Rhode Island Convertible Note Financing

Description

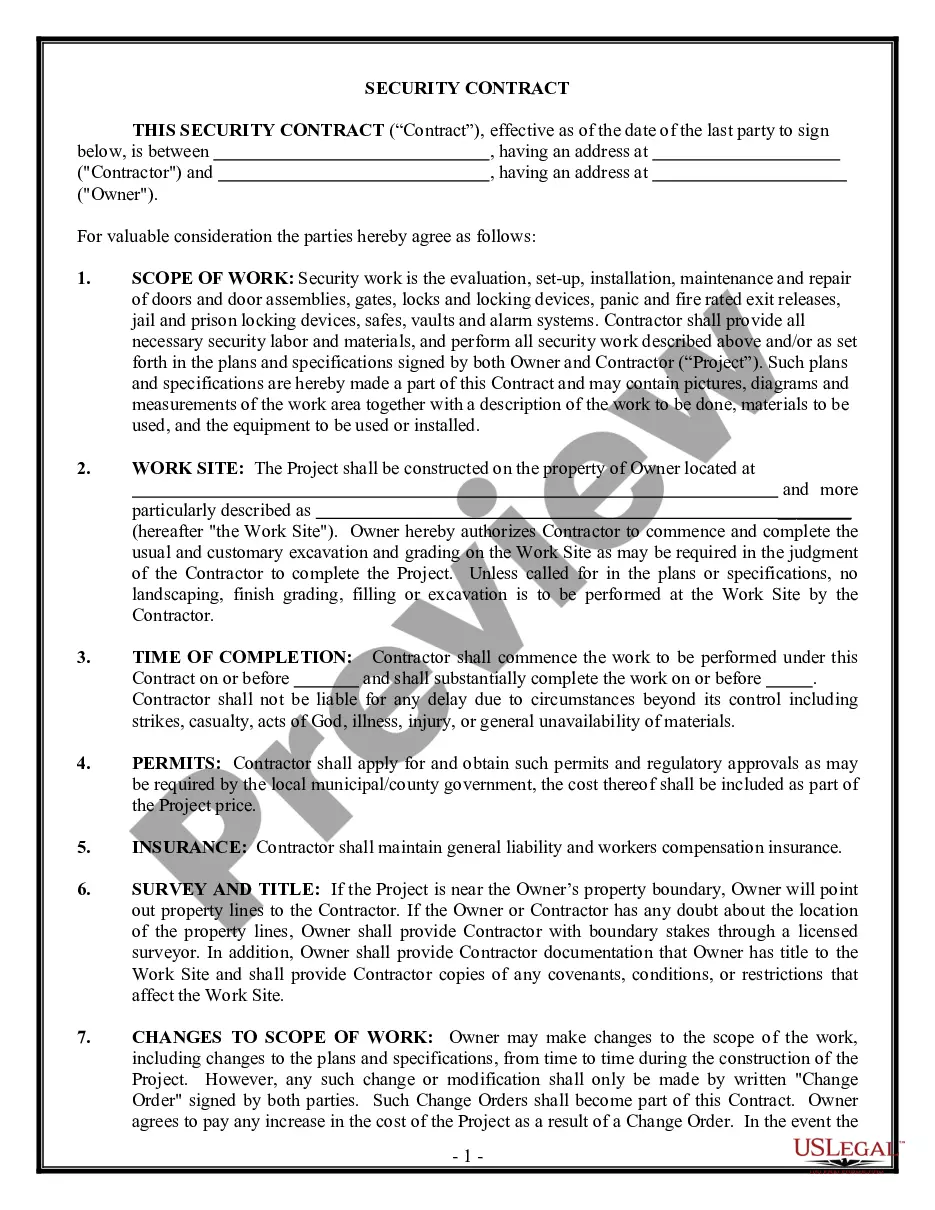

Just like any other debt investment, senior convertible notes offer investors the ability to earn interest. Rather than cash payments, however, the interest payments typically will accrue and the amount the company owes the investor will increase over time.

Bothstartup companiesand well-established companies may opt to issue senior convertible notes to raise funds from investors. This type of company financing has the advantage of being fairly simple to execute. This means the process of issuing the notes is relatively inexpensive for companies and it allows them quicker access to investor funding."

How to fill out Convertible Note Financing?

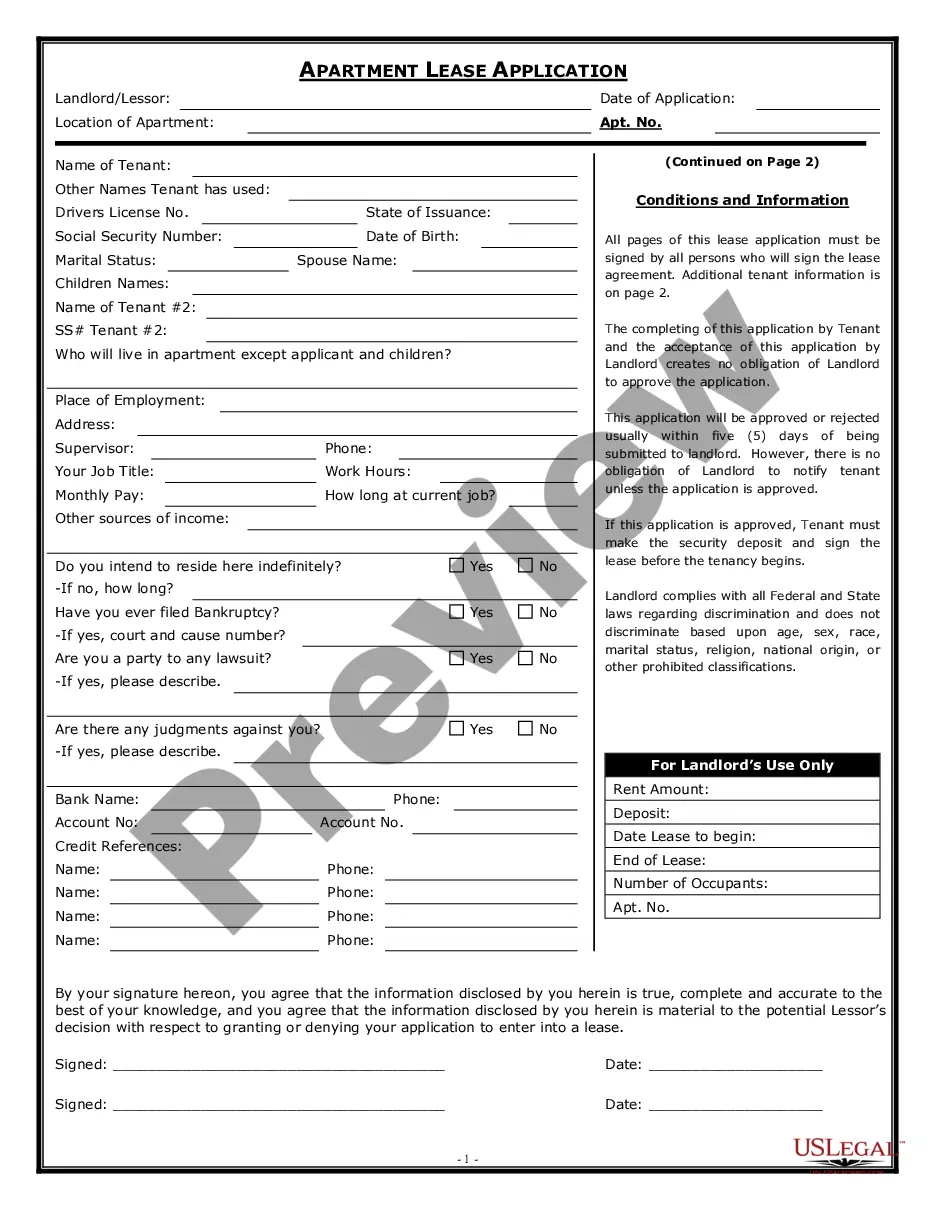

US Legal Forms - one of the most significant libraries of lawful kinds in the States - offers a variety of lawful record templates you are able to down load or print out. Making use of the internet site, you can find a huge number of kinds for organization and personal uses, categorized by classes, claims, or search phrases.You will find the newest types of kinds such as the Rhode Island Convertible Note Financing in seconds.

If you have a registration, log in and down load Rhode Island Convertible Note Financing through the US Legal Forms catalogue. The Down load button will appear on each and every develop you perspective. You have accessibility to all formerly delivered electronically kinds in the My Forms tab of the account.

If you wish to use US Legal Forms the first time, listed here are easy guidelines to get you started off:

- Ensure you have picked the best develop for your personal area/state. Click the Preview button to check the form`s content. Read the develop outline to actually have chosen the proper develop.

- When the develop does not satisfy your specifications, take advantage of the Research industry towards the top of the display to get the one who does.

- When you are satisfied with the form, verify your choice by clicking the Buy now button. Then, pick the prices program you favor and give your accreditations to sign up on an account.

- Method the financial transaction. Use your credit card or PayPal account to perform the financial transaction.

- Choose the structure and down load the form on the device.

- Make changes. Fill up, change and print out and sign the delivered electronically Rhode Island Convertible Note Financing.

Every format you included in your account lacks an expiration particular date and it is the one you have for a long time. So, if you would like down load or print out one more copy, just check out the My Forms area and click on the develop you will need.

Obtain access to the Rhode Island Convertible Note Financing with US Legal Forms, by far the most considerable catalogue of lawful record templates. Use a huge number of specialist and state-particular templates that satisfy your business or personal requirements and specifications.

Form popularity

FAQ

Convertible notes are recorded as debt on the company's balance sheet up until the conversion event. After conversion, they become equity in the company. As debt instruments, convertible notes also have a maturity date and can earn interest (two key differences with SAFEs, as outlined further down).

The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.

Promissory Note. The Promissory Note (or Convertible Promissory Note) is the actual debt instrument in the deal. ... Note Purchase Agreement. ... Subscription Agreement. ... Note Holders Agreements and Voting Agreements. ... Subordination Agreement. ... Warrant to Purchase Stock.

Conversion to Equity - Accounting for Convertible Debt When the note converts, usually during a new funding round, the liability moves to the equity section of the balance sheet. At this stage, the convertible note is settled, and new equity instruments, typically preferred shares, are issued to the investor.

In a convertible note, the loan will convert into equity when you raise what's known as a qualified financing. A qualified financing is equity financing (not a SAFE or Convertible Note round) above a certain threshold, usually $1 million.

Convertible notes are originally structured as debt investments, but have a provision that allows the principal plus accrued interest to convert into an equity investment at a later date.

Simply multiply the convertible note's interest rate by the number of years that have passed since the convertible note was issued. In this case, we would multiply 6% by 5 to get an accrued interest of 30%.

Example 1: Entire note is classified as equity Applying the guidance in the flow chart above, Entity A classifies the convertible notes as 'equity' because: It has no contractual obligation to deliver cash to the holders (the notes are mandatorily convertible)