protect both parties. By utilizing the Rhode Island Engineering Agreement - Self-Employed Independent Contractor template available on UsLegalForms, you ensure a solid foundation that's both professional and tailored to your needs.

An independent contractor typically fills out a 1099 form for tax purposes, which reports earnings and payments received for services provided. Depending on the state, there might be additional forms specific to local regulations. For those working under a Rhode Island Engineering Agreement - Self-Employed Independent Contractor, ensure you consult the appropriate documentation to stay compliant.

To fill out an independent contractor form, start by gathering your personal information, including your name, address, and Social Security number. Next, input the details of the work arrangement, such as the project description, payment terms, and schedule. Additionally, make sure to review the terms of the Rhode Island Engineering Agreement - Self-Employed Independent Contractor to ensure compliance and clarity in your engagement.

To qualify as a self-employed independent contractor in Rhode Island, you must meet specific criteria, such as having control over how you perform your work and providing your tools. You should also establish a business identity that shows your independence from clients. Understanding these qualifications helps you navigate your Rhode Island Engineering Agreement - Self-Employed Independent Contractor more effectively. Additionally, platforms like uslegalforms can provide resources and templates to ensure you comply with regulations.

Yes, Rhode Island does require certain contractors to possess a license, especially for construction-related work. The licensing process ensures that contractors meet specific qualifications and adhere to state regulations. If you operate as a self-employed independent contractor in engineering, it is crucial to check the requirements applicable to your field. This ensures compliance with laws surrounding your Rhode Island Engineering Agreement - Self-Employed Independent Contractor.

Choosing between an LLC or a self-employed independent contractor status depends on your specific business needs. An LLC provides personal liability protection and can enhance your credibility. In contrast, operating as an independent contractor may offer simplicity in terms of administration and taxes. The ideal choice often relates to factors like income level, risk, and your preference for liability protection in your Rhode Island Engineering Agreement - Self-Employed Independent Contractor.

Receiving a 1099 form typically indicates that you earned income as an independent contractor, thus classifying you as self-employed. This form is important for tax purposes and reflects the income you've earned outside of a traditional employment relationship. If you operate under a Rhode Island Engineering Agreement - Self-Employed Independent Contractor, understanding your self-employed status is key for proper income reporting. Always consult a tax professional to navigate your obligations.

The choice between saying self-employed or independent contractor depends on context. Both terms describe individuals who work for themselves, but independent contractor often refers to those engaged in specific contracts for services. When discussing legal agreements, such as the Rhode Island Engineering Agreement - Self-Employed Independent Contractor, clarity is essential. Choosing the right term can help communicate your professional status more effectively.

Being self-employed means you operate your own business and earn income directly from clients or customers, rather than as an employee. You can qualify as self-employed through various roles, including independent contractors, freelancers, and sole proprietors. This classification is also reflected in legal documents, like the Rhode Island Engineering Agreement - Self-Employed Independent Contractor, which helps clarify responsibilities. Understanding this status is crucial for managing your taxes effectively.