Rhode Island Form - Licensee Oriented Audiovisual Streaming Agreement Short Form

Description

How to fill out Form - Licensee Oriented Audiovisual Streaming Agreement Short Form?

Are you presently within a position in which you require papers for both enterprise or personal functions just about every working day? There are tons of legitimate file layouts available on the Internet, but locating ones you can trust is not straightforward. US Legal Forms provides a large number of form layouts, like the Rhode Island Form - Licensee Oriented Audiovisual Streaming Agreement Short Form, that happen to be created to satisfy state and federal requirements.

Should you be currently familiar with US Legal Forms web site and have a free account, basically log in. After that, it is possible to acquire the Rhode Island Form - Licensee Oriented Audiovisual Streaming Agreement Short Form format.

If you do not come with an bank account and wish to start using US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is for your proper area/state.

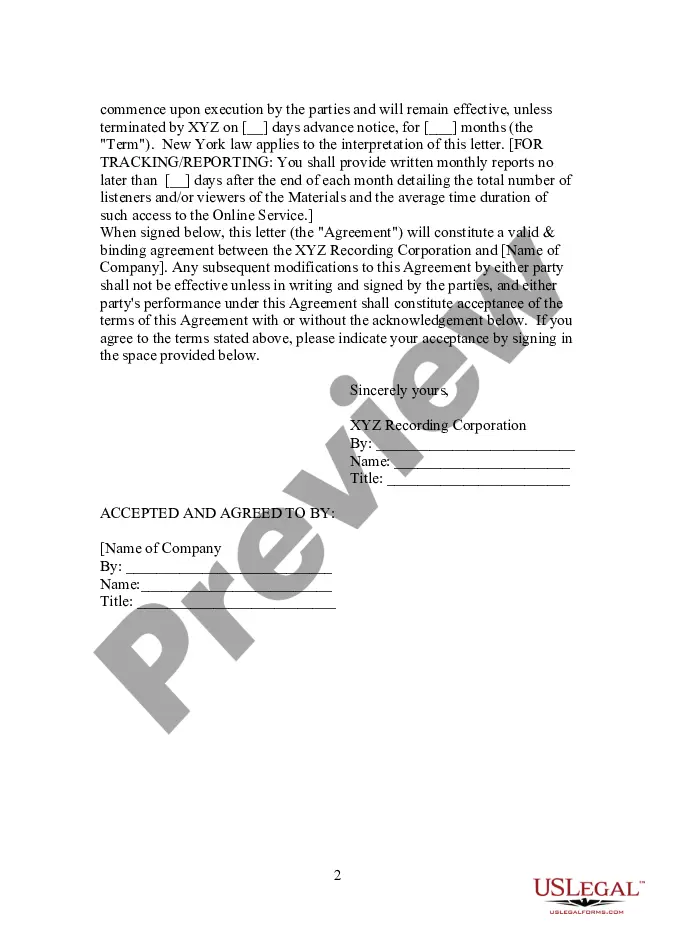

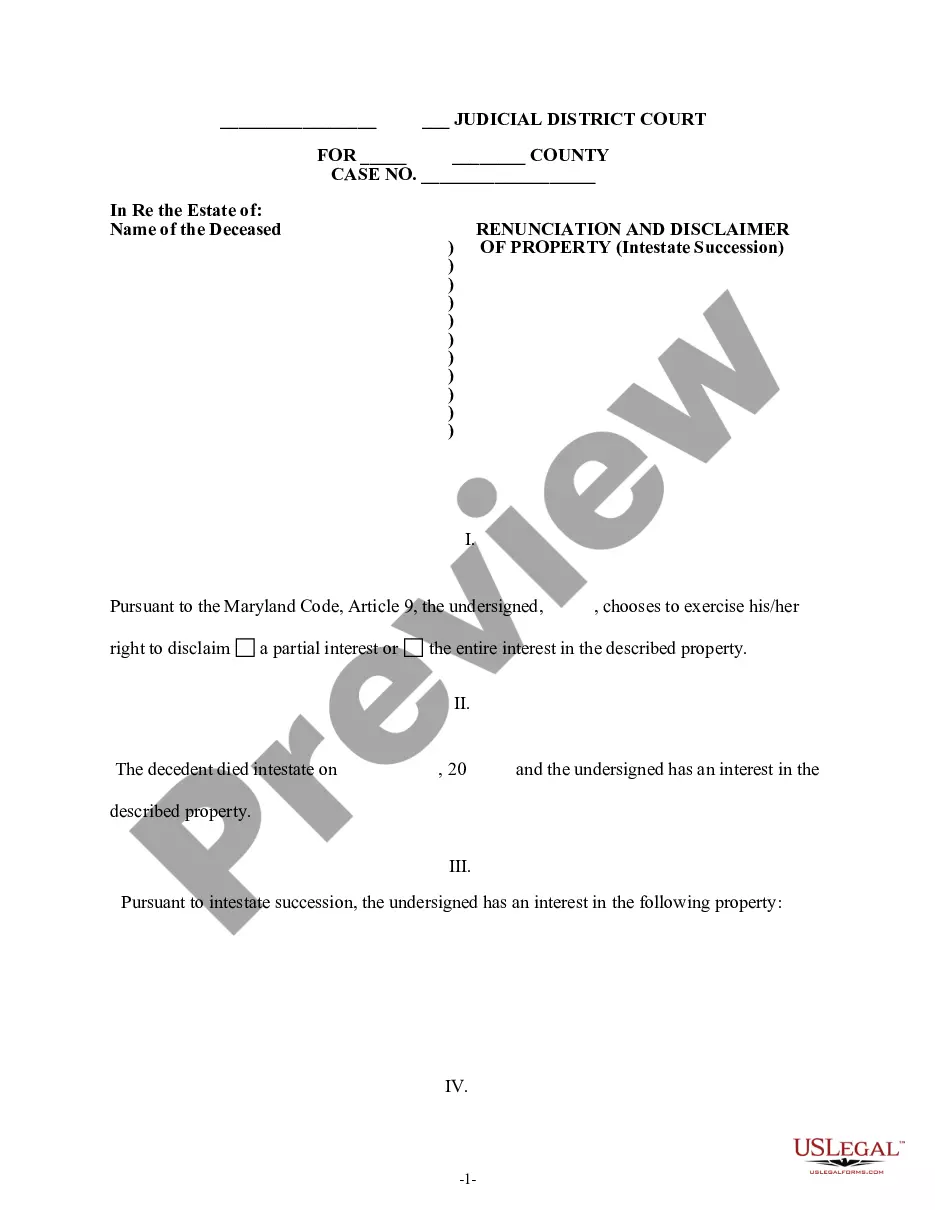

- Take advantage of the Review option to examine the form.

- See the outline to ensure that you have chosen the appropriate form.

- In the event the form is not what you`re searching for, take advantage of the Search discipline to obtain the form that meets your requirements and requirements.

- When you discover the proper form, click on Purchase now.

- Select the costs strategy you want, fill out the specified information to produce your bank account, and pay for your order with your PayPal or bank card.

- Decide on a practical data file format and acquire your copy.

Get each of the file layouts you may have bought in the My Forms food list. You can get a more copy of Rhode Island Form - Licensee Oriented Audiovisual Streaming Agreement Short Form at any time, if necessary. Just go through the needed form to acquire or printing the file format.

Use US Legal Forms, one of the most substantial selection of legitimate types, in order to save efforts and steer clear of mistakes. The assistance provides appropriately produced legitimate file layouts which can be used for a variety of functions. Make a free account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

The state-wide sales tax in Rhode Island is 7%.

Hear this out loud PauseThe Massachusetts use tax is 6.25% of the sales price or rental charge on tangible personal property, including property purchased by phone, mail order, and online where sales tax was not collected or was paid at a lower tax rate. Use tax is generally paid directly to Massachusetts by the purchaser.

Hear this out loud PauseRhode Island imposes a 7 percent sales tax on the sale of most tangible items. However, the state offers exemptions on a range of goods and services, as well as for certain organizations and types of sales. Common exempt goods include clothing and footwear, food, and medical items.

Hear this out loud PauseThe sales tax is a levy imposed on the retail sale, rental or lease of many goods and services. Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business. The sales tax is imposed upon the retailer at the rate of 7% of the gross receipts from taxable sales.

Wayfair, Inc., et al., on June 21, 2018, the State of Rhode Island has enacted legislation that requires remote sellers, marketplace facilitators, and referrers to register with the RI Division of Taxation and collect and remit Rhode Island's 7% sales and use tax effective July 1, 2019.

This law applies to sellers who meet these requirements: Makes more than $100,000 in gross sales from Rhode Island buyers in a calendar year OR. Makes more than 200 individual sales to buyers in Rhode Island in a calendar year.

Hear this out loud PauseUse Tax Imposed (RIGL 44-18-20): The article repeals the 7.0 percent use tax rate, and replaces it with a 6.85 rate starting October 1, 2023. Sales and Use Tax Background: Rhode Island levies a sales and use tax equivalent to 7.0 percent of the retail sales price of certain goods and services.

You can register for a Rhode Island seller's permit online through the Rhode Island Division of Taxation. To apply, you'll need to provide the Rhode Island Division of Taxation with certain information about your business, including but not limited to: Business name, address, and contact information. Federal EIN number.